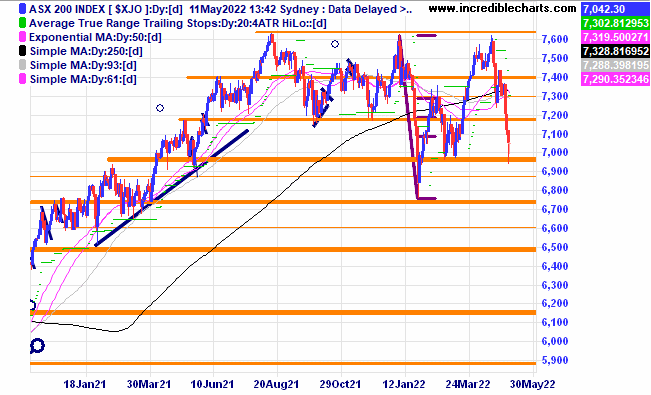

The local market had a big move down to touch the bottom of the large sideways congestion that has been in place for a year. The decent rebound from the low and higher close shows some strength from the buyers.

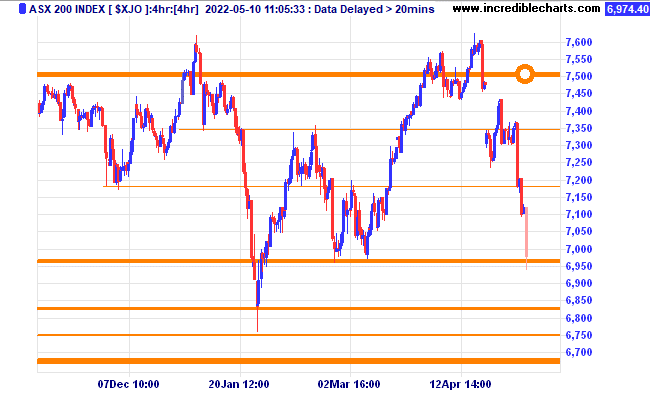

A four-hour chart of the local index and the brief excursion below the sideways pattern.

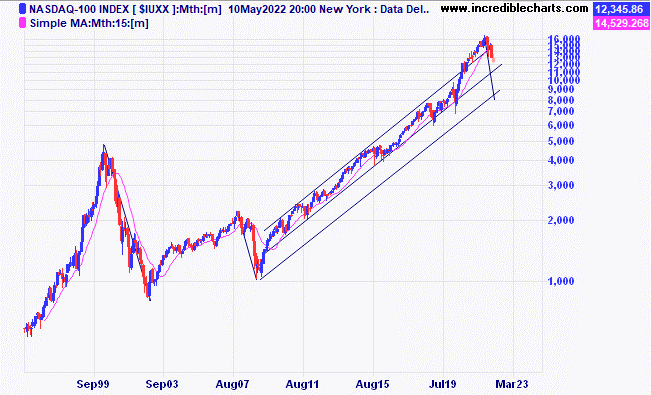

Looking at a monthly log scale chart of the Nasdaq index we see the index moving along at a fast rate for some time and now it seems that has come to an end. This index declined 80 per cent from the 2000 peak and dropped 50 per cent from the 2007 high. If you project a 50 per cent retracement onto the current market high we get around 8,000 points which would be the lower line of the trend channel. As the chart shows the index has spent most of the time above the midline.

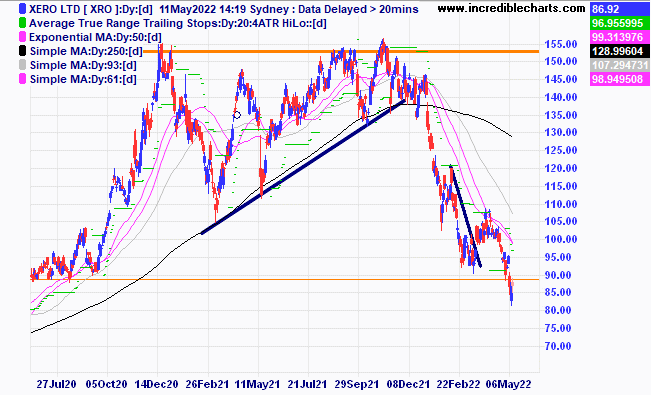

We were stopped out of Xero and a few other stocks when the moved below our stop levels. A sign of a bottom forming could well see some buying opportunities.

