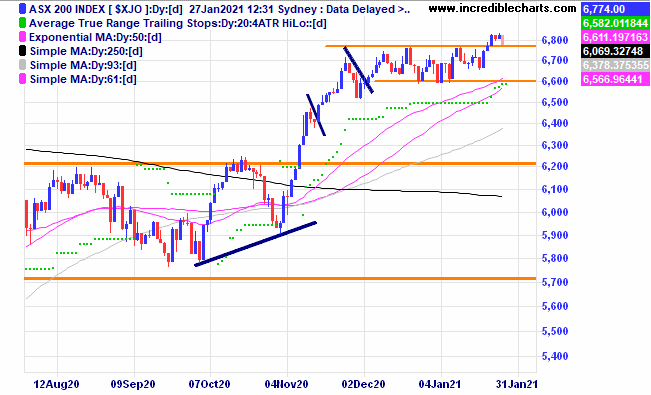

After the local market nudged up out of the sideways congestion the market is close to moving back into that zone. With February being a historically poor performing month for stocks we will be keeping an eye open for any hedging possibilities.

This graphic from Chart of the Day shows the average monthly gains and losses for one of the indexes in the United States from 1950.

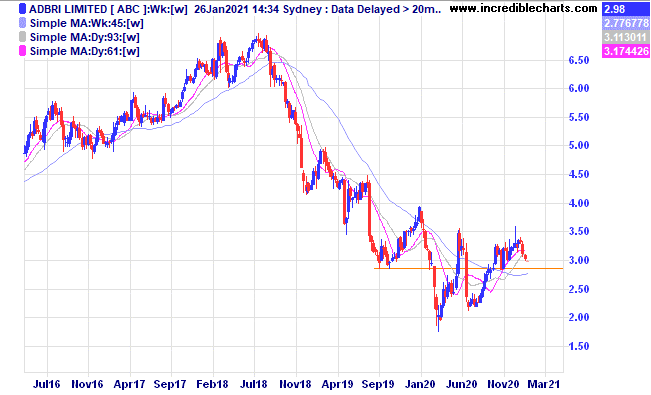

The Adbri price is at a possible inflection point. Watching.

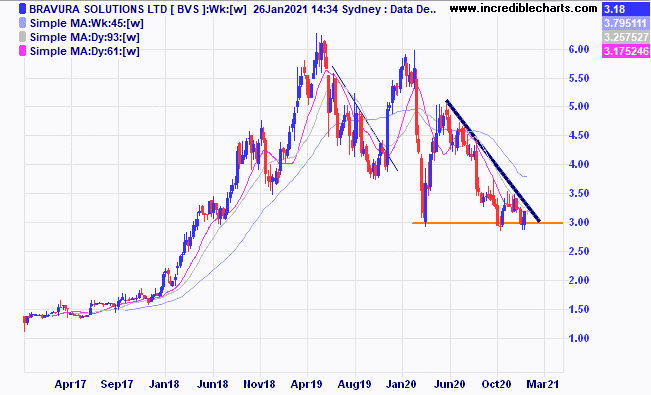

Bravura looks to be at a make or break point. A move above the trend line could provide a possible trade opportunity.

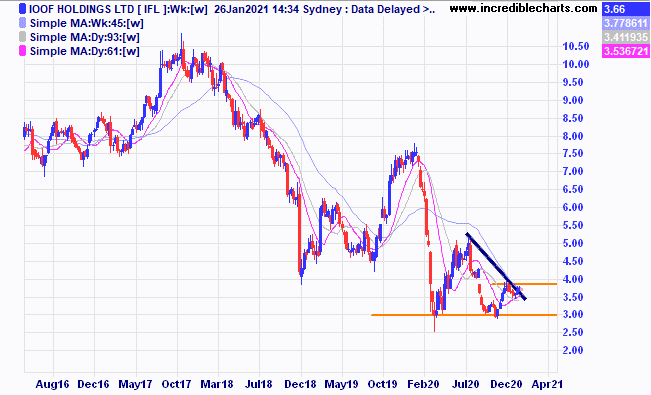

IOOF is also at an interesting point with a move higher giving some trade possibilities.

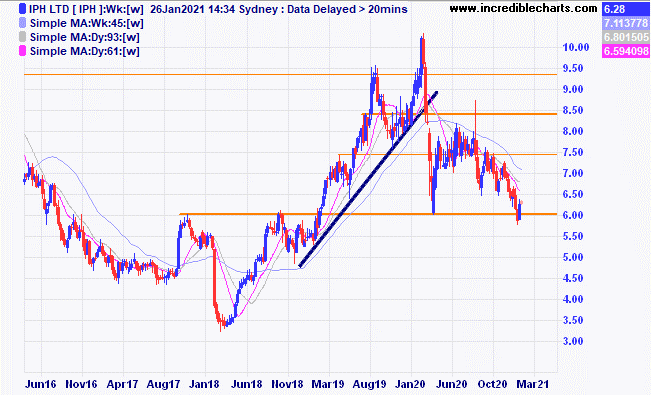

Can the support level hold for IPH this time around?

