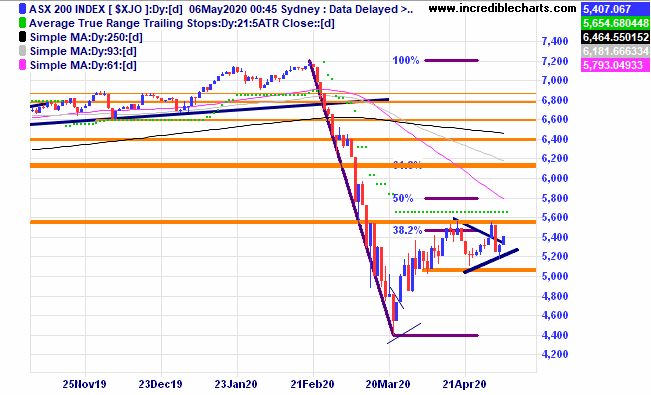

The local market continues to trade in a big sideways range. Some investors have done well buying at the higher low on April 22nd. Is it time to sell in May and go away?

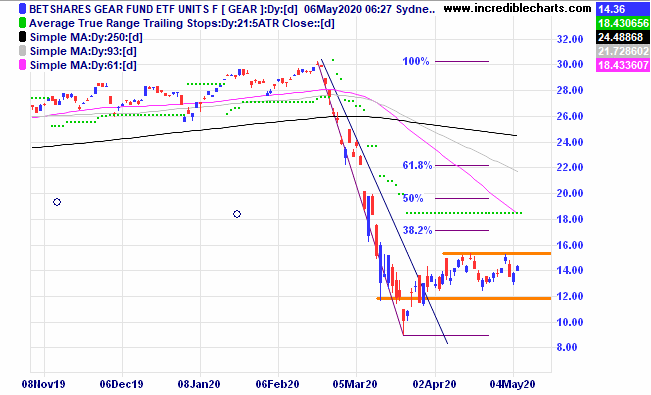

The GEAR ETF exhibits a similar pattern and shows if the fund moved from current levels to the February high it would make a tad more than a 100 per cent gain. We will buy a parcel today and aim to hold for the longer term. Holding an index fund lowers the risk of holding individual companies which could go broke and at the same time lowers the potential gains of holding individual companies.

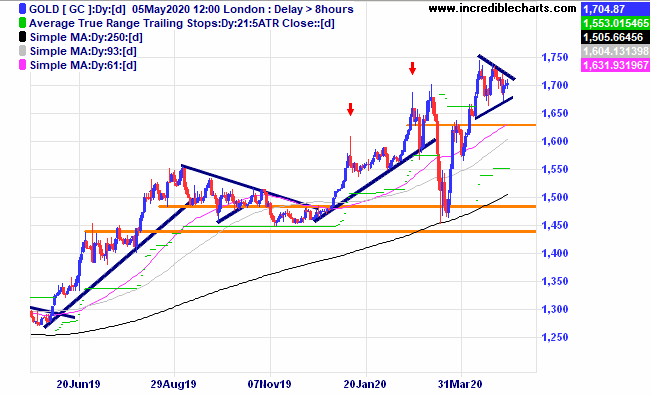

The price of gold is forming an interesting consolidation pattern.

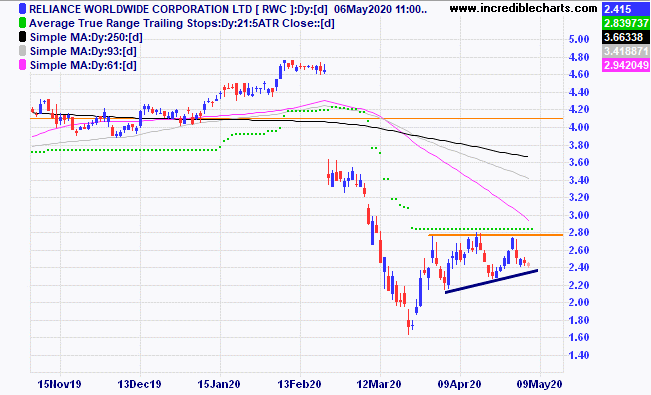

Plumbing outfit Reliance Worldwide looks close to breaking out of the current congestion.

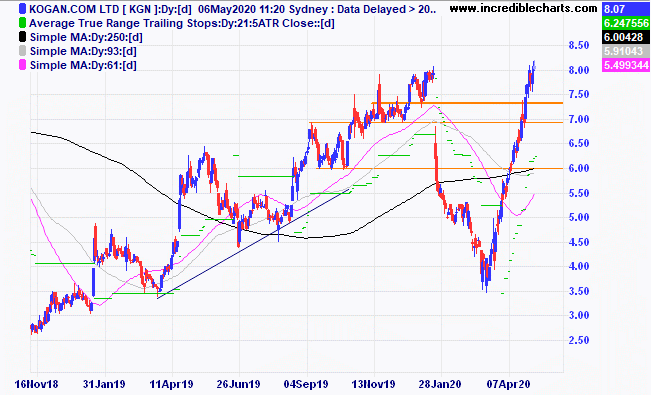

Kogan is one of a handful of companies including Afterpay which have moved to new yearly highs.

