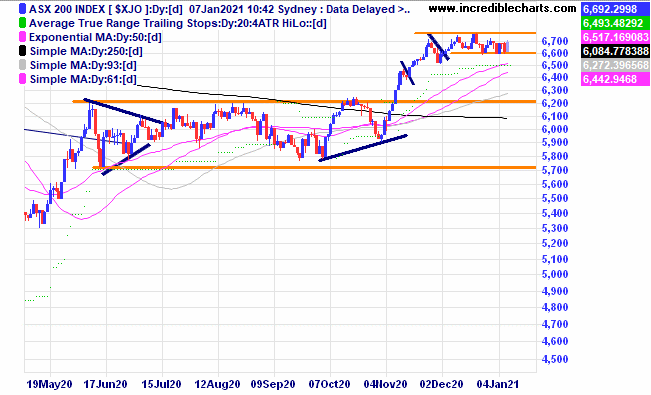

The local market is trading in a sideways range and any breakout could have some interesting trade possibilities.

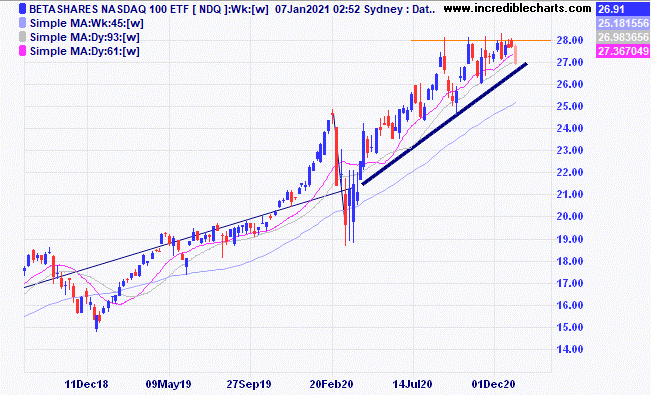

Volatile markets continue in the US as the Democrats look to win control of the Senate. The Nasdaq ETF chart below shows a bounce off support and a build-up to a possible breakthrough of the resistance zone.

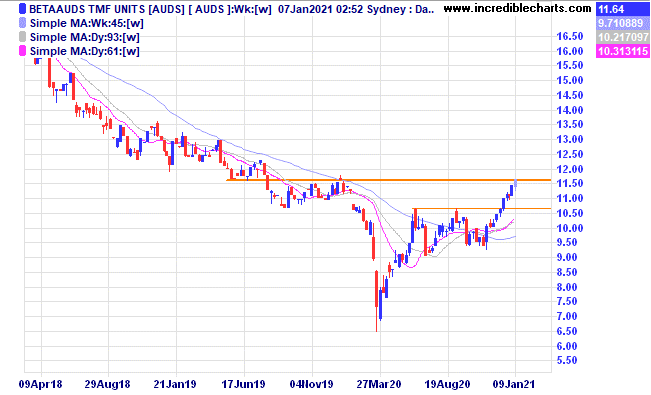

The Australian dollar continues to strengthen and we will buy some of the AUDS ETF today.

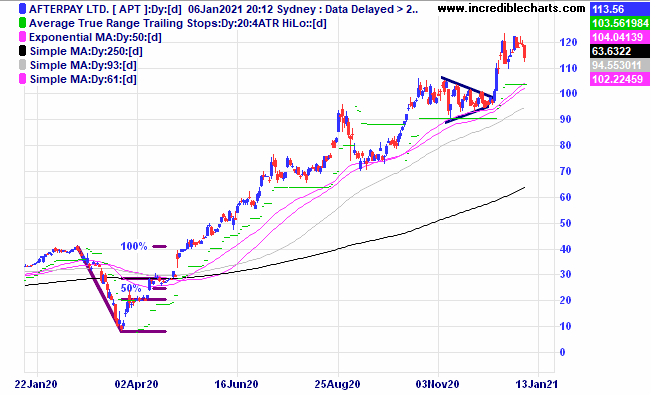

Afterpay looks to be stalled at current prices and may have formed a small potential double top pattern and could be in for a downturn.

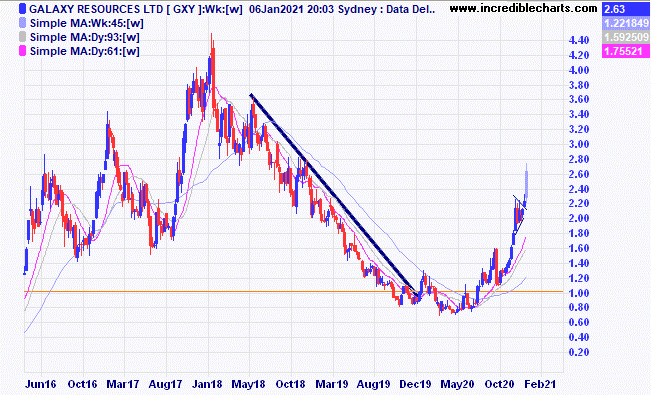

Lithium miners like Galaxy are continuing their run higher.