Nufarm has just moved up through the down trend line.

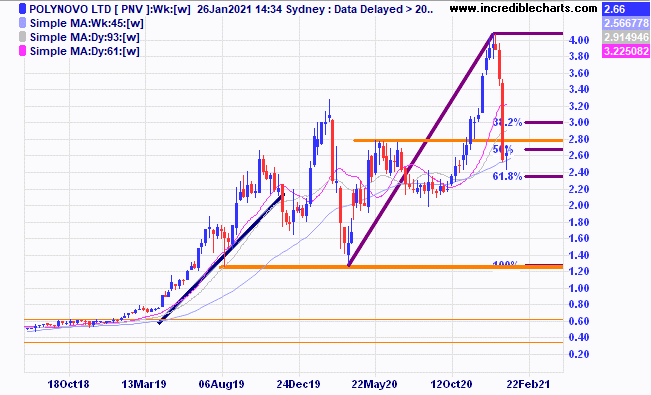

The price of Polynovo took a belting after some delays on a possible FDA approval and looks to have found some support at an important Fibonacci retracement level.

Smartgroup looks poised to break through the resistance zone.

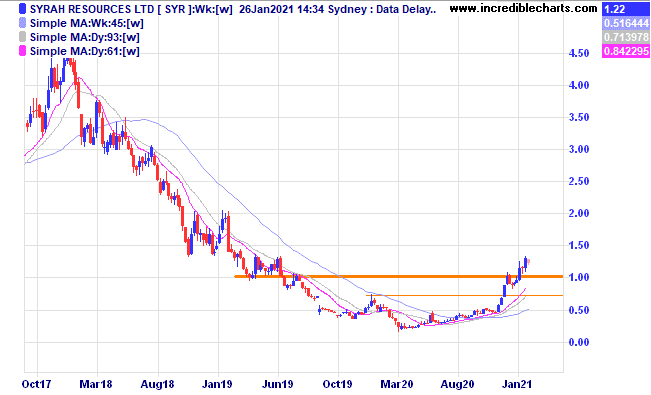

Syrah Resources looks to have formed a large rounding bottom pattern on the weekly chart.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL c/fwd 29/12/2020 at $288.30 | Bought 10 at $183.00 3/12/2018 | 3/12/2018 | $271.14 | $275.54 | +$44.00 |

Bought Nickel Mines c/fwd 29/12/2020 at $1.14 | Bought 2,500 at 52.5c | 29/4/2020 | $1.22 | $1.40 | +$450.00 |

Bought Whitehaven Coal c/fwd 29/12/2020 at $1.67 | Bought 2,000 at $1.05 | 28/9/2020 | $1.76 | $1.58 | -$360.00 |

Bought NDQ ETF c/f $28.07 | Bought 100 at $26.50 | 1/10/2020 | $27.74 | $28.80 | +$106.00 |

Bought Resimac c/f $2.04 | Bought 1,500 at $1.45 | 2/10/2020 | $2.06 | $2.35 | +$435.00 |

Bought Webjet c/f $5.32 | Bought 600 at $3.90 | 4/11/2020 | $4.91 | $4.77 | -$84.00 |

Bought Hearts and Minds c/f $4.36 | Bought 600 at $4.50 | 11/11/2020 | $4.36 | $4.55 | +$114.00 |

Bought Perseus c/f $1.26 | Bought 2,200 at $1.20 | 2/12/2020 | $1.18 | $1.27 | +$198.00 |

Bought Resolute c/f 78.5c | Bought 2,000 at 79c | 2/12/2020 | 69c | 70 | +$20.00 |

Bought Baby Bunting c/f $4.85 | Bought 500 at $4.60 | 17/12/2020 | $5.00 | $5.32 | +$160.00 |

Bought AUDS ETF

| Bought 250 at $11.75 | 7/1/2021 | $11.43 | $11.50 | +$17.50 |

Bought Harvey Norman | Bought 500 at $5.10 | 13/1/2021 | $5.51 | $5.29 | -$110.00 |

Bought Platinum Asset Management | Bought 600 at $4.20 | 31/1/2021 | $4.11 | $4.06 | -$30.00 |

Bought 6 ASX 200 cfd’s | Bought 6 at 6,765 | 20/1/2021 | 6,765 | 6,824 | +$324.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $49,739.40 |

|

|

| $49,739.40 |

| Gains/losses week +$1,284.50 |

|

|

| +$1,284.50 |

| Current total $51,023.90 |

|

|

| $51,023.90 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $37,176.50 |

|

|

| $37,176.50 |

Prices from Tuesday night or 6am for US positions. | Cash available $13,847.40 |

|

|

| $13,847.40

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here