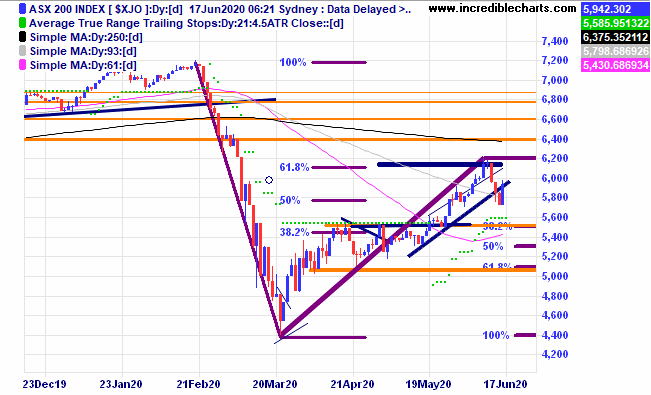

The local market gained good ground yesterday on the back of stronger overseas markets following an announcement from the US Federal Reserve to buy more bonds. Central Bank interventions seem to be propping up the weak fundamentals for now. A larger move to the downside could eventuate with price moving below the small trend channel and towards what could be seen as stronger support some 400 points below current levels. Time will tell.

The US S@P 500 index futures market last night closed off the highs.

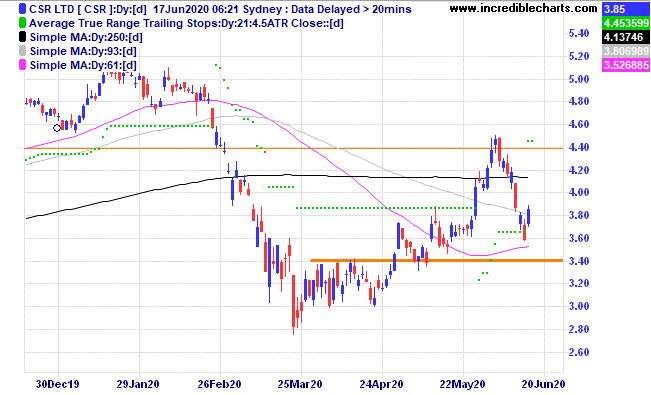

The educational portfolio suffered a big drawdown over the past week with a few stocks closing near stop loss orders. We sold some stocks today including EOS, CSR, the smaller FLT parcel and cut the FXL position by half in anticipation of a larger downswing from recent highs. We will look to hedge the portfolio by selling some ASX 200 cfd’s when appropriate.

CSR has actually fallen through one level of stops after reaching the first profit target.

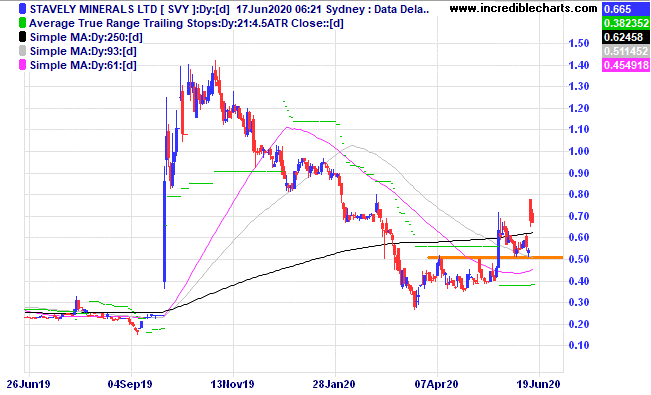

Recently acquired Stavely Minerals has pushed up higher possibly on the back of being promoted into the All Ordinaries Index.

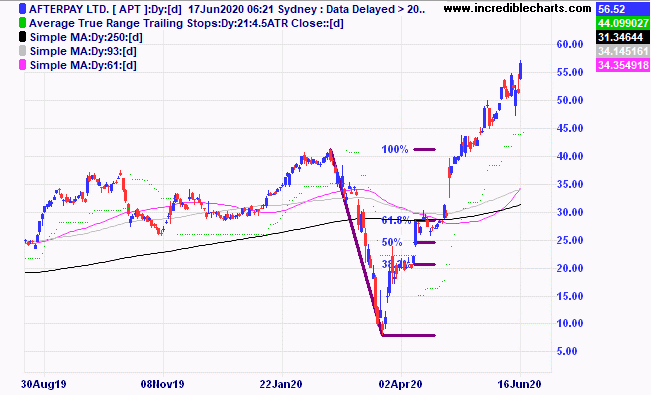

Afterpay is on a hot run up from the March lows.

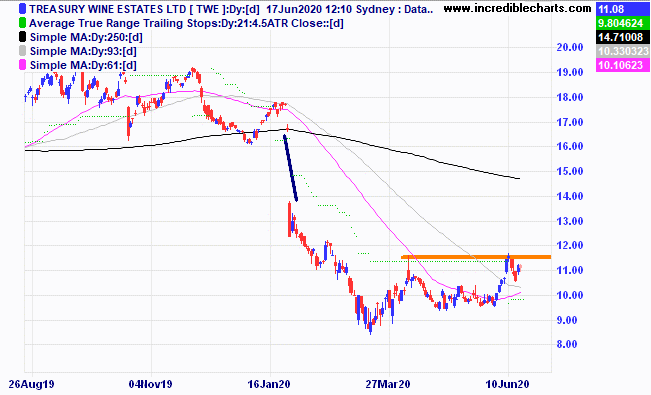

Treasury Wines could be building up for another move higher.

