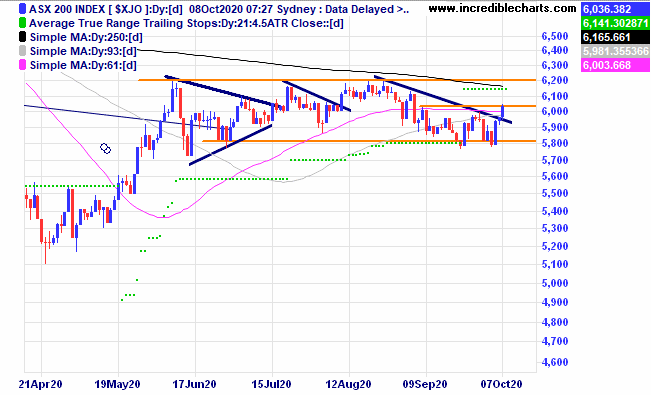

The local market has been boosted somewhat by the Federal Budget’s spending spree as it remains to be seen if that alone can lift consumer confidence enough to open people’s wallets and spend some of the recently accumulated savings. The index has again moved up from the lows of the sideways range with punters placing their bets on whether it will finally break out to the upside.

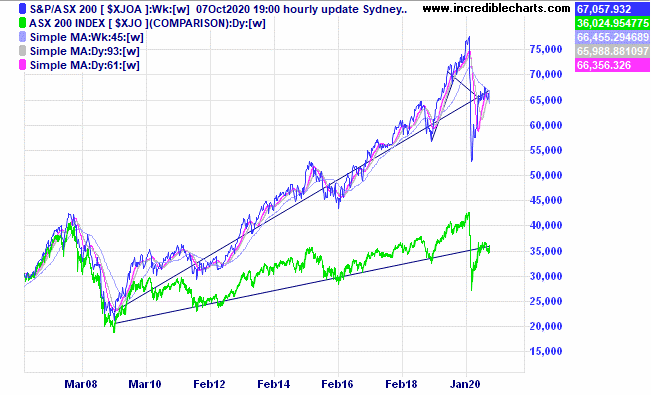

The reinvestment of dividends makes a big difference over time as the chart below shows with the movement of the index itself rising 74 per cent against the accumulation index where dividends are re-invested rising 189 per cent from the GFC lows.

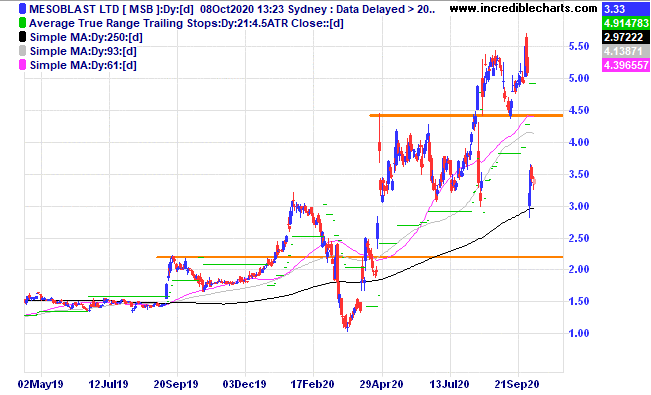

Mesoblast shares fell heavily after an unexpected hiccup in FDA approval for one of their treatments. We exited the next day for one of the bigger individual losses for the year. The advantages of having a diversified portfolio comes into play when you consider that the stock fell around 30 per cent yet only impacted the portfolio by a negative 1.25 per cent.

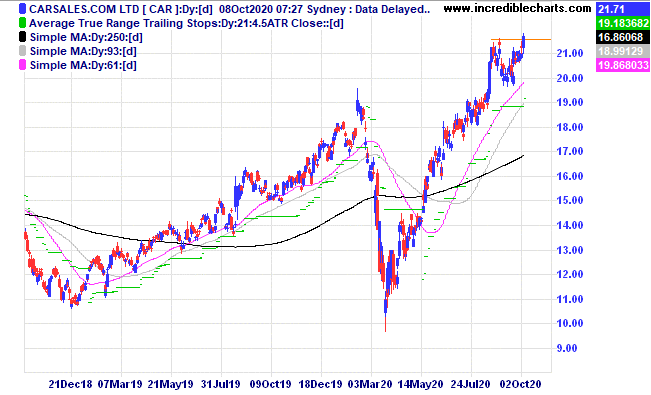

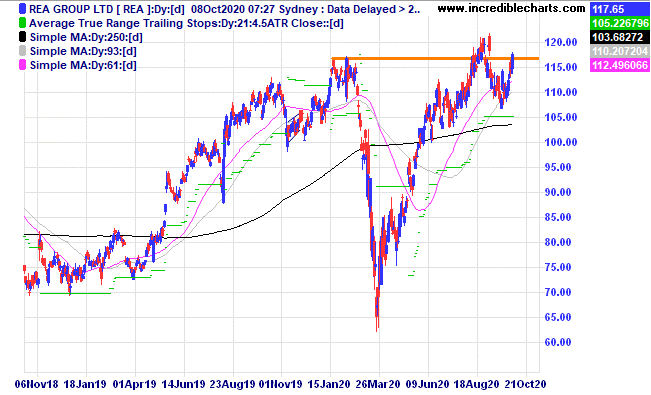

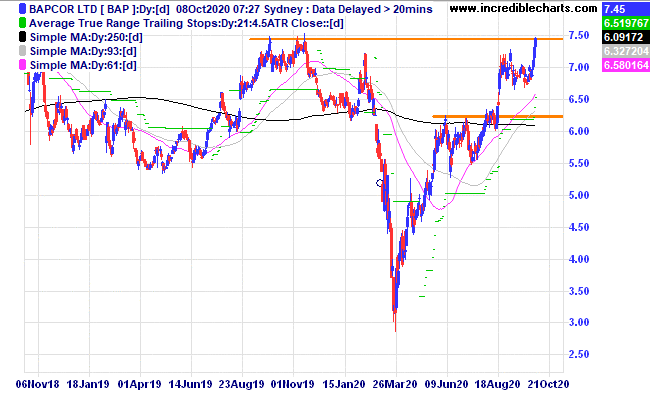

Quite a few stocks are near their yearly highs including Carsales.com.

