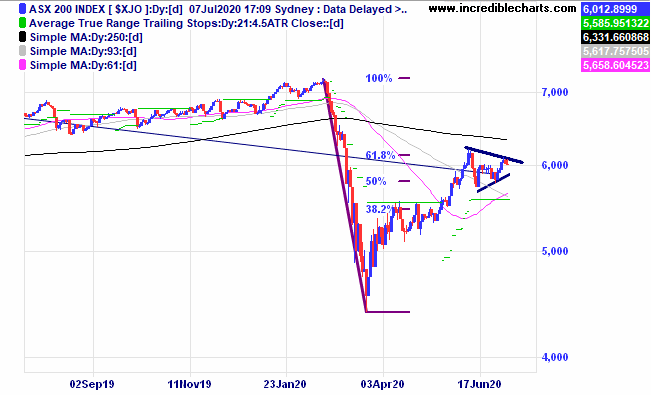

The local market looks to be at an interesting juncture forming a triangular consolidation or possibly continuation pattern.

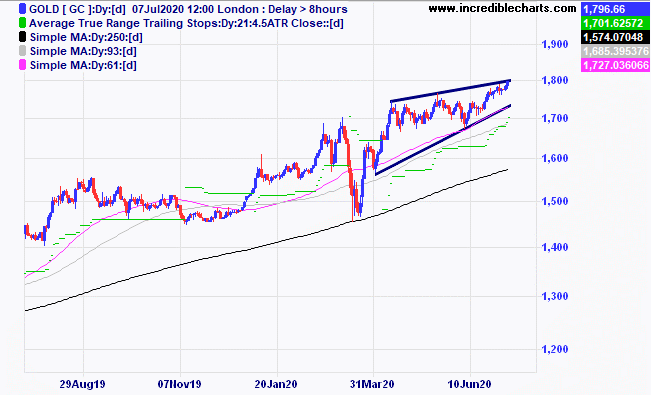

The daily chart of gold shows a rising wedge formation which can precede a drop in prices when the lower trend line is breached. Which way will it go?

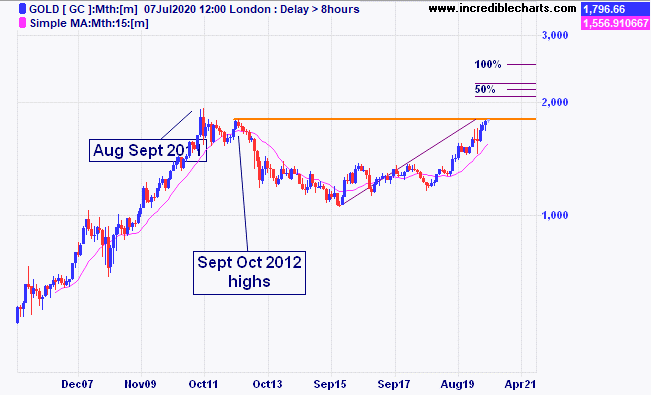

The price of gold on a monthly chart showing the target that a leg up the same length as that from the low in a saucer or rounding bottom shaped pattern would make and see price reach $2,500. Interestingly price in the past has topped out in the August to September period. Will it run out of steam this time or power ahead?

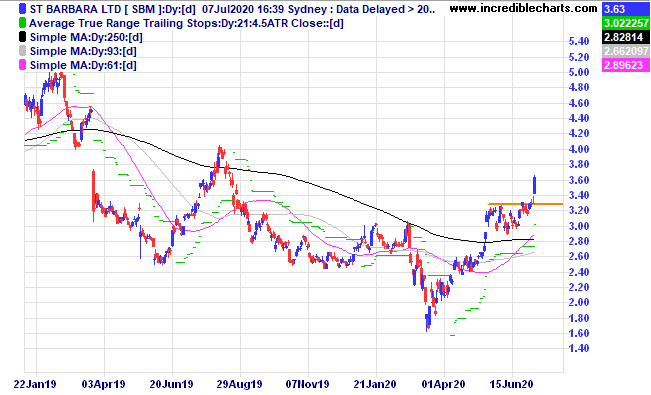

St Barbara released an upbeat report which saw shares move up and out of the recent consolidation pattern and we bought a parcel for the educational portfolio. We are top heavy in the gold sector and are keeping a close watch.

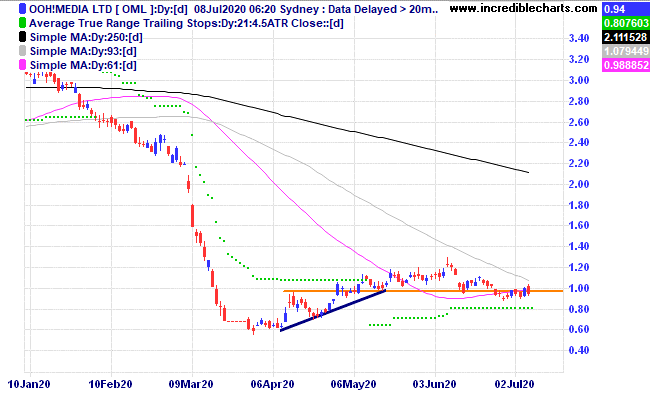

OOH Media has not yet breached the stop loss level.

