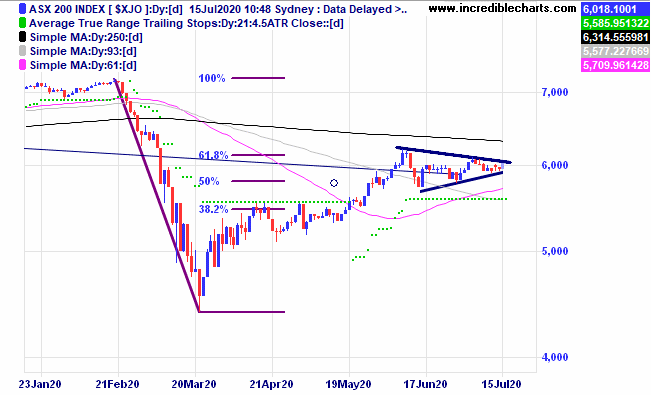

The local market has been consolidating at these levels in an increasingly tight range and today’s positive price action has made a new 6 day high and yet still remains just within the triangular pattern.

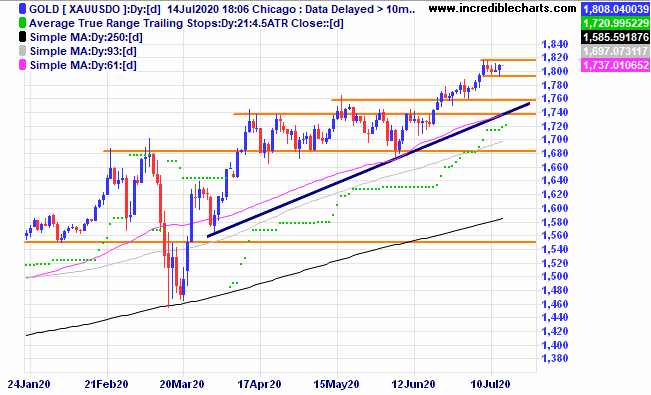

The price of gold has been trading in a small range just below the highs and could be building up a head of steam for a further move higher into an August top, or maybe not, time will tell.

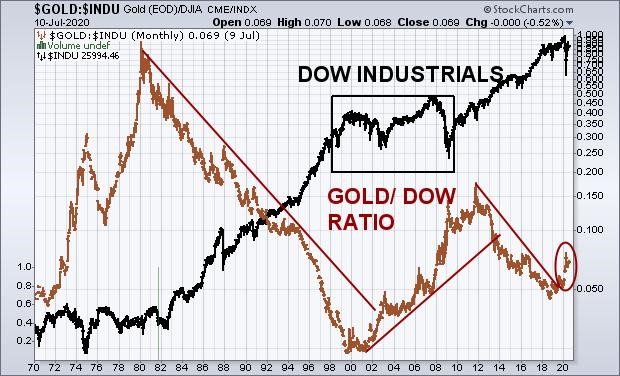

The gold/Dow ratio is showing the latest turn in direction. How far will this leg take us?

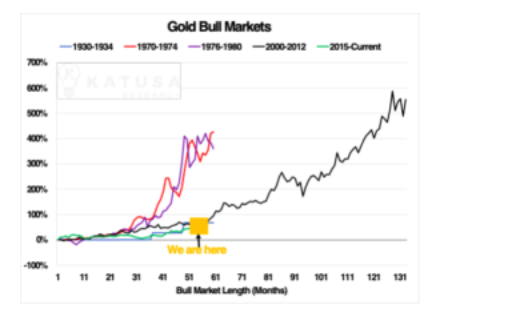

A somewhat blurry picture showing a few previous bullish runs in the gold price and where we are currently positioned. Another run similar to 2000-2012 could see price hit $5,000 an ounce. With all that money sloshing through the system courtesy of central bank stimulus and a lot of negative interest rate products it has to go somewhere.

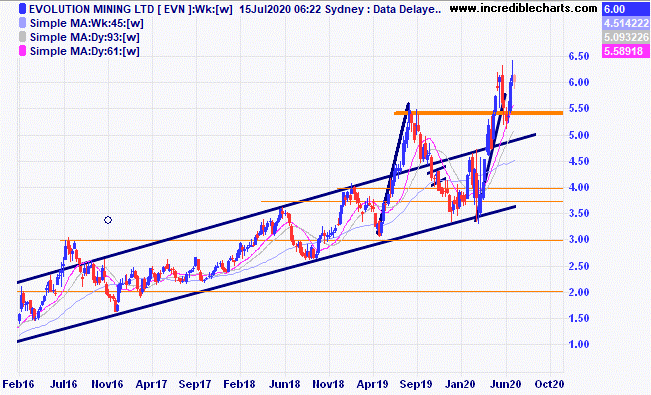

Evolution has again bounced to be well above the trend channel. We took some more profit off the table today.

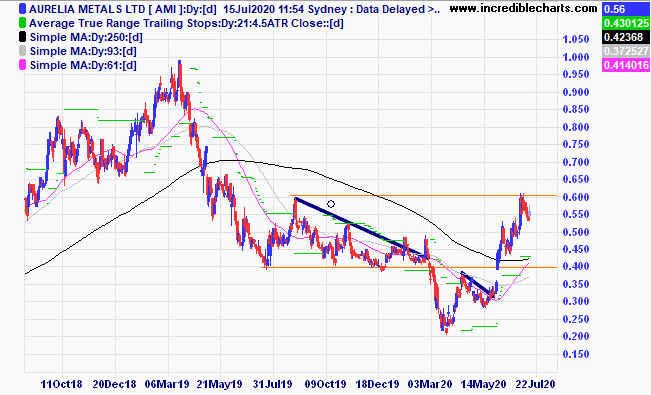

Aurelia Metals has been making a few higher lows.

