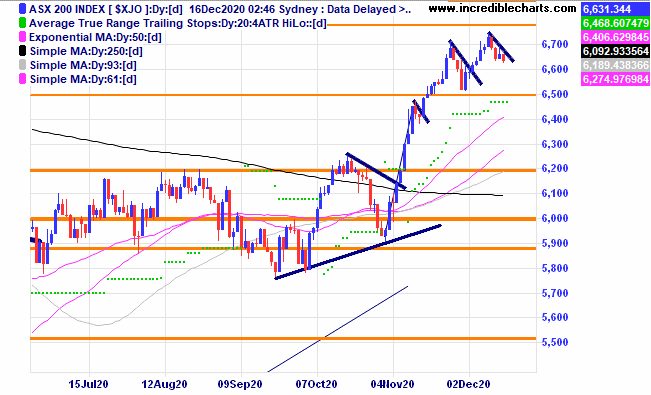

The local market is up today after a mid-December slide as punters ponder when or if the December Christmas rally will appear or if the strong run in November was it for now. Some interesting trade possibilities are forming for the long and short side.

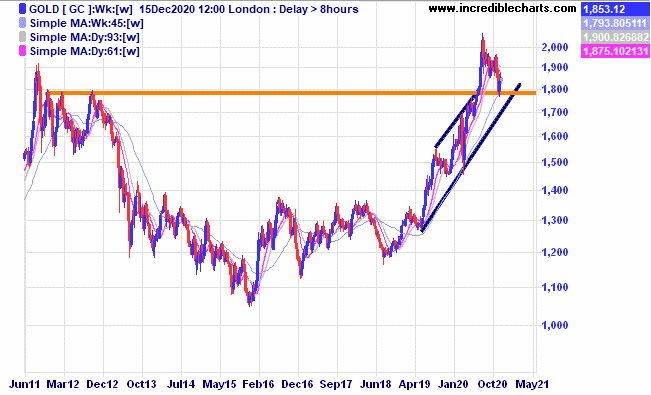

Gold looks to have bounced from a likely support level around previous tops just as seasonal strength is about to come into play.

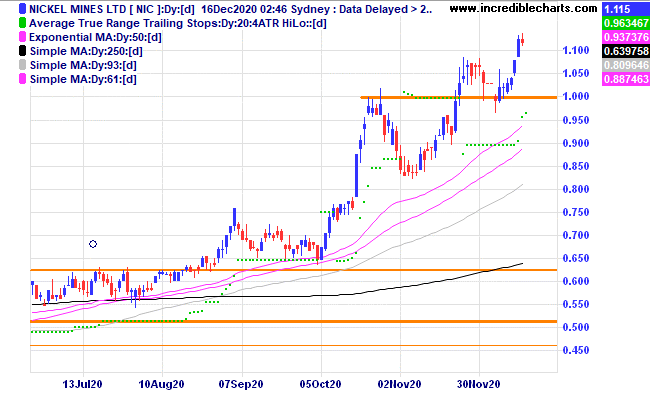

Nickel Mines continues to expand through acquisition and has again tapped the market for $364 million. We will sell down our holding by 500 shares to lower our exposure even though we still like the company and in all likelihood it will be one of the stocks we hold at the start of the 2021 trading year.

Goodman Group has again bounced from recent lows.

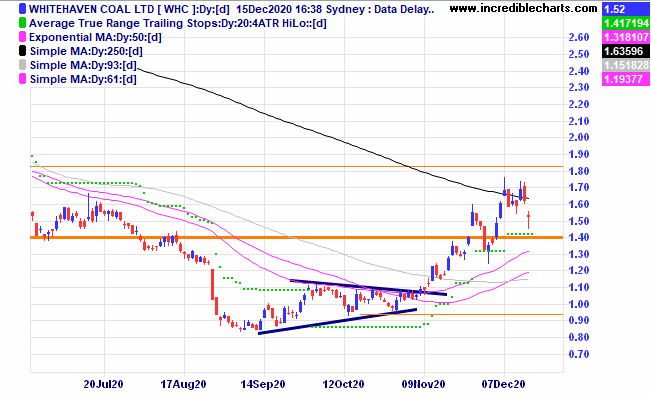

Whitehaven Coal looks to have made a higher low.