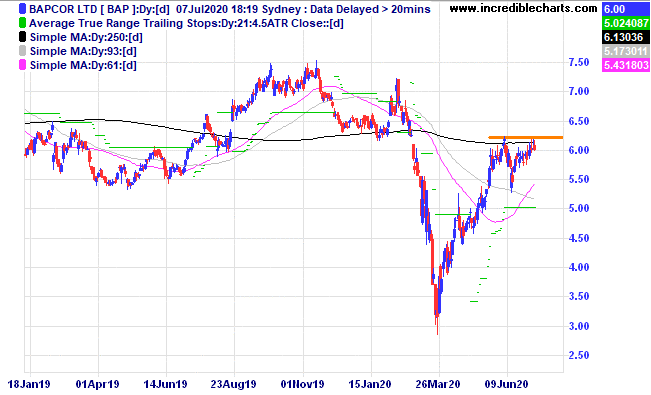

Can car parts supplier Bapcor move above resistance?

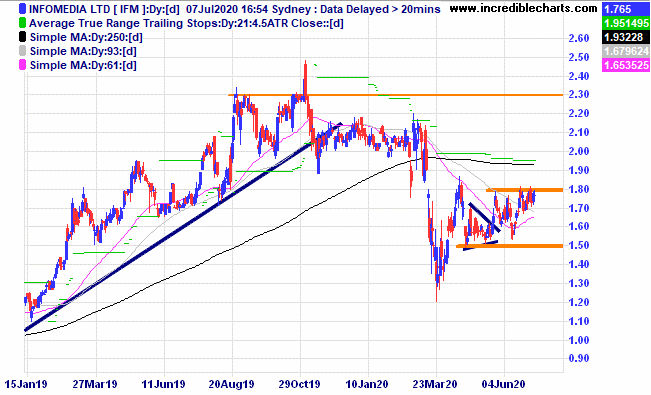

Infomedia is finding it hard to move above current resistance.

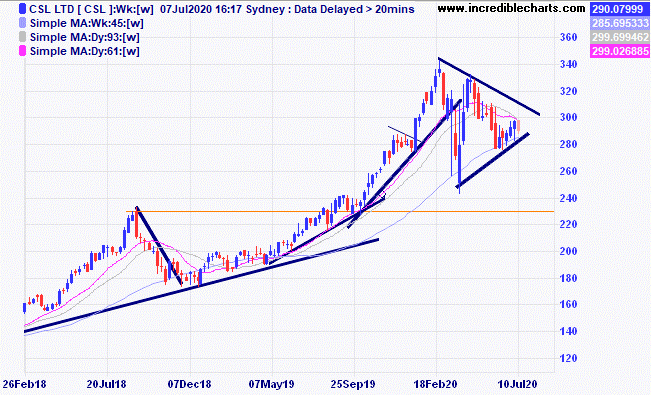

Market heavyweight CSL is forming a very large triangular pattern and a possible smaller bearish flag pattern inside the triangle.

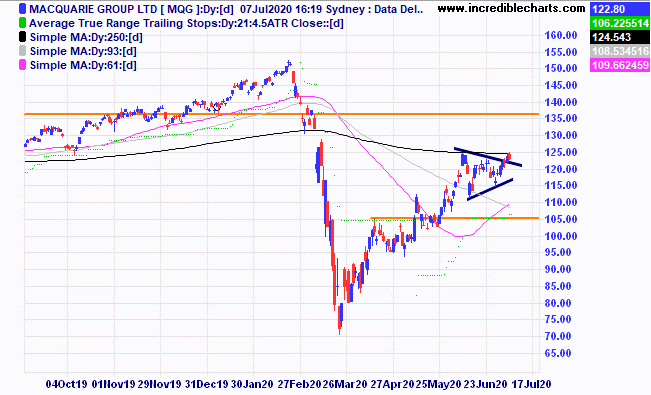

Macquarie the international banker has popped higher for now.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $287.00 | $290.00 | +$30.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $58.01 | $64.01 | +$240.00 |

Bought Evolution

| Bought 600 at $3.98 | 24/3/2020 | $5.67 | $5.98 | +$186.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.13 | $2.21 | +$120.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.13 | $1.19 | +$150.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 59c | 60c | +$60.00 |

Bought Flexigroup

| Bought 1,500 at 95c | 7/5/2020 | $1.12 | $1.21 | +$135.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $25.50 | $25.99 | +$49.00 |

Bought Ooh! Media

| Bought 2,800 at $1.14 | 19/5/2020 | 91c | $94c | +$84.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 59c | 62.5 | +$160.00 |

Sold 5 ASX 200 cfd’s

| Sold 5 at 5,850.00 | 25/6/2020 | 5,900 | Bought 5,920 | -$130.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 40c | 37.5 | -$75.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $11.50 | $10.98 | -$78.00 |

Bought St Barbara

| Bought 800 at $3.50 | 7/7/2020 | $3.55 | $3.63 | +$64.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $69,334.65 |

|

|

| $69,334.65 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$995.00 |

|

|

| +$995.00 |

| Current total $70,329.65 |

|

|

| $70,329.65 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $34,954.40 |

|

|

| $34,954.40 |

Prices from Tuesday’s close or 6am for US | Cash available $35,375.25 |

|

|

| $35,375.25

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here