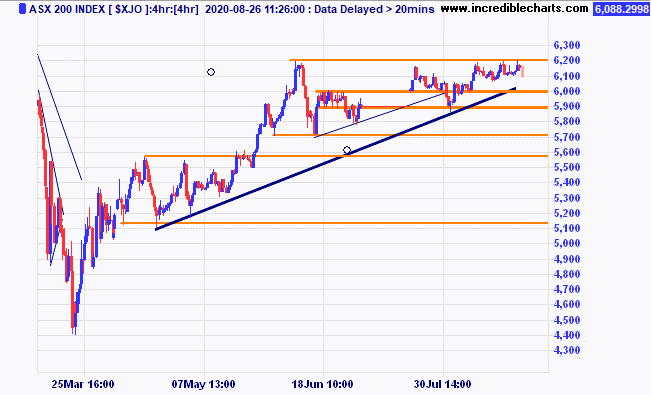

The local market has again failed to close above the 6,200 point resistance level and the month of September on the average is one of the weaker months of the year. If the rising trend line is broken we may have seen the high for now.

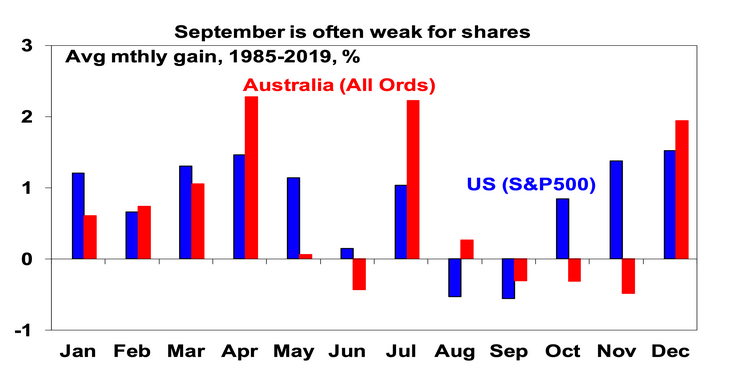

A seasonal table of average monthly movements which can be skewed by large one-off events.

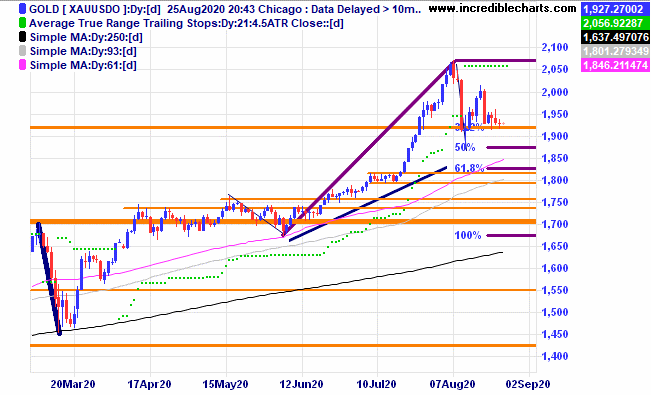

The price of gold looks to be in a holding pattern for now. Any move below current support could set up some selling short possibilities.

