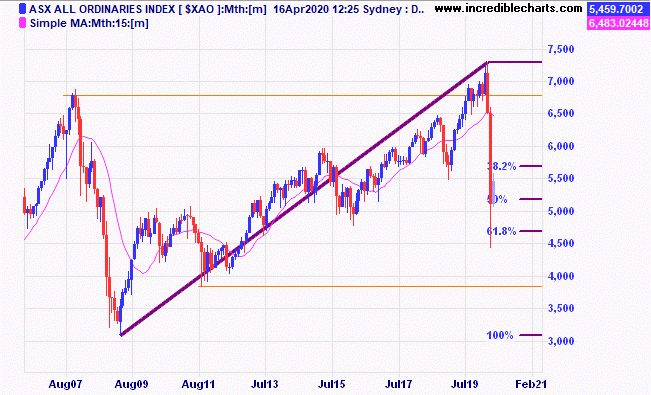

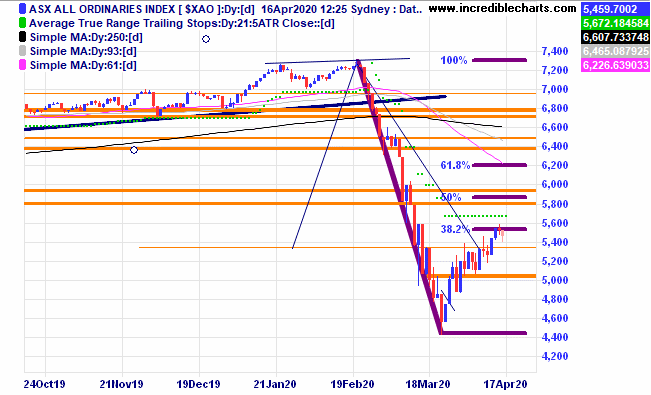

The local market has rebounded strongly after briefly moving below the .618 retracement level of the 2009 to 2020 range on the longer-term chart. This could be one reason some analysts are suggesting the low is in.

Many downturns have at least two legs down in an ABC type pattern. The index has moved up from the low around 4,400 to the 38.2 retracement level of the move down and stalled for now. Will we have another leg down to a new low or form a higher low? Traders will be making their plans for both scenarios. A move below today’s low could trigger some short trades.

The technology biased Nasdaq index has had a much stronger move up from the lows.

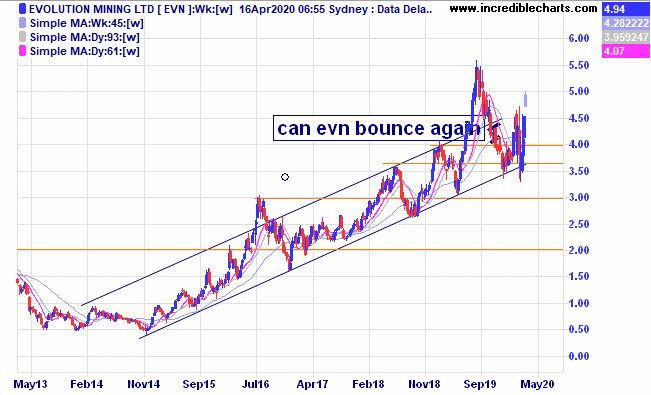

We love it when a plan comes together. Last week we looked at the gold chart and hypothesised how the forming of a new low followed by an ABC pattern could be a good place to take a trade. Hey presto it happened very quickly and gave a reasonable risk reward trade situation and we were lucky to be able to take advantage of that. We sold half of our position before the Easter break to take some profit and reduce risk and sold the remainder on the next trading day.

The gold market is setting up again for a possible trade higher as shown in the chart below, watching.

Evolution and Northern Star are gold miners that have again bounced up from long term trend lines.

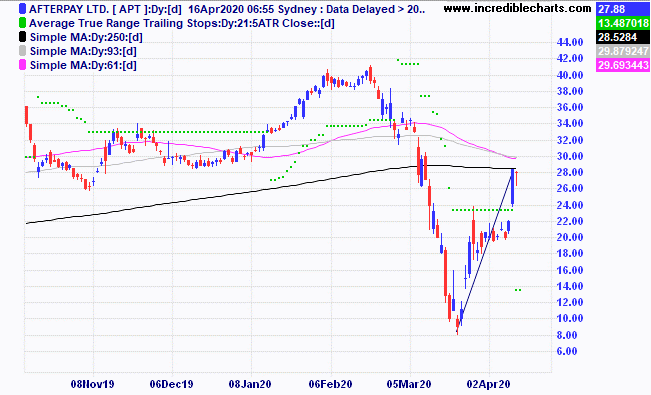

In the ASX share game all the top 100 players have added more than 50 per cent to their portfolios in a month. One of the many stocks to quickly rebound was Afterpay which is up from lows around $8 to $27 today.

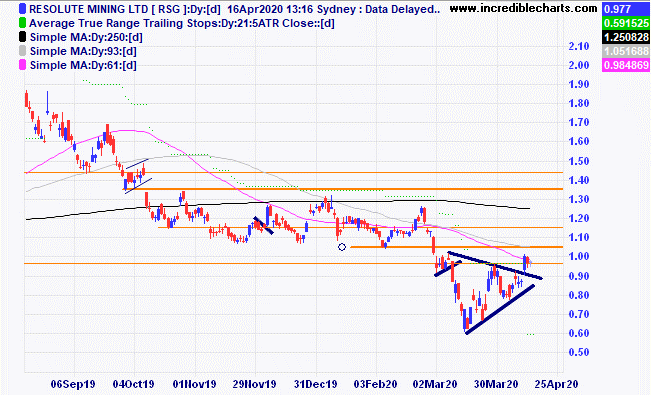

Resolute Mining provided an excellent trade set-up breaking out of a triangular consolidation pattern after making a higher high and a higher low. We bought some for the educational portfolio on the break.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $311.99 | $324.14 | +$121.50 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $47.98 | $48.68 | +$28.00 |

Bought GEAR ETF

| Bought 200 at $10.85 | 24/3/2020 | $13.54 | Sold 200 8/4 at $13.94

| +$50.00

|

Bought VTS ETF

| Bought 10 at $195.87 | 24/3/2020 | $215.41 | $221.10 | +$56.90 |

Bought Evolution

| Bought 800 at $3.98 | 24/3/2020 | $4.40 | $4.94 | +$432.00 |

Bought Silverlake

| Bought 2,000 at $1.41 | 24/3/2020 | $1.52 | $1.78 | +$520.00 |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $2.13 | $2.06 | -$84.00 |

Bought Invocare

| Bought 250 at $11.00 | 1/4/2020 | $10.58 | $11.51 | +$232.50 |

Bought mini gold contracts | Bought 2 at $1,697.00 | 8/4/2020 | $1,697.00 | Sold 1 9/4 at $1,727.00 Sold 1 13/4 at $1,747.00 |

+$1,440.00

+$2,440.00 |

Bought Magellan

| Bought 30 at $50.00 | 14/4/2020 | $50.00 | $48.68 | -$39.60 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | 98c | 96.5 | -$37.50 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $60,971.45 |

|

|

| $60,971.45 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$5,159.80 |

|

|

| +$5,159.80 |

| Current total $66,131.25 |

|

|

| $66,131.25 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $24,623.90 |

|

|

| $24,623.90 |

Prices from Tuesday’s close or 6am for US | Cash available $41,507.35 |

|

|

| $41,507.35

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here