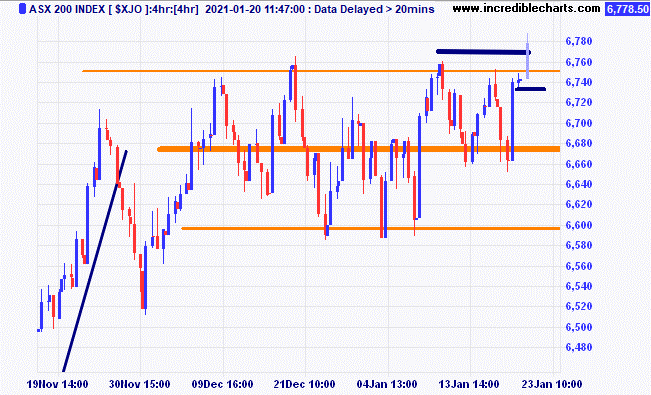

The local market has moved above obvious resistance and we bought six ASX 200 cfd’s and put our stop in place if things do not go the way we planned. Apparently, the move from election day to now has been the second biggest gain in history and with Janet Yellen looking to add further stimulus to the US economy it could push markets higher. Time will tell.

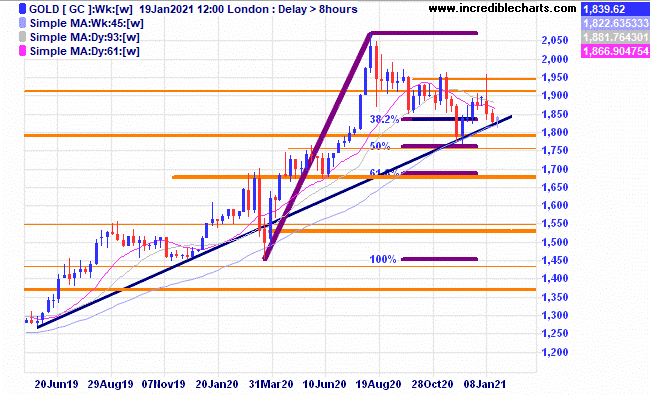

The price of gold is looking close to breaking down through current support levels. The educational portfolio’s two gold stocks are moving towards the stop loss points, watching.

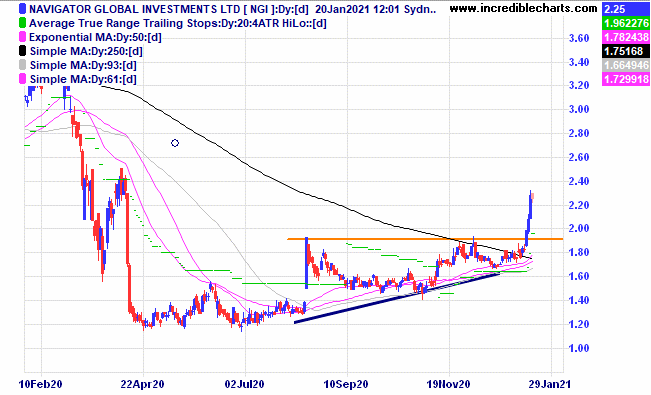

Navigator Global has broken through resistance and some kind of retracement could set up some trade possibilities. HUB24 has a similar chart.

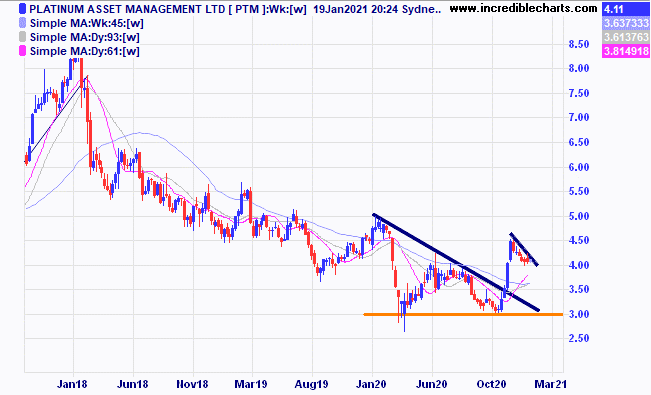

We bought some Platinum Asset Management when price looked to have broken upwards on the weekly chart and as yet has failed to follow through.

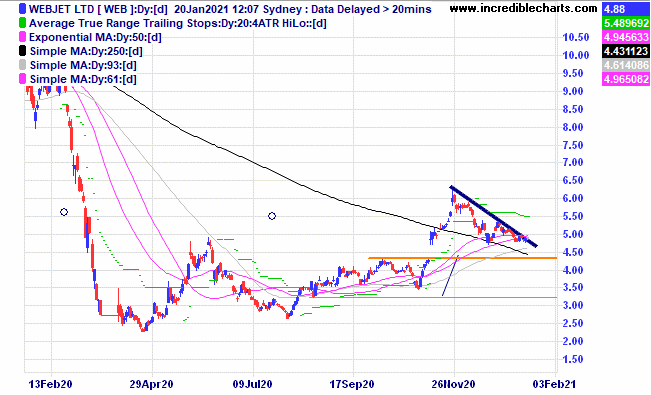

Carryover stock Webjet is getting close to our stop loss point.

