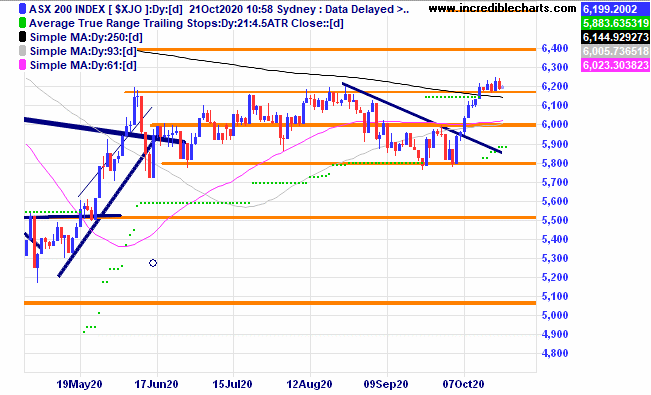

The local market is trading in a very tight range after moving slightly above the previous longer-term congestion zone. Perhaps world markets are waiting on some clearer space that may come after the US election.

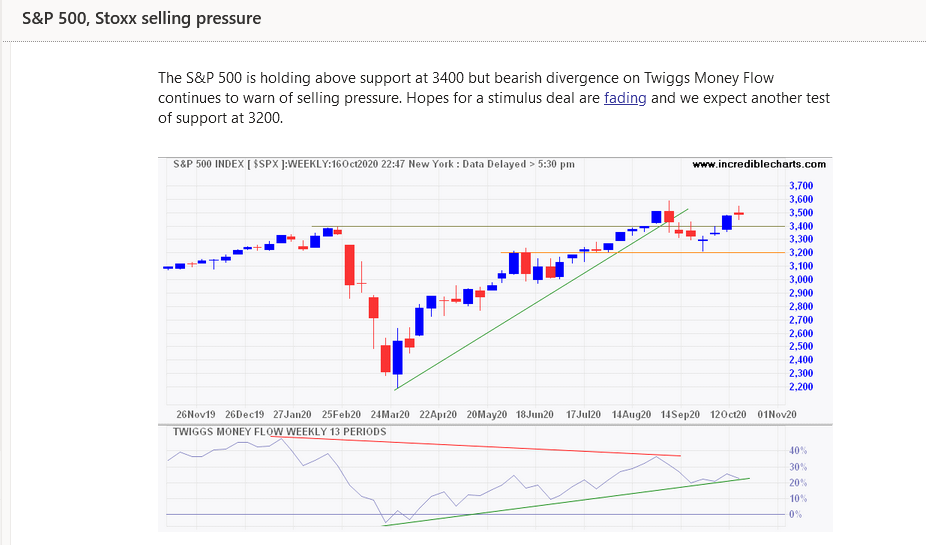

The US S@P 500 index is forming some divergence on a weekly chart which can be a warning of lower prices to come. The passing of time will tell us which way this pattern resolves. Chart and commentary from Colin Twiggs.

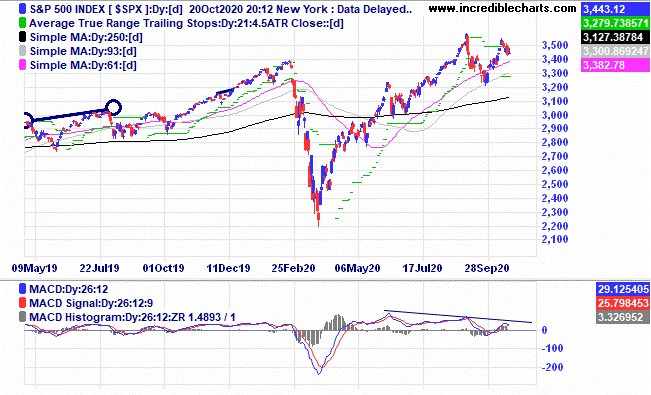

The S@P 500 index on a daily chart showing some divergence with the MACD indicator.

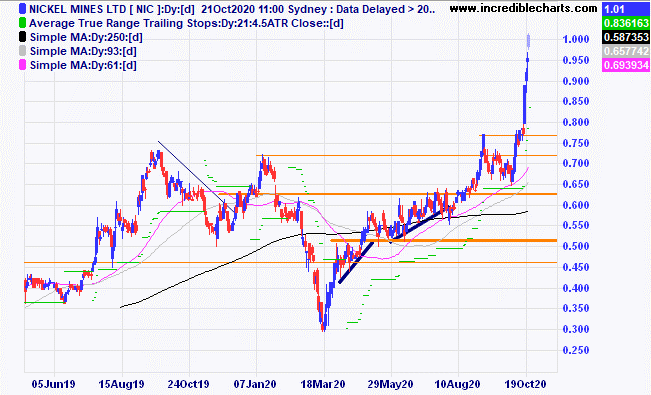

Nickel Mines has been moving up swiftly after announcing a deal which would see earnings increase substantially. A brokers report with a glowing outlook and updated price target in the $1.50’s could also be a positive for the price.

