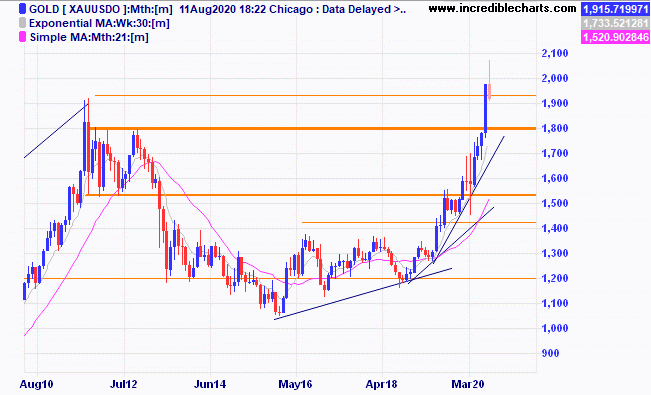

The price of gold was slammed last night down 5.7 per cent on strong volume. The price has a tendency to peak sometimes at this time of year and to bottom in December. We will see if this plays out this year.

On a monthly chart the price could move lower to the $1,800 possible support zone and still maintain the uptrend that started back in 2016.

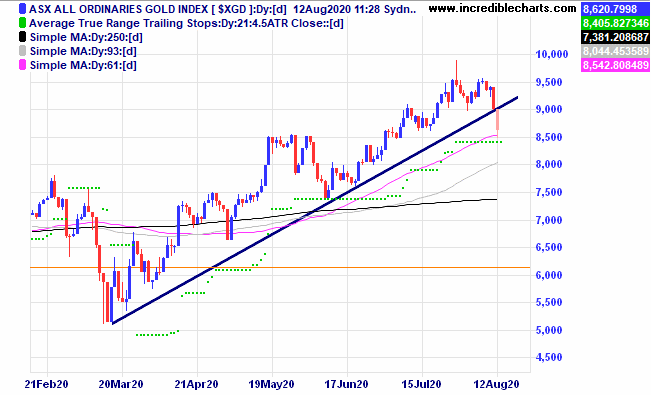

The local gold index has breached the daily trend line as local stocks come under pressure. We sold the Northern Star, St Barbara and Resolute holdings today.

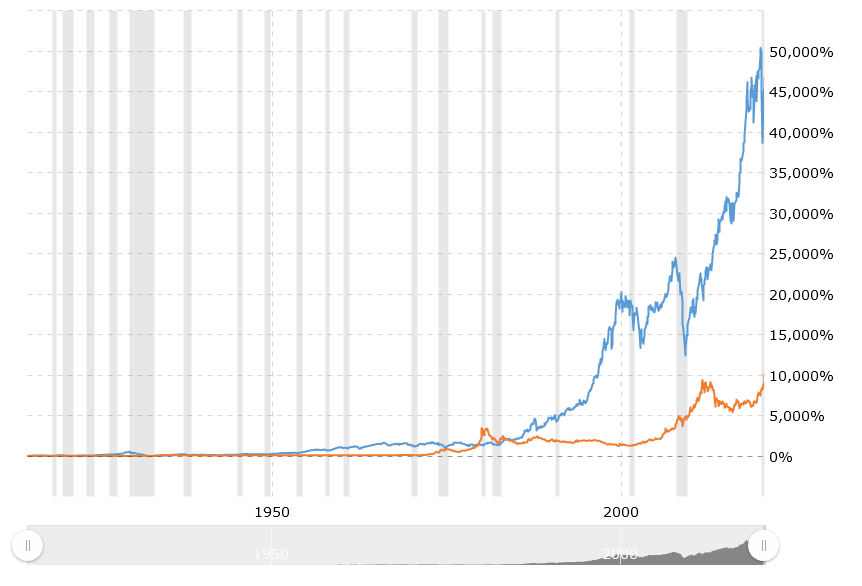

A story by Scott Pape in the weekend press said one study showed $1 invested in gold in 1802 would only be worth $3 now compared to $1,033,487 if that same $1 had been invested in the share market. The gold price was fixed by governments for more than 100 years and since the early 1970’s when the gold price “floated” it has been a slightly better performer than gold.