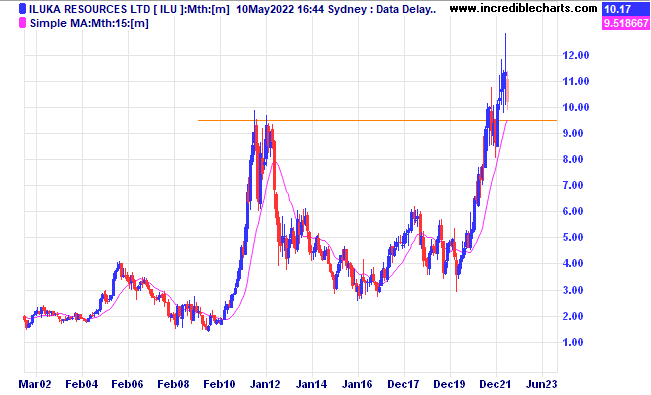

Iluka has retraced from the highs and still holds above a probable support zone.

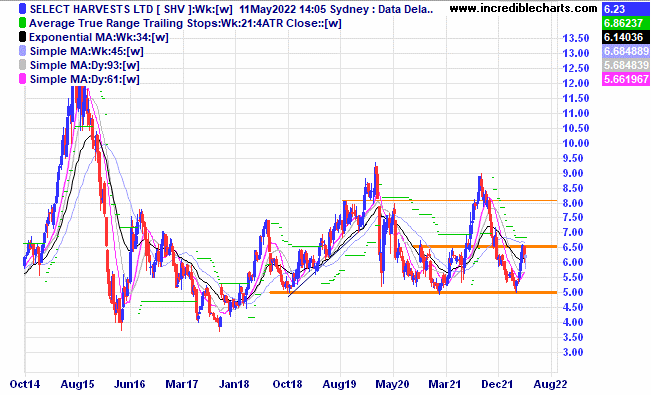

Select Harvest has retraced from a resistance zone offering the possibility of an ABC type trade.

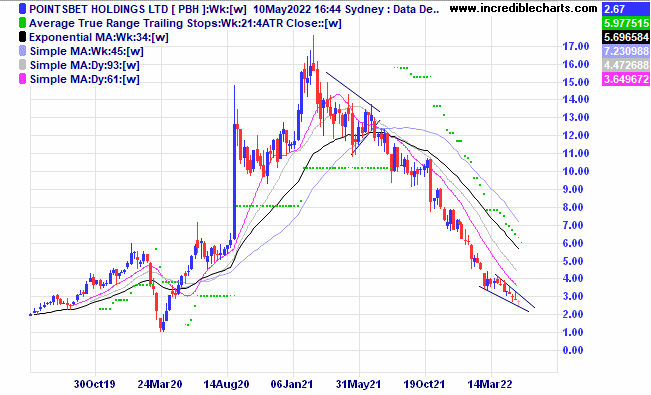

Pointsbet is still moving lower.

