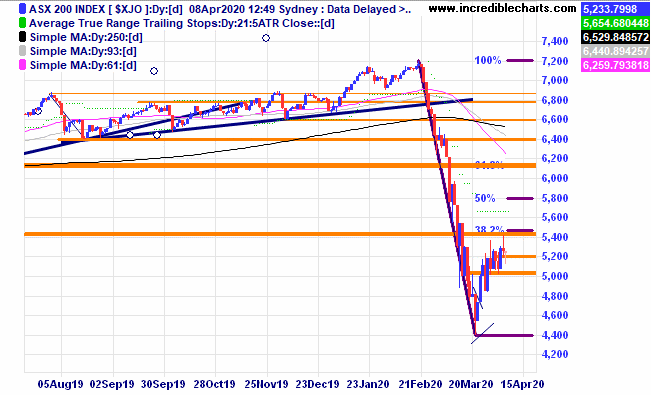

The local index spiked higher yesterday near a possible resistance zone and fell during this morning’s trade before recovering. With the long Easter break fast approaching there may be some conservative unwinding of positions from traders.

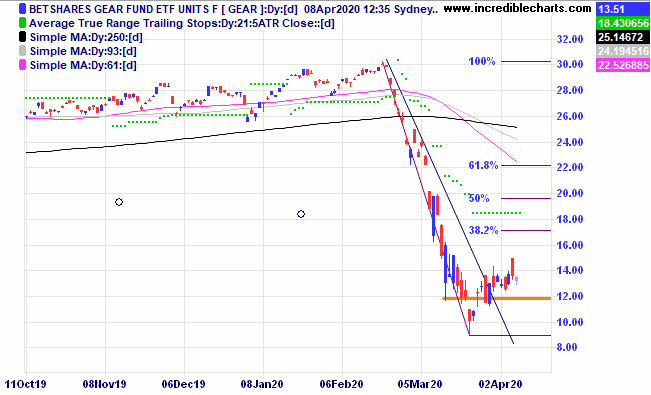

In winding down before the Easter holiday we sold the remainder of the GEAR ETF today. We will look to buy back in when conditions are more favourable.

We bought some Invocare after a spike down and a bounce up from a previous support level.

The price of gold made another brief spike higher into the $1,700’s before closing lower. A nice ABC pattern along with another higher low could provide traders with a possible entry point.

A big mover early in the week was Mesoblast before it ran into a resistance zone.

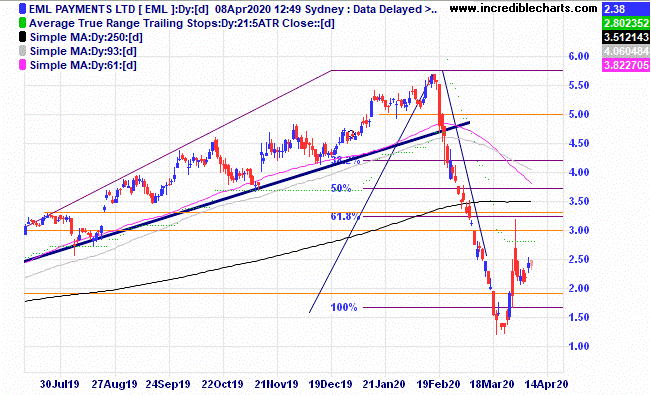

EML Payments looks to be consolidating.

Kogan has moved up nicely from the low and an ABC type pattern with a higher low could provide some interesting trade possibilities.

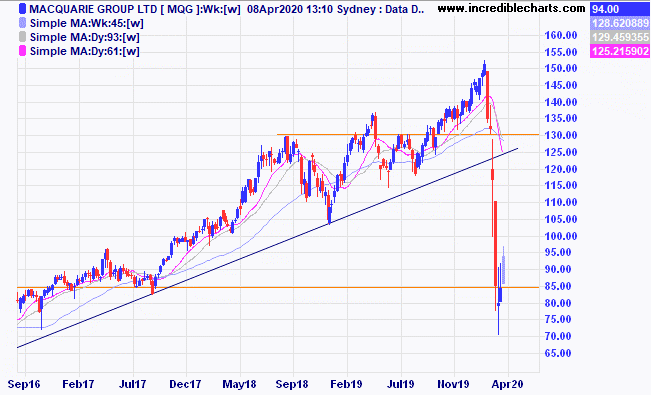

The weekly chart of Macquarie Bank is similar to a lot of other companies which have made a fast decline and are again on the way up. A higher low could offer some decent trade possibilities. There is still a long way to go before global trade conditions get anywhere near back to normal and it would not surprise to see markets fall further over time.

Jumbo Interactive looks to have found some support.

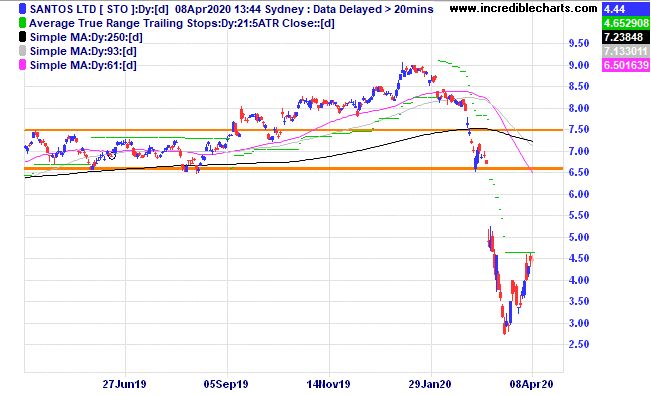

Santos has moved up from the lows. With the oil price so low the US fracking industry is under pressure to remain profitable. Winding down of unprofitable production could put a floor under the oil price.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $296.68 | $311.99 | +$153.10 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $43.52 | $47.98 | +$178.40 |

Bought GEAR ETF

| Bought 400 at $10.85 | 24/3/2020 | $12.72 | Sold 200 at $14.50 200 left at $13.54 |

+$326.00 +$164.00 |

Bought VTS ETF

| Bought 10 at $195.87 | 24/3/2020 | $210.38 | $215.41 | +$50.30 |

Bought Evolution

| Bought 800 at $3.98 | 24/3/2020 | $3.82 | $4.40 | +$464.00 |

Bought Silverlake

| Bought 2,000 at $1.41 | 24/3/2020 | $1.38 | $1.52 | +$280.00 |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $1.92 | $2.13 | +$252.00 |

Bought Invocare

| Bought 250 at $11.00 | 1/4/2020 | $11.00 | $10.58 | -$105.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $59,208.65 |

|

|

| $59,208.65 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$1,762.80 |

|

|

| +$1,762.80 |

| Current total $60,971.45 |

|

|

| $60,971.45 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $22,208.00 |

|

|

| $22,208.00 |

Prices from Tuesday’s close or 6am for US | Cash available $38,763.45 |

|

|

| $38,763.45

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here