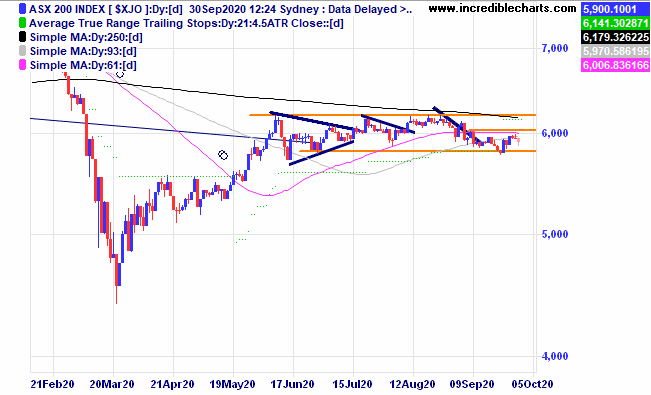

The local market is continuing to trade in the bottom half of the larger sideways congestion that began back in June. We reduced the ASX 200 cfd holding before the weekend and sold the remainder late on Tuesday after retreating from near the 6,000 level.

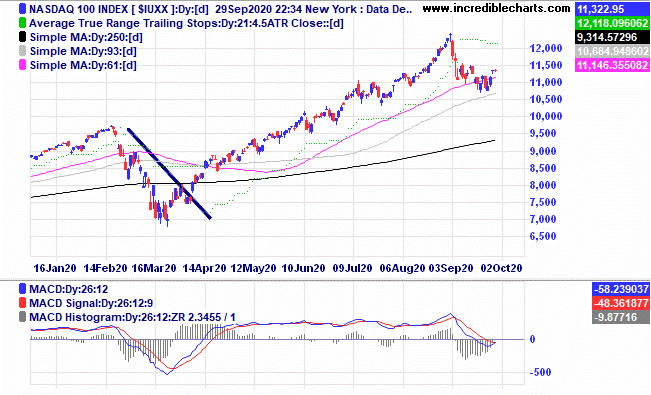

The time is fast approaching for a possible entry into the “Best eight months” seasonal strategy for the Nasdaq 100 Index outlined by Jeffrey and Yale Hirsch. The Nasdaq index is shown below and could be traded with the NDQ and for the more aggressive traders the geared LNAS ETF’s listed in Australia, watching.

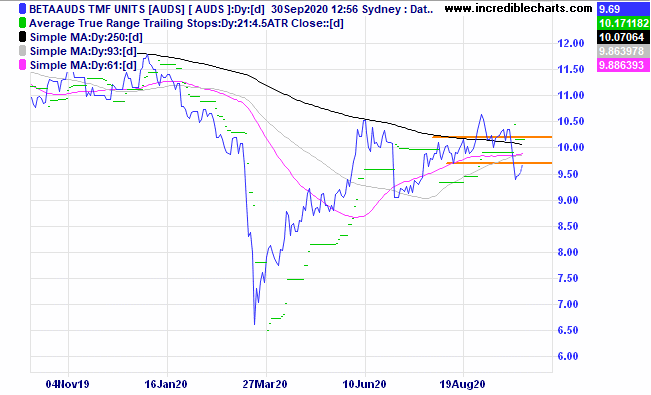

During the past week we were stopped out of the AUDS ETF and the BBOZ bear ETF.

