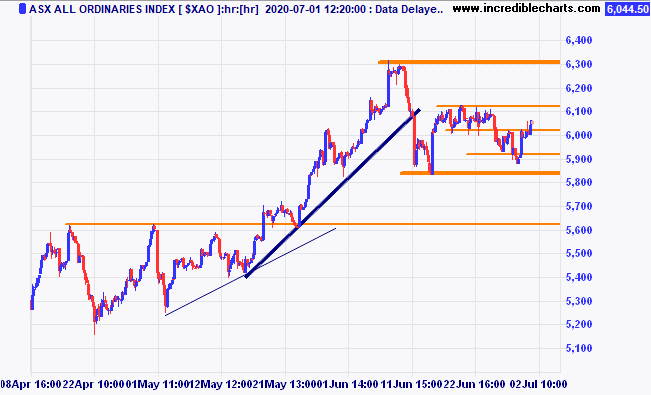

The local market is up again today and back in the middle of the previous tight sideways range after a brief excursion lower. Will this be a lower top forming as prices ease late today?

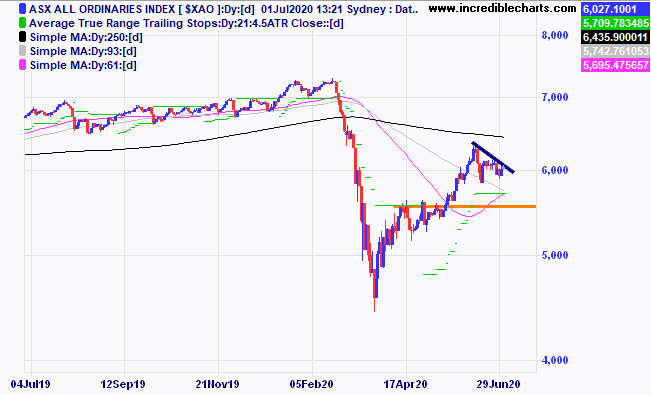

The ASX 200 index over the past year lost 11 percent with the ASX 200 accumulation index which includes dividends down around 8 percent.

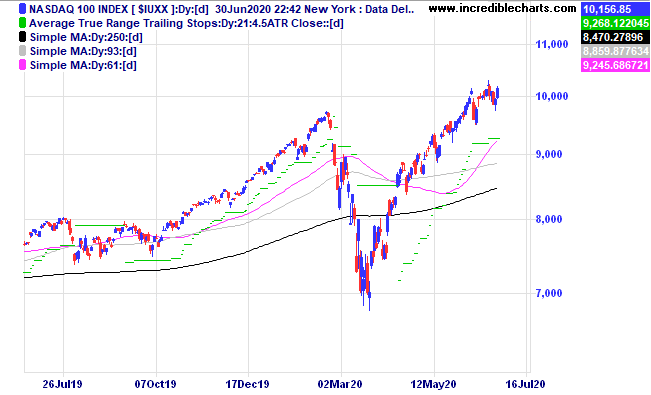

The US based Nasdaq 100 index over the past year gained 30 percent.

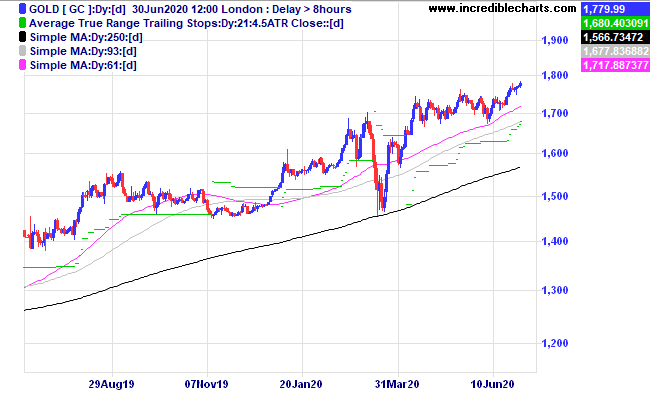

The price of gold gained 28 percent over the past year.

