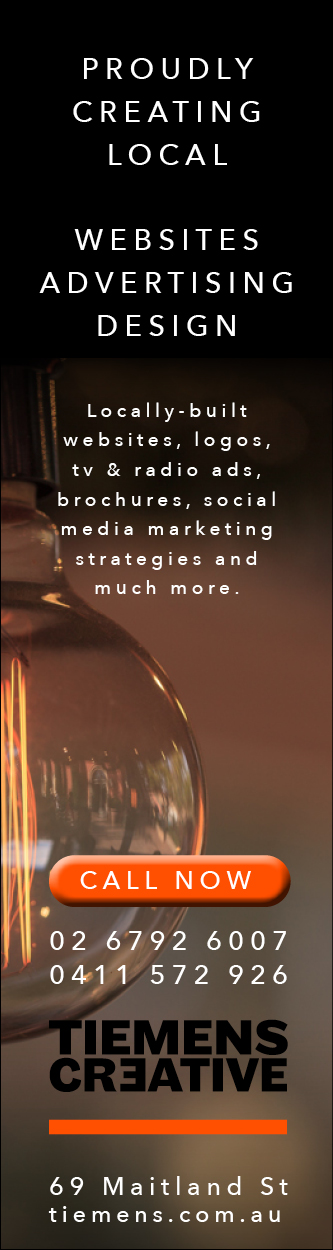

The local market is treading water after a great run up in November. The daily chart shows the index made a slightly higher new high before trading in a tighter range yesterday and has potentially made a small double top pattern.

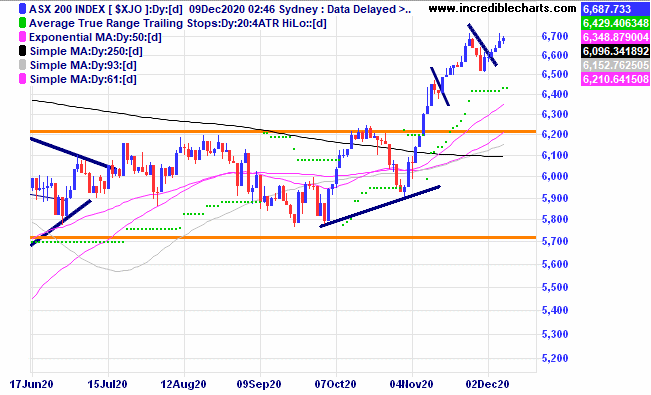

The weekly chart has made a higher swing low.

The gold price continued to move up to the resistance zone and could consolidate here before the next move. The next lot of stimulus to be tipped into the US economy could be nearly a trillion dollars and with Janet Yellen appointed to the treasury in Biden’s new government gold is well worth watching. A bullish outside day with volume created a new higher low.

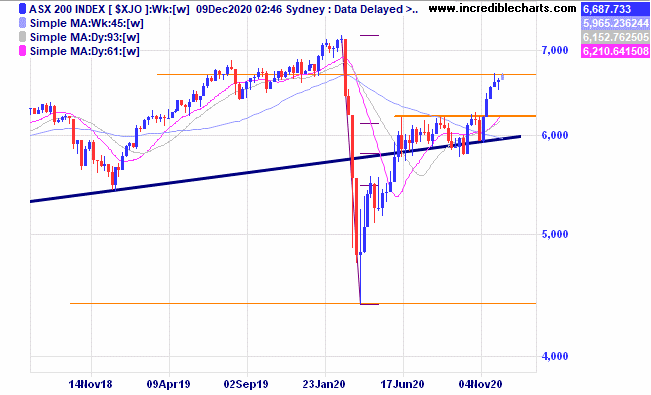

The pop in the iron ore price has pushed BHP above the resistance zone for now. One wonders how much further this can go.

