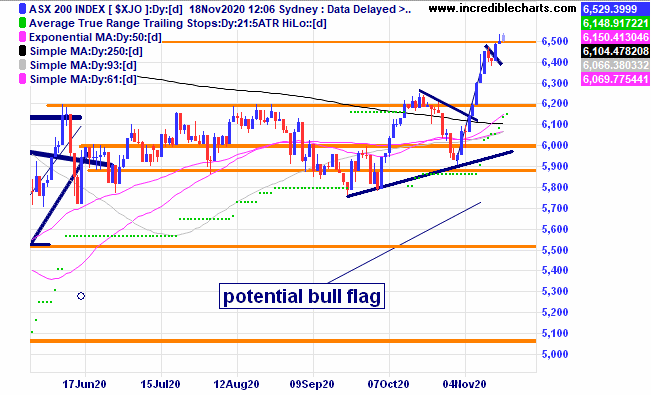

After a strong run the local market went sideways for two days then pushed up from a bullish flag type pattern in limited trading Monday. The index is now just above the 6,500 level which was first reached back in September 2007.

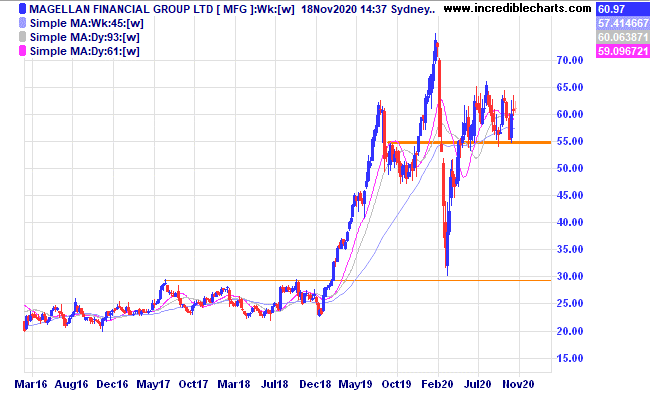

Magellan Financial Group has been in a sideways funk for a while and we switched out of this into a faster moving Hearts and Minds Investment which has recently been making new highs. We may buy back in at a later date.

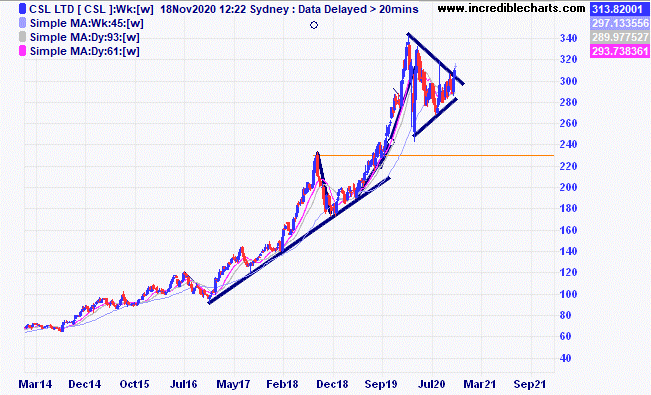

One of the Aussie stocks that made the Hearts and Minds picks was CSL which has just been creeping up of late and recently moved out of a triangular type congestion pattern. The company’s massive R and D program has produced new products than now account for 40 per cent of revenues.

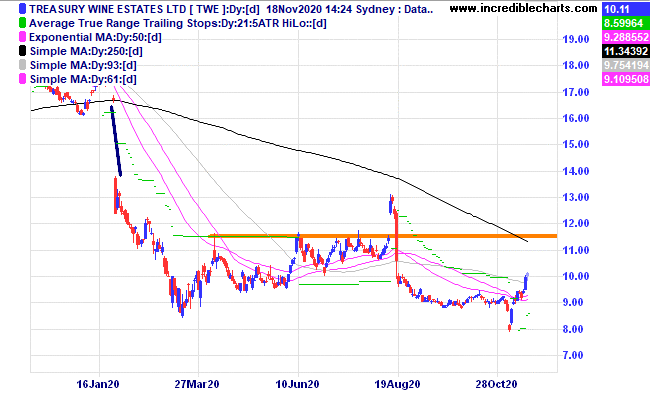

Other Aussie listed picks at the Hearts and Minds conference included Treasury Wine Estate pictured below and Temple and Webster.