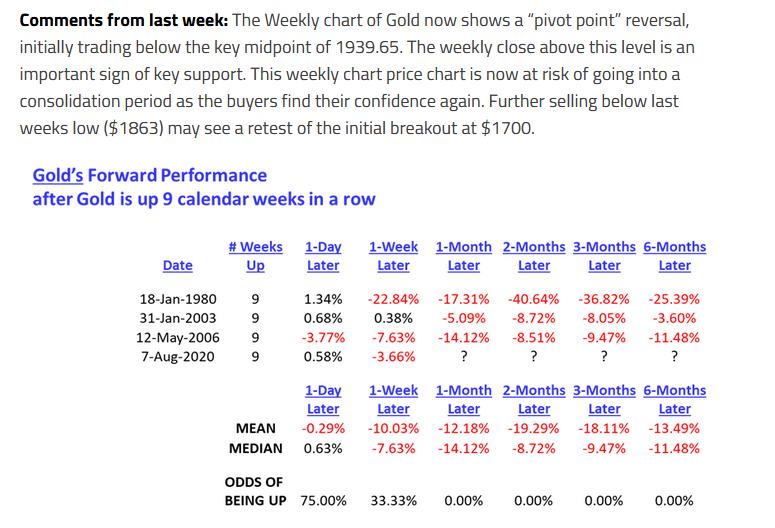

An interesting commentary and table from Gary Burton shows when gold has previously gone up for nine weeks in a row it tends to move lower.

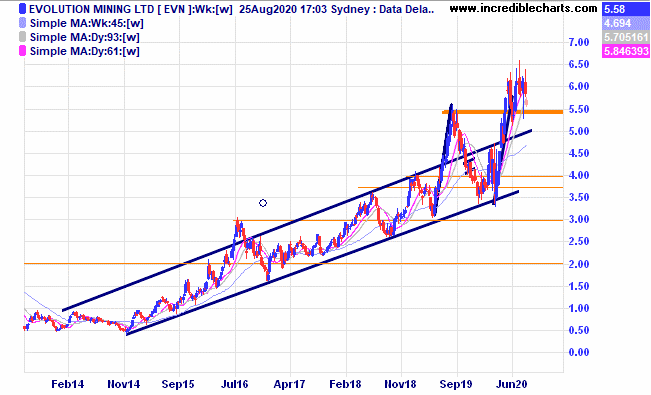

Some gold mining stocks including Evolution are close to breaching support zones.

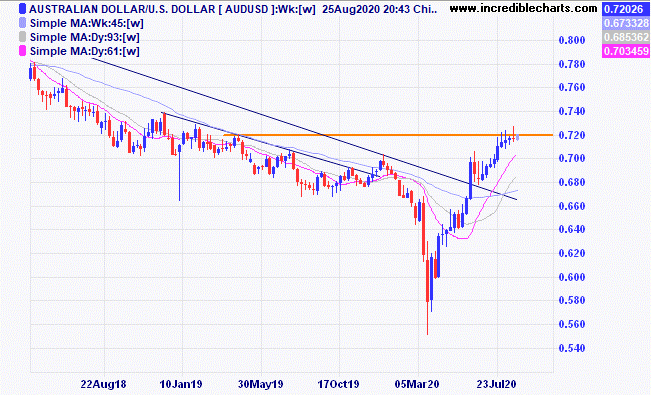

The Australian dollar is struggling to have a close above the 72 cents mark.

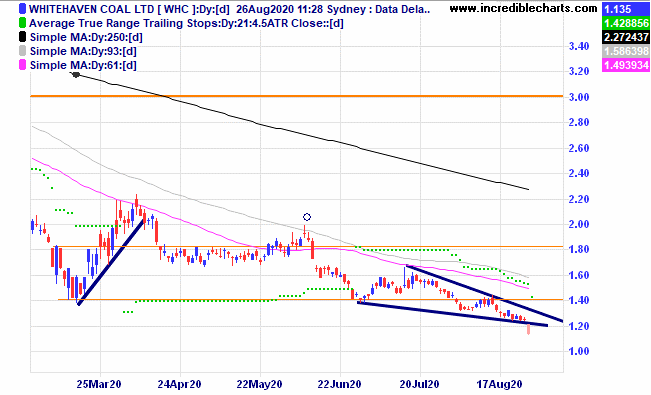

The heading “Lower prices impacts earnings” said it all for Whitehaven Coal with shares down today after releasing their latest results.