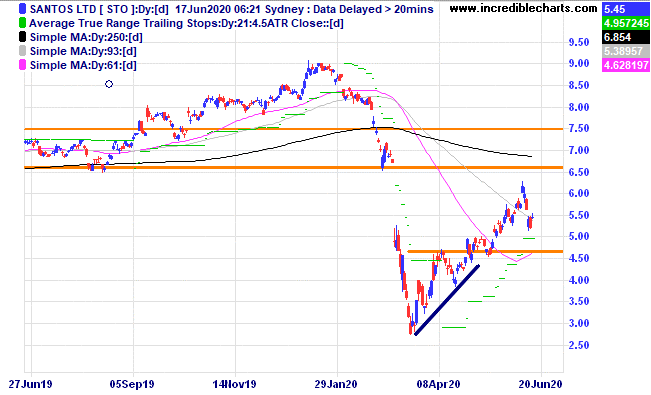

Santos moved a step closer to having development approval for the Narrabri Gas Project.

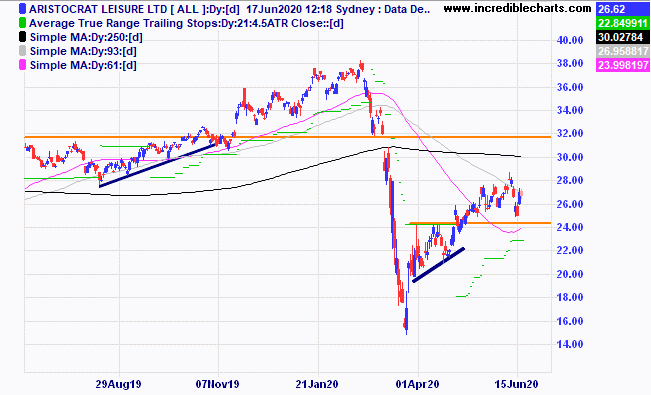

Aristocrat Leisure looks to have found some support.

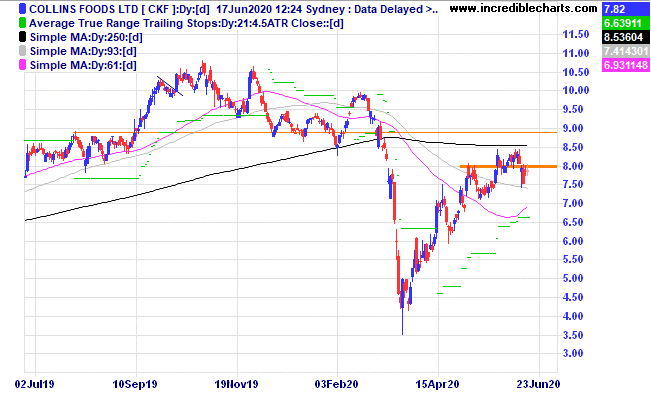

A few stocks that have recently made a fresh high have sunk below possible support levels like Collins Foods.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $285.69 | $284.01 | -$16.80 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $60.60 | $56.11 | -$179.60 |

Bought Evolution

| Bought 600 at $3.98 | 24/3/2020 | $5.30 | $5.40 | +$60.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $1.93 | $1.93 | Steady |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $1.87 | $1.65 | -$264.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.06 | $1.04 | -$50.00 |

Bought Jumbo Interactive | Bought 300 at $10.20 | 22/4/2020 | $12.07 | $11.41 | -$198.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 56.5c | 55c | -$90.00 |

Bought CSR

| Bought 1,000 at $3.50 | 30/4/2020 | $4.18 | $3.85 | -$330.00 |

Bought GEAR ETF

| Bought 200 at $14.00 | 6/5/2020 | $19.01 | $17.78 | -$246.00 |

Bought Flight Centre

| Bought 150 at $10 | 6/5/2020 | $16.85 | $14.10 | -$412.50 |

Bought Flexigroup

| Bought 3,000 at 95c | 7/5/2020 | $1.42 | $1.20 | -$660.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $28.05 | $27.02 | -$103.00 |

Bought Ooh! Media

| Bought 2,800 at $1.14 | 19/5/2020 | $1.19 | $1.06 | -$364.00 |

Bought Flight Centre

| Bought 100 at $12.65 | 25/5/2020 | $16.85 | $14.10 | -$275.00 |

Bought Electro Optic Systems | Bought 500 at $5.75 | 27/5/2020 | $6.62 | $5.59 | -$515.00 |

Bought Ardent Leisure | Bought 6,000 at 46c | 3/6/2020 | 65c | 51.5c | -$810.00 |

Bought Qantas

| Bought 600 at $4.20 | 3/6/2020 | $4.99 | $4.52 | -$282.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 56c | 66.5c | +$420.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $76,120.65 |

|

|

| $76,120.65 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$4,315.90 |

|

|

| -$4,315.90 |

| Current total $71,804.75 |

|

|

| $71,804.75 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $55,820.10 |

|

|

| $55,820.10 |

Prices from Tuesday’s close or 6am for US | Cash available $15,984.65 |

|

|

| $15,984.65

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here