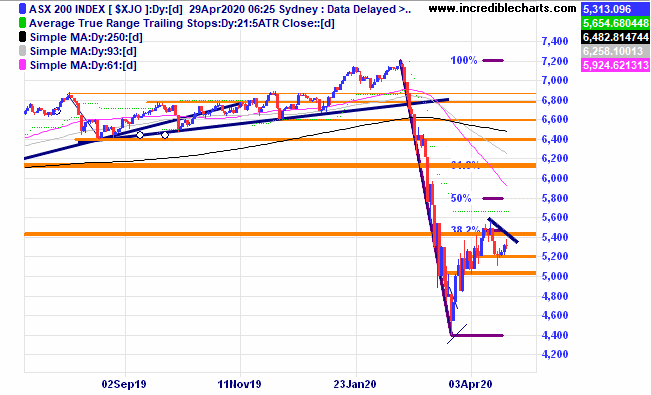

The local market has been drifting sideways as investors decide how fast the recovery might be. If a lower-high should form here we could see another move lower.

The US S@P 500 looks to have also stalled for now, perhaps waiting on the next lot of unemployment data.

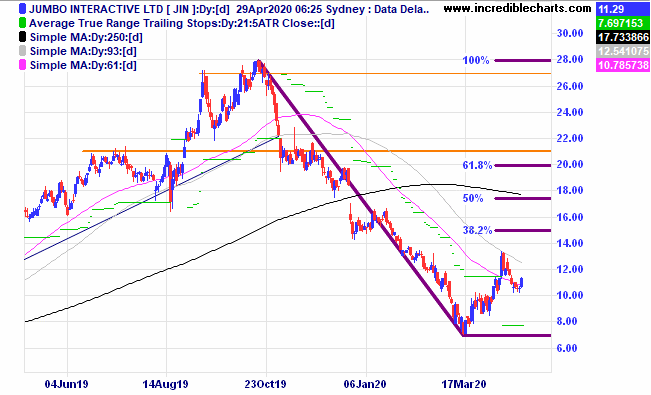

Online lottery mob Jumbo Interactive looks to be moving higher and we bought a parcel last week.

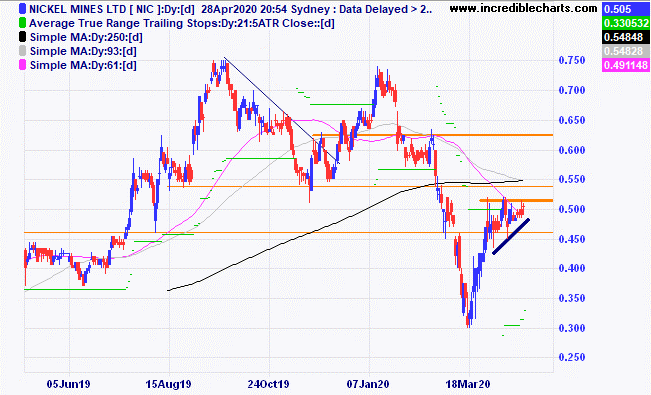

Nickel Mines was one of the top picks at last year’s Hearts and Minds conference and looks to be setting up nicely for a further move higher with some good risk to reward possibilities, we bought a parcel today as price moved up.

With what looks like to be the worst of the COVID-19 virus cases behind us for now investors and pondering what stocks to buy. The thing though is the worst of the economic impacts over or just beginning. The major banks are signalling more pain is to come. Buyers be aware and ready to change tack when needed.

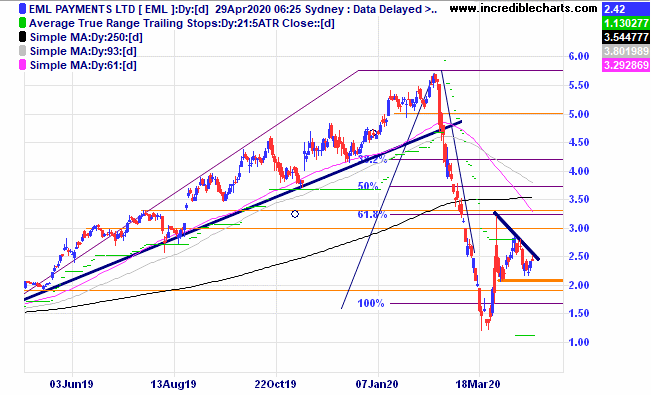

EML Payments has an interesting looking chart as does Pro Medicus.

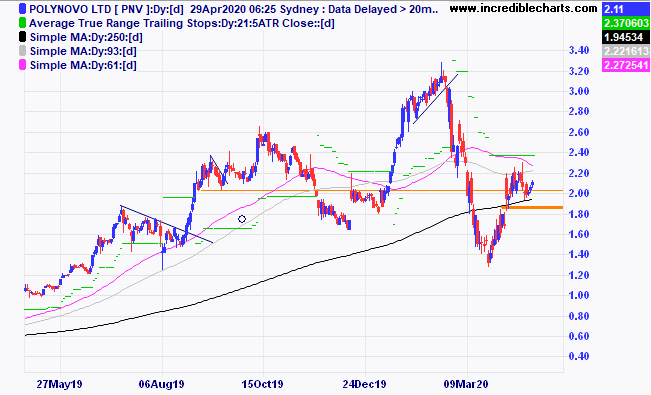

Polynovo recently released some nice results and the chart is showing some interesting trade possibilities.

