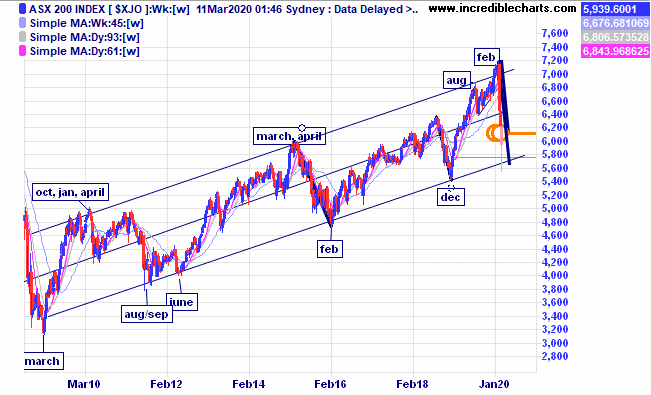

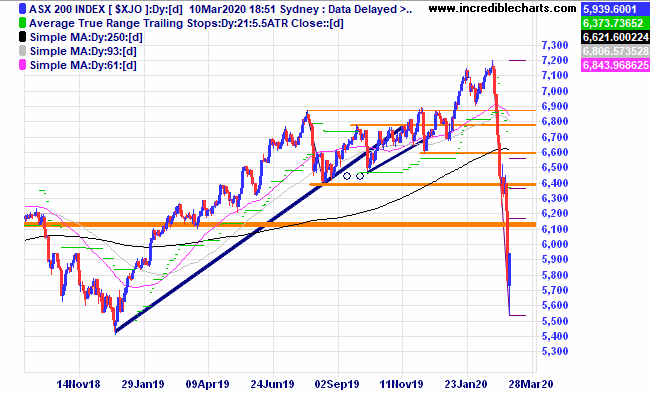

The local market continues the roller coaster ride on the back of Covid19 and oil price ructions while the community as a whole is waiting to see what the Australian Federal Government will do to help ease the situation. The ASX200 index briefly touched the lower channel line and bounced higher. Trading in the 5,790’s today.

On a daily chart a bounce up to 5,900 to 6,100 zone would be a good start. With all that is happening and whole countries going into self-imposed lockdown who knows what might happen next. Apart from our long term holds and a few speculative positions our portfolio remains well cashed up. Bellevue Gold was stopped out today.

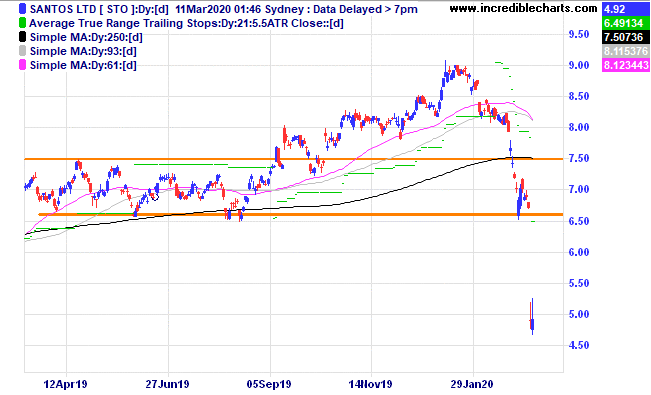

Most oil stocks were hammered when the price of oil fell heavily including Santos which triggered our stop loss rule. It may well bounce today after a stronger oil price overnight, that’s the way the cookie crumbles sometimes and by following our trading rules there can be brutal losses to take. Over the course of hundreds of trades it all works out in the end by cutting potential large losses quickly.

