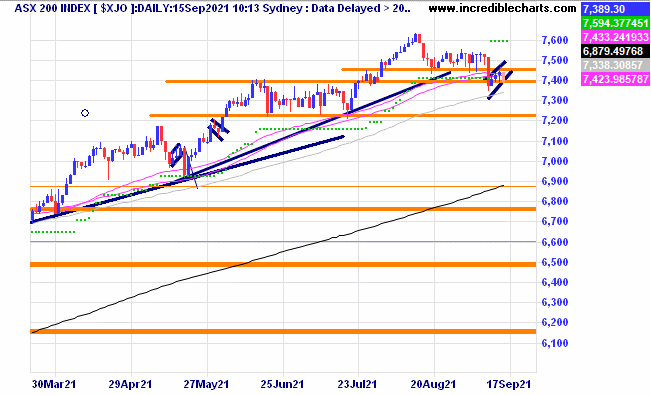

The local market looks to be making a bearish flag type pattern and we sold short 6 ASX 200 cfd’s this morning in the expectation the market will trend lower over the next few days.

On a weekly time frame the market has moved below the up- trend line and it could be hypothesised that the market has a possibility of a retracement all the way down to the breakout levels around the 7,200 mark. Time will tell.

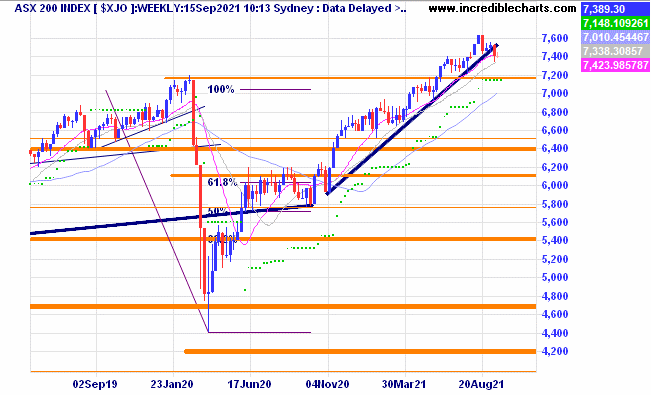

In anticipation of a late September down turn we bought a position in the BBOZ EFT which is a bearish fund where prices move up when the market goes down. We bought when price moved above the downtrend line on above average volatility.

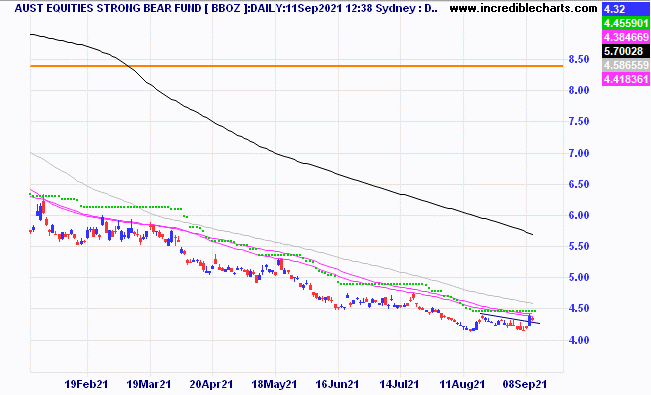

A table showing the traditional weakness seen in the US stock market in the August/September period.

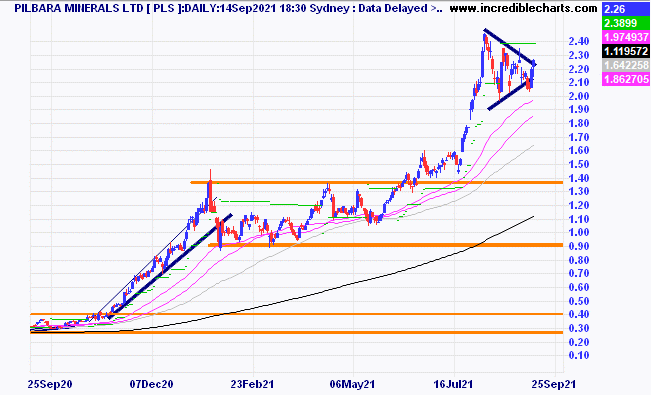

Pilbara Minerals formed a bullish type candle yesterday falling just short of a breakout and we bought a parcel just on the close in anticipation of a further move up.