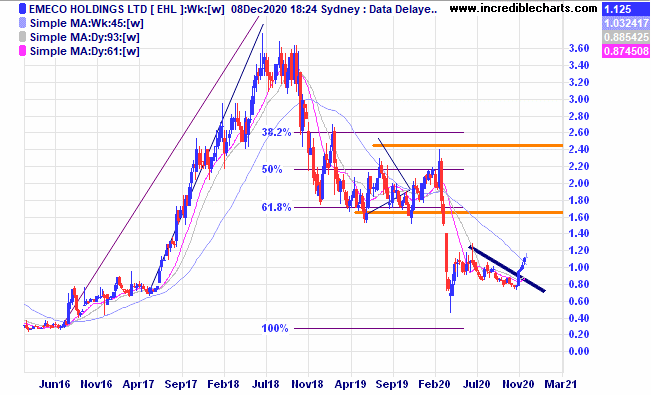

Emeco Holdings continues the recent rise.

Maca looks close to breaking higher.

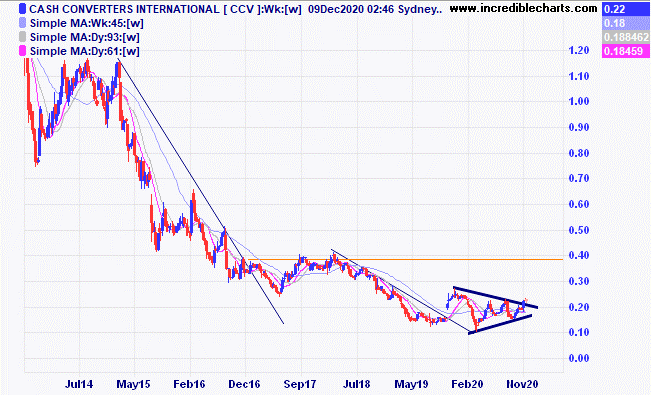

Cash Converters has moved just out the congestion pattern and we will buy a small parcel for the educational portfolio.

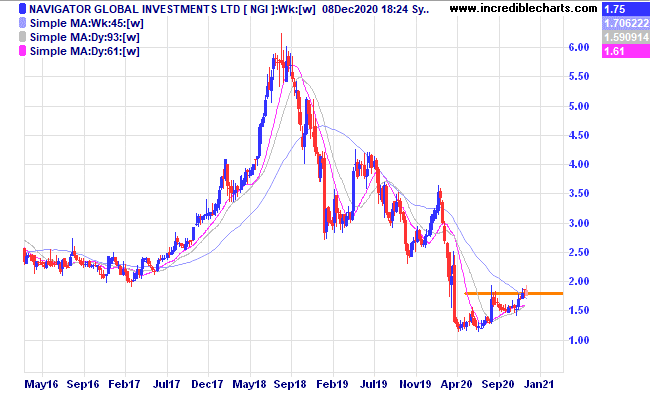

Navigator looks close to a decent breakout.

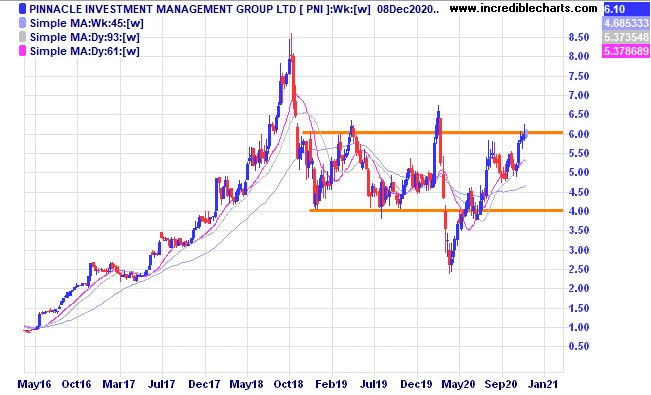

Heard on a recent podcast that Pinnacle had a few “value” orientated funds in their stable. Value managed funds have been picking up performance over growth funds with some analysts saying the rotation into value is just starting. Perhaps a buy above resistance.