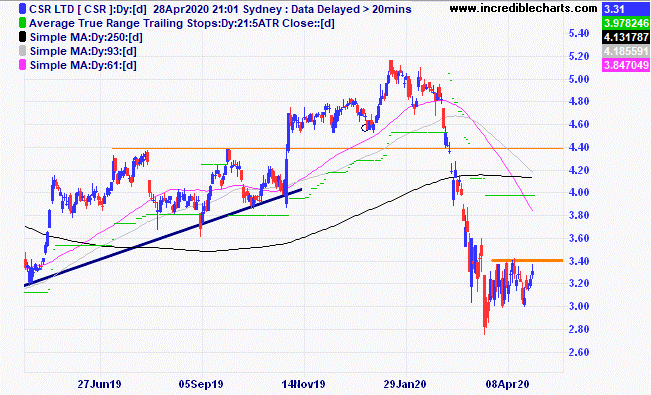

The chart for CSR also looks interesting from a trade perspective as does Adelaide Brighton.

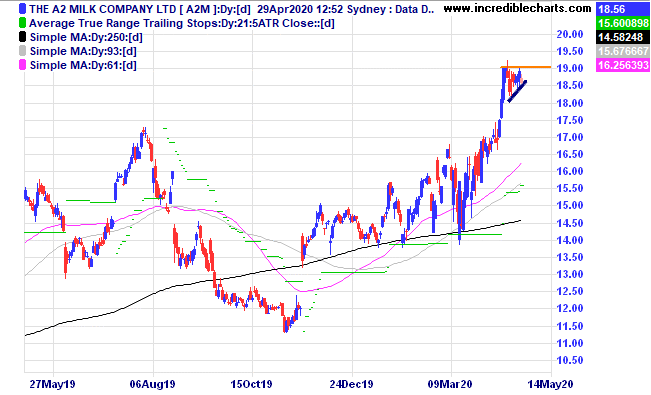

A2Milk has been one of the stronger stocks this year and is consolidating for now.

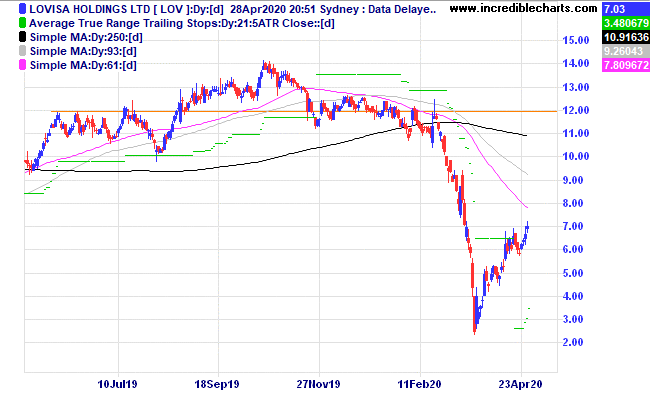

Lovisa is moving higher

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $306.69 | $320.20 | +$135.10 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $46.32 | $48.90 | +$103.20 |

Bought VTS ETF

| Bought 10 at $195.87 | 24/3/2020 | $221.10 | $222.91 | +$18.10 |

Bought Evolution

| Bought 800 at $3.98 | 24/3/2020 | $4.99 | $5.28 | +$232.00 |

Bought Silverlake

| Bought 2,000 at $1.41 | 24/3/2020 | $1.81 | $1.98 | +$340.00 |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $1.73 | $1.70 | -$36.00 |

Bought Invocare

| Bought 250 at $11.00 | 1/4/2020 | $10.00 | Sold 22/4 at $10.00 | -$30.00 |

Bought Magellan

| Bought 30 at $50.00 | 14/4/2020 | $46.32 | $48.90 | +$77.40 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | 86.5 | 93.5 | +$175.00 |

Sold 8 ASX 200 cfd’s

| Sold 8 at 5,308 | 21/4/2020 | 5,221 | Bought 4 22/4 at 5,155 Bought 4 23/4 at 5,210 | +$234.00

+$11.00 |

Bought Jumbo Interactive | Bought 300 at $10.20 | 22/4/2020 | $10.20 | $11.29 | +$387.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $65,604.05 |

|

|

| $65,604.05 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$1,646.80 |

|

|

| +$1,646.80 |

| Current total $67,250.85 |

|

|

| $67,250.85 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $25,712.10 |

|

|

| $25,712.10 |

Prices from Tuesday’s close or 6am for US | Cash available $41,538.75 |

|

|

| $41,538.75

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here