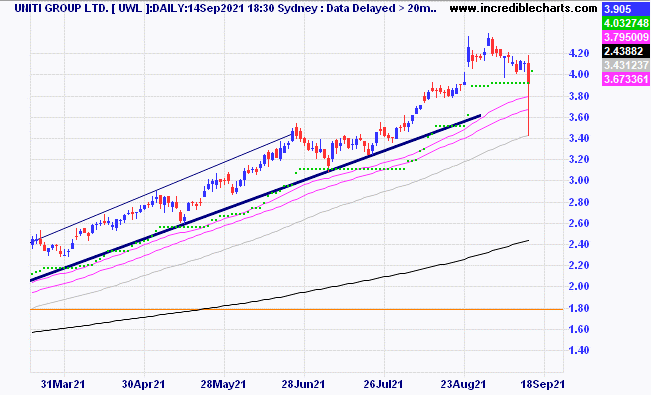

The chart of Uniti Group shows the price volatility from yesterday which triggered our exit from this position which had so far been one of the big profit makers of the educational portfolio.

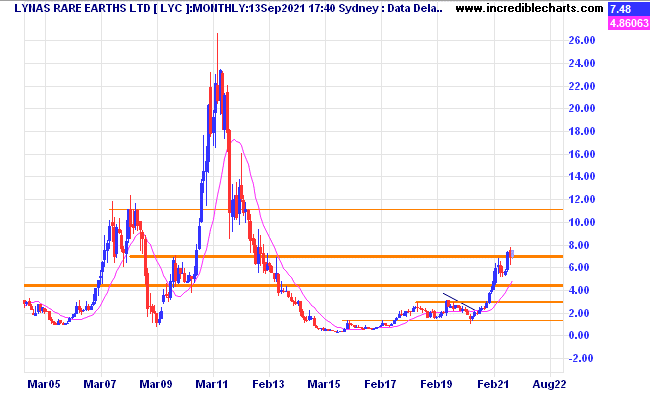

The monthly chart for Lynas shows if resistance around current levels is overcome the next target would be close to the $11 mark.

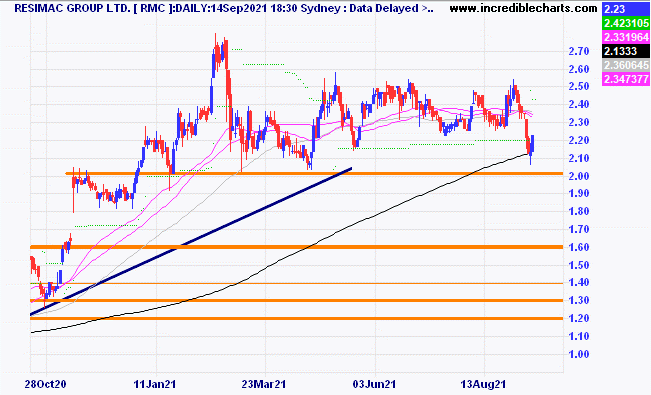

Resimac shows a nice spike low near support.

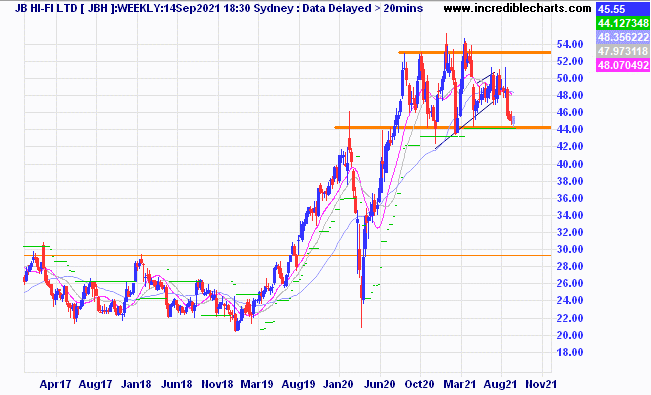

JB Hi-Fi is trading at the bottom of a large sideways pattern.

