The local market has been trading in a very tight sideways range as shown on the 4 hourly chart and could go for a nice run when it breaks.

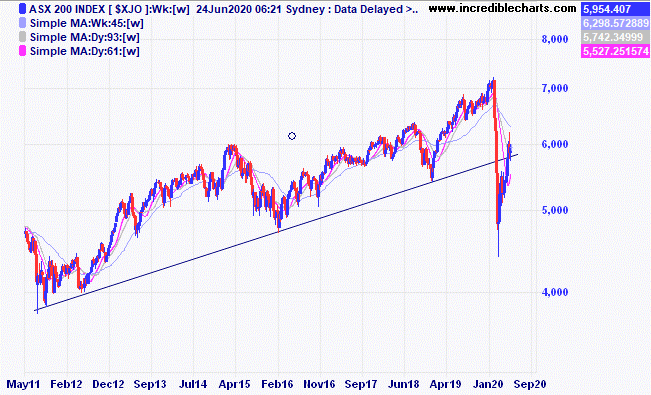

A longer-term weekly chart shows the index is back above the long-term trend line.

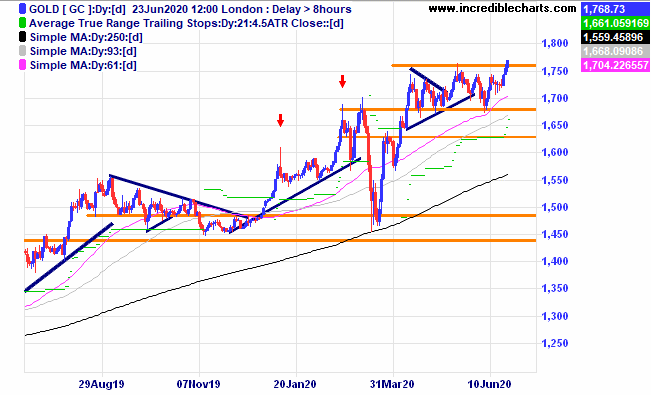

The price of gold has been trading in a small range and closed at a new high. Is this the start of a new rally or a false break before a move lower?

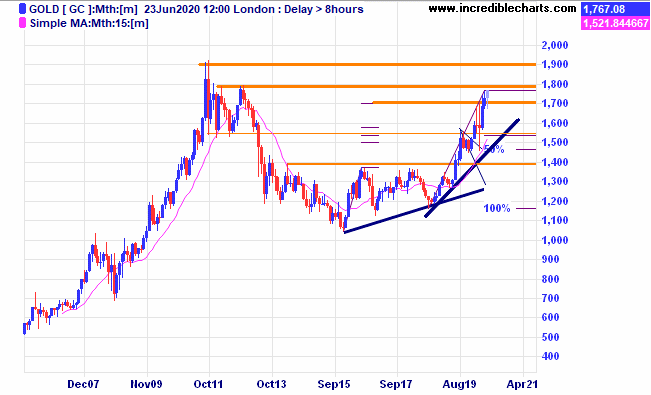

A longer-term chart of the gold price shows the resistance levels ahead to overcome before making new all-time highs.

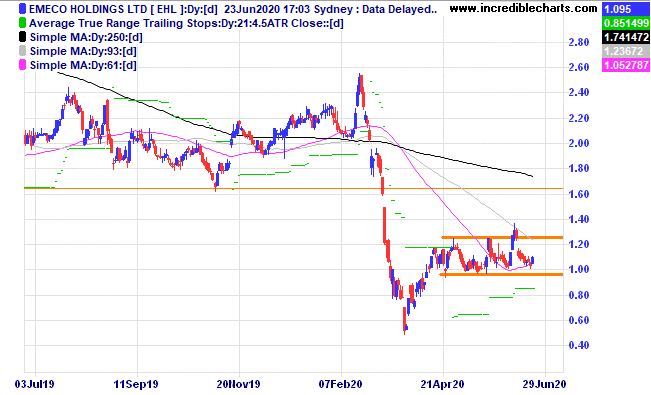

Emeco is trading in the bottom half of the range.