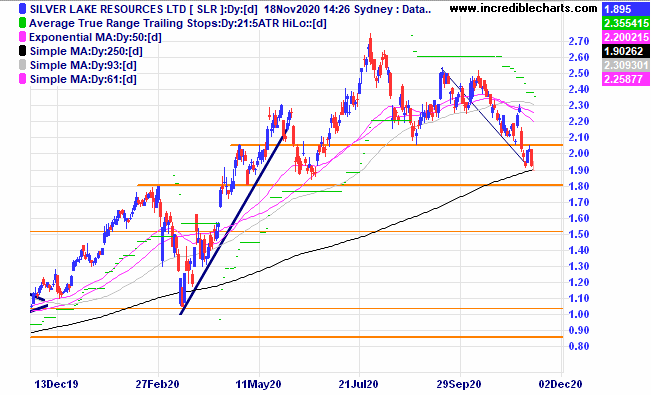

Silver Lake Resources has finally fallen through our stop loss level and we sold the remainder of the original holding after a decent stay in the educational portfolio.

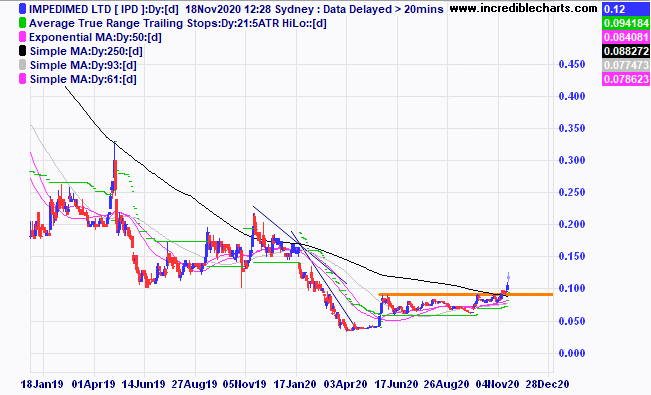

A company that has been in the educational portfolio before at different times is Impedimed which recently moved up through a resistance level on big volumes after a really big decline. We bought a parcel today.

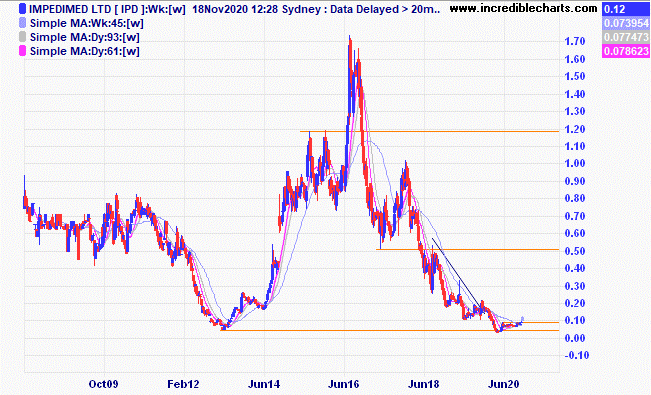

A weekly chart of Impedimed showing the scale of the fall from 2016. Perhaps a ten bagger in the making if all goes well, time will tell.

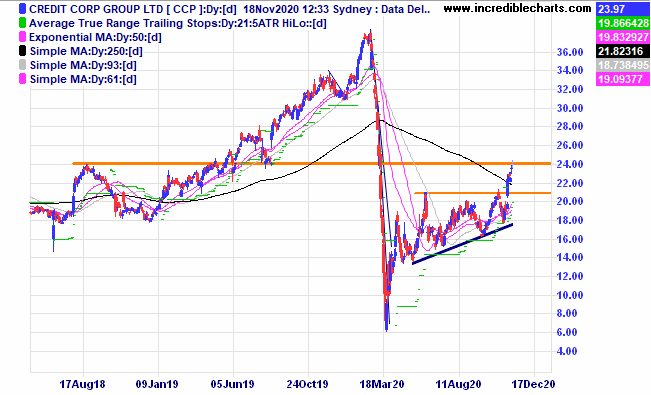

Credit Corp moved up out of a consolidation type pattern and may run into some resistance at these levels. A possible trade if price comes back a bit, watching.