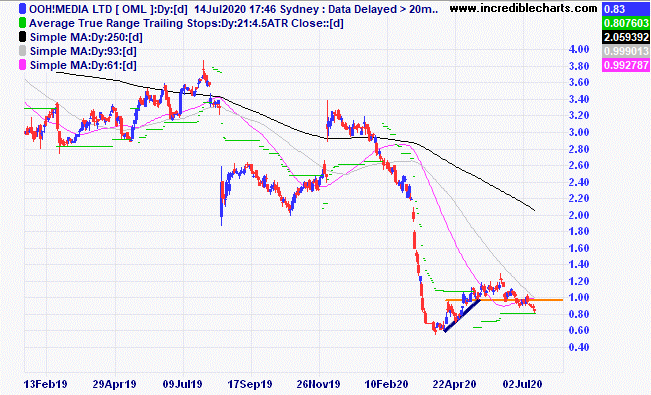

We finally sold the Ooh Media holding yesterday.

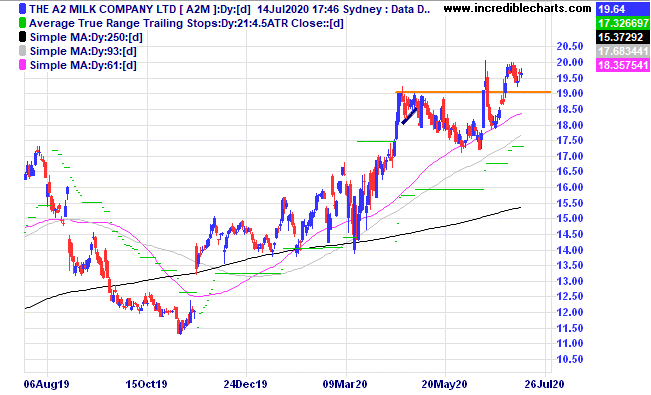

A2 Milk looks to be consolidating the move higher.

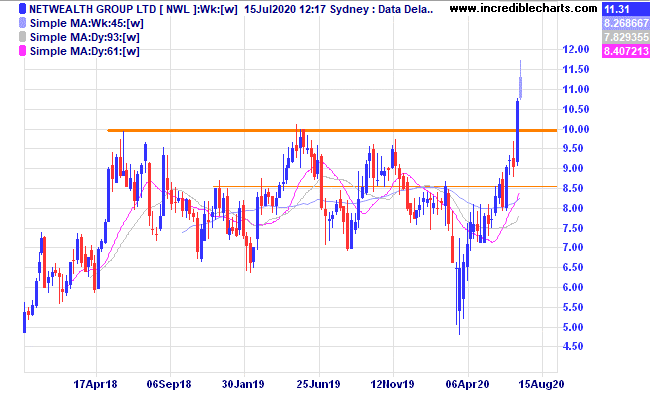

Netwealth has finally moved above the $10 resistance level.

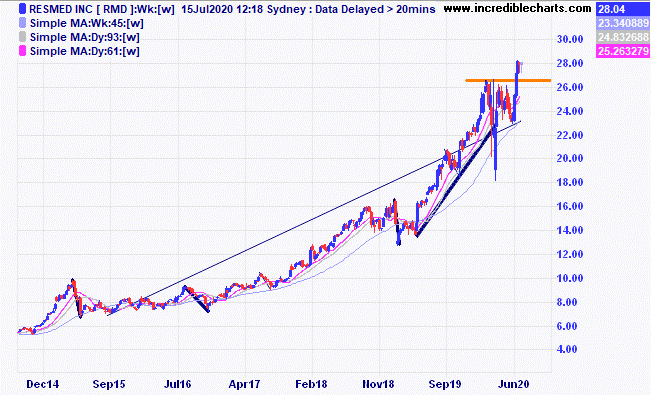

Resmed has moved above resistance after some sideways action and we bought a parcel today for the educational portfolio.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $290.00 | $278.90 | -$111.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $64.01 | $60.99 | -$120.80 |

Bought Evolution

| Bought 600 at $3.98 | 24/3/2020 | $5.98 | $6.00 | +$12.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.21 | $2.26 | +$75.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.19 | $1.15 | -$100.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 60c | 58.5 | -$90.00 |

Bought Flexigroup

| Bought 1,500 at 95c | 7/5/2020 | $1.21 | $1.01 | -$300.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $25.99 | $25.09 | -$90.00 |

Bought Ooh! Media

| Bought 2,800 at $1.14 | 19/5/2020 | 94c | Sold 14/7 at 83c | -$338.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 62.5c | 68.5 | +$240.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 37.5c | 33.5 | -$120.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $10.98 | $10.27 | -$106.50 |

Bought St Barbara

| Bought 800 at $3.50 | 7/7/2020 | $3.63 | $3.54 | -$72.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $70,329.65 |

|

|

| $70,329.65 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$1,121.30 |

|

|

| -$1,121.30 |

| Current total $69,208.35 |

|

|

| $69,208.35 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $31,306.60 |

|

|

| $31,306.60 |

Prices from Tuesday’s close or 6am for US | Cash available $37,901.75 |

|

|

| $37,901.75

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here