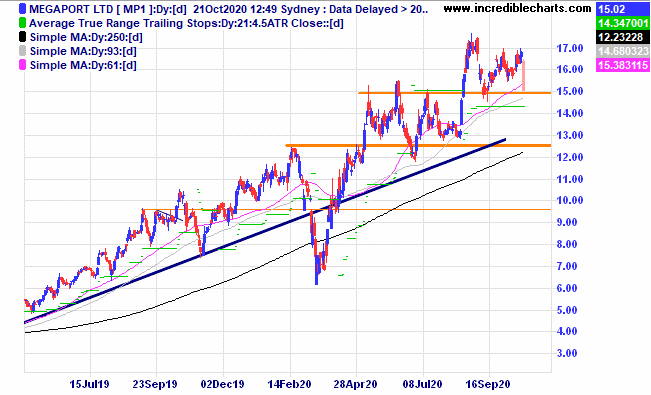

Megaport is down a lot today after the latest earnings update.

Ausnet Services has made a fresh yearly high.

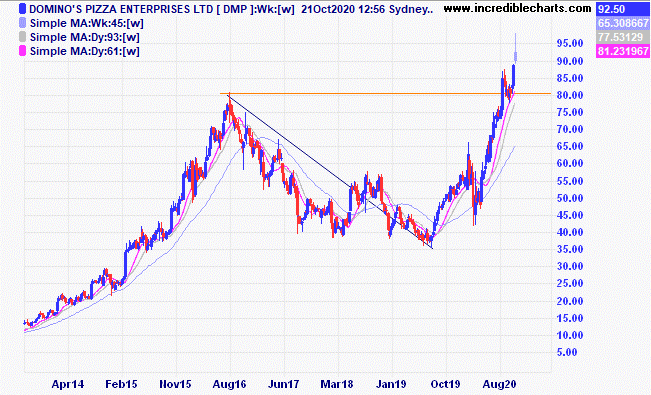

After dropping 55 per cent from the August 2016 high Domino’s Pizza has again surpassed the $80 level.

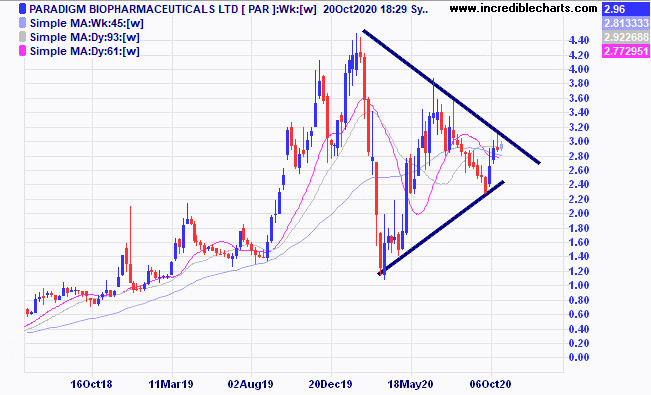

Paradigm is yet to break out of the large triangular pattern and has made a higher low for now.

Altium looks to have moved above a large congestion zone for now. How high can it go?

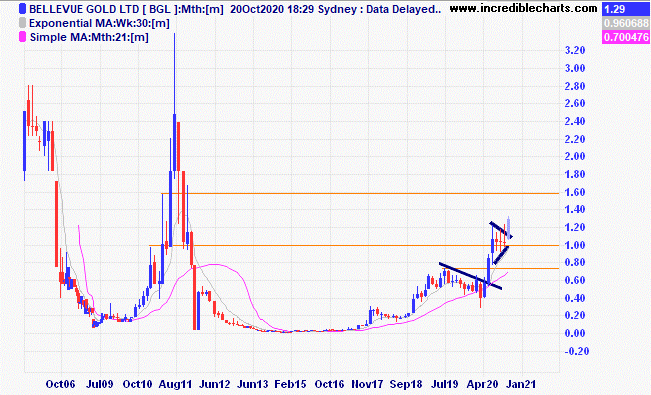

The unfinished and higher monthly candle on the Bellevue chart below could be a positive sign for a further leg higher and Westgold has moved into fresh air after moving above previous resistance.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $298.23 | $301.04 | +$28.10 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $64.20 | $60.25 | -$158.00 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $6.11 | $5.89 | -$88.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.41 | $2.31 | -$150.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 77 | 95 | +$1080.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $31.10 | $30.91 | -$19.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 59.5 | 63 | +$140.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 62.5 | 75.5 | +$390.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $14.39 | $13.48 | -$136.50 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 62.5 | 75.5 | +$195.00 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $27.86 | $32.58 | +$472.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $3.69 | $3.66 | -$21.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.41 | $1.34 | -$175.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | 99c | $1.03c | +$120.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $27.81 | $27.55 | -$39.00 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.56 | $1.47 | -$180.00 |

Bought Carsales

| Bought 130 at $22.15 | 8/10/2020 | $22.35 | $22.31 | -$52.00 |

Bought Bapcor

| Bought 400 at $7.61 | 9/10/2020 | $8.11 | $8.19 | +$32.00 |

Bought Goodman Group | Bought 150 at $19.10 | 14/10/2020 | $19.10 | $18.78 | -$48.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $73,908.05 |

|

|

| $73,908.05 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +1,390.60 |

|

|

| +$1,390.60 |

| Current total $75,298.65 |

|

|

| $75,298.65 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $56,405.70 |

|

|

| $56,405.70 |

Prices from Tuesday’s close or 6am for US | Cash available $18,892.95 |

|

|

| $18,892.95

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here