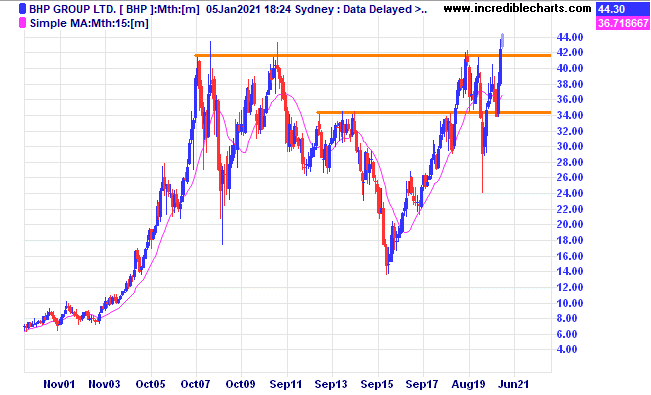

BHP looks to be stabilising at recent highs and with decent economic growth worldwide predicted this year it could well move higher.

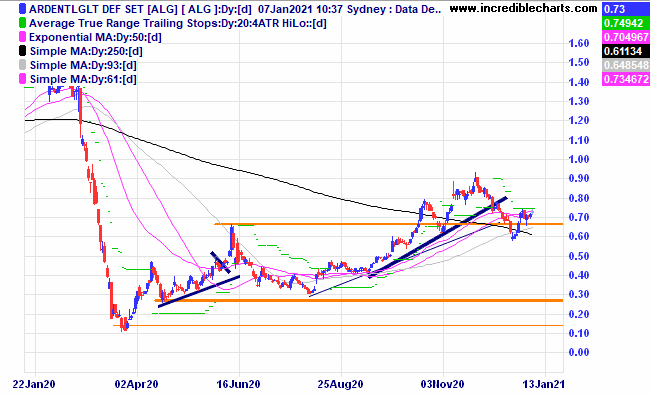

Ardent Leisure could bounce from recent support, watching.

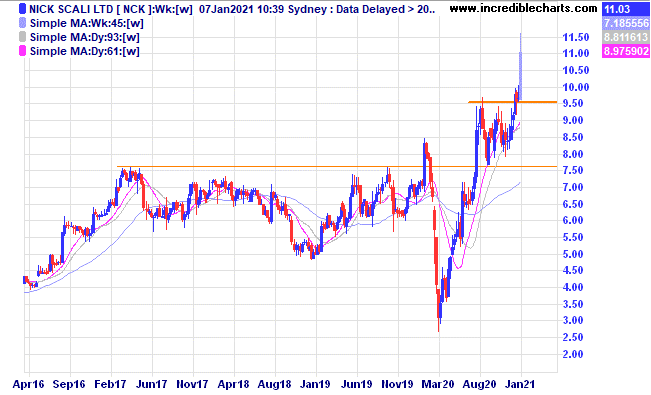

Nick Scali rose strongly on an earnings upgrade.

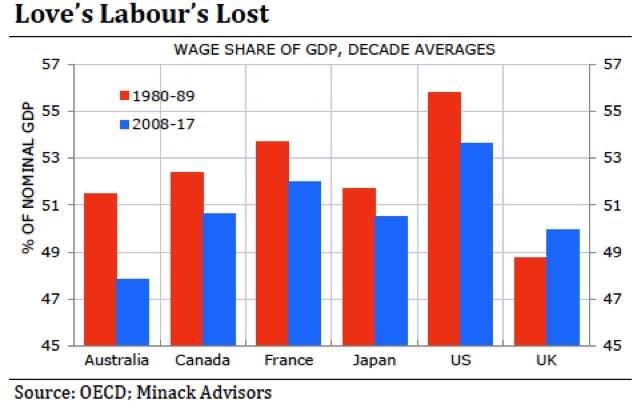

An interesting graph showing wages as a percentage of GDP.

