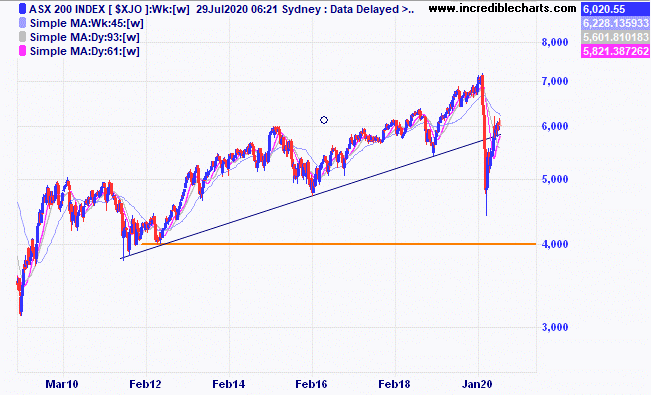

The local market continues to trade around the 6,000 point level in a tight range after a brief push higher last week and it could be argued that the index is again positioning itself for another move higher. We were quickly stopped out of our long index positions when the market turned south.

This weekly chart of the index shows the fast fall and recovery to be just above the longer-term trend line.

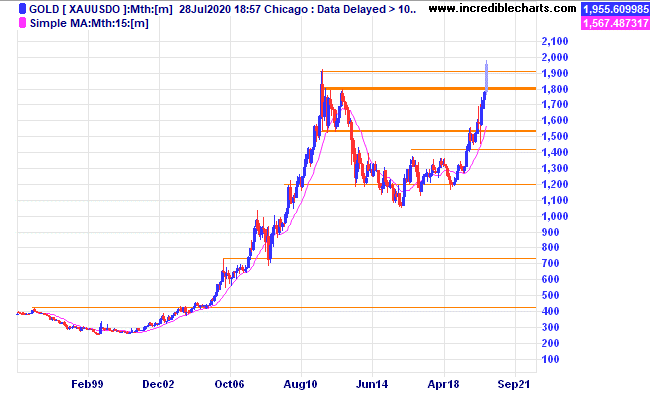

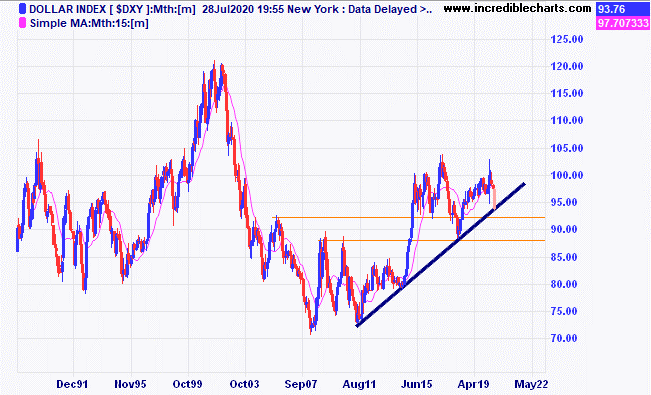

The price of gold has been in the news after reaching an all-time high. The current rally has only just begun according to some analysts with the mighty US Dollar coming under increasing pressure.

A chart of the US Dollar index shows price close to the long-term trend line. Will it bounce or drop? The last major low in this index coincided roughly with the top in the gold price.

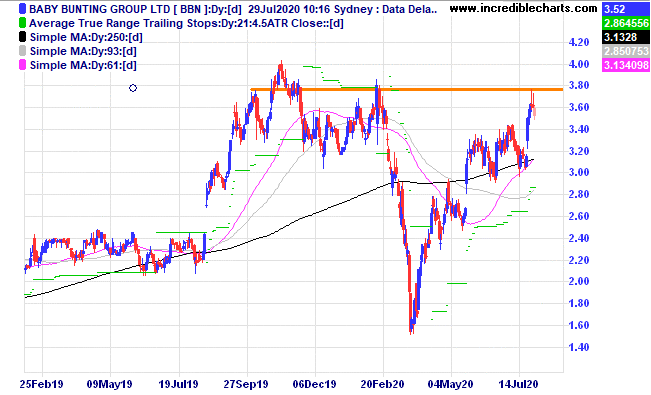

Baby Bunting said sales were up and price moved accordingly. Watching.

