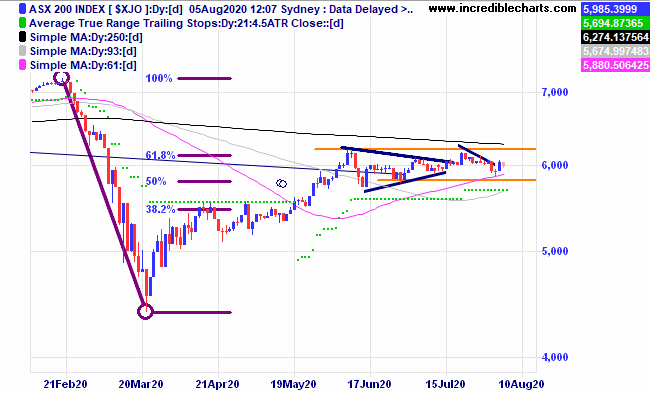

The local market is still trading in a 400 point sideways range and getting close to a breakout in both directions yet still unable to do so. Nice range trading for some. We managed to eek out a small profit on the most recent ASX 200 cfd trades.

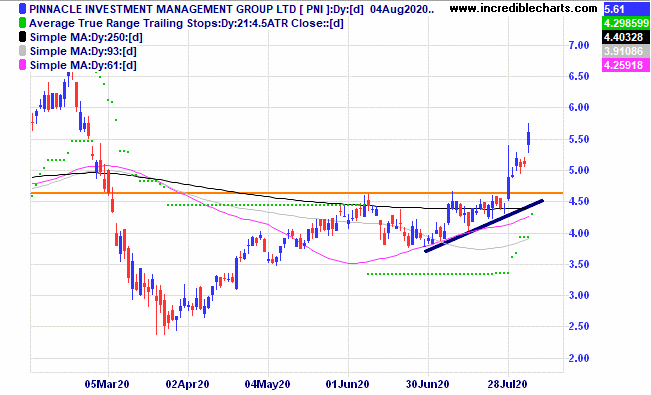

Pinnacle announced some good results with most individual funds under their umbrella beating the benchmarks.

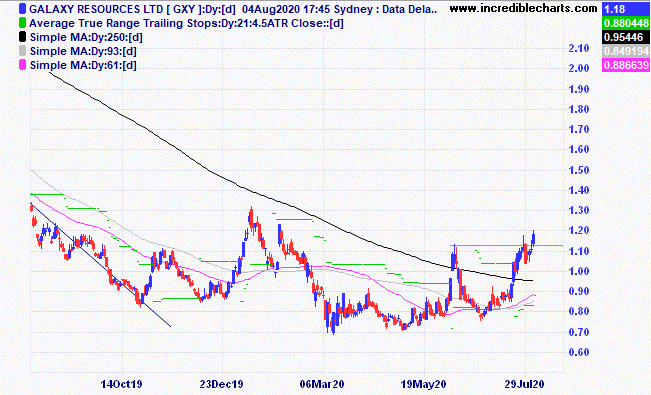

Galaxy is one of a few stocks to have popped higher and it also looks good on a weekly chart. We added some to the educational portfolio.

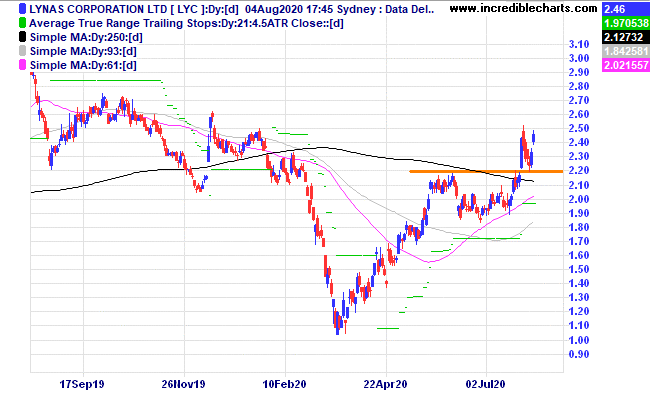

Lynas looks to have consolidated the break higher and with the US looking for rare earths outside of China this could be the start of a nice run up.