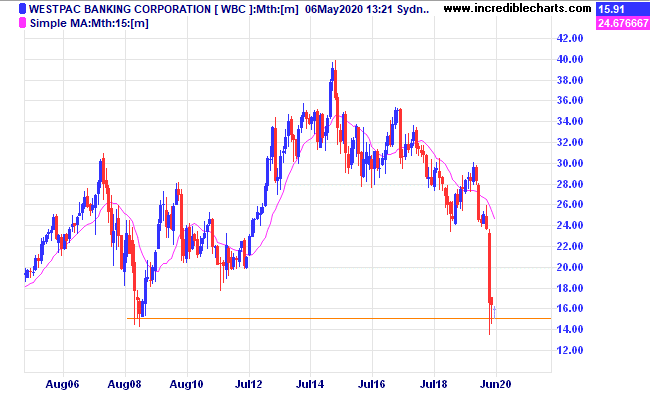

Interesting to see Westpac trading at a similar price to the early 2009 GFC lows.

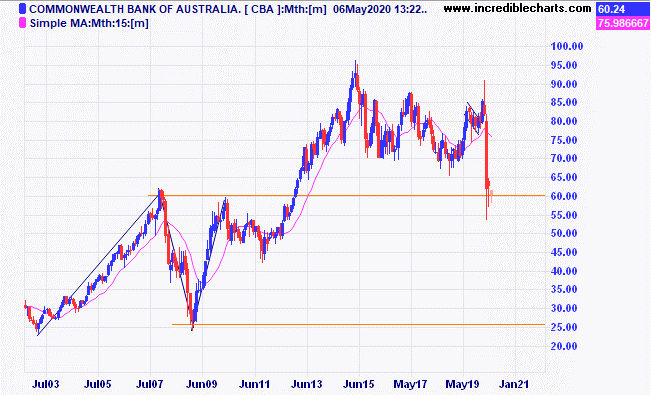

Commonwealth Bank has so far remained well above the GFC lows.

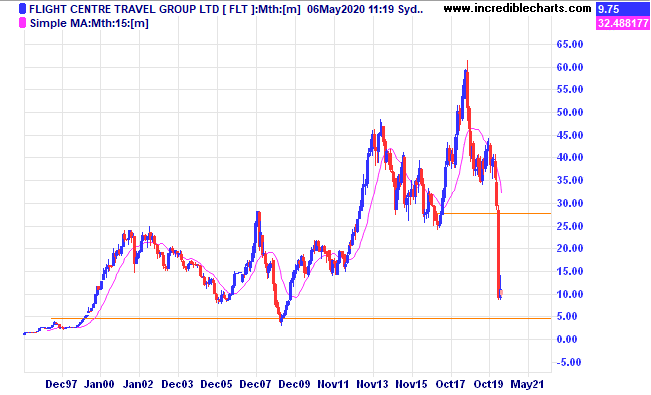

Flight Centre has a long history of price fluctuations. Can it once again do the trick for investors after the travel restrictions come to an end? We will buy an initial smaller speculative parcel for the educational portfolio today.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $320.20 | $305.70 | -$145.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $48.90 | $50.53 | +$65.20 |

Bought VTS ETF

| Bought 10 at $195.87 | 24/3/2020 | $222.91 | $221.48 | -$14.30 |

Bought Evolution

| Bought 800 at $3.98 | 24/3/2020 | $5.28 | $5.23 | -$40.00 |

Bought Silverlake

| Bought 2,000 at $1.41 | 24/3/2020 | $1.98 | $1.94 | -$80.00 |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $1.70 | $1.77 | +$84.00 |

Bought Magellan

| Bought 30 at $50.00 | 14/4/2020 | $48.90 | $50.53 | +$48.90 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | 93.5 | 91.5 | -$50.00 |

Bought Jumbo Interactive | Bought 300 at $10.20 | 22/4/2020 | $11.29 | $11.89 | +$180.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 52.5c | 55.5 | +$180.00 |

Bought CSR

| Bought 1,000 at $3.50 | 30/4/2020 | $3.50 | $3.52 | +$20.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $67,250.85 |

|

|

| $67,250.85 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$248.80 |

|

|

| +$248.80 |

| Current total $67,499.65 |

|

|

| $67,499.65 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $32,278.70 |

|

|

| $32,478.70 |

Prices from Tuesday’s close or 6am for US | Cash available $35,020.95 |

|

|

| $35,020.95

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here