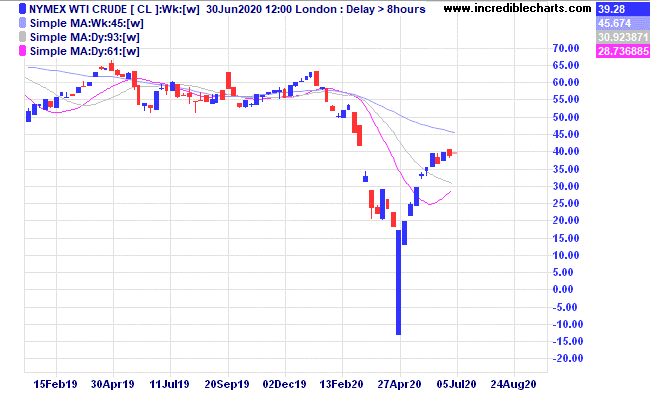

The price of Nymex Crude oil was down around 30 percent in a very volatile year.

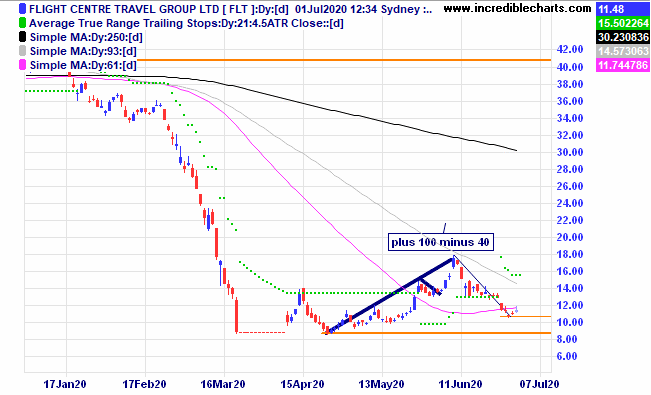

Quite a few of the educational portfolio’s stocks reached their stop loss levels during the past week including Flight Centre which looks like forming a bigger basing pattern.

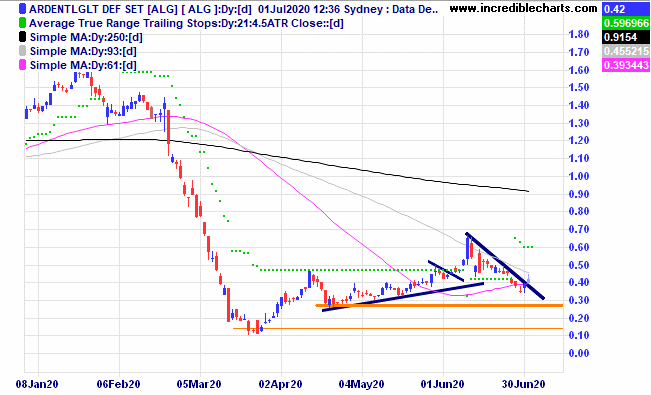

The travel industry is still suffering from domestic and international border closures and there is a big gap in where stock prices were pre-Covid and now. Some good gains could be made when the travel market turns around. We have again added small speculative parcels of Ardent Leisure and Flight Centre for now and then wait for a more “technical” entry point to add to those positions.

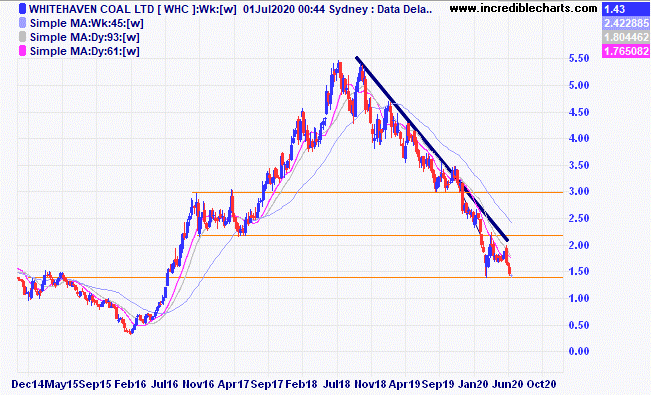

Whitehaven Coal could be making a double bottom type pattern. The longer-term chart shows that this price level in the past has seen some turning points. Watching.