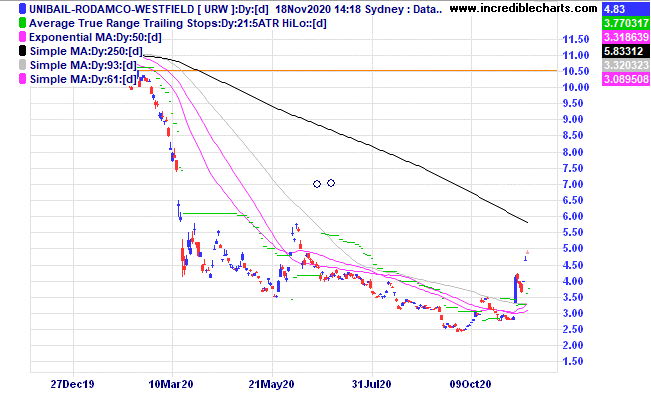

Shopping centres mob Unibail-Rodamco-Westfield has been one of the best performers among the big caps since the news of a possible vaccine success.

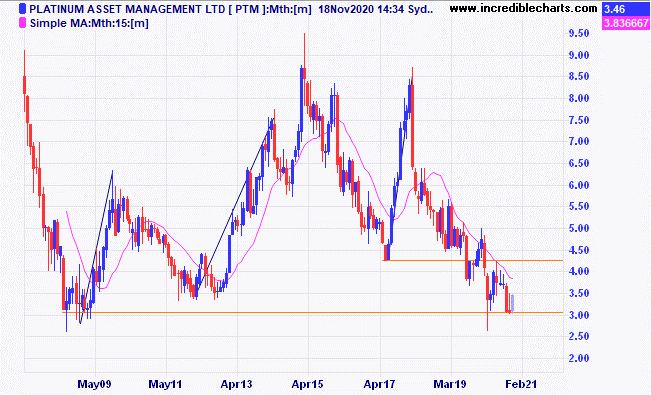

A monthly chart of Platinum Asset Management shows price has bounced up at quite a decent rate from these levels in the past. Reckon it is worth a punt in this low interest rate environment.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $304.60 | $311.37 | +$67.70 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $60.51 | Sold 11/11 at $62.00 | +$29.60 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $5.78 | $5.70 | -$32.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.03 | Sold 17/11 at $1.92 | -$195.00 |

Bought Nickel Mines

| Bought 4,500 at 52.5c | 29/4/2020 | 87.5 | 97 | +$427.50

|

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 91 | 88 | -$120.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 81 | 81 | Steady |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 81 | 81 | Steady |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $32.78 | $32.34 | -$44.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $3.69 | $4.09 | +$280.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.59 | $1.67 | +$200.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | $1.12 | $1.27 | +$450.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $26.73 | $27.18 | -$67.50 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.58 | $1.98 | +$800.00 |

Bought Carsales

| Bought 130 at $22.15 | 8/10/2020 | $21.33 | $20.87 | -$59.80 |

Bought Bapcor

| Bought 400 at $7.61 | 9/10/2020 | $7.40 | $7.13 | -$108.00 |

Bought Goodman Group | Bought 150 at $19.10 | 14/10/2020 | $18.30 | $18.76 | +$69.00 |

Bought Baby Bunting | Bought 700 at $4.40 | 4/11/2020 | $4.49 | $4.44 | -$35.00 |

Bought Webjet

| Bought 800 at $3.90 | 4/11/2020 | $4.86 | $5.15 | +$232.00 |

Bought Hearts and Minds | Bought 700 at $4.50 | 11/11/2020 | $4.50 | $4.50 | Steady |

Bought Santos

| Bought 500 at $5.80 | 11/11/2020 | $5.80 | $5.86 | +$30.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $77,502.75 |

|

|

| $77,502.75 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$1,924.50 |

|

|

| +$1,924.50 |

| Current total $79,427.25 |

|

|

| $79,427.25 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $61,015.20 |

|

|

| $61,015.20 |

Prices from Tuesday’s close or 6am for US | Cash available $18,412.05 |

|

|

| $18,412.05

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here