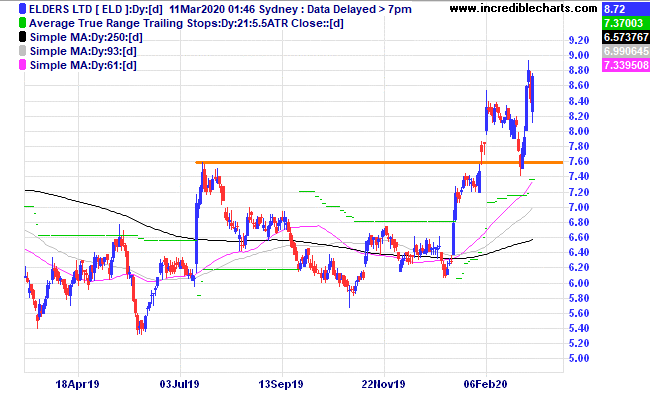

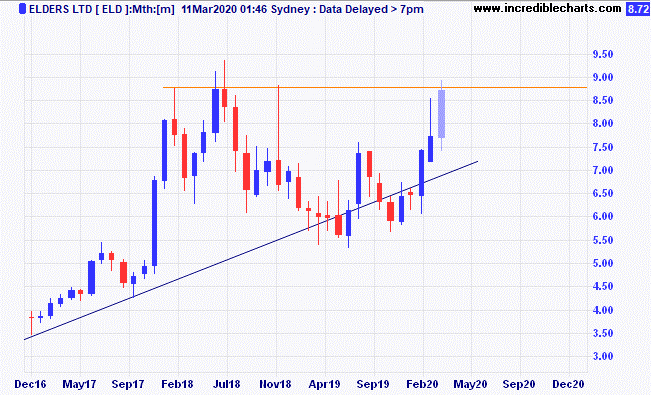

Elders ran down to support and bounced thanks to some widespread rain and a more cheerful outlook for farmers.

On a monthly time-frame Elders has run into some stiff looking resistance.

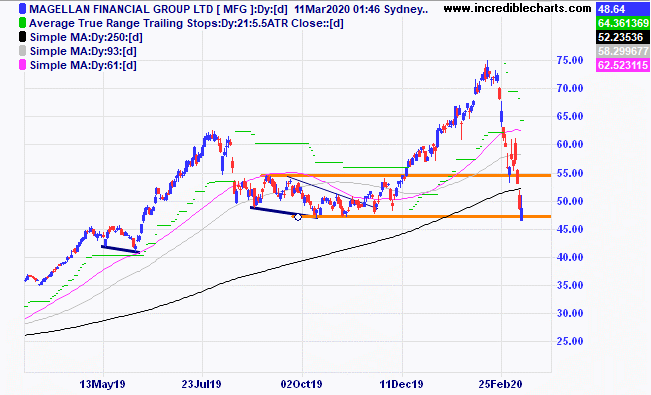

Fund manager Magellan has fallen heavily to lower support levels and will be held throughout the cycle with boss Hamish Douglas quoted as saying he was looking for some bargains in the current environment.

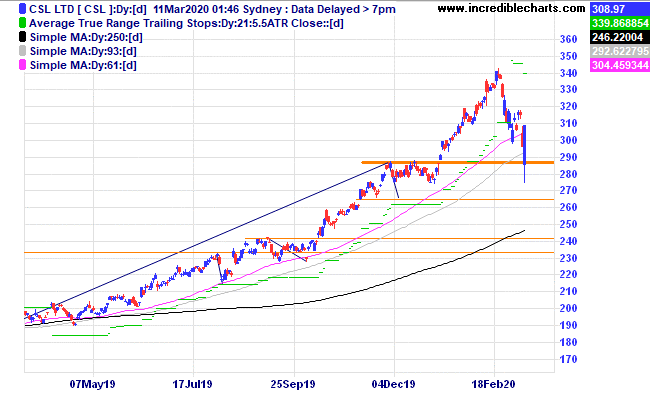

CSL has held up better. Well managed companies will pull through the current turmoil and it could be seen as a time to stock up on better quality companies. Timing as always is difficult with traders generally sticking to well tested and tried battle plans.

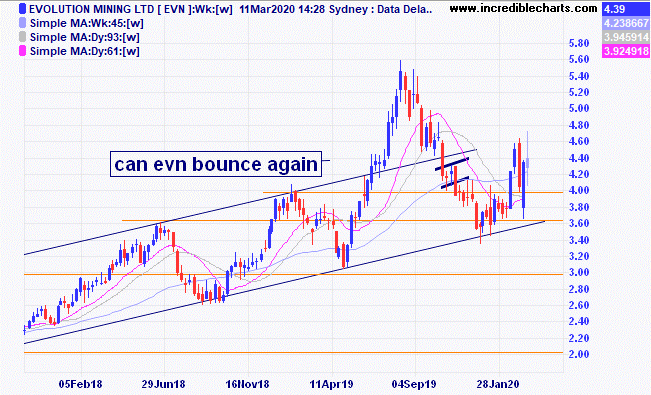

Gold stocks have been belted as well with Evolution falling to below $4 today and just holding above the long-term trend line. The price of gold looked to be over the worst and is still well up from recent lows.