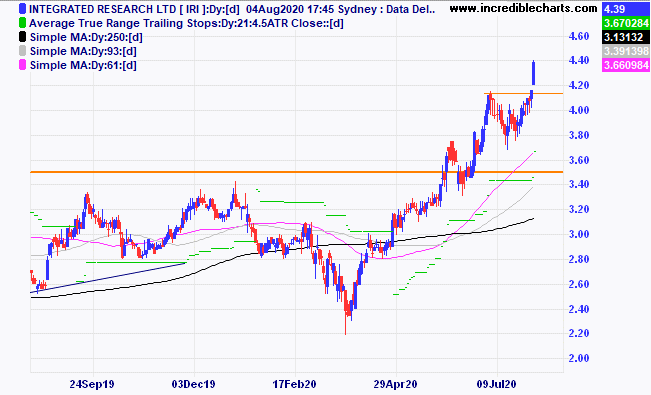

Integrated Research has moved higher and has cleared the previous highs back in 2017. We added some to the educational portfolio today.

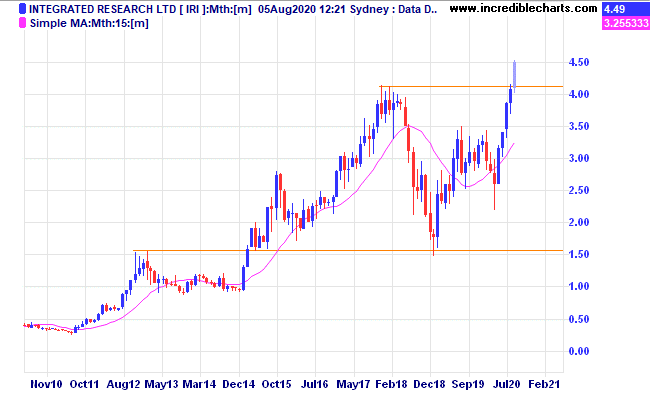

Integrated Research on a monthly chart showing the fresh move higher.

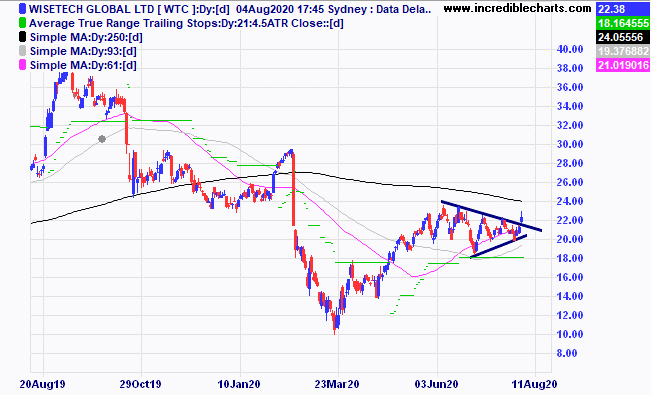

A tentative move out of congestion for Wisetech.

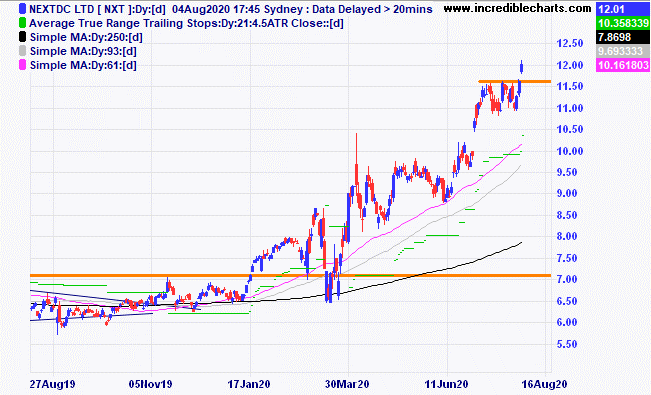

NextDC has also moved higher and we added some to the portfolio.

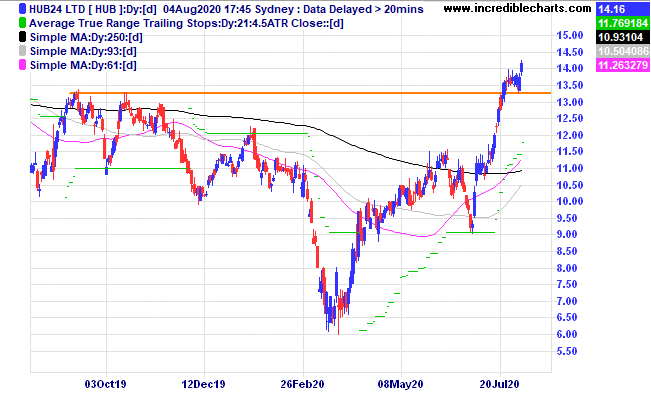

Hub24 has had a similar run up from the lows as fellow wealth platform provider Netwealth.