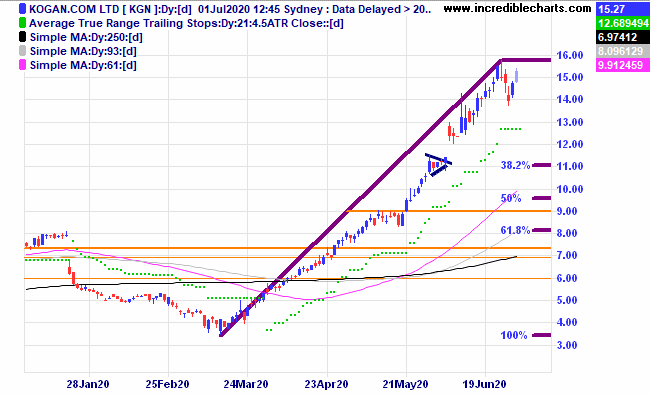

After a strong rise in volumes will online shopping platform Kogan see lower volumes as people get back to shopping centres?

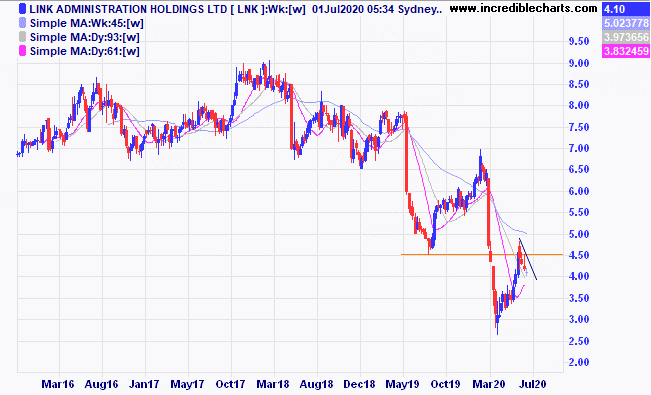

Link Administration Holdings could be forming a bullish flag type pattern.

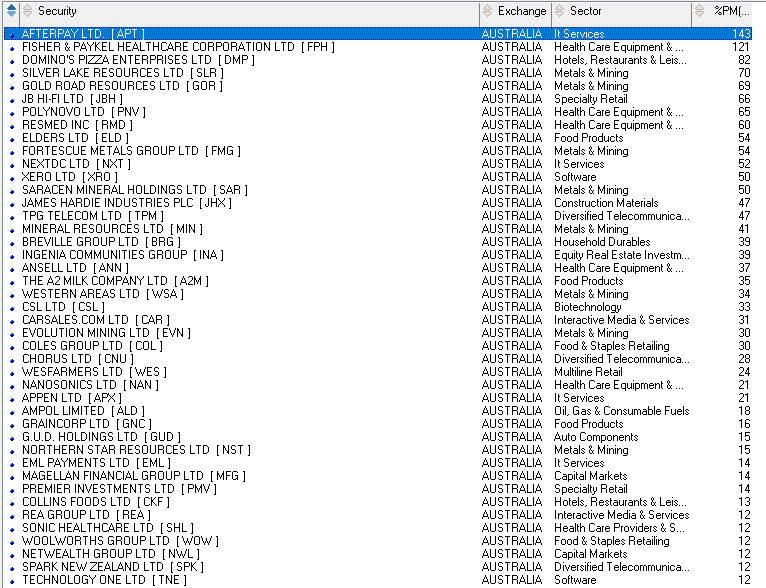

These are the top gaining stocks in the ASX 200 index over the past financial year.

