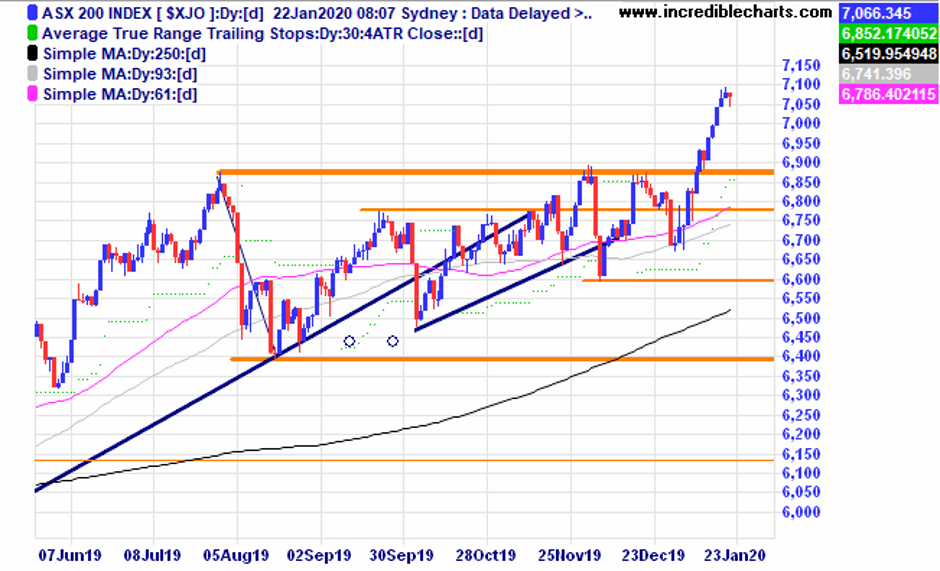

The local market took a breather yesterday closing slightly down before a strong rally today. We sold the remaining half of the ASX 200 cfd’s late on Friday before the weekend. A retracement down to the old highs could be seen as a consolidation move before a further upswing. Some analysts suggest the market is way overvalued, time will tell how far this rally goes.

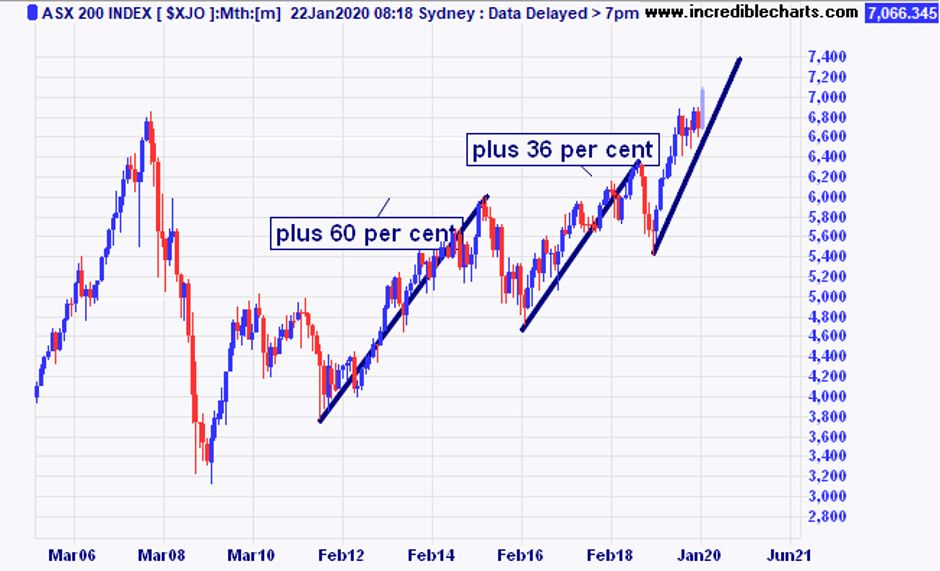

People forget how far a market can move before the eventual downturn comes. The last two legs up are shown in the chart below with a line up from the last low showing the 36 per cent rally target. On the other side of the coin price looks to be extended within the weekly channel lines shown last week.

