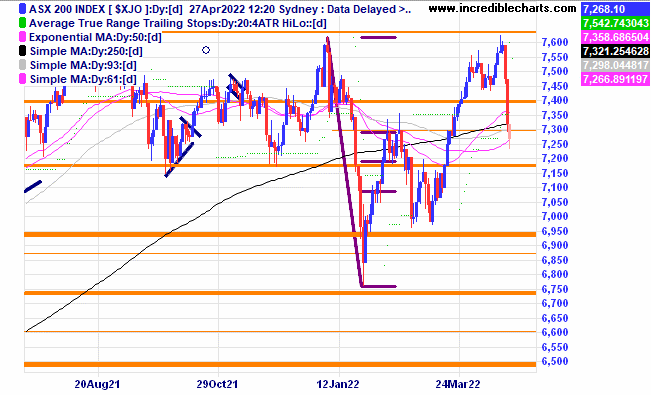

The local market has dropped by more than 3 per cent this week on concerns over Chinese growth and interest rates and has retreated for the third time from the 7,600 point resistance zone.

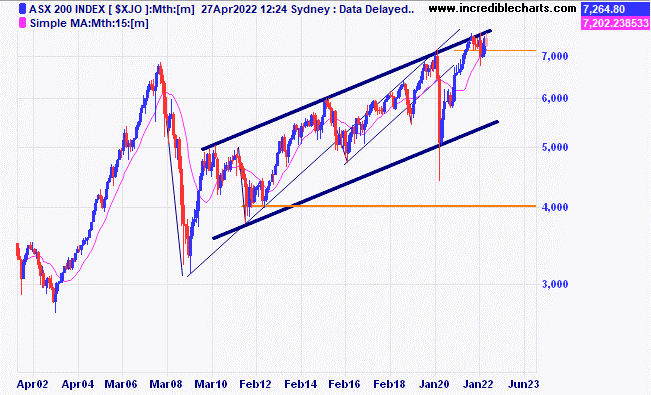

The local market from a wider perspective shows price is again butting up against the upper trend line.

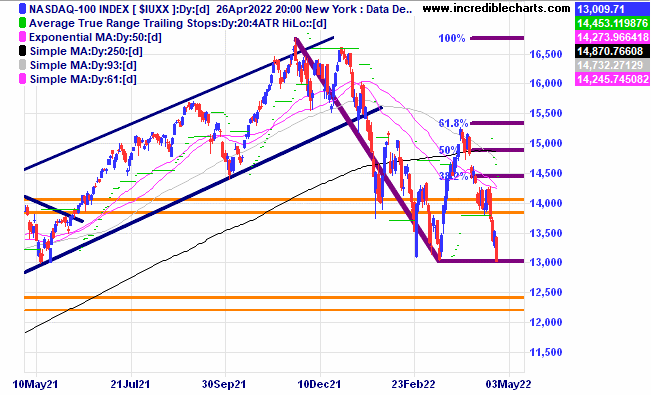

The US tech heavy Nasdaq index is flirting with recent lows.

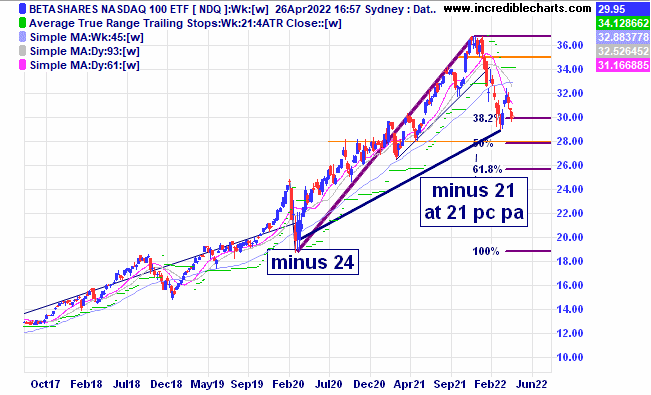

The locally listed NDQ ETF has made a slightly higher low and we bought a small and speculative parcel for the educational portfolio.

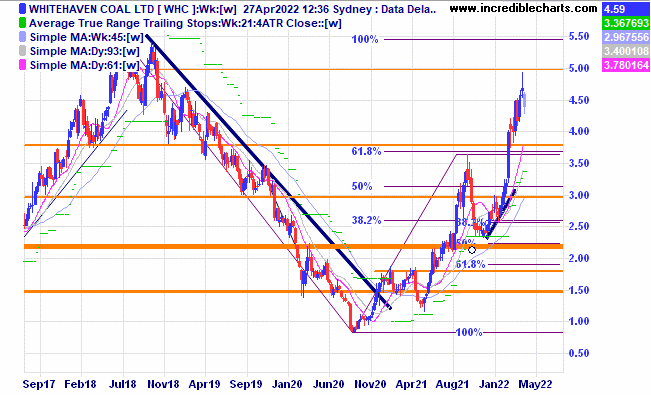

We sold some of our Whitehaven Coal parcel after it came off the highs close to the $5 mark. An ABC type move could present another entry point.