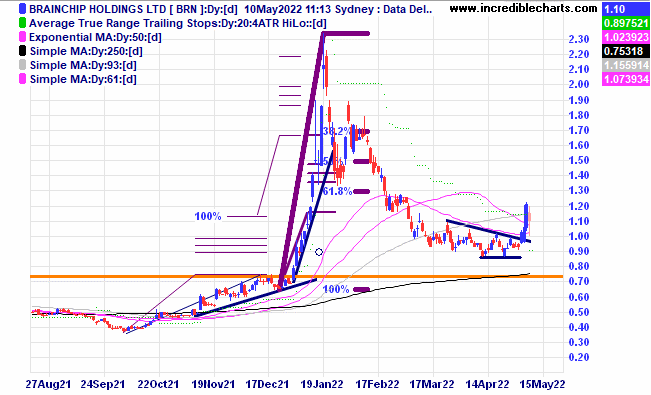

We added another parcel of Brainchip to the educational portfolio after a broker reported it could be promoted into the ASX 200 index. After a volatile day the next day we sold a portion at the 20 per cent profit level to lock in some cash and cover costs.

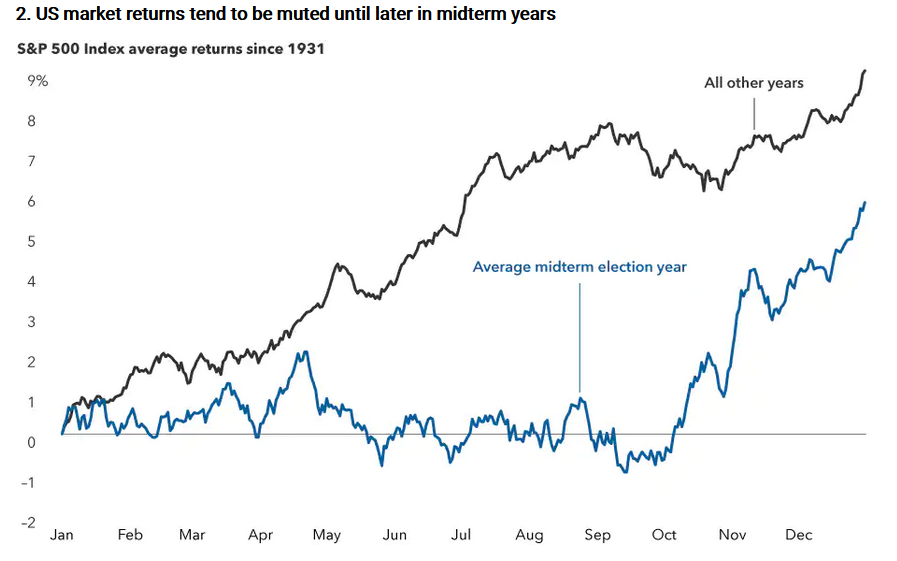

Mid-term election years in the US usually come good towards the later part of the year.

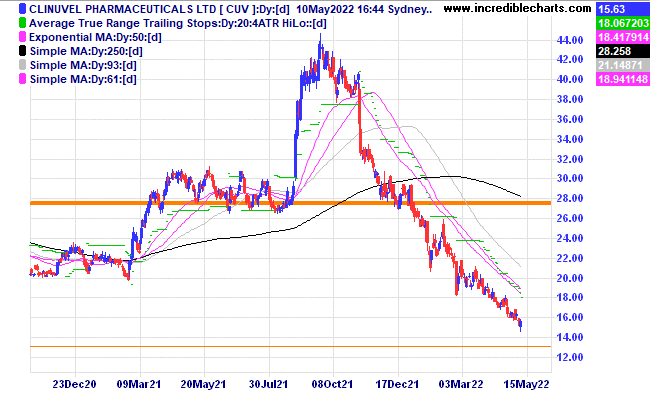

Some analysts still like the business behind Clinuvel and a bottoming pattern could provide a nice entry point.

