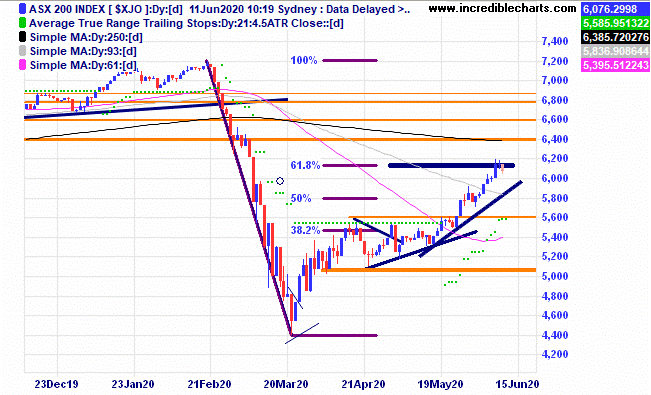

The local market surged higher early in the week on the back of strong gains in overseas markets and reached a typical Fibonacci retracement level in the process which also happened to be up 100 per cent of the range of the sideways consolidation. Some kind of correction is possible with a few analysts saying the market is getting ahead of itself.

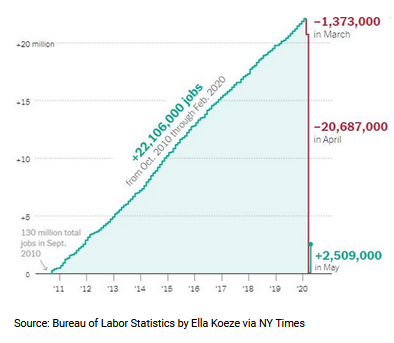

One of the triggers for the US stock market gains was the higher than forecast jobs numbers. The graph below shows the recent gains in a longer-term perspective with a long way to go to a full job’s recovery.

In the just published Firstlinks newsletter Ashley Owen has done some informative analysis on past recessions and the share market in Australia noting that share prices rose in 17 of the last 20 recessions and rose in each of the past nine recessions. Will this time be different?

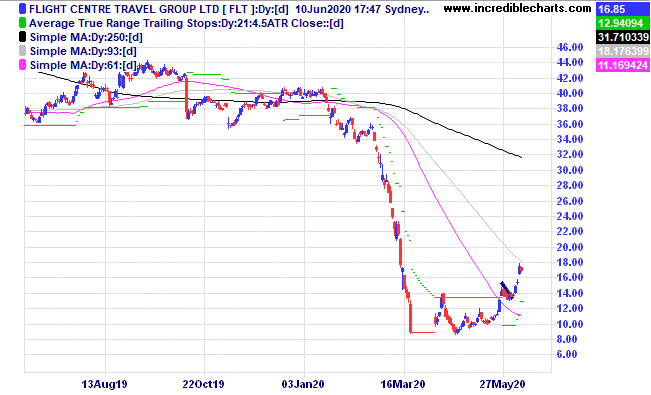

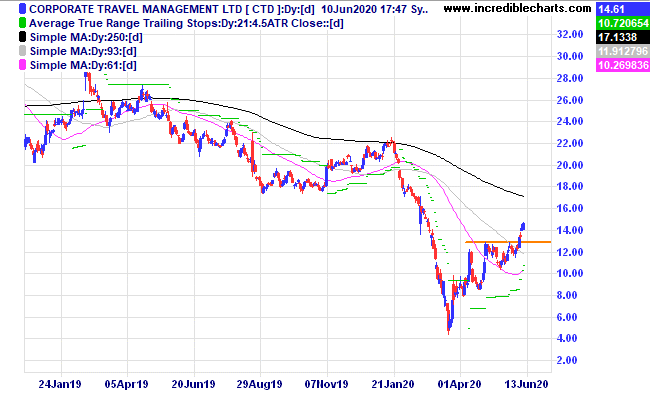

Quite a few travel and leisure stocks have risen sharply including Flight Centre and Ardent Leisure.