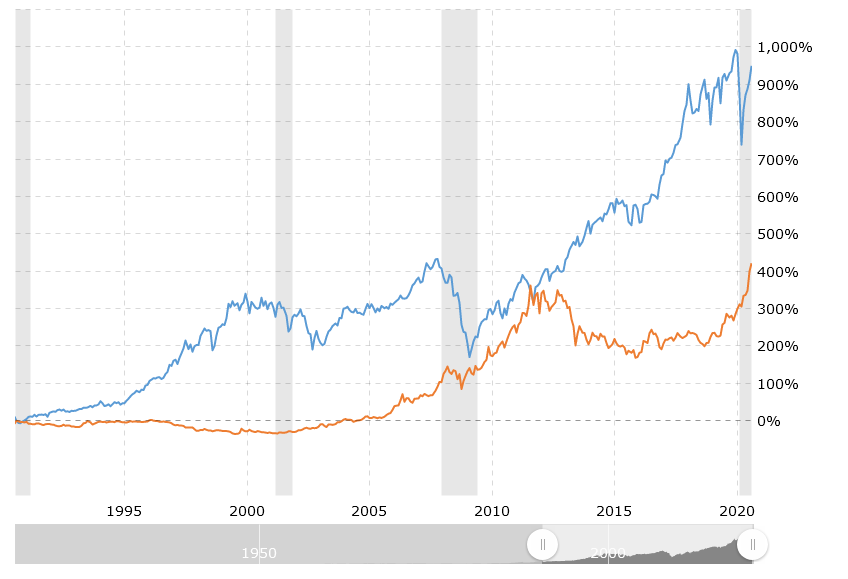

Gold vs US stocks from 1915 with stocks the clear winner.

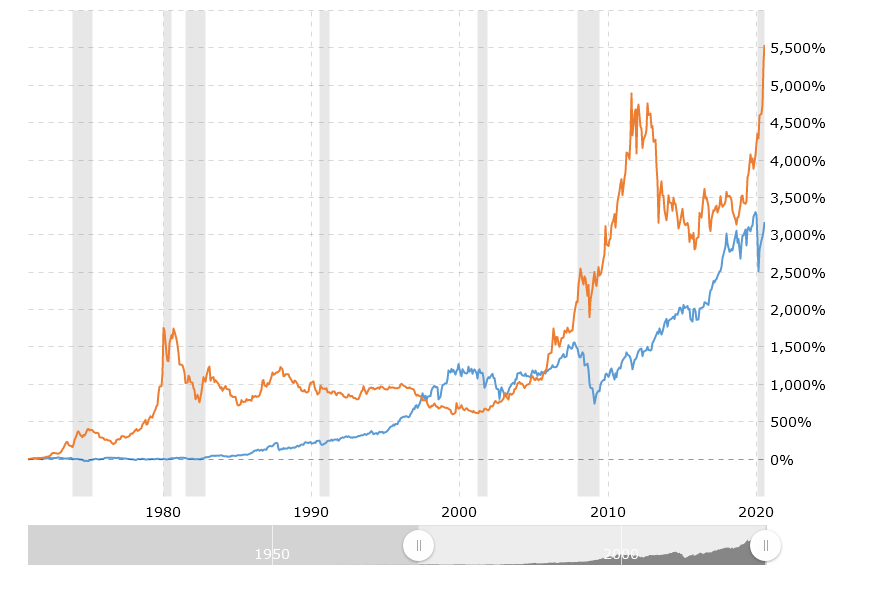

Gold vs US stocks from the 1970’s when the gold price restrictions placed by government were lifted shows gold the clear winner.

One thing for sure is that at times shares move better than gold and at other times gold moves better than shares. The trick is to be on the one that is moving up fastest. Since 1990 US shares have outperformed but gold looks to be catching up.

