The local market is trading at the higher end of the current range and could remain in a sideways pattern as the uncertainty of earnings season unfolds. There is also a divergence with price moving higher as relative strength deteriorates which can indicate a possible fall is not far away.

The price of gold has been stuck in a sideways range for some time. Three separate months with spike highs suggests further deterioration is possible.

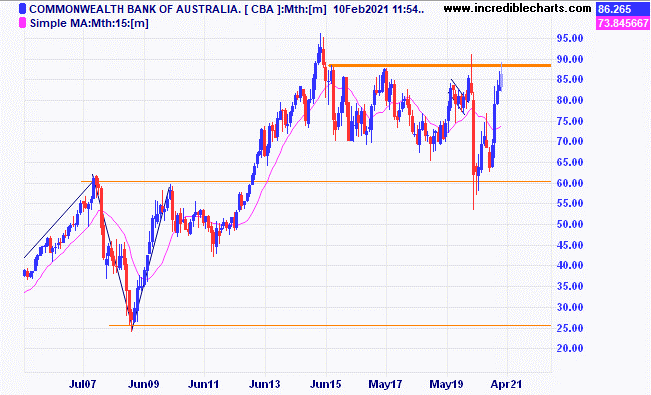

It is interesting to note that the Commonwealth Bank has previously struggled to stay above the $89 level for any length of time.

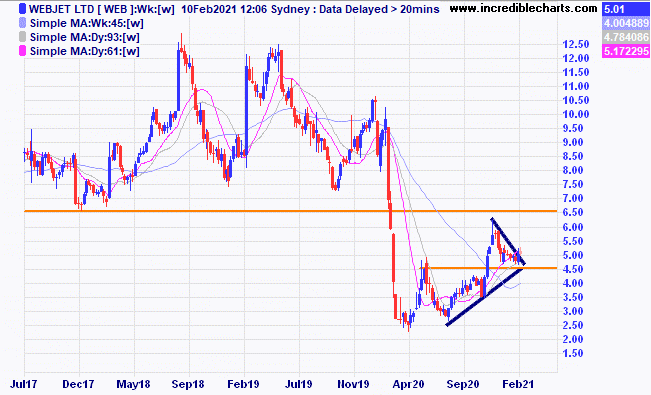

Travel stocks Webjet and Flight Centre along with Ardent Leisure have similar congestion patterns which could break to the upside.

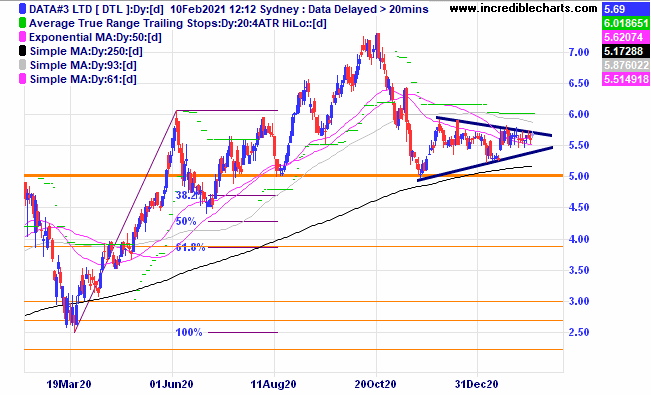

Data#3 is in a nice consolidation pattern which could go any way from here. We bought a parcel for the educational portfolio in anticipation of a move higher.

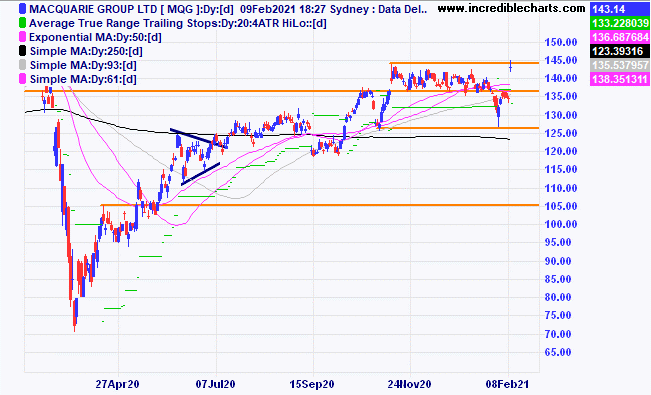

Macquarie Bank moved up on a good earnings report.

