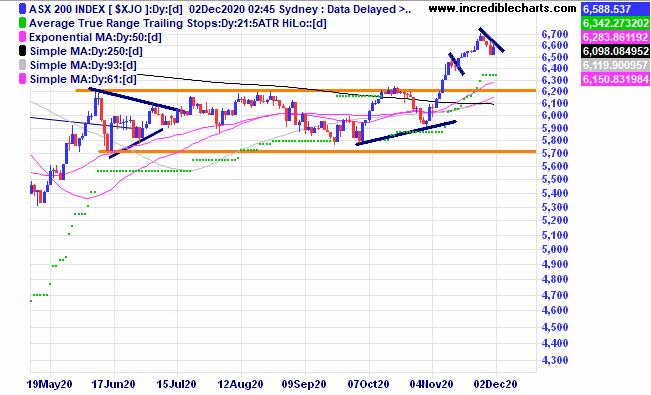

The local market had a nice change of pace closing up a tad over one per cent yesterday after a slow three day move down. After a stellar November with the biggest monthly gain since the eighties it could be that the market may pause for a while as the current rally has already tagged 100 per cent of the consolidation range. The current pattern also provides a possible long entry point for index traders. Watching.

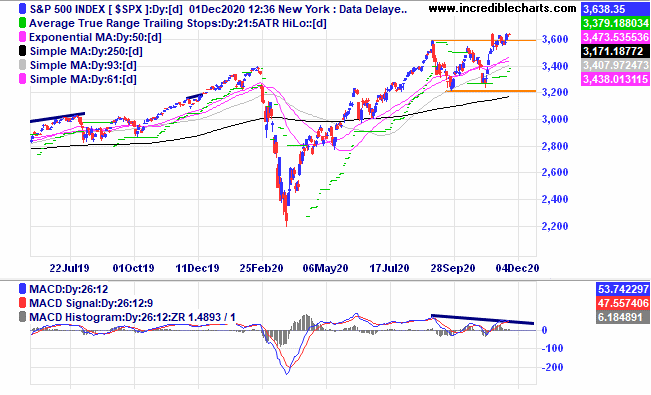

This chart of the S@P 500 index shows a small bearish type divergence pattern. Watching for a possible shorting opportunity in an appropriate ETF and at the same time looking at the possible small continuation pattern at the top. Which way will it go?

This very long-term chart of the S@P 500 courtesy of Mary McNamara shows the potential of the current upswing or “Secular Bull” to run a few more years yet.

Gold looked to have the possibility of a good bounce off old tops early Tuesday morning and presented us with a nice entry point. We bought one mini contract and sold Wednesday morning when it reached our profit target, and as luck would have it the thing just kept on going up. All good, we stuck to our plan and came out ahead. Tuesday 4 hour graph below.

Where we got out this morning with trade stats will be tabled next week. There is a window for seasonal change in the gold price direction around this time of year and further trades are on the table. An ABC type move could prove irresistible though 1860 is seen as a future stumbling block or resistance zone.

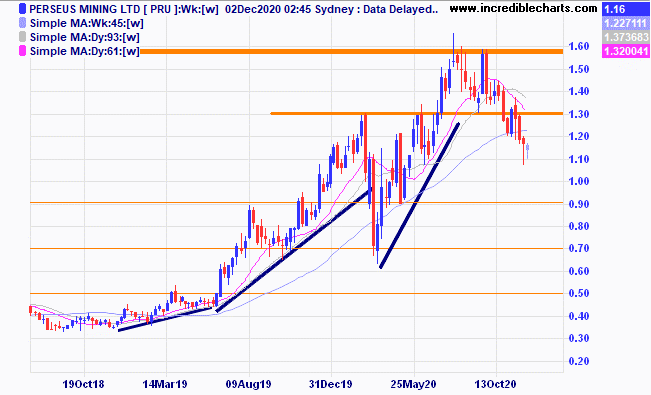

Local gold stocks mostly put in a spike reversal type pattern last week similar to the Perseus chart below. We will add some to the portfolio today along with a smaller nibble at Resolute Mining which could become a takeover prospect at these levels.

We recently bought Downer as it moved to a new high and it has yet to move higher. Our stop was in place should the stock continue the adverse move, however, we see more profitable opportunities in the gold space and will sell today. As long-term followers will know Charlie is a bit of a gold “bug”. We will also dispose of Costa Group and Baby Bunting, sell 5,000 Impedimed and the smaller Ardent Leisure holding to lock in some profits and give the educational portfolio a bit more cash to aid flexibility and take advantage of future opportunities.