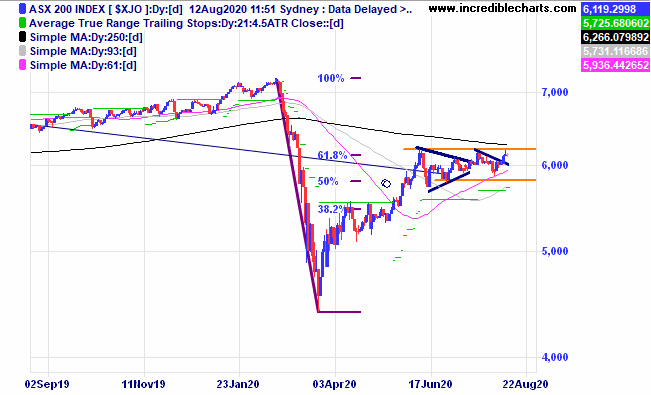

The local market has again reached the top of the sideways range.

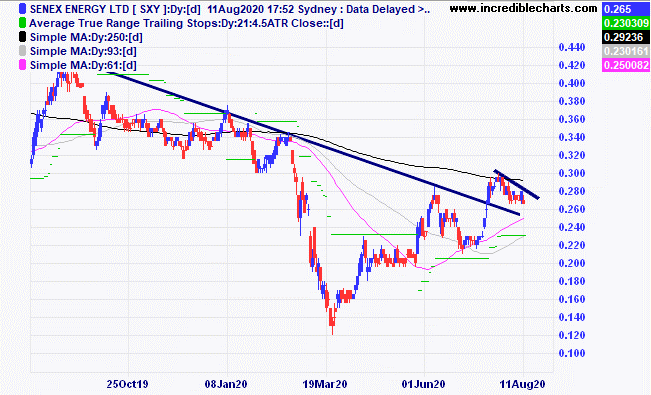

Senex could be forming a bullish flag type pattern.

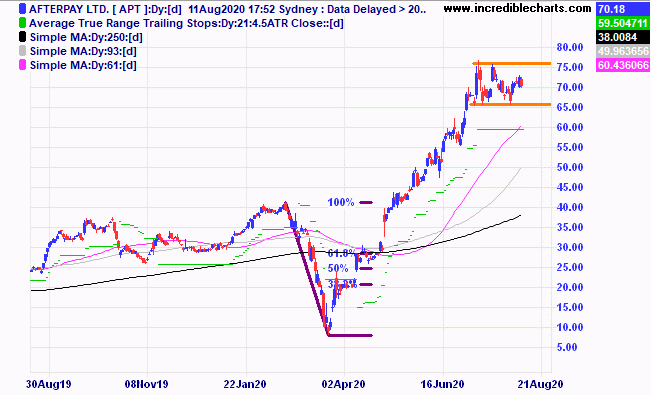

Afterpay looks to be taking a breather after a strong run up.

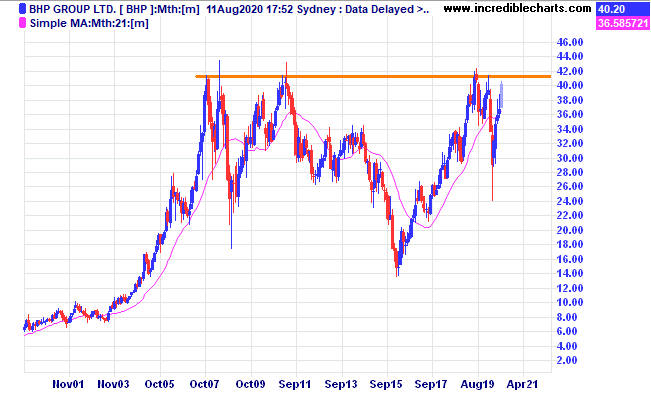

BHP is close to a stubborn resistance level where price has retreated in the past.