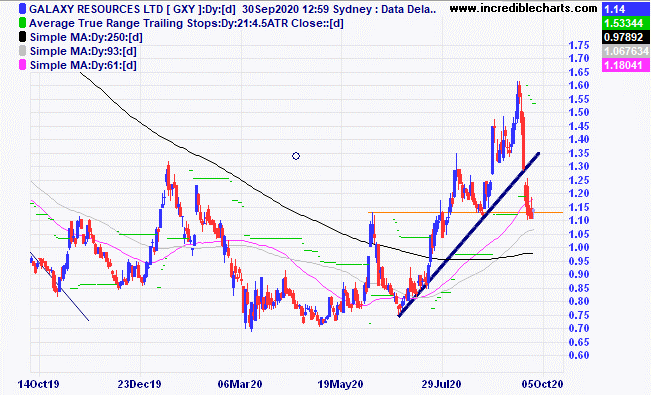

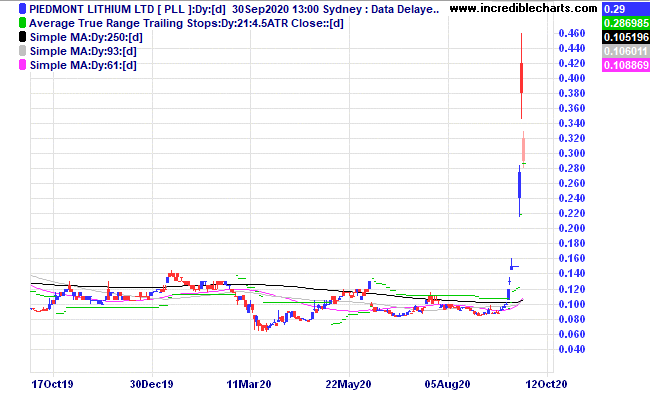

More than a few lithium miners including Galaxy were pounded after Tesla’s battery day event and we were stopped out of our position.

On the other side of things little known Piedmont Lithium gained substantially after inking a deal with Tesla for the supply of Lithium.

Ooh Media moved out of the tight sideways range and we bought some for the educational portfolio.

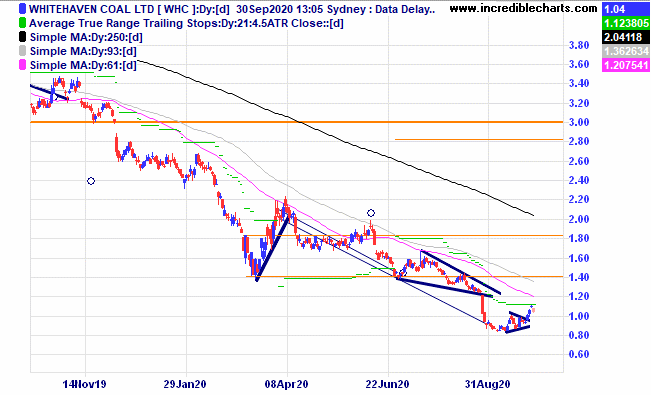

Whitehaven Coal has moved out of a small congestion pattern and we bought a parcel.

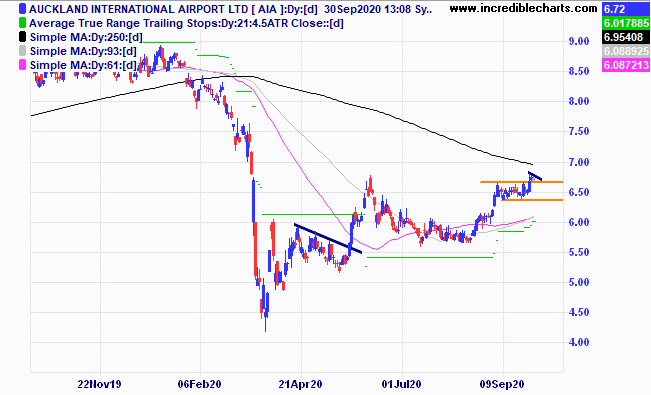

Auckland Airport has an interesting pattern forming and with a possibility of a trans-Tasman bubble and could be on the move sooner rather than later.

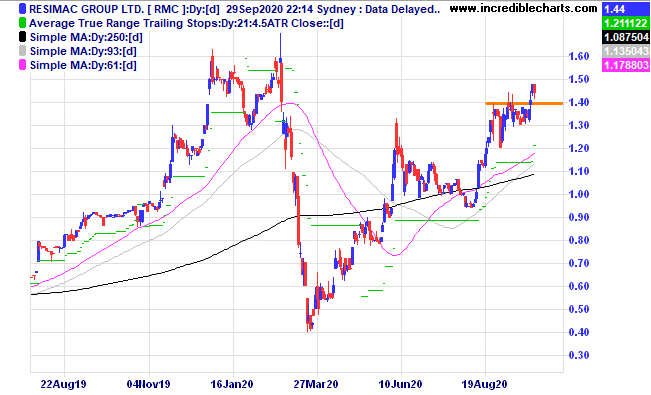

A few stocks could benefit from relaxed lending rules including Resimac.

