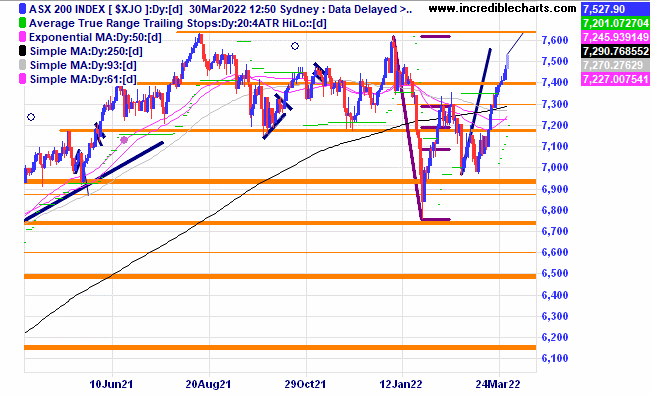

The local market is now marching up toward the previous high as the price of oil slides in the hope of peace talks over the Ukraine situation coming to some fruition.

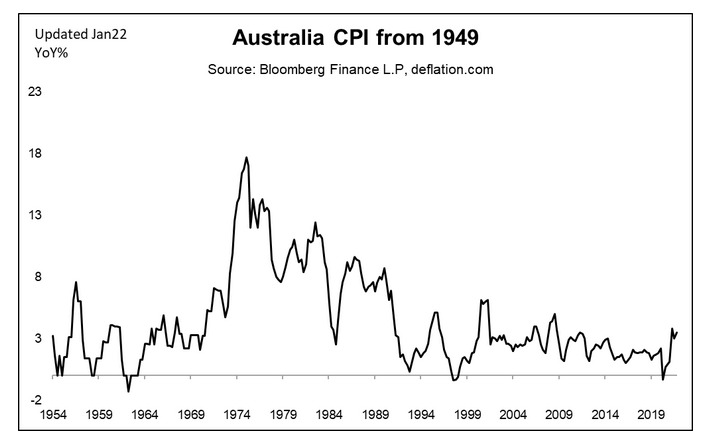

A nice chart of Australia’s CPI over the past 70 odd years.

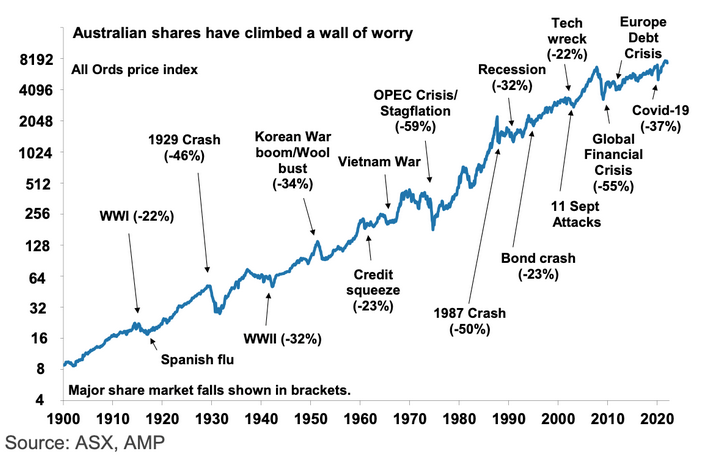

Shares climb a wall of worry over the very long term.