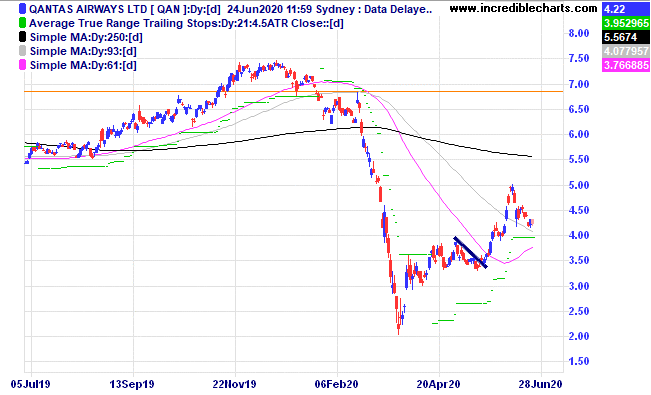

Travel stocks like Qantas and Flight Centre are drifting towards stop loss levels as is Ardent Leisure.

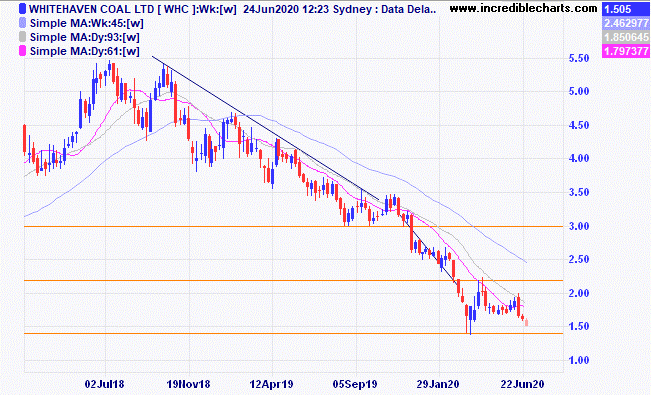

Whitehaven Coal is also drifting towards the lower end of the range and stop loss level.

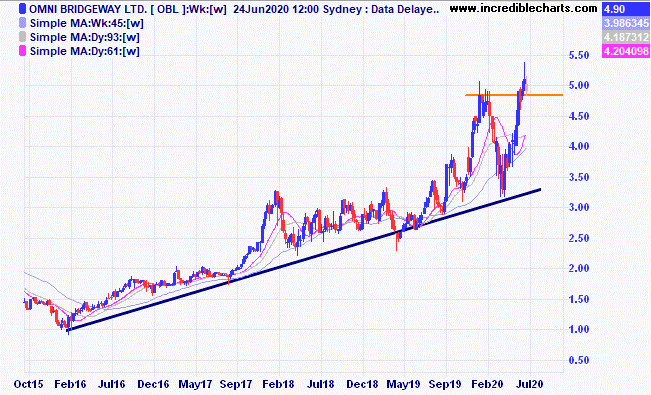

Omni Bridgeway is the new name for the old litigation mob IMF Bentham. Price is trying to hold the recent break higher.

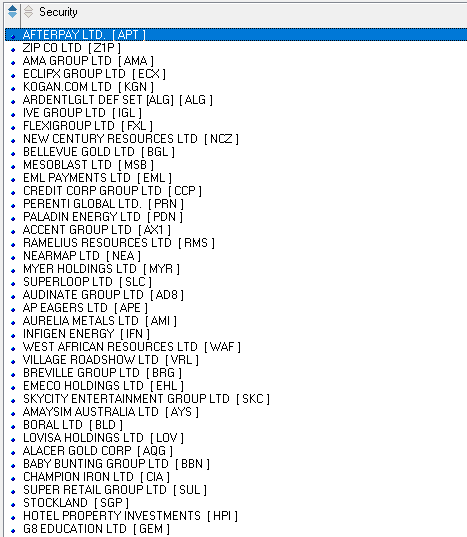

These are the top gaining stocks in the ASX 300 over the past 3 months and range from over 550 per cent for Afterpay to 100 per cent for G8 Education.