Nickel Mines reached the target of 100 per cent of the previous range and we wanted to sell more shares today to lock in some profit but the shares are in a trading halt and the company is raising more capital so we will reevaluate.

Flight Centre looks to be taking a little breather and possibly presenting a pyramiding point of entry.

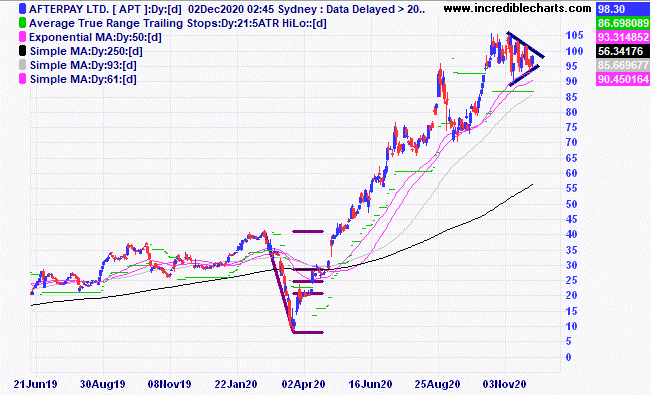

Strong running outfit Afterpay looks to be forming a possible continuation pattern. The multiples are too pricey for Charlie.

Megaport looks to have found some support at these levels.

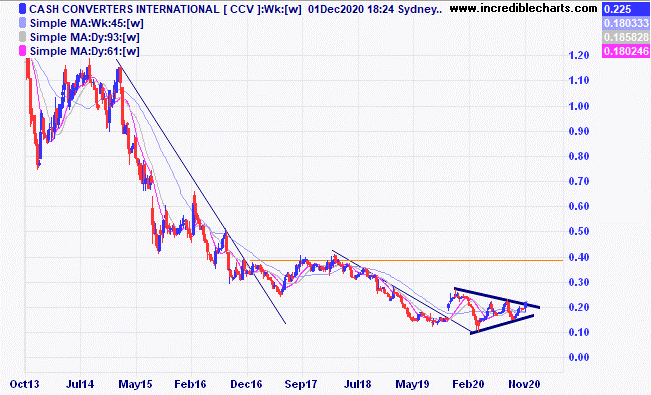

Cash Converters looks to be forming a nice consolidation pattern. Watching.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $318.57 | $297.38 | -$211.90 |

Bought Nickel Mines

| Bought 4,500 at 52.5c | 29/4/2020 | $1.06 | $1.08 | +$90.00

|

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 86.5 | 91 | +$180.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 86 | 83 | -$90.00 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 86 | 83 | -$45.00 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $31.00 | $29.54 | -$146.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $3.95 | $4.03 | +$56.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.76 | $1.67 | -$225.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | $1.40 | $1.32.5 | -$225.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $27.12 | $27.43 | +$46.50 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.96 | $1.87 | -$180.00 |

Bought Carsales

| Bought 130 at $22.15 | 8/10/2020 | $20.62 | Sold 25/11 at $20.20 | -$32.50 |

Bought Bapcor

| Bought 400 at $7.61 | 9/10/2020 | $7.17 | $7.01 | -$64.00 |

Bought Goodman Group | Bought 150 at $19.10 | 14/10/2020 | $18.50 | $18.68 | -$84.60 |

Bought Baby Bunting | Bought 700 at $4.40 | 4/11/2020 | $4.30 | $4.34 | +$28.00 |

Bought Webjet

| Bought 800 at $3.90 | 4/11/2020 | $5.51 | $5.77 | +$208.00 |

Bought Hearts and Minds | Bought 700 at $4.50 | 11/11/2020 | $4.59 | $4.50 | -$63.00 |

Bought Santos

| Bought 500 at $5.80 | 11/11/2020 | $6.36 | $6.16 | -$100.00 |

Bought Impedimed

| Bought 25,000 at 11.5c | 18/11/2020 | 13.5c | 16.5 | +$750.00 |

Bought Platinum Asset Management | Bought 800 at $3.47 | 19/11/2020 | $3.65 | $4.16 | +$408.00 |

Bought Emeco

| Bought 2,500 at $1.05 | 25/11/2020 | $1.05 | $1.04 | -$25.00 |

Bought Downer

| Bought 500 at $5.55 | 25/11/2020 | $5.55 | $5.36 | -$95.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $81,264.75 |

|

|

| $81,264.75 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$179.50 |

|

|

| +$179.50 |

| Current total $81,444.25 |

|

|

| $81,444.25 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $69,648.30 |

|

|

| $69,648.30 |

Prices from Monday’s close or 6am for US | Cash available $11,795.95 |

|

|

| $11,795.95

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here