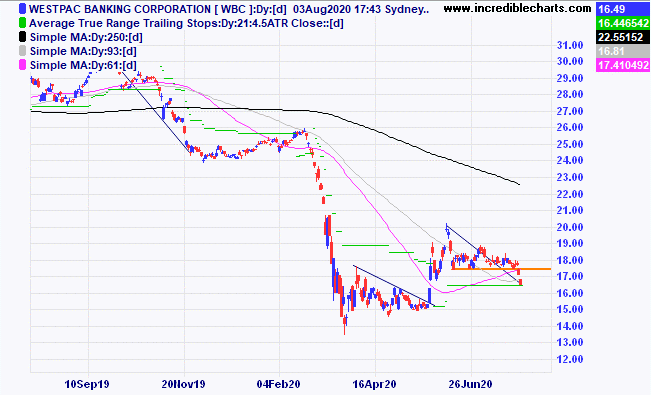

Westpac moving lower says it all for the banks under pressure in this environment.

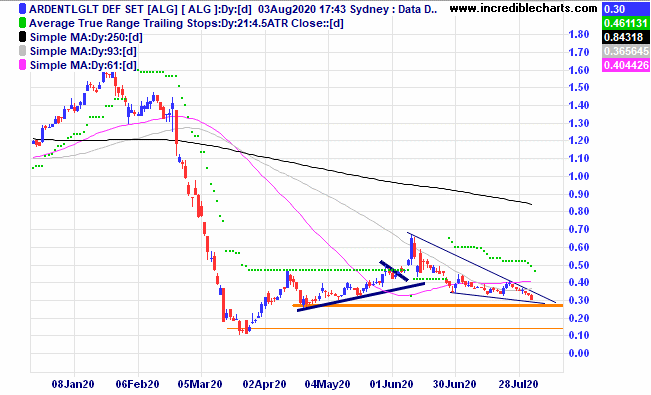

Ardent Leisure could be forming a downward wedge type pattern that can have some possible explosive upside when and if it breaks out.

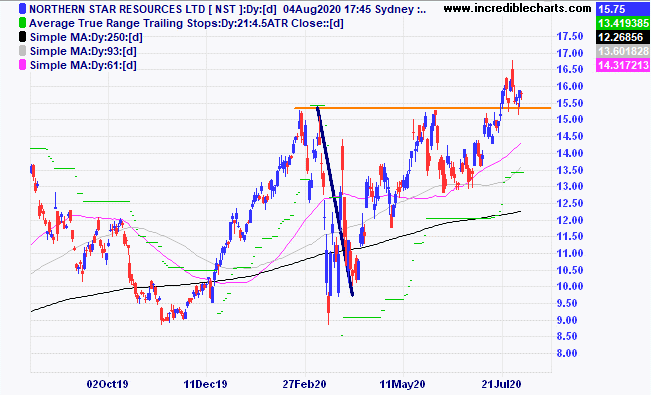

Northern Star looks to be consolidating the move to higher prices above previous tops.

Infomedia and Flexigroup have not been moving as expected and we sold out of both positions today.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $272.2 | $283.73 | +$115.30 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $59.66 | $62.89 | +$129.20 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $5.94 | $5.91 | -$12.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.57 | $2.48 | -$135.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.37 | $1.35 | -$50.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 58.5 | 59 | +$30.00 |

Bought Flexigroup

| Bought 1,500 at 95c | 7/5/2020 | $1.28 | $1.18 | -$150.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $25.65 | $27.66 | +$201.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 64c | 58 | -$240.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 35.5c | 30.5 | -$150.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $10.43 | $10.00 | -$64.50 |

Bought St Barbara

| Bought 800 at $3.50 | 7/7/2020 | $3.80 | $3.44 | -$288.00 |

Bought Resmed

| Bought 100 at $28.00 | 15/7/2020 | $28.60 | $28.79 | +$19.00 |

Bought Infomedia

| Bought 1,500 at $1.85 | 21/7/2020 | $1.78 | $1.76 | -$30.00 |

Bought Northern Star | Bought 150 at $15.70 | 21/7/2020 | $15.96 | $15.75 | -$31.50 |

Sold ASX 200 cfd’s

| Sold 5 ASX 200 cfd’s at 5995 | 31/7/2020 | 5,995 | Bought 2 at 5,890 3/8 Bought 3 at 6,020 4/8 | +$180.00

-$105.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $71,185.15 |

|

|

| $71,185.15 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$581.50 |

|

|

| -$581.50 |

| Current total $70,603.65 |

|

|

| $70,603.65 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $38,949.40 |

|

|

| $38,949.40 |

Prices from Tuesday’s close or 6am for US | Cash available $31,654.25 |

|

|

| $31,654.25

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here