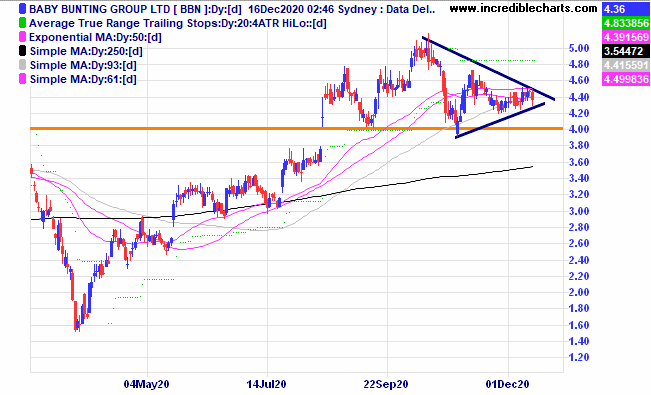

A recent article suggested that there was a mini baby-boom on the way next year. Baby Bunting is forming an interesting consolidation pattern, watching.

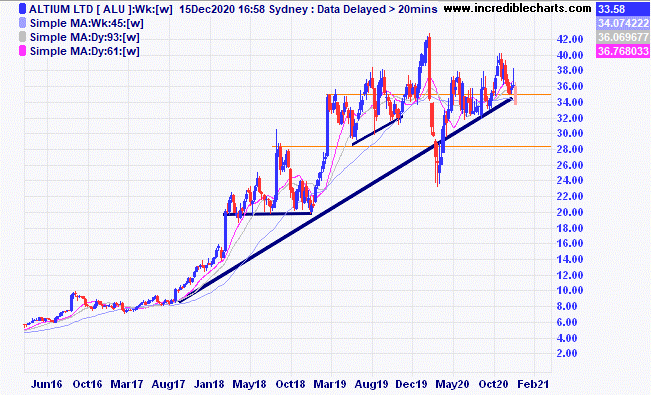

Altium is close to breaching the current uptrend line.

Platinum Asset Management has paused for the moment.

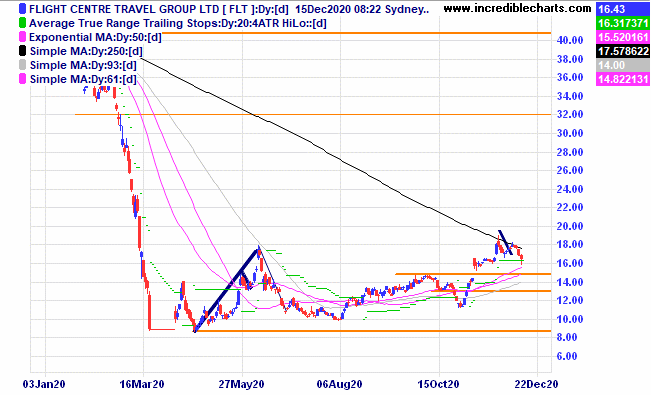

Could Flight Centre be posturing for another move higher as domestic travel opens up even though the company is valued more now than in February through an increased number of shares on issue.

Perseus was one of the stronger stocks today and looks to have found support around current levels.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $297.38 | $289.84 | Steady |

Bought Nickel Mines | Bought 4,500 at 52.5c | 29/4/2020 | $1.02 | $1.11 | -$270.0 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 88 | 83.5 | -$120.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 75 | 68 | -$240.00 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $30.62 | $30.62 | Steady |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.77 | $1.76 | -$25.00 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | $1.58 | $1.52 | -$180.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $28.05 | $27.44 | +$93.00 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.89 | $1.92 | +$40.00 |

Bought Goodman Group | Bought 150 at $19.10 | 14/10/2020 | $18.42 | $18.19 | -$39.00 |

Bought Webjet

| Bought 800 at $3.90 | 4/11/2020 | $5.65 | $5.03 | -$96.00 |

Bought Hearts and Minds | Bought 700 at $4.50 | 11/11/2020 | $4.69 | $4.55 | +$133.00 |

Bought Santos

| Bought 500 at $5.80 | 11/11/2020 | $6.44 | $6.39 | +$140.00 |

Bought Impedimed

| Bought 20,000 at 11.5c | 18/11/2020 | 14c | 13c | -$200.00

|

Bought Platinum Asset Management | Bought 800 at $3.47 | 19/11/2020 | $4.33 | $4.33 | Steady |

Bought Emeco

| Bought 2,500 at $1.05 | 25/11/2020 | $1.12 | $1.13 | +$25.00 |

Bought Perseus

| Bought 2,500 at $1.20 | 2/12/2020 | $1.20 | $1.14 | -$150.00 |

Bought Resolute

| Bought 2,000 at 79c | 2/12/2020 | 77c | 72.5c | -$90.00 |

Bought Cash Converters | Bought 10,000 at 22c | 9/12/2020 | 22c | 23.5 | +$150.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $82,655.25 |

|

|

| $82,655.25 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$829.00 |

|

|

| -$829.00 |

| Current total $81,826.25 |

|

|

| $81,826.25 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $62,339.40 |

|

|

| $62,339.40 |

Prices from Monday’s close or 6am for US | Cash available $19,486.85 |

|

|

| $19,486.85

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here