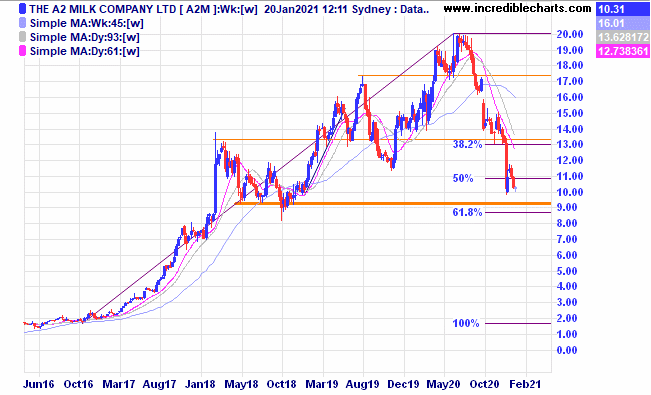

The A2 Milk Company has fallen quite a lot from the highs and is closing in on possible support levels.

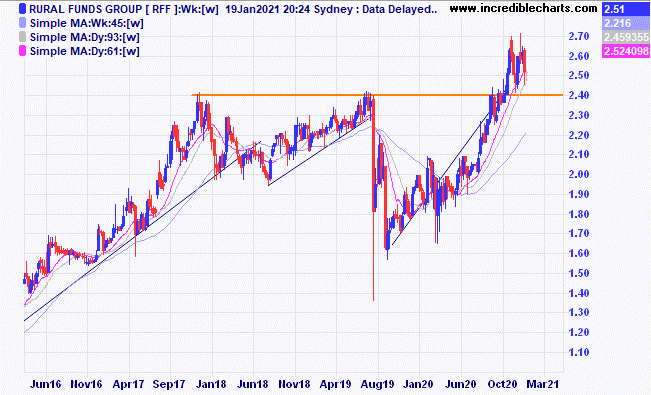

Rural Funds Group looks to be consolidating the recent move up and looks to be tradeable around these levels.

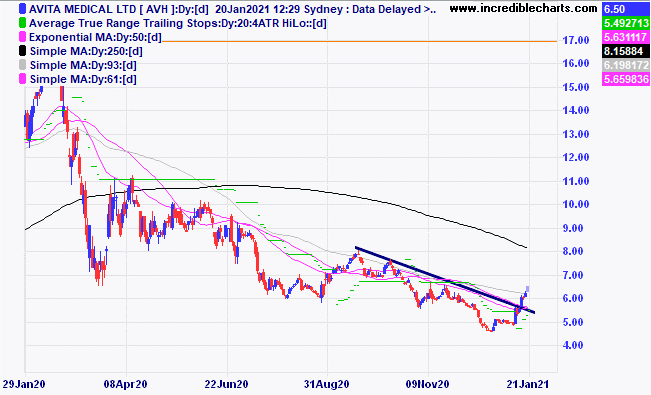

Avita Medical has moved up through the down trend line and presents some interesting trade possibilities.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL c/fwd 29/12/2020 at $288.30 | Bought 10 at $183.00 3/12/2018 | 3/12/2018 | $273.07 | $271.14 | -$19.30 |

Bought Nickel Mines c/fwd 29/12/2020 at $1.14 | Bought 2,500 at 52.5c | 29/4/2020 | $1.22 | $1.22 | Steady |

Bought Whitehaven Coal c/fwd 29/12/2020 at $1.67 | Bought 2,000 at $1.05 | 28/9/2020 | $1.60 | $1.76 | +$320.00 |

Bought NDQ ETF c/f $28.07 | Bought 100 at $26.50 | 1/10/2020 | $28.80 | $27.74 | -$106.00 |

Bought Resimac c/f $2.04 | Bought 1,500 at $1.45 | 2/10/2020 | $2.18 | $2.06 | -$180.00 |

Bought Webjet c/f $5.32 | Bought 600 at $3.90 | 4/11/2020 | $4.78 | $4.91 | +$78.00 |

Bought Hearts and Minds c/f $4.36 | Bought 600 at $4.50 | 11/11/2020 | $4.45 | $4.36 | -$54.00 |

Bought Perseus c/f $1.26 | Bought 2,200 at $1.20 | 2/12/2020 | $1.18 | $1.18 | Steady |

Bought Resolute c/f 78.5c | Bought 2,000 at 79c | 2/12/2020 | 79c | 69 | -$200.00 |

Bought Baby Bunting c/f $4.85 | Bought 500 at $4.60 | 17/12/2020 | $4.96 | $5.00 | +$20.00 |

Bought AUDS ETF

| Bought 250 at $11.75 | 7/1/2021 | $11.39 | $11.43 | +$10.00 |

Bought Harvey Norman | Bought 500 at $5.10 | 13/1/2021 | $5.10 | $5.51 | +$205.00 |

Bought Platinum Asset Management | Bought 600 at $4.20 | 31/1/2021 | $4.20 | $4.11 | -$54.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $49,719.70 |

|

|

| $49,719.70 |

| Gains/losses week +$19.70 |

|

|

| +$19.70 |

| Current total $49,739.40 |

|

|

| $49,739.40 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $36,212.50 |

|

|

| $36,212.50 |

Prices from Tuesday night or 6am for US positions. | Cash available $13,526.90 |

|

|

| $13,526.90

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here