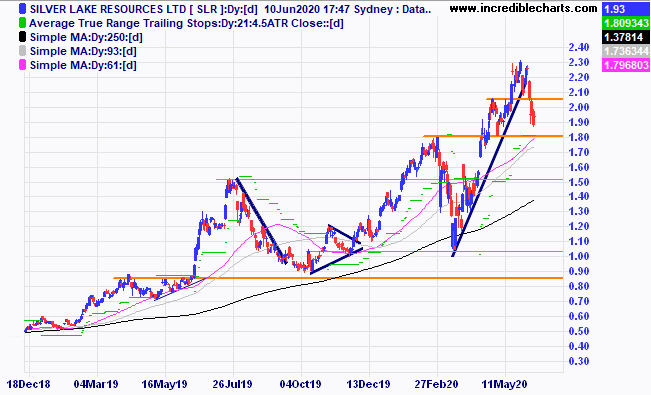

Silver Lake Resources moved below the stop level we initiated for the most recent purchase and we were stopped out.

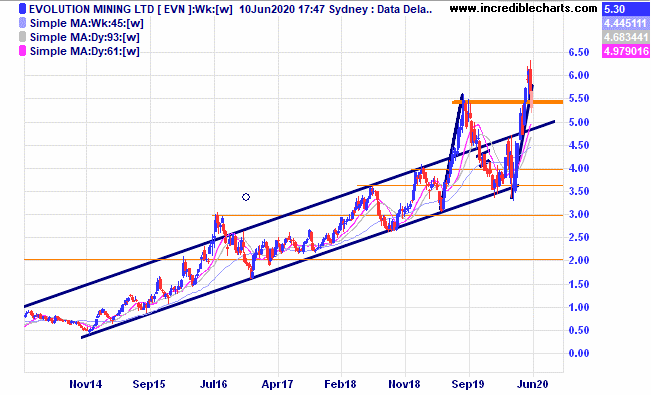

Gold miner Evolution could fall by around 50 per cent from recent highs and still be considered in a long-term uptrend.

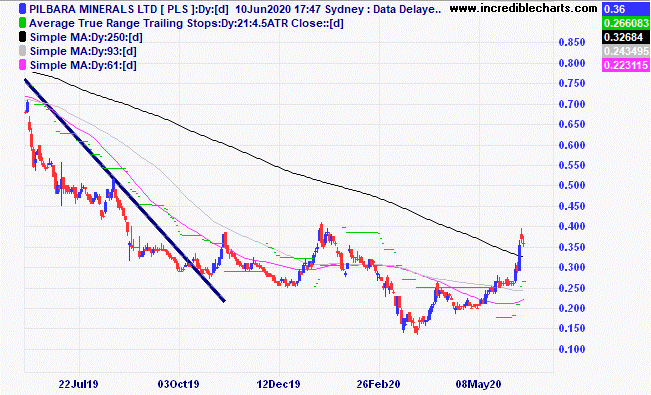

Some of the once hot lithium stocks have been moving up from the lows including Pilbara Minerals.

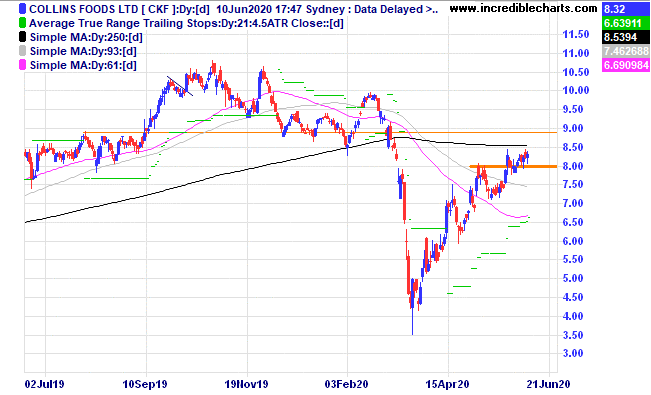

Takeaway food operator Collins Foods recently moved above resistance.

Corporate Travel has also popped higher.