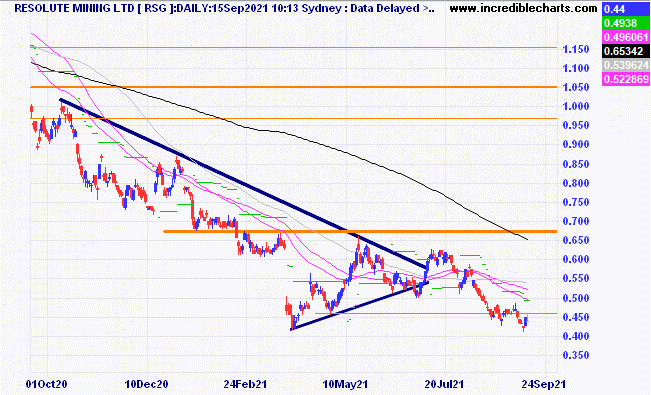

Has Resolute finally made a bottom?

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL c/fwd 29/12/2020 at $288.30 | Bought 10 at $183.00 3/12/2018 | 3/12/2018 | $310.25 | $300.67 | -$95.80 |

Bought NDQ ETF c/f $28.07 | Bought 100 at $26.50 | 1/10/2020 | $33.71 | $33.59 | -$12.00 |

Bought Resimac c/f $2.04 | Bought 1,500 at $1.45 | 2/10/2020 | $2.35 | $2.23 | -$180.00 |

Bought Uniti Group

| Bought 800 at $2.15 | 24/2/2021 | $4.16 | Stopped 14/9 at $3.90 | -$238.00 |

Bought Webjet

| Bought 500 at $5.20 | 2/6/2021 | $6.10 | $6.04 | -$30.00 |

Bought Whitehaven Coal | Bought 1,500 at $1.90 | 9/6/2021 | $2.98 | $3.09 | +$165.00 |

Bought Super Retail

| Bought 200 at $13.19 | 16/62021 | $12.51 | Sold 8/9 at $12.20 | -$92.00 |

Bought Resolute Mining | Bought 2,500 at 58c | 7/7/2021 | 47 | 45 | -$50.00 |

Bought Audinate

| Bought 300 at $8.90 | 9/7/2021 | $10.38 | $10.32 | -$18.00 |

Bought Life 360

| Bought 300 at $8.25 | 11/8/2021 | $9.56 | $9.20 | -$108.00 |

Bought Atomos

| Bought 2,000 at $1.32 | 19/8/2021 | $1.65 | $1.56 | -$180.00 |

Bought Telix

| Bought 400 at $6.60 | 19/8/2021 | $6.67 | $6.87 | +$80.00 |

Bought Redbubble

| Bought 700 at $3.70 | 19/8/2021 | $4.37 | $4.02 | -$245.00 |

Bought Flight Centre

| Bought 150 at $15.90 | 25/8/2021 | $18.59 | $18.34 | -$37.50 |

Bought Hazer Group

| Bought 2,500 at $1.05 | 25/8/2021 | $1.11 | $1.01 | -$250.00 |

Bought Ioneer

| Bought 5,000 at 56c | 2/9/2021 | 65c | 72 | +$350.00 |

Bought BBOZ ETF

| Bought 1,000 at $4.30 | 9/9/2021 | $4.30 | $4.27 | -$30.00 |

Bought Pilbara Minerals | Bought 1,000 at $2.26 | 14/9/2021 | $2.26 | $2.26 | Steady |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $61,583.10 |

|

|

| $61,583.10 |

| Gains/losses week -$971.30 |

|

|

| -$971.30 |

| Current total $60,611.80 |

|

|

| $60,611.80 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $48,889.70 |

|

|

| $48,889.70 |

Prices from Wednesday night or 6am for US positions. | Cash available $12,919.90 |

|

|

| $12,919.90

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here