By Ben Hennessy (HENNESSY REAL ESTATE)

With census week upon us, it’s timely to reflect back and see what has changed in our markets, since history is a good predictor of the future.

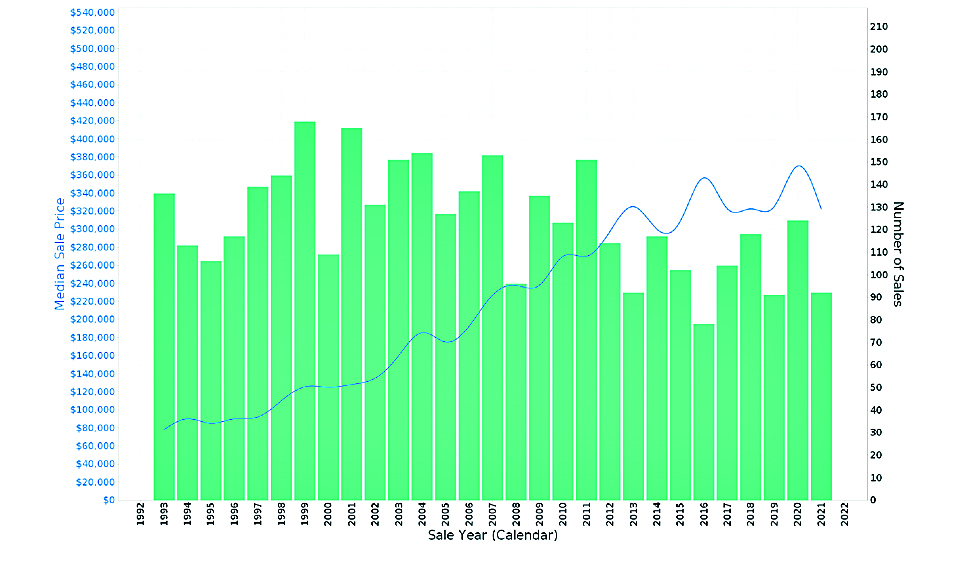

The Narrabri residential housing market has been a consistently strong performer over the past two decades.

If we wind the clock back to the start of the Millenium, the median house price in Narrabri in 2000 was just $125,000!

Currently the median house price is $370,000.

This equates to a whopping 196 per cent capital growth in the market over the last 21 years! Oh to know what we now know back then!

So does that mean we have missed the market? Or should we be waiting for the next fall in the market so we can ensure we bag a bargain? What if we pay too much?

Despite the positive sentiment in our markets, these are all still understandable doubts that can creep into our minds.

I remember hearing some real estate advice at the start of my career that has stuck with me even now almost two decades later and is a question that I am often asked – ‘When is the best time to buy real estate?’ The answer, ‘A decade ago.’

Yes small comfort for some of today’s buyers who were only 10 at the time!

However, when is the second best time to buy real estate?

The answer – right now.

While that may seem like a glib (or somewhat self-serving comment) the historical facts support the truth of these comments.

Time and longevity in the market is one of the key factors to growing the value of your property.

The property you buy today, given enough time, will inevitably grow into a more valuable asset in the future.

Likewise, if you are buying a family home – more often than not the home you want to buy today will cost more to buy in a years’ time.

So while timing your entry into the market is an important factor, procrastinating about the ideal time to buy can be equally damaging

Another of the common mistakes in real estate investing is to enter and exit the market in too short a period of time.

Of course there will always be circumstances where this decision is forced upon us by outside factors, be it changing work, family or financial situations.

However, if you can, it is best to avoid entering and exiting markets in a short period of time unless you have substantially improved the value of the property you are selling.

How best to renovate for profit?

A great question and one we will cover in the coming weeks.

So if we believe that history is a good indicator of the future, then can we expect 300 per cent growth over the next 20 years?

Well as I consult with my crystal ball here, ponder your answer to this question? What are your real estate goals?

Is it to use real estate as the proven foundation to wealth that it has been for decades for many successful investors before you?

It is worth noting that almost a quarter of the richest 200 in Australia built their fortunes through the property sector.

While joining the list of the Fortune 500 may not be on most of our radars, it is worth noting how real estate occupies an undeniable and significant part in our economic pursuits.

But if our real estate goals are somewhat more closer to home, seeking more to provide a place of shelter, comfort and security for ourselves and our loved ones, than market growth and capital gains takes a distant second place to simply finding and purchasing the right home for you and your family.

Whatever your goals, real estate will always be an intrinsic part of our social and economic DNA, providing a place we create our memories with family, as well as an investment vehicle that we love for its safe and reliable performance over the decades.

See more like this:

To order photos from this page click here