The local market has been on a bit of volatile ride within a larger sideways pattern over the past week. Although our original trade did not pan out we managed to eke out a small advantage from the spike low on Monday and exited that position near the range highs.

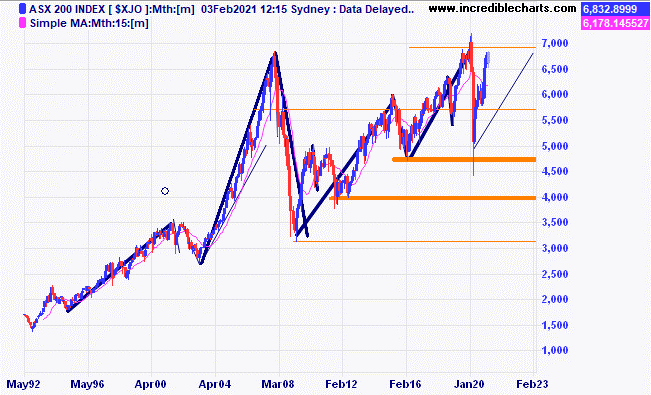

Over time markets have a tendency to move higher for longer and a range equal in time to the smallest range up over the past 30 years would have the current rally move up till around early 2023 and equal to the longest range would give early 2025.

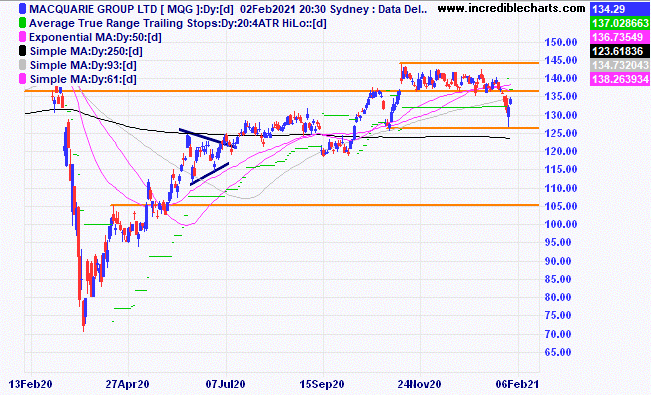

Macquarie Group had a nice little bounce off previous support.

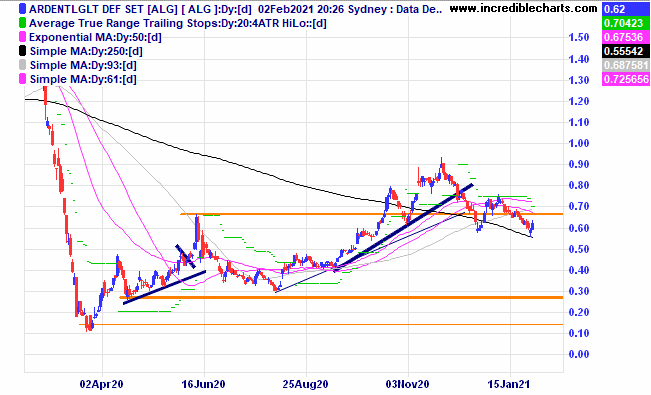

With Queensland borders open again it could be good for Ardent Leisure which has potentially made a double bottom low.

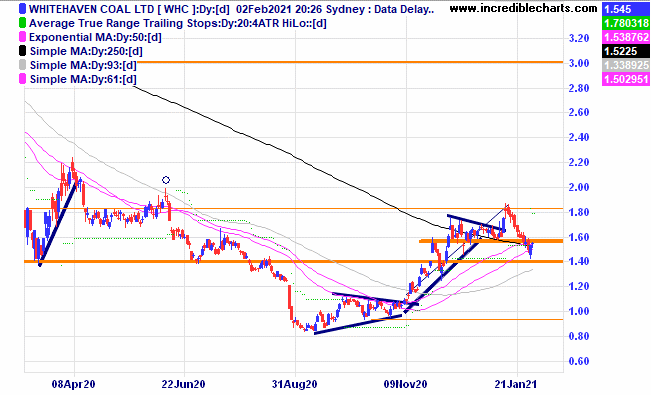

We were stopped out of Whitehaven Coal for now and should turn around some time down the track we could be a buyer.

After a strong run up Nickel Mines made a reversal type pattern and we sold down our holding to take some profits. Interestingly the company has made a list of the best buys for 2021 a couple of times.

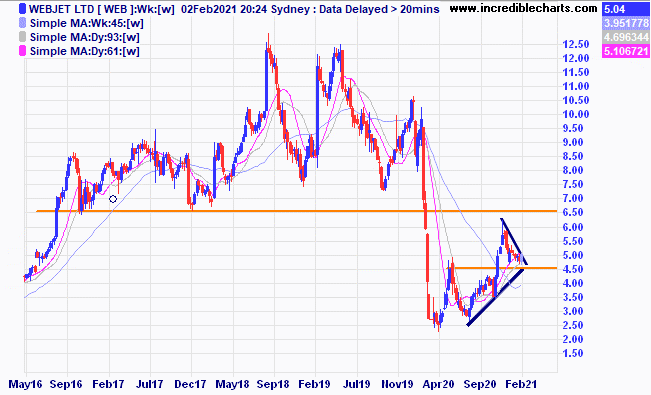

Webjet is forming an interesting consolidation pattern.

