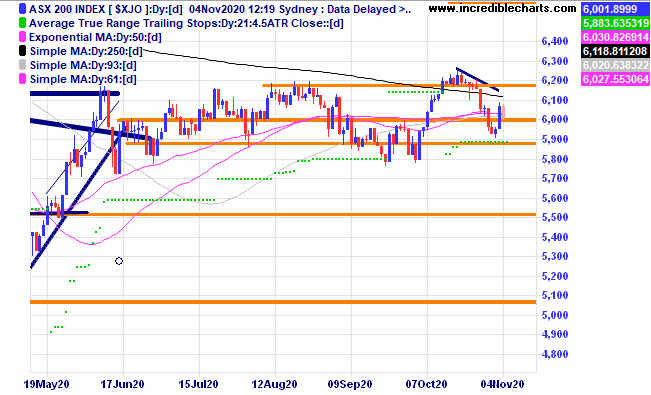

The local market put in a strong day yesterday and we sold out of the remainder of our short position. US election uncertainty could cause some volatility over the next few days until the dust settles. Historically US markets generally rise this time of year and we will stick with the Nasdaq ETF position.

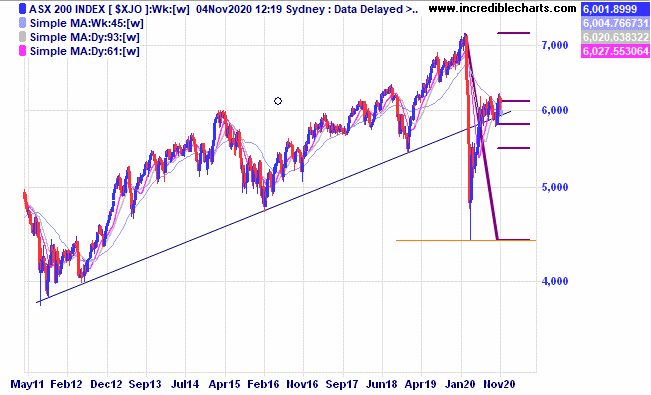

A longer- term chart of the local index shows price just above the long term trend line and is still stuck in some indecisive sideways “chop”.

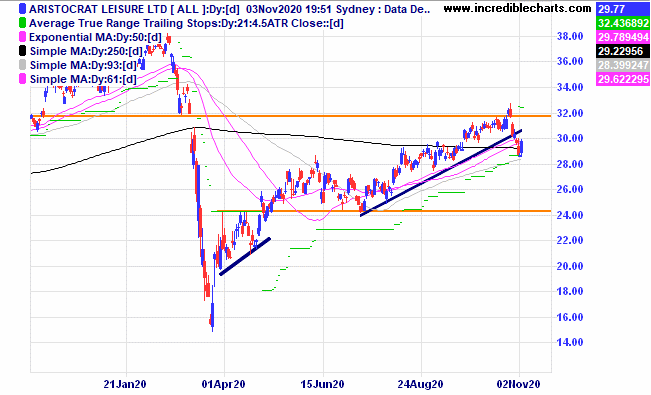

Aristocrat Leisure fell through the uptrend line and our stop loss level and we sold.

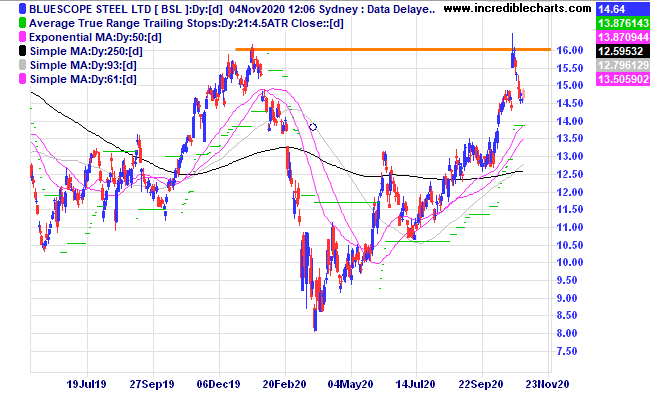

Bluescope Steel has again topped out at the $16 level. Can it rebound and finally push through?

With domestic borders set to open up Webjet could benefit. We bought a parcel for the educational portfolio today

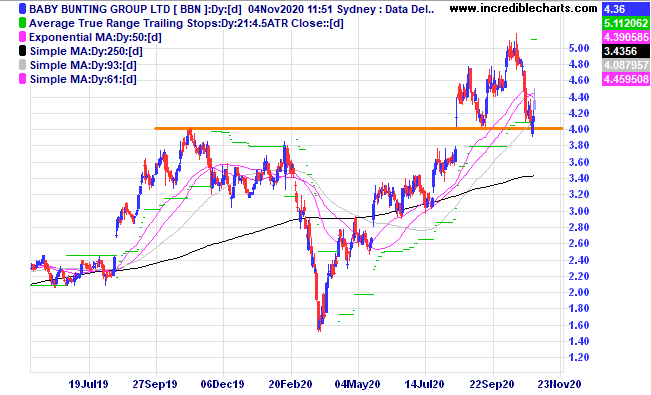

Baby Bunting looks to have found some support at these levels and we added some to the portfolio.

