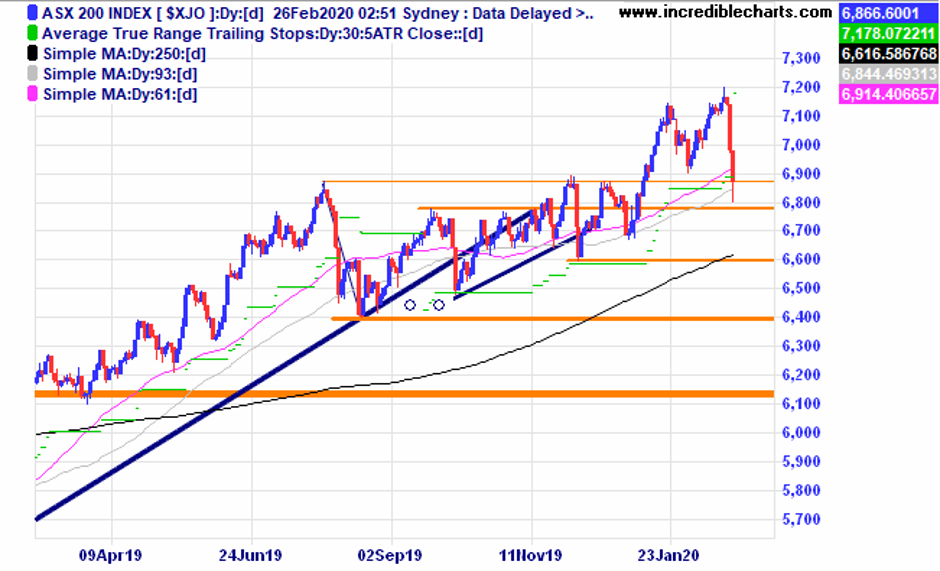

The local market has been falling in sync with world markets as the spread of the COVID-19 virus widens and a certain amount of fear creeps in. On the daily chart the index bounced from a possible support zone only temporarily with this index sitting some 140 points lower at present.

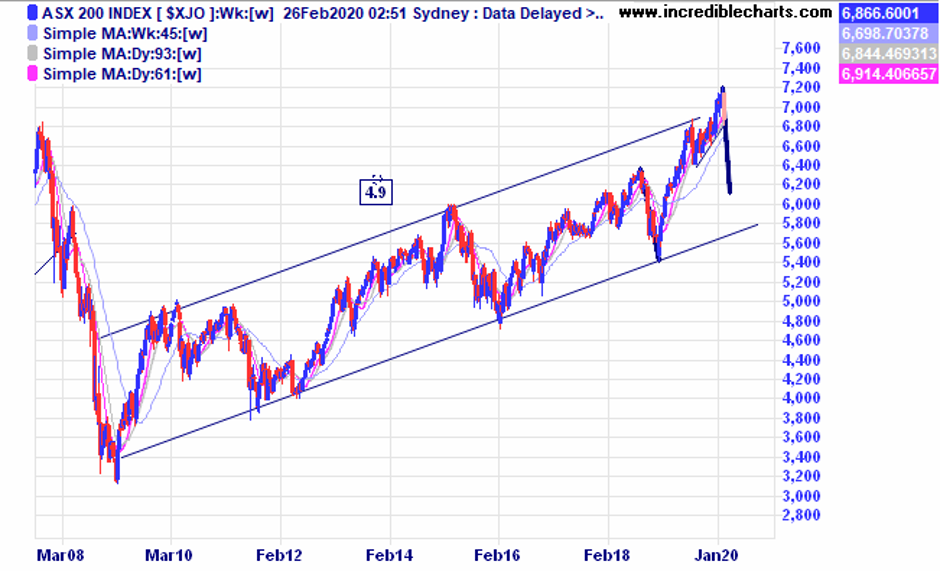

On a weekly chart the index moved briefly out of the big upwards trending channel. The dark blue line shows where a similar range down to that in late 2018 would end and of course we cannot rule out yet another fall to the lower support line of the channel.

The price of gold showed its inherent volatile nature as price spiked upwards in reaction to fears over the COVID-19 virus. How long before the trend line is broken?