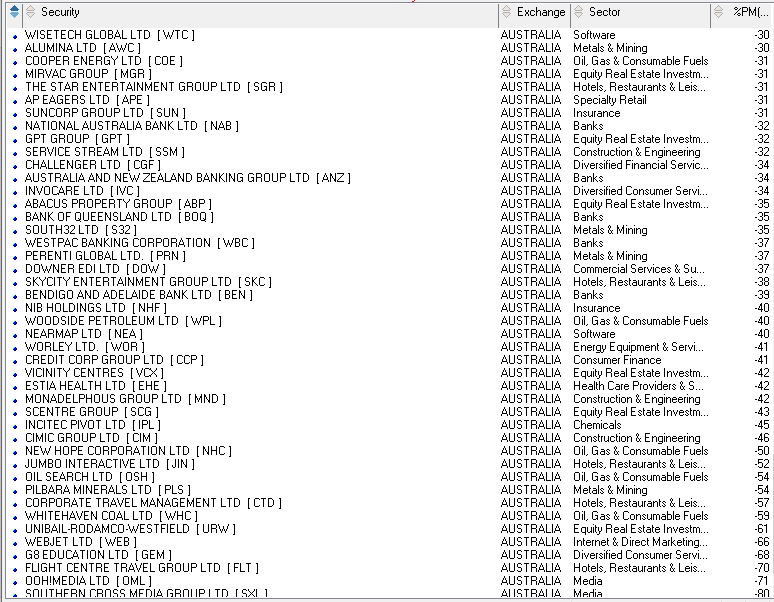

These are the top losing stocks in the ASX 200 index over the past financial year showing some big licks of capital evaporating during this time.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $289.20 | $287.00 | -$22.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $57.51 | $58.01 | +$20.00 |

Bought Evolution

| Bought 600 at $3.98 | 24/3/2020 | $5.26 | $5.67 | +$246.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.01 | $2.13 | +$180.00 |

Bought Whitehaven Coal | Bought 1,200 at $2.00 | 31/3/2020 | $1.54 | Stopped 25/6 at $1.41 | -$186.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.14 | $1.13 | -$25.00 |

Bought Jumbo Interactive | Bought 300 at $10.20 | 22/4/2020 | $11.41 | Sold 29/6 at $10.00 | -$453.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 59c | 59c | Steady |

Bought GEAR ETF

| Bought 200 at $14.00 | 6/5/2020 | $17.66 | Sold 25/6 at $17.00 | -$162.00 |

Bought Flight Centre

| Bought 150 at $10 | 6/5/2020 | $13.11 | Sold 25/6 at $11.50 | -$271.50 |

Bought Flexigroup

| Bought 1,500 at 95c | 7/5/2020 | $1.17 | $1.12 | -$75.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $26.38 | $25.50 | -$88.00 |

Bought Ooh! Media

| Bought 2,800 at $1.14 | 19/5/2020 | $1.02 | $91c | -$308.00 |

Bought Ardent Leisure | Bought 6,000 at 46c | 3/6/2020 | 44.5 | Sold 25/6 at 39c | -$360.00 |

Bought Qantas

| Bought 600 at $4.20 | 3/6/2020 | $4.31 | Sold 26/6 at $3.80 | -$336.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 66c | 59 | -$280.00 |

Sold 5 ASX 200 cfd’s

| Sold 5 at 5,942.00 | 19/6/2020 | 5,954 | Bought 29/6 at 5,808 | +$700.00 |

Sold 5 ASX 200 cfd’s

| Sold 5 at 5,850.00 | 25/6/2020 | 5,850 | 5,900 | -$280.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $71,035.15 |

|

|

| $71,035.15 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$1,700.50 |

|

|

| -$1,700.50 |

| Current total $69,334.65 |

|

|

| $69,334.65 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $32,974.00 |

|

|

| $32,974.00 |

Prices from Tuesday’s close or 6am for US | Cash available $36,360.65 |

|

|

| $36,360.65

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here