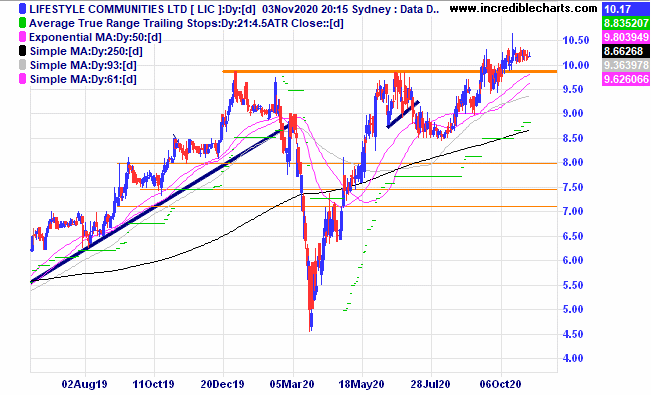

Lifestyle Communities looks to be consolidating at these levels.

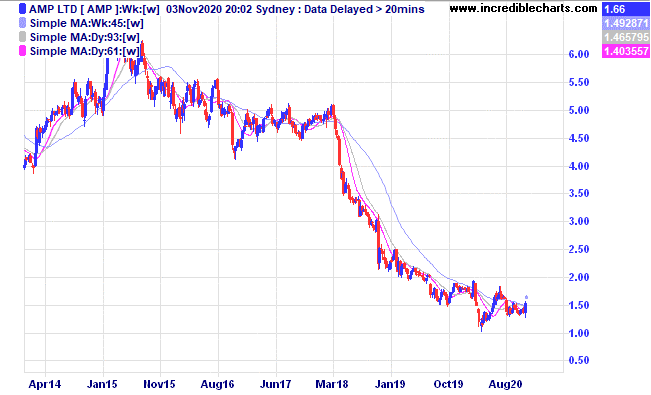

With AMP shares up on takeover speculation it is a long way off those 2015 highs and even further from the $13 level in 2001.

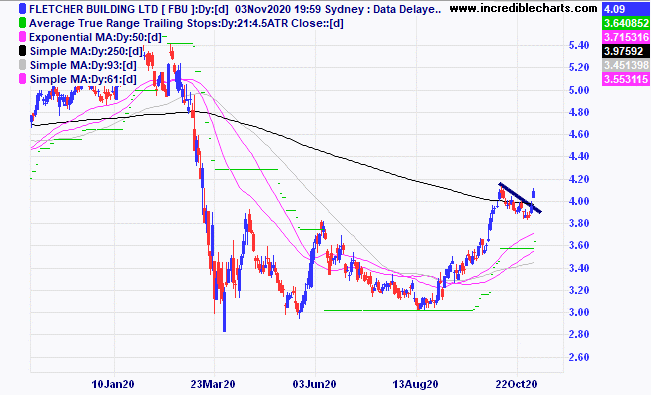

Fletcher Building has moved up and out of the bullish flag type pattern.

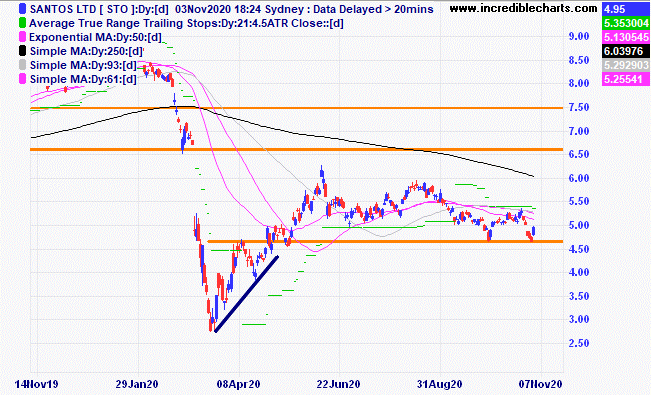

Santos is holding support for now.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $291.97 | $291.97 | Steady |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $57.07 | $57.14 | +$2.80 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $5.57 | $5.83 | +$104.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.13 | $2.17 | +$60.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 93 | Sold 1,500 at 96c 4,500 left at 84c | +$15.00 -$405.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $30.17 | Sold 29/10 at $29.62 | -$85.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 68 | 79.5 | +$460.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 69.5 | 65.5 | -$120.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $12.53 | Sold 28/10 at $11.95 | -$117.00 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 69.5 | 65.5 | -$60.00 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $32.69 | $32.75 | +$6.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $3.55 | $3.56 | +$7.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.32 | $1.30 | -$50.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | 98.5c | $1.07 | +$255.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $26.74 | $26.10 | -$96.00 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.30 | $1.36 | +$120.00 |

Bought Carsales

| Bought 130 at $22.15 | 8/10/2020 | $21.24 | $20.88 | -$46.80 |

Bought Bapcor

| Bought 400 at $7.61 | 9/10/2020 | $7.84 | $7.71 | +$52.00 |

Bought Goodman Group | Bought 150 at $19.10 | 14/10/2020 | $18.49 | $18.69 | +$30.00 |

Sold 5 ASX 200 cfd’s

| Sold 5 at 6,090 | 27/10/2020 | 6,051 | Buy 2 2/11 5,957 Buy 3 2/11 6,020 | +$158.00 +$63.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $73,547.15 |

|

|

| $73,547.15 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$353.00 |

|

|

| +$353.00 |

| Current total $73,900.15 |

|

|

| $73,900.15 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $48,967.70 |

|

|

| $48,967.70 |

Prices from Tuesday’s close or 6am for US | Cash available $24,932.45 |

|

|

| $24,932.45

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here