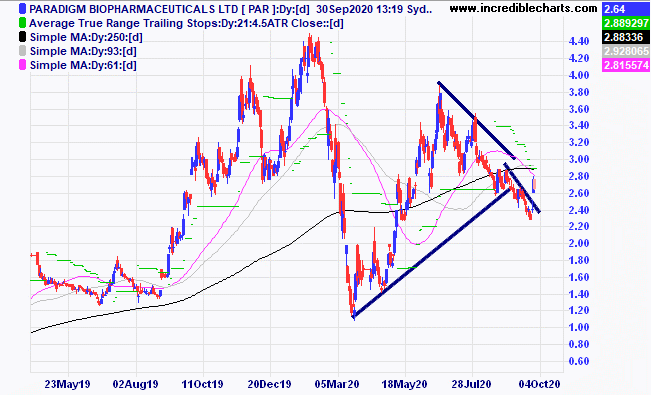

Paradigim is forming an interesting looking pattern and could have made a low for now.

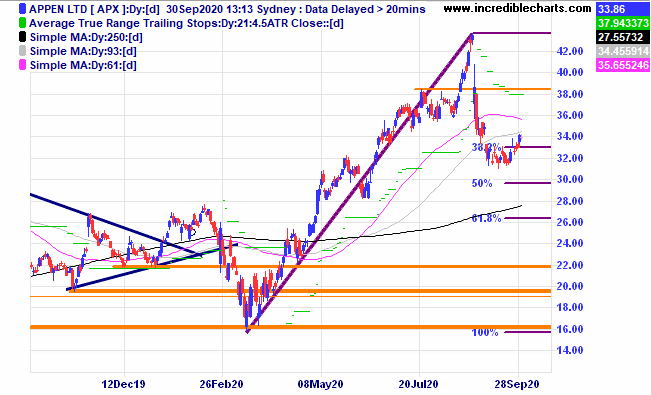

Appen may have found some support at these levels.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $286.35 | $295.54 | +$91.90 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $54.80 | $58.04 | +$129.60 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $5.88 | $5.79 | -$36.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.38 | $2.42 | +$60.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 68 | 70 | +$120.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $29.15 | $30.68 | +$153.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 55.5 | 54.5 | -$40.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 48 | 57.5 | +$285.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $12.85 | $13.98 | +$169.50 |

Bought Galaxy

| Bought 2,500 at $1.16 | 5/8/2020 | $1.46 | Sold 23/9 at $1.30 | -$430.00 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 48 | 57.5 | +$142.50 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $26.13 | $27.45 | +$132.00 |

Bought Aust Dollar ETF AUDS | Bought 500 at $10.49 | 31/8/2020 | $10.04 | Sold 24/9 at $9.50 | -$300.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $3.32 | $3.46 | +$98.00 |

Bought BBOZ Strong Bear ETF | Bought 500 at $8.40 | 7/9/2020 | $8.90 | Sold 29/9 at $8.35 | -$305.00 |

Bought Mesoblast

| Bought 500 at $4.90 | 16/9/2020 | $5.02 | $5.19 | +$85.00 |

Bought 6 ASX 200 cfd’s | Bought 6 ASX 200 cfds At 5,880 | 23/9/2020 | 5,880 | Sold 3 at 5,964 Sold 3 at 5,952 | +$222.00 +$186.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.13 | $1.21 | +$200.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | $1.05 | $1.09 | +$120.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $71,343.75 |

|

|

| $71,343.75 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +1,083.50 |

|

|

| +$1,083.50 |

| Current total $72,427.25 |

|

|

| $72,427.25 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $40,255.90 |

|

|

| $40,255.90 |

Prices from Tuesday’s close or 6am for US | Cash available $32,171.35 |

|

|

| $32,171.35

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here