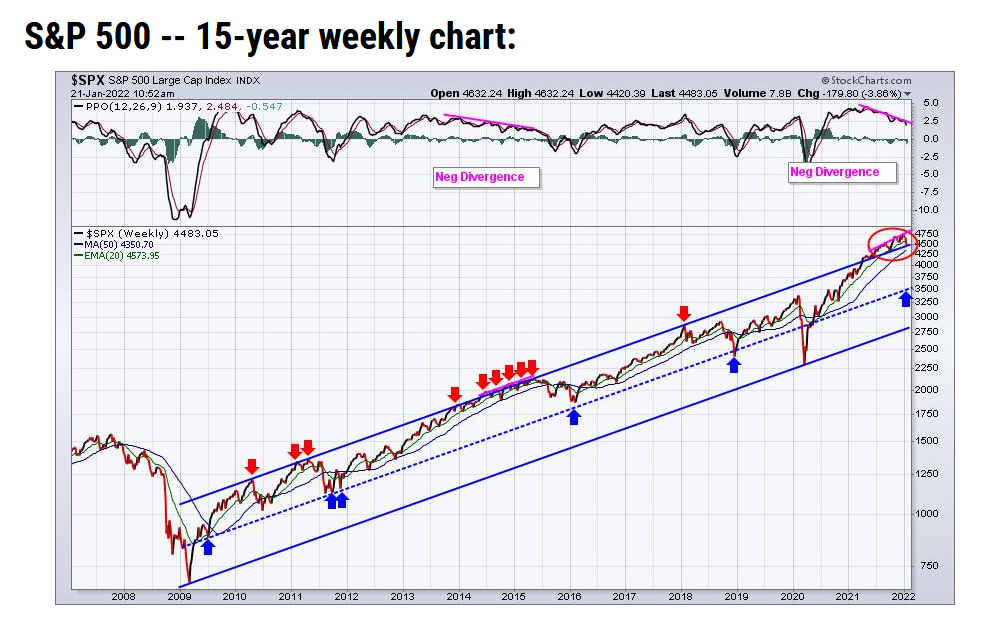

A chart showing how far from the mid-line of the upwards trending channel the US market was and how far it could correct and still be in a primary uptrend.

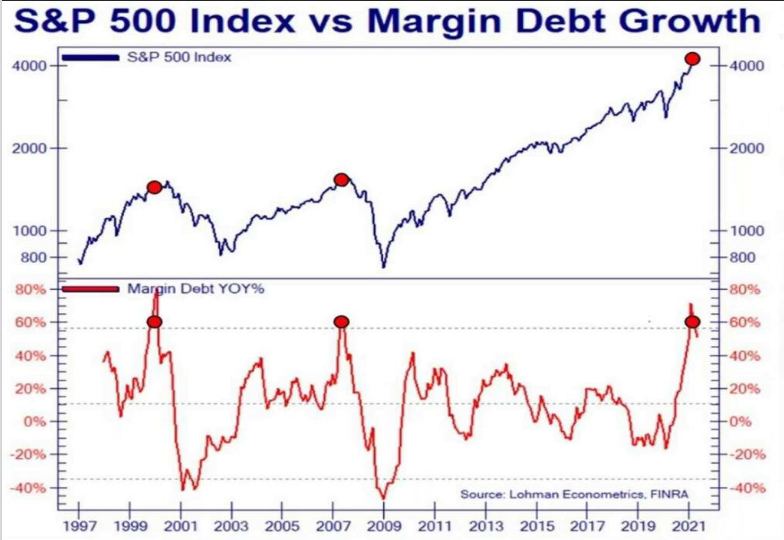

A sobering look at what has happened in the recent past after some big growth in margin lending.

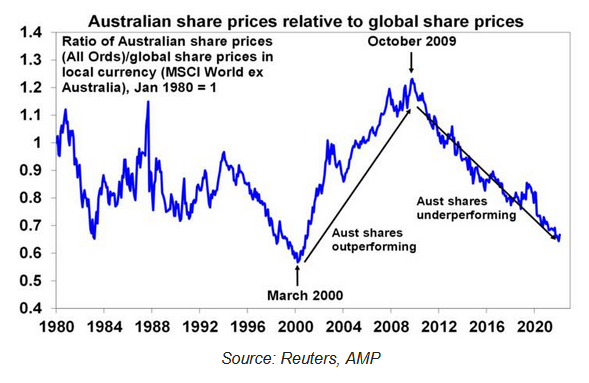

With the commodity sector exploding upwards we may be close to a time when domestic equities turn the corner and start outperforming global shares.