Real estate mob REA Group.

Car parts supplier Bapcor.

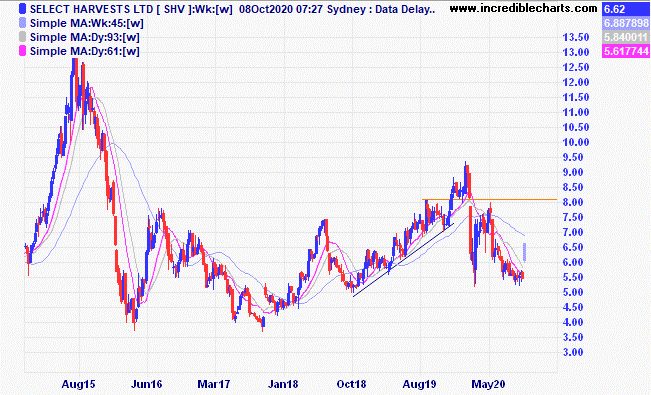

Select Harvests has moved up strongly on the back of the news of an expansive acquisition.

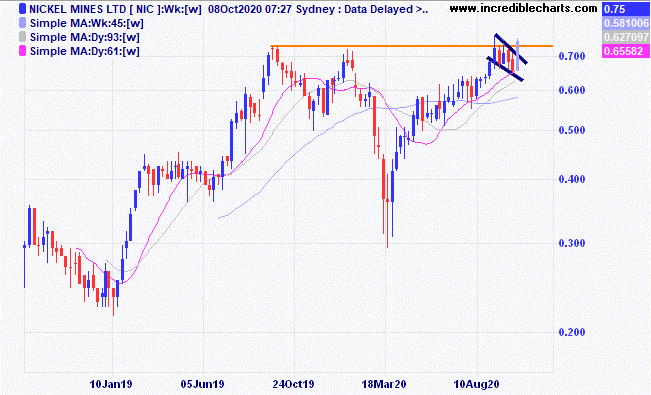

Nickel Mines is close to breaking through to new highs.

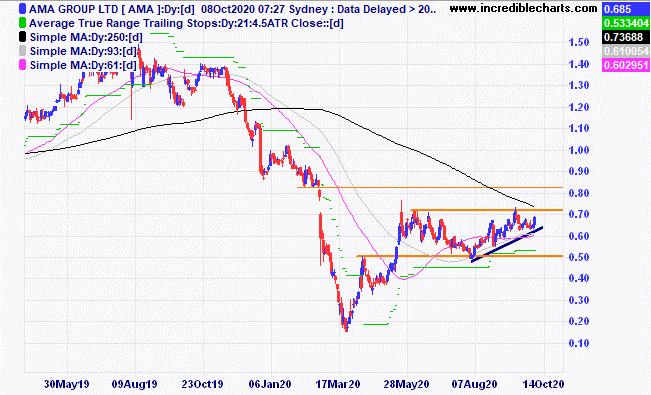

AMA Group looks to be posturing towards a further move up.

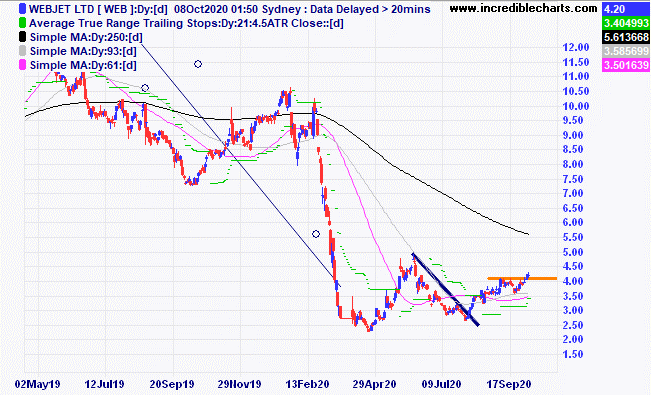

Webjet has been inching up posting a fresh high in this move.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $295.54 | $291.85 | -$36.90 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $58.04 | $60.34 | +$92.00 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $5.79 | $5.83 | +$16.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.42 | $2.45 | +$45.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 70 | 75 | +$300.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $30.68 | $31.10 | +$42.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 54.5 | 55 | +$20.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 57.5 | 56 | -$45.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $13.98 | $14.51 | +$79.50 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 57.5 | 56 | -$22.50 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $27.45 | $27.00 | -$45.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $3.46 | $3.67 | +$147.00 |

Bought Mesoblast

| Bought 500 at $4.90 | 16/9/2020 | $5.19 | Sold 5/10 at $3.45 | -$900.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.21 | $1.37 | +$400.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | $1.09 | $1.07 | -$60.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $26.50 | $26.29 | -$31.50 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.45 | $1.56 | +$220.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $72,427.25 |

|

|

| $72,427.25 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +220.60 |

|

|

| +$220.60 |

| Current total $72,647.85 |

|

|

| $72,647.85 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $44,884.60 |

|

|

| $44,884.60 |

Prices from Tuesday’s close or 6am for US | Cash available $27,763.25 |

|

|

| $27,763.25

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here