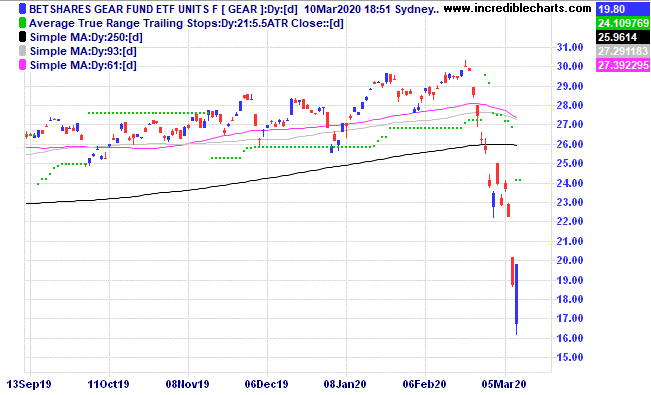

The GEAR fund put in a strong bounce yesterday and we bought a good-sized parcel looking for that bounce to continue. We have reduced our holding by half today as prices fell and will look to add more on a possible small ABC type pattern.

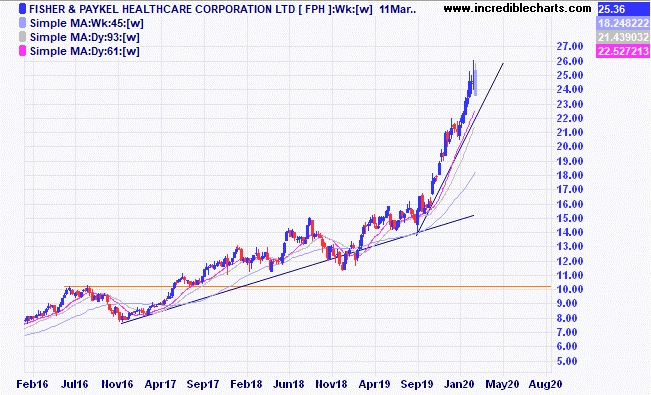

Fisher and Paykel has just kept on going up.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $313.00 | $308.97 | -$40.30 |

Bought Westgold c/fwd 3/1 at $2.33 | Bought 1,000 at $1.03 7/2/2019 | 7/2/2019 | $1.94 | $1.87 | -$70.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $57.38 | $48.64 | -$349.60 |

Bought Appen

| Bought 100 at $25.00 | 16/1/2020 | $22.80 | Stopped 9/3 at $20.00 | -$310.00 |

Bought Capitol Health | Bought 8,000 at 25.5c | 5/2/2020 | 29 | 26.5 | -$200.00 |

Bought City Chic

| Bought 900 at $3.20 | 5/2/2020 | $2.88 | Stopped 9/3 at $2.20 | -$642.00 |

Bought Evolution | Bought 600 at $4.50

| 19/2/2020 | $4.09 | $4.39 | +$180.00 |

Bought QBE

| Bought 100 at $15.00 | 19/2/2020 | $13.32 | Sold 6/3 at $12.40 | -$122.00 |

Bought IPH

| Bought 200 at $10.20 | 19/2/2020 | $8.66 | Sold 9/3 at $7.30 | -$302.00 |

Bought Bellevue Gold | Bought 4000 at 58c | 21/2/2020 | 55c | 48c | -$280.00 |

Bought Gear ETF

| Bought 150 at $23.00 | 2/3/2020 | $23.92 | Sold 6/3 at $22.50 | +$243.00 |

Bought 8 ASX 200 cfd’s | Bought4 at 6,360 | 2/3/2020 | 6,485 | Sold 4/3/at 6,355 | +$490.00

|

Bought NDQ ETF

| Bought 150 at $22.00 | 2/3/2020 | $22.75 | Sold 9/3 at $21.00 | -$292.50 |

Bought Santos

| Bought 400 at $7.00 | 2/3/2020 | $7.00 | Sold 9/3 at $5.10 | -$790.00 |

Bought Lifestyle

| Bought 300 at $8.40 | 2/3/2020 | $8.52 | $8.27 | -$75.00 |

Bought BBOZ ETF

| Bought 250 at $10.85 | 6/3/2020 | $10.85 | Sold 10/3 at $12.60 | +$407.50 |

Sold 4 ASX 200 cfd’s

| Sold 4 at 5,914 | 9/3/2020 | 5,914 | Buy 9/3 at 5,828 | +$314.00 |

Buy GEAR ETF

| Buy 200 at $18.50 | 10/3/2020 | $18.50 | $19.80 | +$260.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $58,215.30 |

|

|

| $58,215.30 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$1,578.90 |

|

|

| -$1,578.90 |

| Current total $56,636.40 |

|

|

| $56,636.40 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $21,139.70 |

|

|

| $21,139.70 |

Prices from Tuesday’s close or 6am for US | Cash available $35,496.70 |

|

|

| $35,496.70

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here