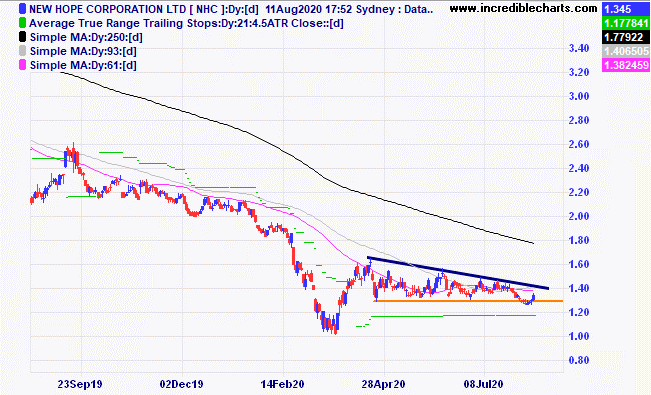

Can New Hope move past resistance after what appears to be a false break lower?

Some travel and tourism stocks have been creeping up like Flight Centre.

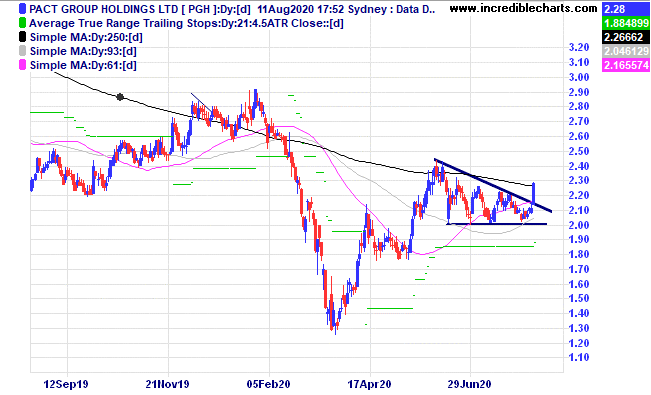

Packaging mob Pact looks to have moved up and out of consolidation.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $283.73 | $280.98 | -$27.50 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $62.89 | $61.68 | -$48.40 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $5.91 | $5.85 | -$24.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.48 | $2.36 | -$180.00 |

Bought Resolute Mining | Bought 2,500 at 98c | 14/4/2020 | $1.35 | $1.28 | -$175.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 59 | 62.5 | +$210.00 |

Bought Flexigroup

| Bought 1,500 at 95c | 7/5/2020 | $1.18 | Sold 5/8 at $1.20 | No Change |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $27.66 | $28.79 | +$113.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 58c | 62.5 | +$180.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 30.5c | 40c | +$285.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $10.00 | $11.70 | +$255.00 |

Bought St Barbara

| Bought 800 at $3.50 | 7/7/2020 | $3.44 | $3.42 | -$16.00 |

Bought Resmed

| Bought 100 at $28.00 | 15/7/2020 | $28.79 | Stopped 6/8 at $26.50 | -$259.00 |

Bought Infomedia

| Bought 1,500 at $1.85 | 21/7/2020 | $1.76 | Sold at $1.75 | -$45.00 |

Bought Northern Star | Bought 150 at $15.70 | 21/7/2020 | $15.75 | $15.32 | -$64.50 |

Bought Galaxy

| Bought 2,500 at $1.16 | 5/8/2020 | $1.16 | $1.23 | +$175.00 |

Bought Integrated Research | Bought 700 at $4.40 | 5/8/2020 | $4.40 | $4.81 | +$287.00 |

Bought NextDC

| Bought 250 at $11.97 | 5/8/2020 | $11.97 | $11.70 | -$67.50 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 35c | 40c | +$75.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $70,603.65 |

|

|

| $70,603.65 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$673.10 |

|

|

| +$673.10 |

| Current total $71,276.75 |

|

|

| $71,276.75 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $41,630.50 |

|

|

| $41,630.50 |

Prices from Tuesday’s close or 6am for US | Cash available $29,646.24 |

|

|

| $29,646.25

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here