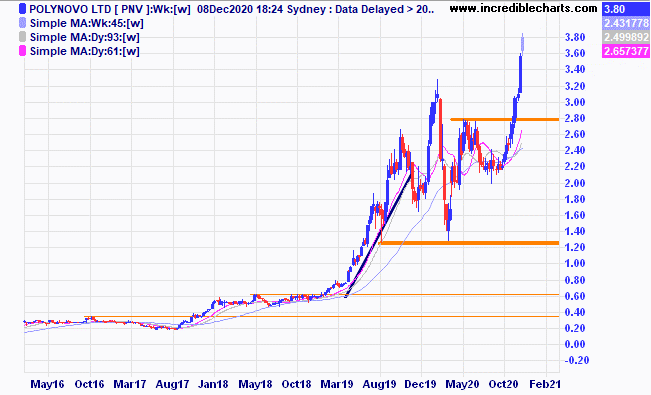

Polynovo has moved up quickly after breaking out of congestion.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $297.38 | $297.38 | Steady |

Bought Nickel Mines

| Bought 4,500 at 52.5c | 29/4/2020 | $1.08 | $1.02 | -$270.00

|

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 91 | 88 | -$120.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 83 | 75 | -$240.00 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 83 | Sold 2/12 at 82c | -$45.00 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $29.54 | $30.62 | +$108.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $4.03 | Sold 2/12 at $4.10 | +$19.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.67 | $1.77 | +$250.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | $1.32.5 | $1.58 | +$765.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $27.43 | $28.05 | +$93.00 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.87 | $1.89 | +$40.00 |

Bought Bapcor

| Bought 400 at $7.61 | 9/10/2020 | $7.01 | Sold 7/12 at $6.90 | -$74.00 |

Bought Goodman Group | Bought 150 at $19.10 | 14/10/2020 | $18.68 | $18.42 | -$39.00 |

Bought Baby Bunting | Bought 700 at $4.40 | 4/11/2020 | $4.34 | Sold 2/12 at $4.32 | -$44.00 |

Bought Webjet

| Bought 800 at $3.90 | 4/11/2020 | $5.77 | $5.65 | -$96.00 |

Bought Hearts and Minds | Bought 700 at $4.50 | 11/11/2020 | $4.50 | $4.69 | +$133.00 |

Bought Santos

| Bought 500 at $5.80 | 11/11/2020 | $6.16 | $6.44 | +$140.00 |

Bought Impedimed

| Bought 25,000 at 11.5c | 18/11/2020 | 16.5c | Sold 5,000 2/12 at 15.5 leaves 20,000 at 14c | -$80.00

-$500.00 |

Bought Platinum Asset Management | Bought 800 at $3.47 | 19/11/2020 | $4.16 | $4.33 | +$136.00 |

Bought Emeco

| Bought 2,500 at $1.05 | 25/11/2020 | $1.04 | $1.12 | +$200.00 |

Bought Downer

| Bought 500 at $5.55 | 25/11/2020 | $5.36 | Sold at $5.33 | -$45.00 |

Bought 1 e-mini gold

| Bought 1 at $1,787.00 | 1/12/2020 | $1,787.00 | Sold at profit target $1,806.00 | +$920.00 |

Bought Perseus

| Bought 2,500 at $1.20 | 2/12/2020 | $1.20 | $1.20 | Steady |

Bought Resolute

| Bought 2,000 at 79c | 2/12/2020 | 79c | 77c | -$40.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $81,444.25 |

|

|

| $81,444.25 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$1,211.00 |

|

|

| +$1,211.00 |

| Current total $82,655.25 |

|

|

| $82,655.25 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $61,080.30 |

|

|

| $61,080.30 |

Prices from Monday’s close or 6am for US | Cash available $21,574.95 |

|

|

| $21,574.95

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here