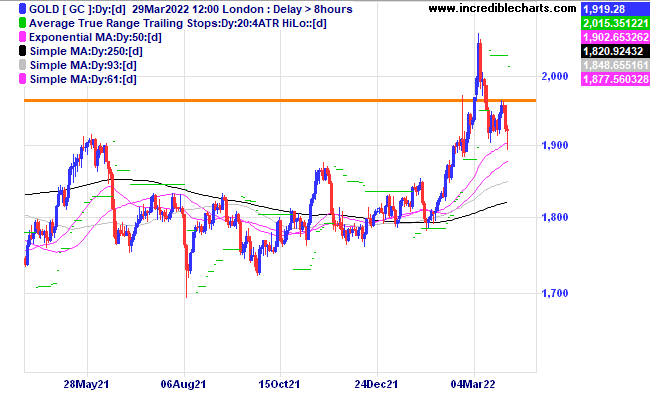

Interesting to see the price of gold spike briefly below the $1,900 level and close nearer the day’s high.

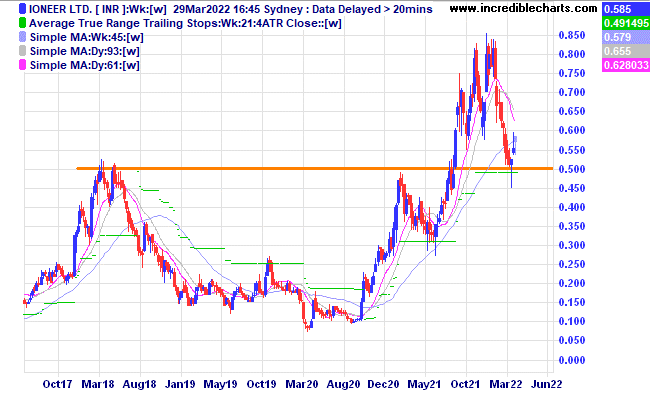

Ioneer made a similar spike down below the resistance and support zone.

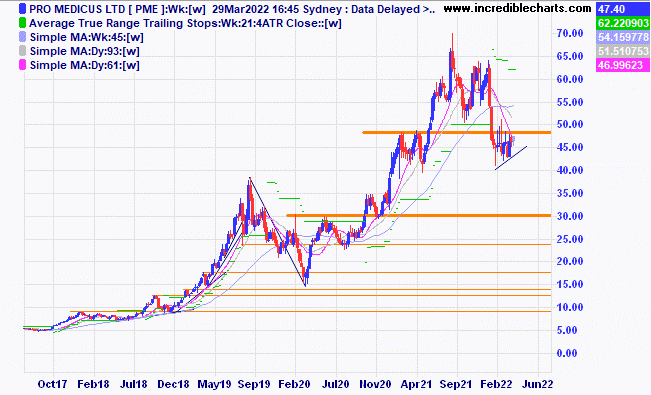

Pro Medicus is making a nice-looking consolidation pattern and could trigger a buy for some traders above the resistance zone. Watching.

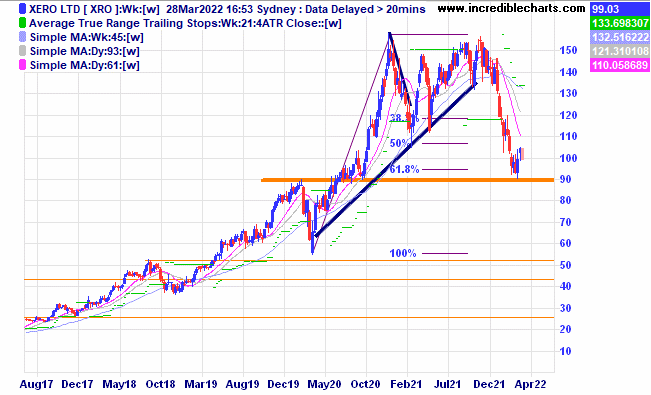

Xero looks to be bouncing off the support and resistance area.