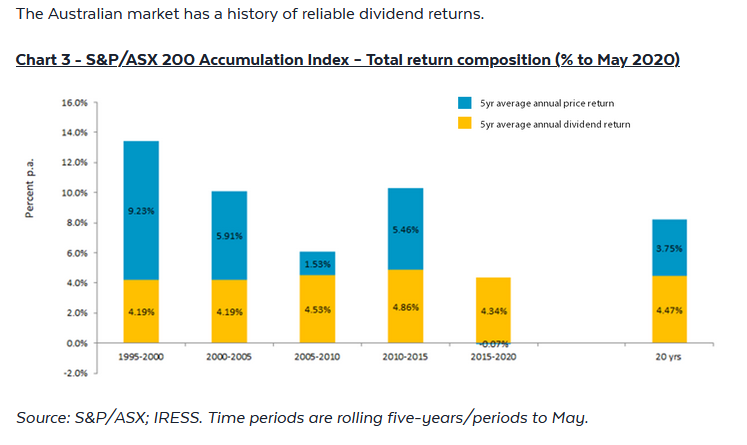

This graphic shows the importance of steady dividends over the long term in the Australian market as the capital appreciation for shares varies widely over different 5 year periods. Could the next five years bring some decent capital gains after the last five years of sub-par gains?

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $284.01 | $289.20 | +$51.90 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $56.11 | $57.51 | +$56.00 |

Bought Evolution

| Bought 600 at $3.98 | 24/3/2020 | $5.40 | $5.26 | -$84.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $1.93 | $2.01 | +$120.00 |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $1.65 | $1.54 | -$132.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.04 | $1.14 | +$250.00 |

Bought Jumbo Interactive | Bought 300 at $10.20 | 22/4/2020 | $11.41 | $11.41 | Steady |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 55c | 59c | +$240.00 |

Bought CSR

| Bought 1,000 at $3.50 | 30/4/2020 | $3.85 | Sold 17/6 at $3.80 | -$80.00 |

Bought GEAR ETF

| Bought 200 at $14.00 | 6/5/2020 | $17.78 | $17.66 | -$24.00 |

Bought Flight Centre

| Bought 150 at $10 | 6/5/2020 | $14.10 | $13.11 | -$148.50 |

Bought Flexigroup

| Bought 3,000 at 95c | 7/5/2020 | $1.20 | Sold 1,500 at $1.17 | -$75.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $27.02 | $26.38 | -$64.00 |

Bought Ooh! Media

| Bought 2,800 at $1.14 | 19/5/2020 | $1.06 | $1.02 | -$112.00 |

Bought Flight Centre

| Bought 100 at $12.65 | 25/5/2020 | $14.10 | Sold 17/6 at $13.73 | -$67.00 |

Bought Electro Optic Systems | Bought 500 at $5.75 | 27/5/2020 | $5.59 | Sold 17/6 at $5.50 | -$75.00 |

Bought Ardent Leisure | Bought 6,000 at 46c | 3/6/2020 | 51.5c | 44.5 | -$420.00 |

Bought Qantas

| Bought 600 at $4.20 | 3/6/2020 | $4.52 | $4.31 | -$126.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 66.5c | 66 | -$20.00 |

Sold 5 ASX 200 cfd’s

| Sold 5 at 5,942.00 | 19/6/2020 | 5,942 | 5,954 | -$60.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $71,804.75 |

|

|

| $71,804.75 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$769.60 |

|

|

| -$769.60 |

| Current total $71,035.15 |

|

|

| $71,035.15 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $49,747.50 |

|

|

| $49,747.50 |

Prices from Tuesday’s close or 6am for US | Cash available $21,287.65 |

|

|

| $21,287.65

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here