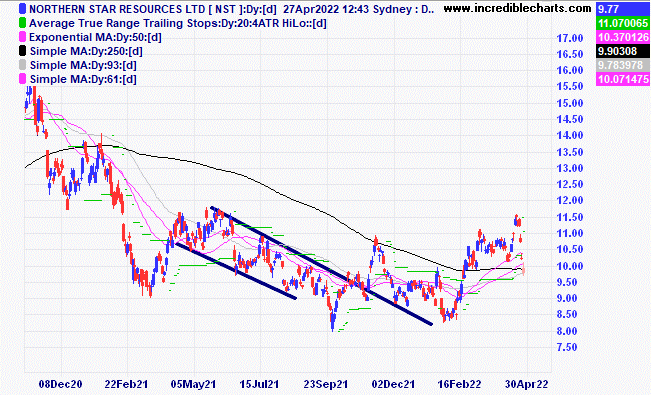

We sold half the Northern Star holding when price fell and sold the remainder today after price fell further and through our stop. We also sold the Imdex holding today.

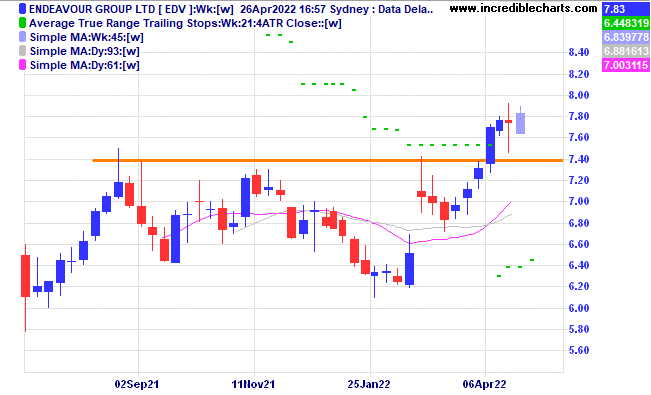

Endeavour Group has a nice looking chart and we bought a parcel today.

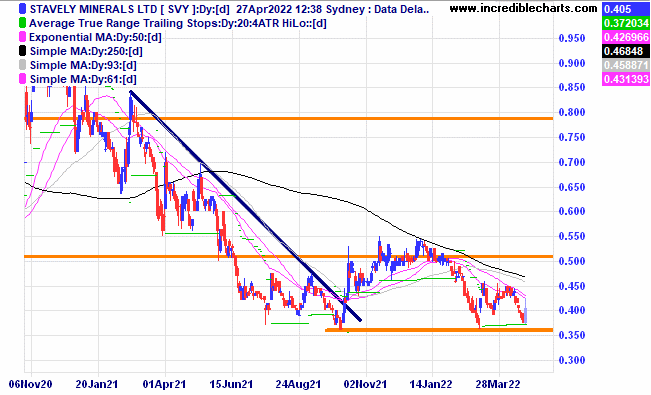

Stavely Minerals looks to be forming a nice looking bottoming type pattern and we bought a parcel for the educational portfolio today.

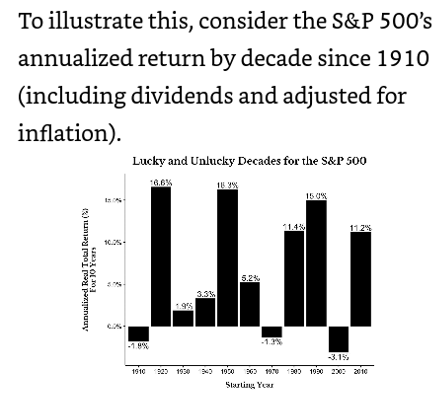

Luck can play a role in investor returns as the table below shows average ten-year returns over many decades can vary significantly.

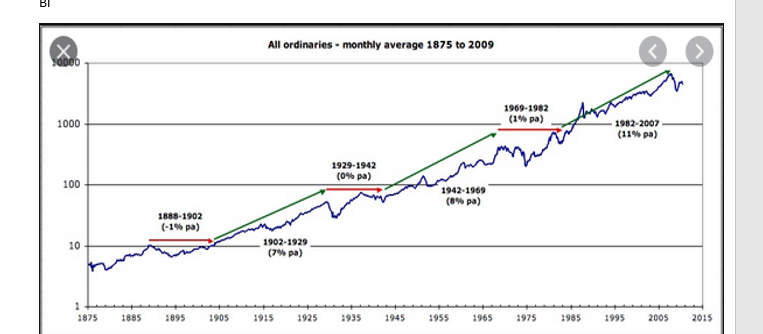

This chart of the Aussie All Ords index shows when returns have remained flat for some time. We are also getting closer to that next flat period, whenever that starts. There are also analysts who say the Australian market is overdue for a period of outperforming the US market.