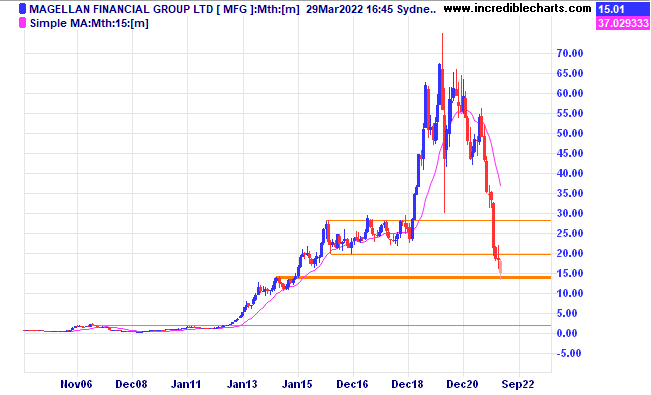

A look at how far Magellan has fallen. It is not the only fund manager to be well off the highs. On the daily chart it looks to be forming a small W bottom. Stavely is also forming a similar pattern. Time will tell if they mature into rising prices.

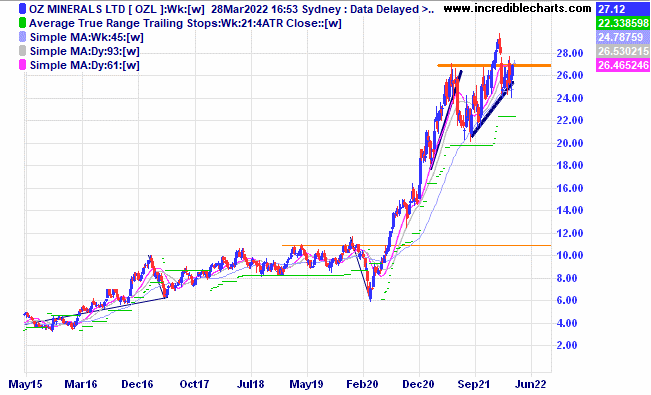

Copper miner Oz Minerals looks to be forming a consolidation pattern and with a recent spike lower could move to the upside. Still with some of China in lockdown the heat may come off commodity prices.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 1,000 at $2.70 | 23/12/2021 | $4.16 | $4.26 | +$100.00 |

Bought Brainchip Holdings | Bought 500 at 85c | 5/1/2022 | 95c | 93.5c | -$7.50

|

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $23.79 | $24.28 | +$58.80 |

Bought Macquarie Group | Bought 10 at $199.00 | 9/2/2022 | $197.00 | $203.20 | +$62.00 |

Bought Red5

| Bought 5,000 at 29.5c | 9/2/2022 | 37.5c | 37.5c | Steady |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $265.00 | $266.00 | +$12.00 |

Bought Northern Star | Bought 400 at $10.00 | 22/2/2022 | $10.60 | $10.78 | +$72.00 |

Bought Monadelphous | Bought 300 at $11.00 | 23/2/22 | $11.02 | $11.23 | +$63.00 |

Bought Goodman

| Bought 100 at $22.00 | 2/3/22 | $22.38 | $22.62 | +$24.00 |

Bought Pilbara

| Bought 800 at $2.80 | 2/3/22 | $3.00 | $3.25 | +$200.00 |

Bought Syrah

| Bought 1,000 at $1.40 | 2/3/22 | $1.48 | $1.54 | +$60.00 |

Bought St Barbara

| Bought 2,000 at $1.52 | 8/3/2022 | $1.53 | $1.44 | -$180.00 |

Bought GGUS ETF

| Bought 100 at $30.63 | 16/3/2022 | $33.67 | $35.71 | +$204.00 |

Bought Xero

| Bought 25 at $102.00 | 17/3/2022 | $98.82 | $102.44 | +$90.50 |

Bought Australian Strategic Minerals | Bought 300 at $8.50 | 23/3/2022 | $8.50 | $7.75 | -$225.00 |

Bought Imdex

| Bought 800 at $2.90 | 23/3/2022 | $2.90 | $2.74 | -$128.00 |

Bought Objective Corporation | Bought 150 at $17.20 | 23/3/2022 | $17.20 | $17.68 | +$72.00 |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $57,696.00 |

| |

| $57,696.00 |

| Gains/losses week +$477.80 |

|

|

| +$477.80 |

| Current total $58,173.80 |

|

|

| $58,173.80 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $45,517.10 |

|

|

| $45,517.10 |

Prices from Tuesday night or 6am for US positions. | Cash available $12,517.00 |

|

|

| $12,517.00

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here