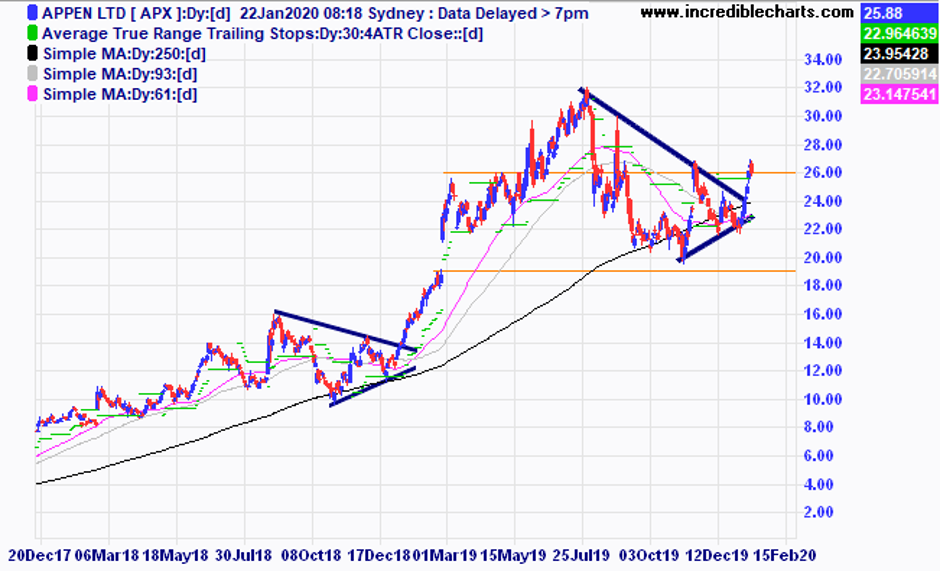

We bought a parcel of Appen when prices moved higher on Thursday and it has already reached a possible resistance zone.

We sold a portion of the Orocobre shares to lock in some profit as price again moved down below a level of resistance. Prices could churn around these levels for some time before a new break higher. Watching.

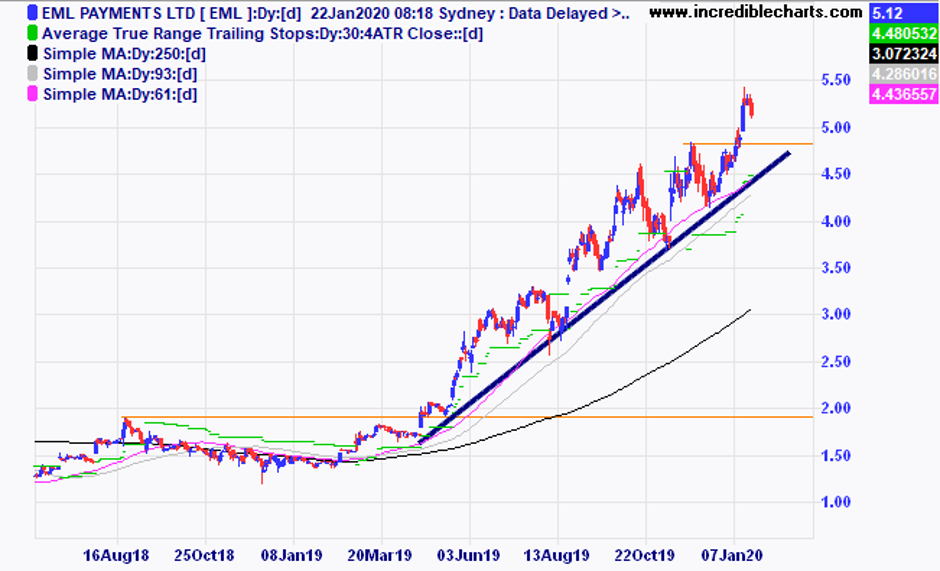

EML Payments is one share on the radar of a few analysts for 2020. A retracement down to the current trend line could bring with it some trading possibilities. Trading on big multiples if the stock disappoints at earnings time price could be downgraded quickly.