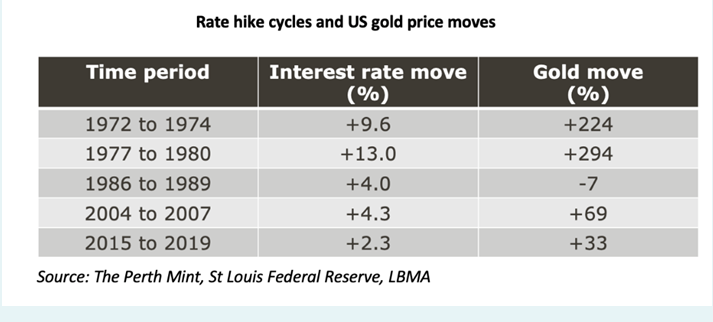

This table shows rising rate cycles versus the price of gold at different times in the past.

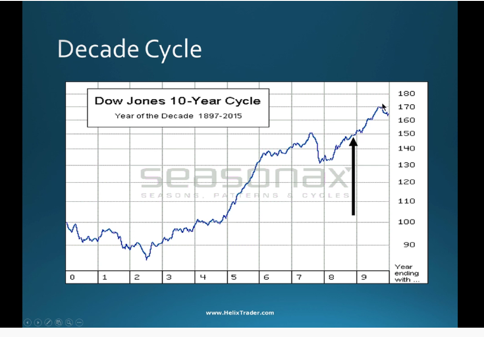

The AVERAGE ten-year Gann cycle for the Dow Jones Index showing years ending in two contain a major low.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 1,000 at $2.70 | 23/12/2021 | $4.67 | Sold 300 at $4.40 700 left at $4.40 | -$111.00 -$189.00 |

Bought Brainchip Holdings | Bought 500 at 85c | 5/1/2022 | 95 | 91c | -$20.00

|

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $25.79 | $24.39 | -$168.00 |

Bought Macquarie Group | Bought 10 at $199.00 | 9/2/2022 | $205.73 | $204.26 | -$14.70 |

Bought Red5

| Bought 5,000 at 29.5c | 9/2/2022 | 44c | 40.5c | -$175.00 |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $261.00 | $269.00 | +$96.00 |

Bought Northern Star | Bought 400 at $10.00 | 22/2/2022 | $11.48 | Sold 200 at $10.17 200 left at $10.17 | -$292.00 -$262.00 |

Bought Monadelphous | Bought 300 at $11.00 | 23/2/22 | $11.00 | $10.64 | -$108.00 |

Bought Goodman

| Bought 100 at $22.00 | 2/3/22 | $22.52 | $23.55 | +$103.00 |

Bought Syrah

| Bought 1,000 at $1.40 | 2/3/22 | $1.79 | $1.66 | -$130.00 |

Bought St Barbara

| Bought 2,000 at $1.52 | 8/3/2022 | $1.49 | $1.37 | -$240.00 |

Bought Xero

| Bought 25 at $102.00 | 17/3/2022 | $100.95 | $96.15 | -$120.00 |

Bought Imdex

| Bought 800 at $2.90 | 23/3/2022 | $2.78 | $2.53 | -$200.00 |

Bought Objective Corporation | Bought 150 at $17.20 | 23/3/2022 | $18.36 | $17.55 | -$121.50 |

Bought Resolute

| Bought 8,000 at 36c | 13/4/2022 | 37.5c | 33.5 | -$320.00 |

Bought GGUS ETF

| Bought 100 at $33.50 | 20/4/2022 | $33.50 | Sold at $32.50 | -$130.00 |

Bought Aussie Broadband | Bought 400 at $5.55 | 20/4/2022 | $5.90 | $5.75 | -$60.00 |

Bought Judo

| Bought 1,000 at $1.70 | 20/4/2022 | $1.70 | $1.68 | -$20.00 |

Bought Flight Centre

| Bought 100 at $21.80 | 20/4/2022 | $21.80 | $21.80 | Steady |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $59,277.53 |

| |

| $59,277.53 |

| Gains/losses week -$2,482.20 |

|

|

| -$2,482.20 |

| Current total $56,795.33 |

|

|

| $56,795.33 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $42,412.90 |

|

|

| $42,412.90 |

Prices from Tuesday night or 6am for US positions. | Cash available $18,038.00 |

|

|

| $18,038.00

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here