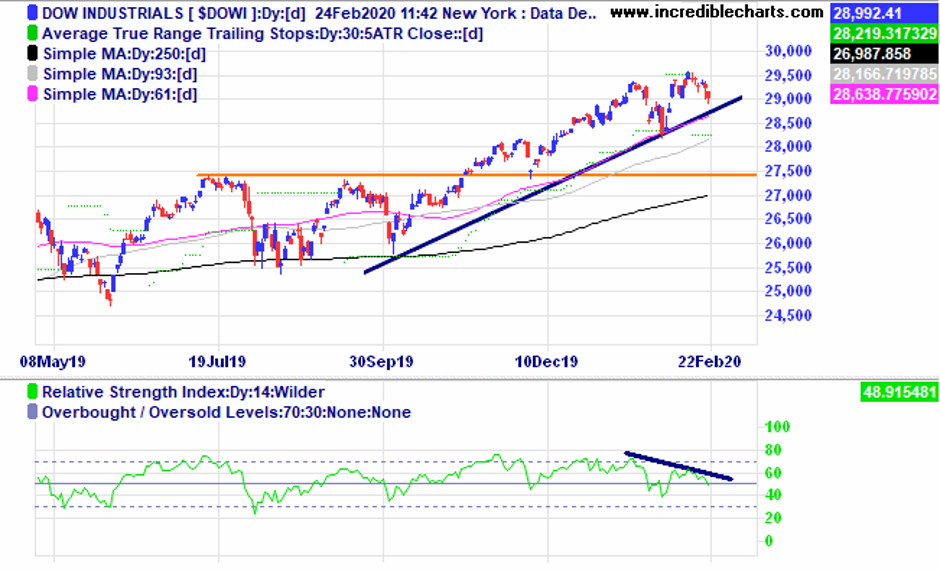

In the US the Dow Jones Index could fall to around 24,00 if a similar range down to late 2018 were to happen. We bought one mini short position last night and bought back at our predetermined exit. Suffice to say the market continued to head lower. We had a specific target related to the chart pattern and exited accordingly and kept our risk reasonably low in such a volatile environment. Owning the BBOZ bear ETF is our longer-term short position at the moment.

It has been a hectic few days on world markets and this is the rough guide of our overnight trade. While only capturing part of one nights fall this trade fell within our risk reward guidelines and margin availability.

The chart of the BBOZ ETF showing a couple of target projections.

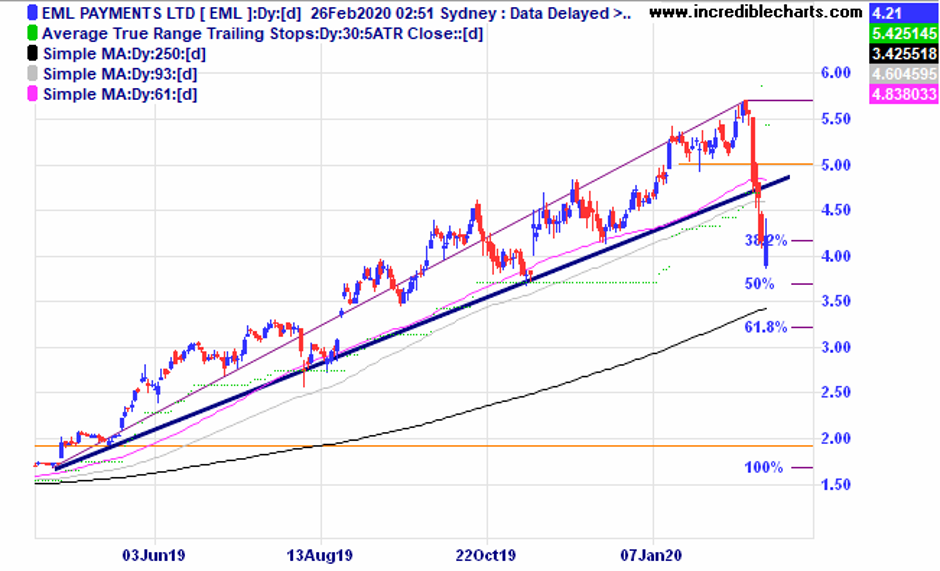

EML Payments broke through two possible support zones last week and we sold. On the watchlist for a look when things start turning around. A bounce from the 50 per cent retracement zone is a possibility.