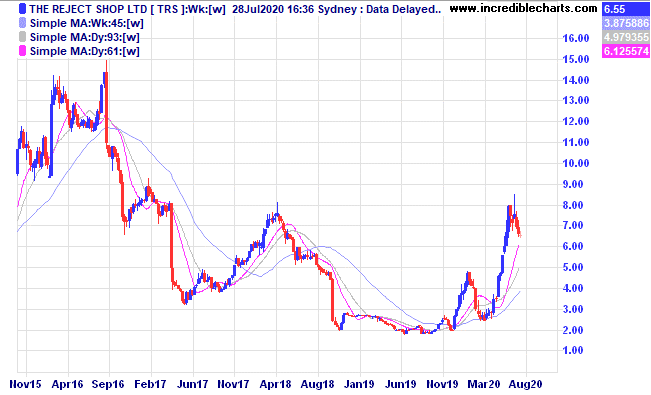

The Reject Shop has been on a tear and looks to have run into some resistance on the weekly chart setting up a possible ABC type pattern.

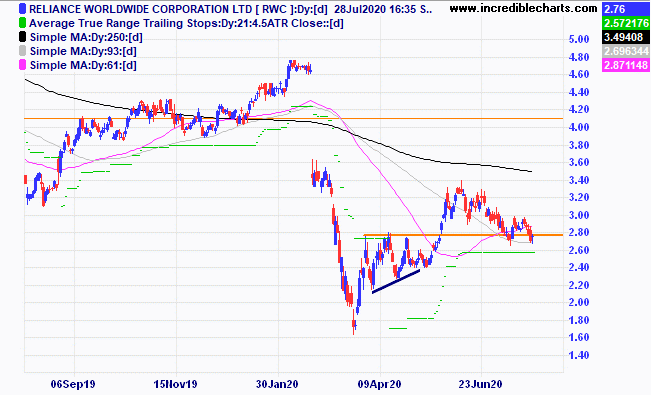

Reliance looks to have found some support.

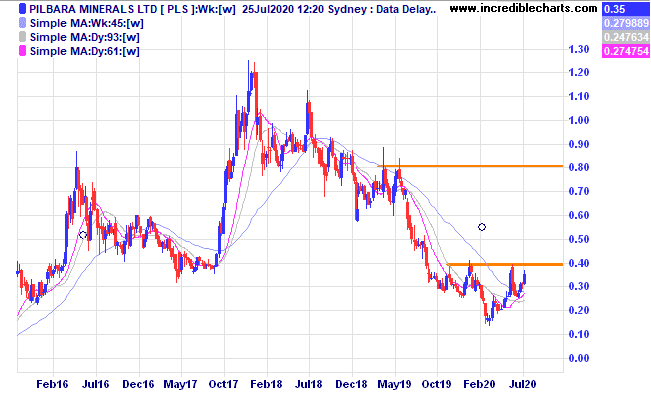

Some lithium stocks including Pilbara Minerals have been on the rise lately and looks close to moving higher.

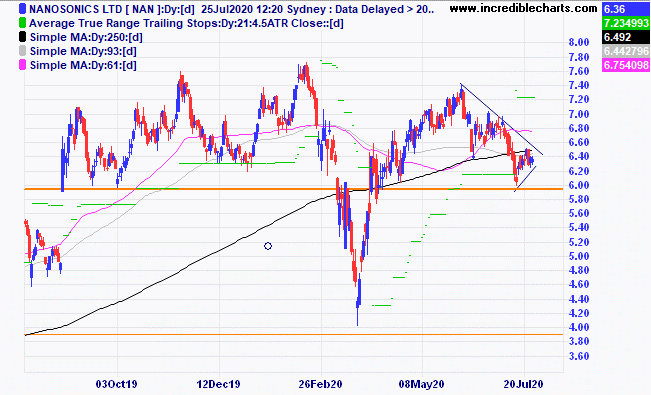

The Nanosonics chart is looking interesting forming a nice consolidation pattern above previous support.