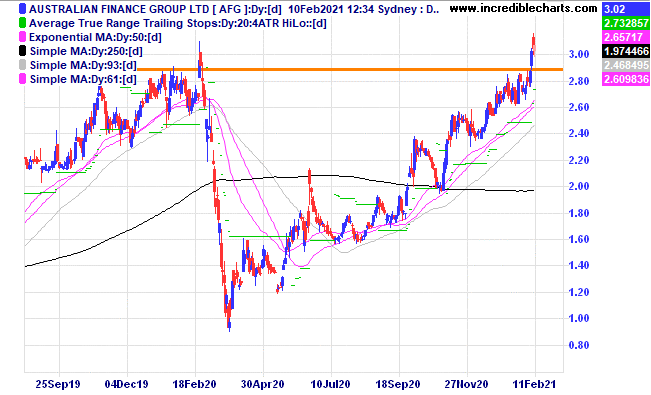

Australian Finance Group is back to pre-Covid levels as analysts ponder the continuation of the current trend.

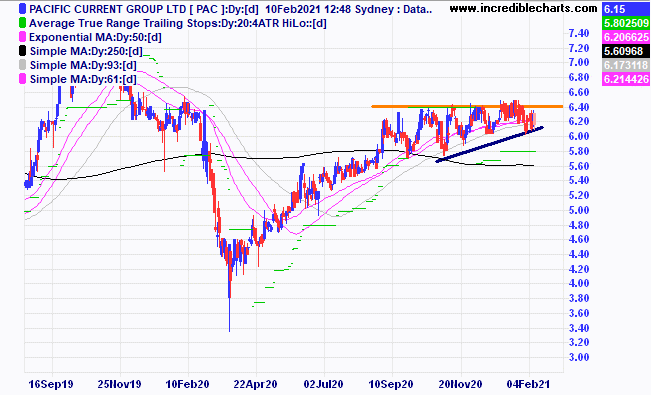

Pacific Current is forming an interesting consolidation pattern.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL c/fwd 29/12/2020 at $288.30 | Bought 10 at $183.00 3/12/2018 | 3/12/2018 | $274.32 | $273.57 | +$7.50 |

Bought Nickel Mines c/fwd 29/12/2020 at $1.14 | Bought 1,900 at 52.5c | 29/4/2020 | $1.31 | $1.20 | -$209.00

|

Bought NDQ ETF c/f $28.07 | Bought 100 at $26.50 | 1/10/2020 | $28.94 | $29.31 | +$37.00 |

Bought Resimac c/f $2.04 | Bought 1,500 at $1.45 | 2/10/2020 | $2.30 | $2.32 | +$30.00 |

Bought Webjet c/f $5.32 | Bought 600 at $3.90 | 4/11/2020 | $5.04 | $5.04 | Steady |

Bought Hearts and Minds c/f $4.36 | Bought 600 at $4.50 | 11/11/2020 | $4.33 | $4.65 | +$192.00 |

Bought Perseus c/f $1.26 | Bought 2,200 at $1.20 | 2/12/2020 | $1.22 | $1.22 | Steady |

Bought Resolute c/f 78.5c | Bought 2,000 at 79c | 2/12/2020 | 70c | 68.5c | -$30.00 |

Bought Baby Bunting c/f $4.85 | Bought 500 at $4.60 | 17/12/2020 | $5.35 | $5.71 | +$180.00 |

Bought AUDS ETF

| Bought 250 at $11.75 | 7/1/2021 | $11.23 | $11.45 | +$55.00 |

Bought Harvey Norman | Bought 500 at $5.10 | 13/1/2021 | $5.36 | $5.62 | +$130.00 |

Bought Platinum Asset Management | Bought 600 at $4.20 | 31/1/2021 | $4.34 | $4.29 | -$30.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $51,154.20 |

|

|

| $51,154.20 |

| Gains/losses week +$362.50 |

|

|

| +$362.50 |

| Current total $51,516.70 |

|

|

| $51,516.70 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $33,074.50 |

|

|

| $33,074.50 |

Prices from Tuesday night or 6am for US positions. | Cash available $18,442.20 |

|

|

| $18,442.20

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here