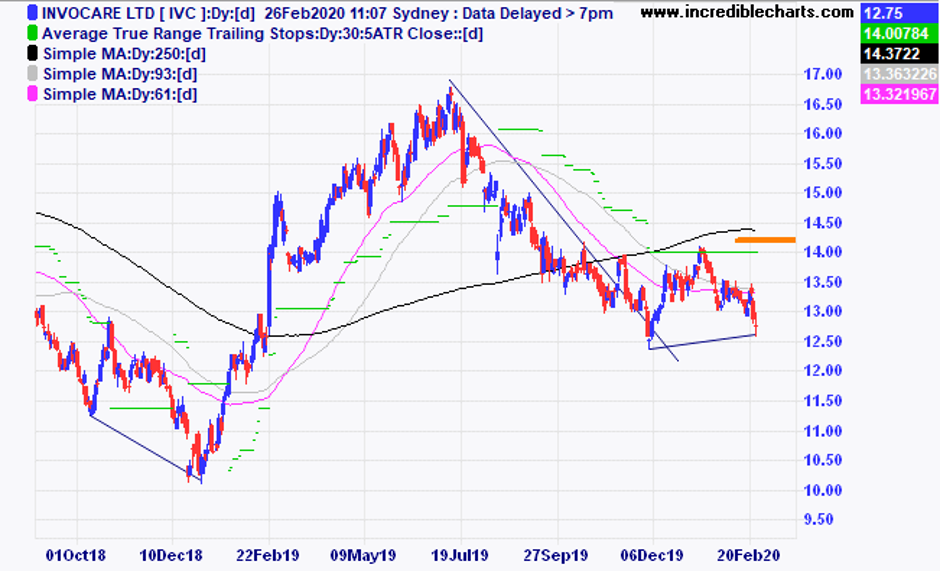

Invocare Ltd was one of the few stocks showing decent gains today. No stock in the top 50 was in the green at the time of writing.

Bellevue Gold moved higher out of a W type basing pattern and we bought a parcel after having been stopped out of Newcrest Mining and wanting to top up our educational portfolio’s gold holdings.

A few stocks are close to being stopped out and in this volatile environment you need to keep a watchful eye on your positions. As the ASX 200 approaches being down 150 points today we will exit half our remaining short position which will be in the table next week.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $331.17 | $324.00 | -$71.70 |

Bought Westgold c/fwd 3/1 at $2.33 | Bought 1,000 at $1.03 7/2/2019 | 7/2/2019 | $2.14 | $2.46 | +$320.00 |

Buy Wagners c/fwd $2.73 | Bought 1,000 at $1.75 on 16/10/2019 | 16/10/2019 | $1.85 | Sold 20/2 at $1.82 | -$60.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $71.58 | $68.00 | -$143.20 |

Bought Newcrest Mining c/fwd 3/1 at $30.44 | Bought 100 at $30.20 31/12/2019 | 31/12/2019 | $27.39 | Sold 19/2 at $28.50 | +$81.00 |

Bought Resolute Mining | Bought 2,000 at $1.25 | 8/1/2020 | $1.13 | $1.18 | +$120.00 |

Bought Appen

| Bought 100 at $25.00 | 16/1/2020 | $26.05 | $25.40 | -$65.00 |

Bought Capitol Health | Bought 8,000 at 25.5c | 5/2/2020 | 28 | 28.5 | +$40.00 |

Bought EML Payments | Bought 500 at $5.40 | 5/2/2020 | $5.55 | Stopped 20/2 at $4.80 | -$405.00 |

Bought City Chic

| Bought 900 at $3.20 | 5/2/2020 | $3.10 | $3.25 | +$135.00 |

Bought Polynovo

| Bought 700 at $2.90 | 5/2/2020 | $3.09 | Sold 24/2 at $2.90 | -$163.00 |

Bought Wisetech

| Bought 100 at $28.30 | 12/2/2020 | $29.44 | Sold 19/2 at $23.50 | -$624.00 |

Sold 8 ASX 200 cfd’s

| Sold 8 at 7,125 | 17/2/2020 | 7,113 | 6,866

| +$1,976.00 |

Bought Evolution | Bought 600 at $4.50

| 19/2/2020 | $4.50 | $4.41 | -$54.00 |

Bought QBE

| Bought 100 at $15.00 | 19/2/2020 | $15.00 | $14.57 | -$43.00 |

Bought IPH

| Bought 200 at $10.20 | 19/2/2020 | $10.20 | $9.27 | -$186.00 |

Bought Bellevue Gold | Bought 4000 at 58c | 21/2/2020 | 58c | 61c | +$12.00 |

Sold 8 ASX 200 cfd’s

| Sold 8 at 7020 | 24/2/2020 | 7020 | Bought 8 at 6,840 11am 25/2 | +$1,410.00 |

Bought BBOZ bear ETF | Bought 500 at $8.60 | 24/2/2020 | $8.60 | $8.92 | +$160.00 |

Sold 1 mini-dow futures contract | Sold 1 at 27,910 | 25/2/2020 | 27,910 | Bought at 27, 396 | +$2,590.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $51,495.50 |

|

|

| $51,495.50 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$5,029.10 |

|

|

| +$5,029.10 |

| Current total $56,524.60 |

|

|

| $56,524.60 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $36,305.00 |

|

|

| $36,305.00 |

Prices from Tuesday’s close or 6am for US | Cash available $20,219.60 |

|

|

| $20,219.60

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise…

Cheers Charlie.

To order photos from this page click here