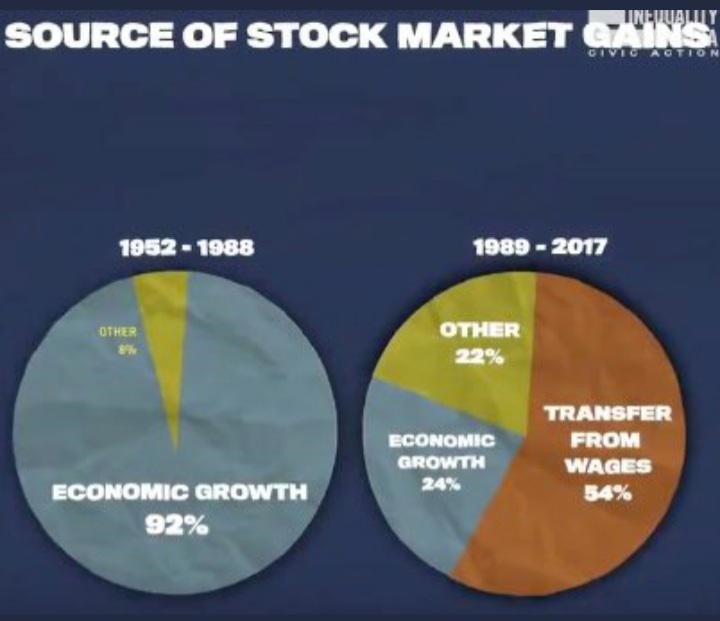

A picture of two pie charts showing how much the transfer of wages has propelled stock market gains over the past 20 plus years.

The top gainers over the past year for stocks in the All Ordinaries Index.

The Educational Portfolio had one of the best years yet in 2020 gaining more than 60 per cent. The winning trades only just outnumbered the losing trades and the top five winning trades produced nearly 50 per cent of the profits. The two best trades were the ASX 200 cfd short position taken back in February and buying Nickel Mines for 52.5 cents back in April.

End of year Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $288.67 | $288.30 | -$3.70 |

Bought Nickel Mines | Bought 4,000 at 52.5c | 29/4/2020 | $1.10 | $1.14 | +$160.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 60 | Sold 24/12 at 67c | +$180.00 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $33.71 | Sold 24/12 at $34.57 | +$56.00 |

Bought Ooh Media

| Bought 2,500 at $1.13 | 28/9/2020 | $1.68.5 | Sold 24/12 at $1.73 | +$82.50 |

Bought Whitehaven Coal | Bought 3,000 at $1.05 | 28/9/2020 | $1.61 | $1.67 | +$180.00 |

Bought NDQ ETF

| Bought 150 at $26.50 | 1/10/2020 | $27.81 | $28.07 | +$39.00 |

Bought Resimac

| Bought 2,000 at $1.45 | 2/10/2020 | $1.90 | $2.04 | +$280.00 |

Bought Goodman Group | Bought 150 at $19.10 | 14/10/2020 | $18.68 | Sold 24/12 at $19.04 | +$24.00 |

Bought Webjet

| Bought 800 at $3.90 | 4/11/2020 | $4.80 | $5.32 | +$416.00 |

Bought Hearts and Minds | Bought 700 at $4.50 | 11/11/2020 | $4.29 | $4.36 | +$49.00 |

Bought Santos

| Bought 500 at $5.80 | 11/11/2020 | $6.11 | Sold 24/12 at $6.37 | +$100.00 |

Bought Impedimed

| Bought 20,000 at 11.5c | 18/11/2020 | 12.5 | Sold 24/12 at 12c | -$130.00

|

Bought Platinum Asset Management | Bought 800 at $3.47 | 19/11/2020 | $4.20 | Sold 24/12 at $4.17 | -$54.00 |

Bought Emeco

| Bought 2,500 at $1.05 | 25/11/2020 | $1.10 | Sold 24/12 at $1.12 | +$20.00 |

Bought Perseus

| Bought 2,500 at $1.20 | 2/12/2020 | $1.25 | $1.26 | +$25.00 |

Bought Resolute

| Bought 2,000 at 79c | 2/12/2020 | 79.5c | 78.5c | -$20.00 |

Bought Cash Converters | Bought 10,000 at 22c | 9/12/2020 | 23c | Sold 24/12 at 23c | -$30.00 |

Bought Baby Bunting | Bought 500 at $4.60 | 17/12/2020 | $4.56 | $4.85 | +$145.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $81,400.05 |

|

|

| $81,400.05 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$1,518.80 |

|

|

| +$1,518.80 |

| Current total $82,918.85 |

|

|

| $82,918.85 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $35,206.50 |

|

|

| $35,206.50 |

Prices from 29/12 2020 our carryover date. | Cash available $47,412.35 |

|

|

| $47,712.35

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here