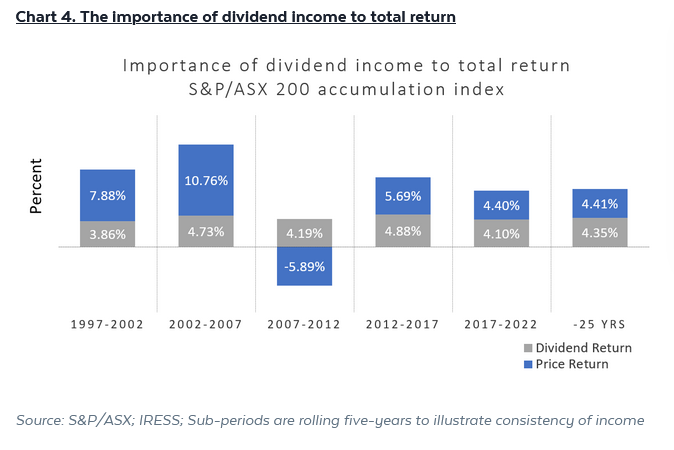

For long term buy and hold type investors this table shows how important dividends are. The 4 per cent retirement withdraw rate looks to be well covered in this sample.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 700 at $2.70 | 23/12/2021 | $4.82 | $4.99 | +$119.00 |

Bought Brainchip Holdings | Bought 500 at 85c | 5/1/2022 | 93.5 | $1.02 | +$42.50

|

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $23.90 | $23.97 | +$8.40 |

Bought Macquarie Group | Bought 10 at $199.00 | 9/2/2022 | $203.43 | Stopped $190.00 | -$164.30 |

Bought Red5

| Bought 5,000 at 29.5c | 9/2/2022 | 39.5c | Sold 2,000 at 37c 3,000 left at 34 | -$80.00 -$165.00 |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $272.00 | $270.00 | -$24.00 |

Bought Syrah

| Bought 1,000 at $1.40 | 2/3/22 | $1.86 | $1.60 | -$260.00 |

Bought St Barbara

| Bought 2,000 at $1.52 | 8/3/2022 | $1.29 | $1.16 | -$260.00 |

Bought Xero

| Bought 25 at $102.00 | 17/3/2022 | $91.83 | Stopped 9/5 at $85.00 | -$200.75 |

Bought Objective Corporation | Bought 100 at $17.20 | 23/3/2022 | $15.70 | Stopped 5/5 $15.10 | -$90.00 |

Bought Resolute

| Bought 8,000 at 36c | 13/4/2022 | 34c | 31c | -$240.00 |

Bought Judo

| Bought 1,000 at $1.70 | 20/4/2022 | $1.64 | $1.58 | -$60.00 |

Bought Flight Centre

| Bought 100 at $21.80 | 20/4/2022 | $22.70 | $20.28 | -$242.00 |

Bought NDQ ETF

| Bought 50 at $29.00 | 27/4/2022 | $29.34 | $28.30 | -$52.00 |

Bought Endeavour

| Bought 250 at $7.76 | 27/4/2022 | $7.62 | $7.69 | +$17.50 |

Bought Stavely

| Bought 6000 at 40c | 27/4/2022 | 39c | 34c | -$300.00 |

Bought Kelsian

| Bought 300 at $7.90 | 4/5/2020 | $7.90 | $7.92 | +$6.00 |

Bought Brainchip

| Bought 3,000 at $1.00 | 5/5/2022 | $1.00 | Sold 1,000 at $1.20 2,000 left at $1.02 | +$170.00 +$40.00 |

Bought BBUS ETF

| Bought 300 at $9.70 | 5/5/2020 | $9.70 | Sold 150 at $11.55 150 left at $11.27 | +$247.50 +$235.50 |

Sold ASX 200 cfd’s

| Sold 10 at 7,270 | 6/5/2022 | 7,270 | Buy 5 at 7,205 Buy 5 10/5 at 6,960 | +$295.00 +$1,515.00 |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $55,607.23 |

| |

| $55,607.23 |

| Gains/losses week +$558.35 |

|

|

| +$558.35 |

| Current total $56,165.58 |

|

|

| $56,165.58 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $31,395.90 |

|

|

| $31,395.90 |

Prices from Tuesday night or 6am for US positions. | Cash available $30,708.00 |

|

|

| $30,708.00

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here