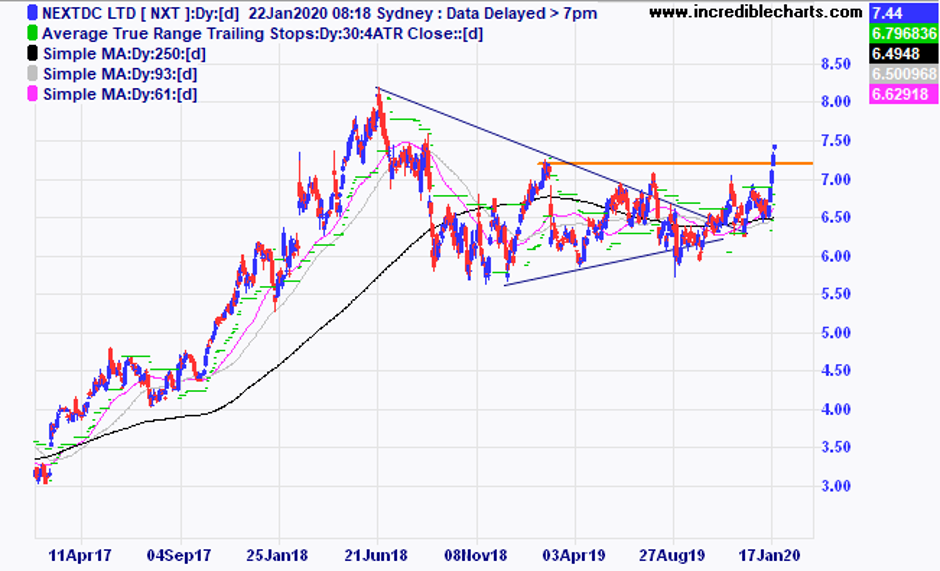

NextDC has moved above resistance.

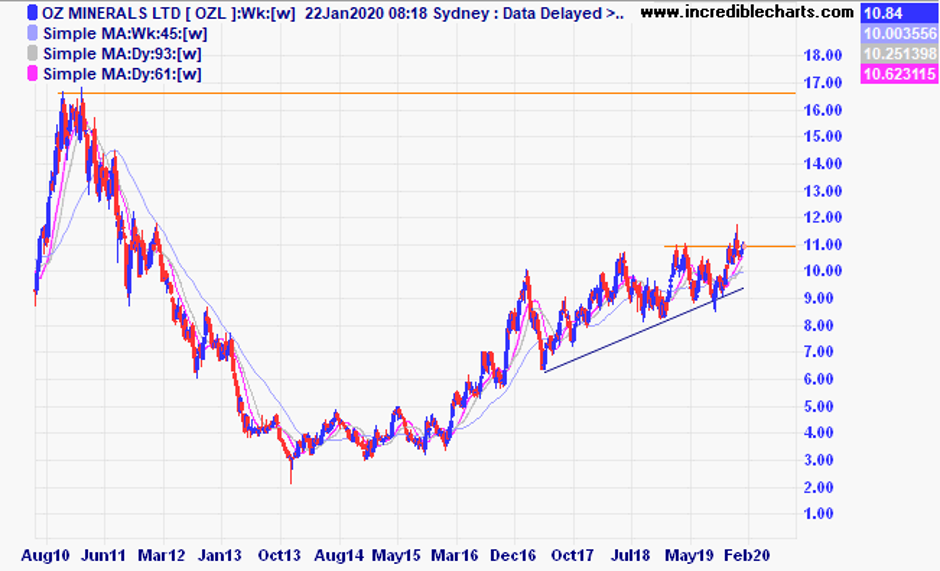

Could Oz Minerals be posturing for another leg higher and will it present some interesting trading possibilities?