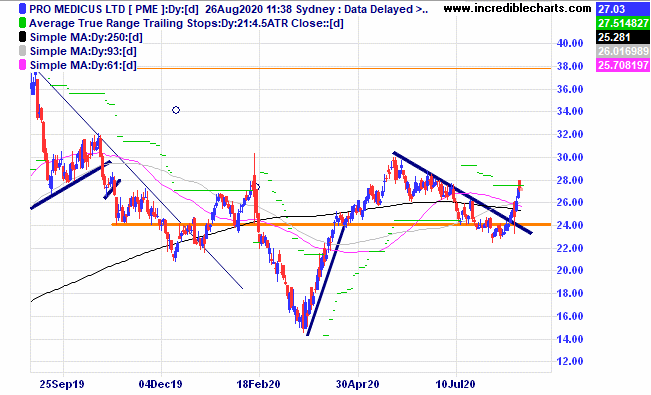

We picked up some Pro Medicus shares for the educational portfolio when they moved above the down trend line.

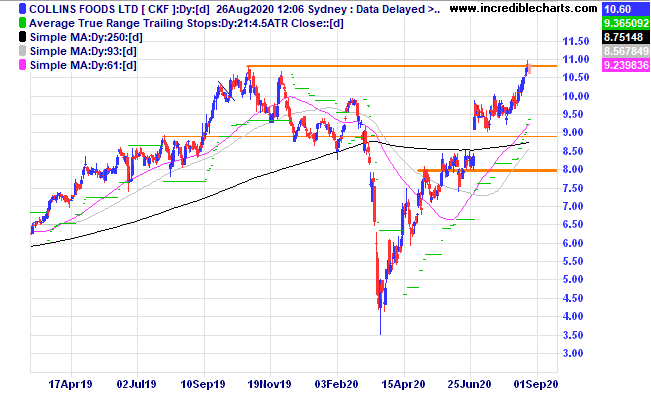

Collins Foods is close to an all-time high.

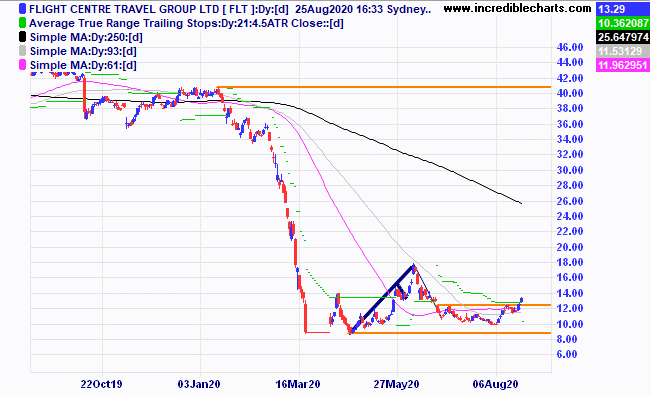

Flight Centre looks to have moved out of the sideways consolidation pattern.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $293.29 | $289.89 | -$34.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $63.36 | $61.84 | -$60.80 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $6.21 | $5.58 | -$252.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.35 | $2.19 | -$240.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 64 | 65 | +$60.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $28.02 | $29.00 | +$98.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 65 | 60 | -$200.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 45c | 46c | +$30.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $11.40 | $13.29 | +$283.50 |

Bought Galaxy

| Bought 2,500 at $1.16 | 5/8/2020 | $1.23 | $1.13 | -$250.00 |

Bought Integrated Research | Bought 700 at $4.40 | 5/8/2020 | $4.79 | $4.26 | -$371.00 |

Bought NextDC

| Bought 250 at $11.97 | 5/8/2020 | $12.00 | $11.86 | -$35.00 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 45c | 46c | +$15.00 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $25.30 | $27.11 | +$181.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $71,533.05 |

|

|

| $71,533.05 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$775.30 |

|

|

| -$775.30 |

| Current total $70,757.75 |

|

|

| $70,757.75 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $35,836.50 |

|

|

| $35,836.50 |

Prices from Tuesday’s close or 6am for US | Cash available $34,921.25 |

|

|

| $34,921.25

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here