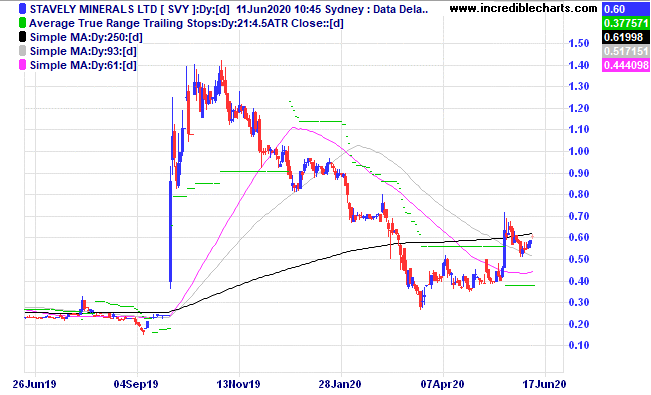

Copper and gold explorer Stavely Minerals are expected to release some maiden resource figures later this year which could see another upwards spurt in the share price. We bought a speculative parcel for the educational portfolio today.

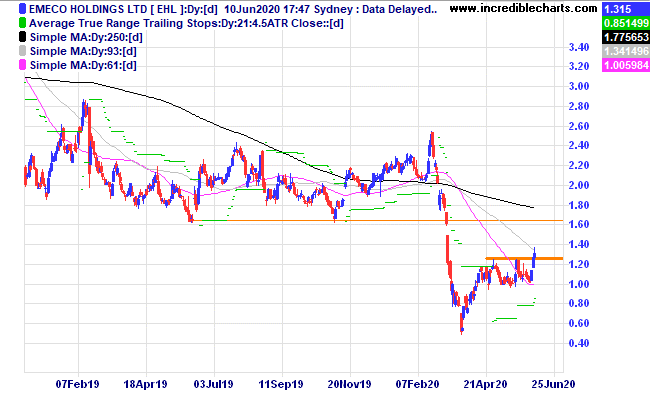

Emeco Holdings has moved above the recent trading range.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $284.73 | $285.69 | +$9.60 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $59.31 | $60.60 | +$51.60 |

Bought VTS ETF

| Bought 10 at $195.87 | 24/3/2020 | $227.28 | Sold 3/6 $225.00 | -$52.80 |

Bought Evolution

| Bought 600 at $3.98 | 24/3/2020 | $6.22 | $5.30 | -$552.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.25 | $1.93 | -$480.00 |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $1.82 | $1.87 | +$60.00 |

Bought Magellan

| Bought 30 at $50.00 | 14/4/2020 | $59.31 | Sold 3/6 $60.00 | -$10.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.17 | $1.06 | -$275.00 |

Bought Jumbo Interactive | Bought 300 at $10.20 | 22/4/2020 | $11.94 | $12.07 | +$39.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 54.5c | 56.5 | +$120.00 |

Bought CSR

| Bought 1,000 at $3.50 | 30/4/2020 | $4.37 | $4.18 | -$190.00 |

Bought GEAR ETF

| Bought 200 at $14.00 | 6/5/2020 | $17.13 | $19.01 | +$376.00 |

Bought Flight Centre

| Bought 150 at $10 | 6/5/2020 | $13.50 | $16.85 | +$502.50 |

Bought Flexigroup

| Bought 3,000 at 95c | 7/5/2020 | $1.33 | $1.42 | +$270.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $26.51 | $28.05 | +$154.00 |

Bought Ooh! Media

| Bought 2,800 at $1.14 | 19/5/2020 | $1.10 | $1.19 | +$253.00 |

Bought Flight Centre

| Bought 100 at $12.65 | 25/5/2020 | $13.50 | $16.85 | +$335.00 |

Bought Electro Optic Systems | Bought 500 at $5.75 | 27/5/2020 | $5.95 | $6.62 | +$335.00 |

Bought Silverlake

| Bought 800 at $2.10 | 28/5/2020 | $2.25 | Stopped 4/6 $1.95 | -$270.00 |

Bought Ardent Leisure | Bought 6,000 at 46c | 3/6/2020 | 46c | 65c | +$1,140.00 |

Bought Qantas

| Bought 600 at $4.20 | 3/6/2020 | $4.20 | $4.99 | +$474.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $73,831.25 |

|

|

| $73,831.25 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$2,289.40 |

|

|

| +$2,289.40 |

| Current total $76,120.65 |

|

|

| $76,120.65 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $44,130.40 |

|

|

| $44,130.40 |

Prices from Tuesday’s close or 6am for US | Cash available $31,990.25 |

|

|

| $31,990.25

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here