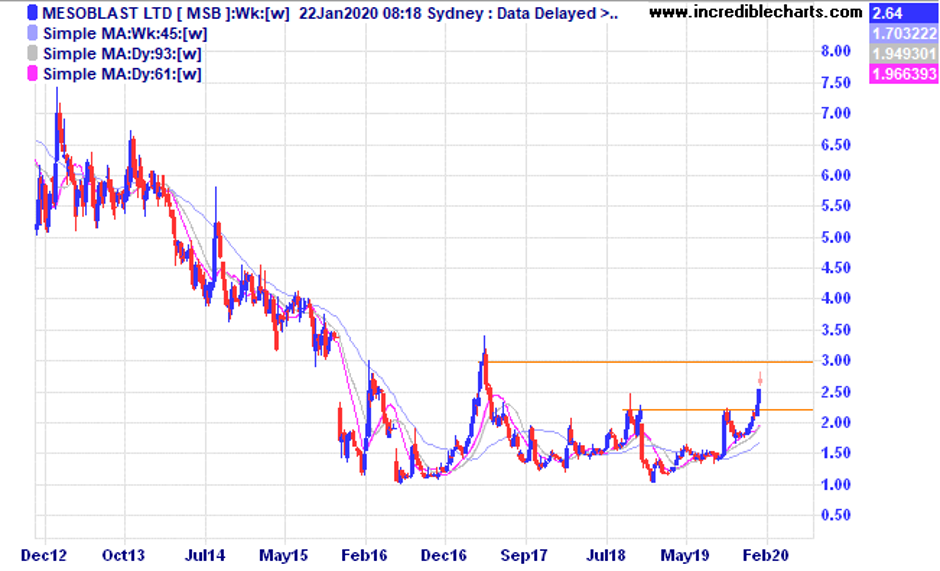

Mesoblast has an interesting looking chart.

Wagner’s has moved down to a possible support zone.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $296.50 | $304.34 | +$78.40 |

Bought Westgold c/fwd 3/1 at $2.33 | Bought 1,000 at $1.03 7/2/2019 | 7/2/2019 | $2.25 | $2.34 | +$90.00 |

Bought Santos c/fwd 3/1 at $8.29

| Bought 350 at $7.80 16/9/2019 | 16/9/2019 | $8.91 | $8.88 | -$10.50 |

Bought Kogan c/fwd 3/1 at $7.54 | Bought 300 at $6.25 25/9/2019 | 25/9/2019 | $7.79 | Stopped 20/1 at $6.50

| -$417.00 |

Buy Wagners c/fwd $2.73 | Bought 1,000 at $1.75 on 16/10/2019 | 16/10/2019 | $2.44 | $2.36

| -$80.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $62.49 | $63.56 | +$42.80 |

Bought Newcrest Mining c/fwd 3/1 at $30.44 | Bought 100 at $30.20 31/12/2019 | 31/12/2019 | $30.39 | $32.51 | +$212.00 |

Bought Resolute Mining | Bought 2,000 at $1.25 | 8/1/2020 | $1.17 | $1.17 | Steady |

Bought Syrah Resources | Bought 3,000 at 55c | 8/1/2020

| 71c | 57.5c | -$405.00 |

Bought Orocobre

| Bought 900 at $3.10 | 9/1/2020 | $3.79 | Sold 400 21/1 At $3.60 500 left $3.59 |

-$106.00 -$100.00 |

Bought 8 ASX 200 cfd’s | Bought 8 at 6934 | 14/1/2020 | 6962 | Sold 4 at 6994 Sold 4 at 7064 | +$98.00 +$378.00 |

Bought Appen

| Bought 100 at $25.00 | 16/1/2020 | $25.00 | $25.88 | +$88.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $52,498.60 |

|

|

| $52,498.60 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$131.60 |

|

|

| -$131.60 |

| Current total $52,367.00 |

|

|

| $52,367.00 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $25,252.80 |

|

|

| $25,252.80 |

Prices from Tuesday’s close or 6am for US | Cash available $27,114.20 |

|

|

| $27,114.20

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise…

Cheers Charlie.

To order photos from this page click here