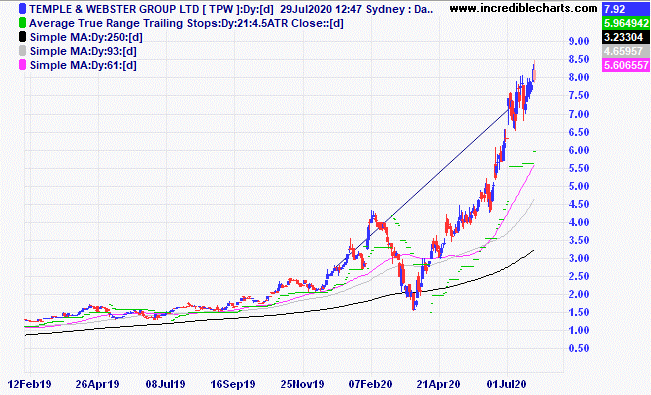

Temple and Webster recently reported sales up 74 per cent.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $293.35 | $272.20 | -$211.50 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $63.47 | $59.66 | -$152.40 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $6.38 | $5.94 | -$176.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.44 | $2.57 | +$195.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.24 | $1.37 | +$325.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 60.5 | 58.5 | -$120.00 |

Bought Flexigroup

| Bought 1,500 at 95c | 7/5/2020 | $1.28 | $1.28 | Steady |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $26.80 | $25.65 | -$85.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 67c | 64 | -$120.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 37c | 35.5 | -$45.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $11.04 | $10.43 | -$91.50 |

Bought St Barbara

| Bought 800 at $3.50 | 7/7/2020 | $3.76 | $3.80 | +$32.00 |

Bought Resmed

| Bought 100 at $28.00 | 15/7/2020 | $29.27 | $28.60 | -$67.00 |

Bought 5 ASX 200 cfd’s | Bought 5 at 6,040 | 21/7/2020 | 6,155 | Sold 5 at 6,075

| -$430.00

|

Bought Gear ETF

| Bought 200 at $18.27 | 21/7/2020 | $18.82 | Sold 24/7 at $18.00 | -$194.00 |

Bought Infomedia

| Bought 1,500 at $1.85 | 21/7/2020 | $1.89 | $1.78 | -$165.00 |

Bought Northern Star | Bought 150 at $15.70 | 21/7/2020 | $15.84 | $15.96 | +$18.00+ |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $72,472.55 |

|

|

| $72,472.55 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$1,287.40 |

|

|

| -$1,287.40 |

| Current total $71,185.15 |

|

|

| $71,185.15 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $39,506.40 |

|

|

| $39,506.40 |

Prices from Tuesday’s close or 6am for US | Cash available $31,768.75 |

|

|

| $31,768.75

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here

Gold’s looking very exciting! It has just been fuelled on the back of depressed treasury yields and technically just powering forward on strong momentum – it’s smashed through the ’11/’12 high’s (1775-1900 resistance) and I think it has room to move further (maybe after a potential pull-back from profit-taking given that retail traders are now extremely long-biased) but those ’11/’12 high’s will have their chance to prove their new role as support.

I think ASX200 is an interesting talking point – there’s a nice bull flag forming from early June and the only resistance to the upside seems to be the local top-of-the-flag 6150 area and then none till around 6330 where a bit of volume was traded during the Feb-Mar crash but there’s no denying the higher-low’s. From a fundamental standpoint I think the only worry is the VIC cases and subsequent restrictions which have estimated to cost the local govt $1 billion a week, the price of copper (a proxy for global growth) has also come to a halt with these trade relations concerns and we all know how sensitive the Australian dollar/index to these kind of sentiment-based events.

For sure will be watching PLS! There’s a very strong resistance at 0.40 but a strong close above and I don’t see any concern until around all that volume traded in ’16/’17 at 0.55 (nearly +40%!)

Really like The Reject Shop as well, looks like a classic pull-back from profit-taking before a clean shot to the upside!

Really good analysis’s here mate, cheers!