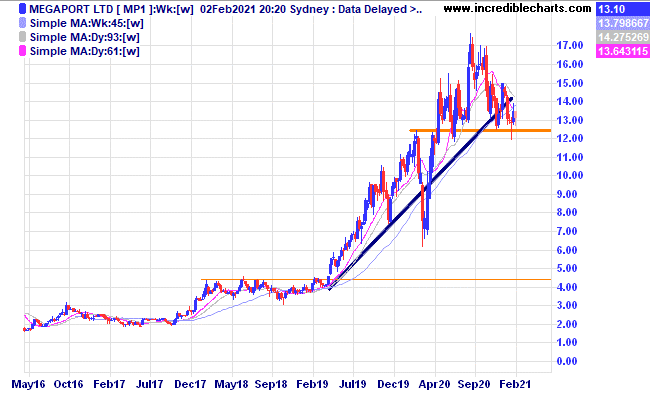

Megaport looks to be staying above the support zone.

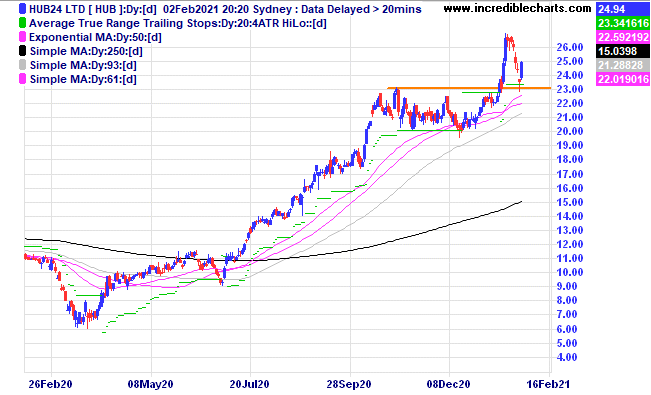

Hub24 has made a nice move down to support.

The dated chart below shows how insignificant the 1987 crash was over the longer term bullish run and we may have some way to go for this longer term move up.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL c/fwd 29/12/2020 at $288.30 | Bought 10 at $183.00 3/12/2018 | 3/12/2018 | $275.54 | $274.32 | -$12.20 |

Bought Nickel Mines c/fwd 29/12/2020 at $1.14 | Bought 2,500 at 52.5c | 29/4/2020 | $1.40 | Sold 600 28/1 at $1.25 1,900 left $1.31 | -$120.00

-$171.00 |

Bought Whitehaven Coal c/fwd 29/12/2020 at $1.67 | Bought 2,000 at $1.05 | 28/9/2020 | $1.58 | Stopped 29/1 at $1.50 | -$190.00 |

Bought NDQ ETF c/f $28.07 | Bought 100 at $26.50 | 1/10/2020 | $28.80 | $28.94 | +$14.00 |

Bought Resimac c/f $2.04 | Bought 1,500 at $1.45 | 2/10/2020 | $2.35 | $2.30 | -$75.00 |

Bought Webjet c/f $5.32 | Bought 600 at $3.90 | 4/11/2020 | $4.77 | $5.04 | +$162.00 |

Bought Hearts and Minds c/f $4.36 | Bought 600 at $4.50 | 11/11/2020 | $4.55 | $4.33 | -$132.00 |

Bought Perseus c/f $1.26 | Bought 2,200 at $1.20 | 2/12/2020 | $1.27 | $1.22 | +$110.00 |

Bought Resolute c/f 78.5c | Bought 2,000 at 79c | 2/12/2020 | 70c | 70 | Steady |

Bought Baby Bunting c/f $4.85 | Bought 500 at $4.60 | 17/12/2020 | $5.32 | $5.35 | +$15.00 |

Bought AUDS ETF

| Bought 250 at $11.75 | 7/1/2021 | $11.50 | $11.23 | -$67.50 |

Bought Harvey Norman | Bought 500 at $5.10 | 13/1/2021 | $5.29 | $5.36 | +$35.00 |

Bought Platinum Asset Management | Bought 600 at $4.20 | 31/1/2021 | $4.06 | $4.34 | +$168.00 |

Bought 6 ASX 200 cfd’s | Bought 6 at 6,765 | 20/1/2021 | 6,824 | Sold 28/1 at 6,750 | -$494.00 |

Sold 6 ASX 200 cfd’s

| Sold 6 at 6,650 | 29/1/2021 | 6,650 | Bought 1/2 at 6,600 | +$270.00 |

Bought 4 ASX 200 cfd’s

| Bought 4 at 6,600 | 1/2/2021 | 6,600 | Closed 2/1 at end of day at 6,762 | +$618.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $51,023.90 |

|

|

| $51,023.90 |

| Gains/losses week +$130.30 |

|

|

| +$130.30 |

| Current total $51,154.20 |

|

|

| $51,154.20 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $32,762.50 |

|

|

| $32,762.50 |

Prices from Tuesday night or 6am for US positions. | Cash available $18,391.70 |

|

|

| $18,391.70

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here