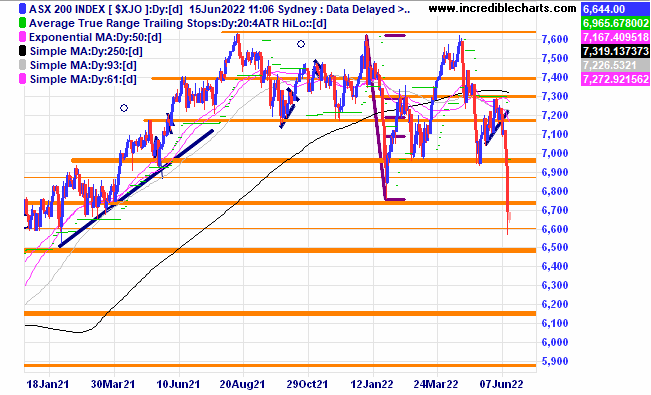

The local market is under pressure as inflation and the prospect of much higher rates begins to sap investor and consumer confidence. The index is now similar to January 2021 levels.

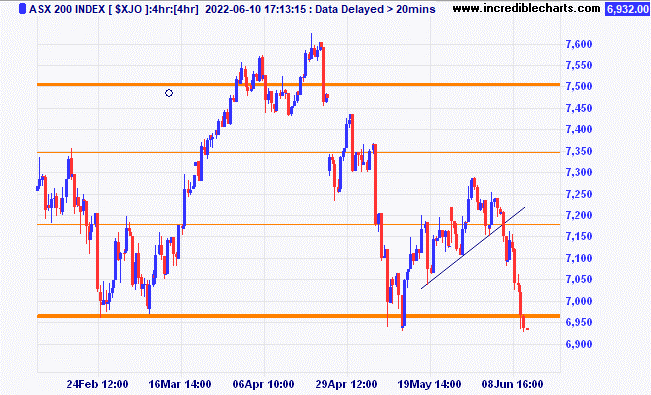

The four-hour chart shows we reached our downside target and the market continued to fall. Weak US futures markets late Friday indicated a possible stormy session or two ahead and we sold another smaller ASX 200 cfd position which we closed near the open on Tuesday.

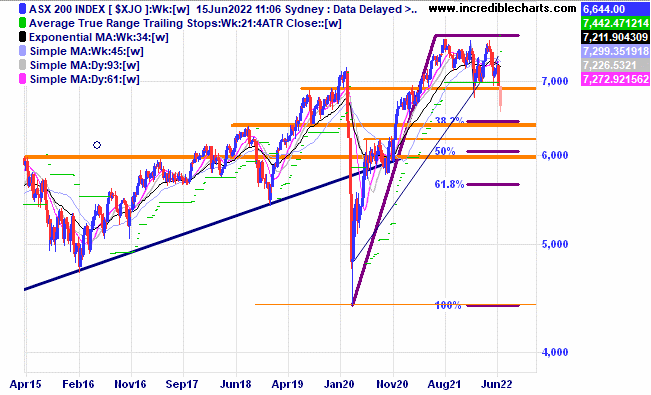

On a weekly chart if the market lost around 16 per cent from the recent high it would then be around the highs of 2018 and equal to a correction of 38 per cent of the range up from the Covid lows and a place where the market has bounced from in the past.

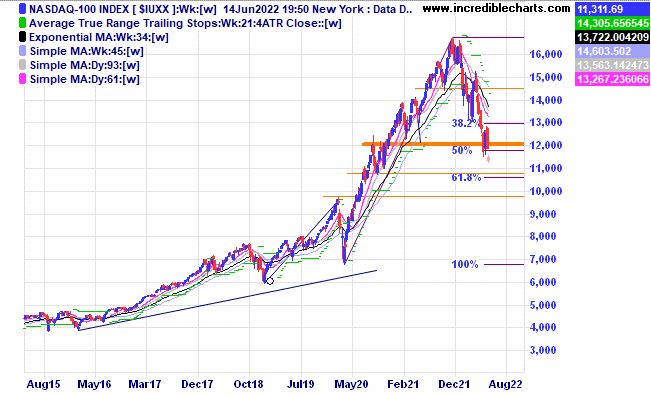

The current state of the Nasdaq 100 index. Will the 61.8 retracement around 11,000 be the bottom or the 10,000 pre-Covid high or even 8,000 perhaps? It is all just an educated guess really and fresh breakouts and following the trend is our thing.

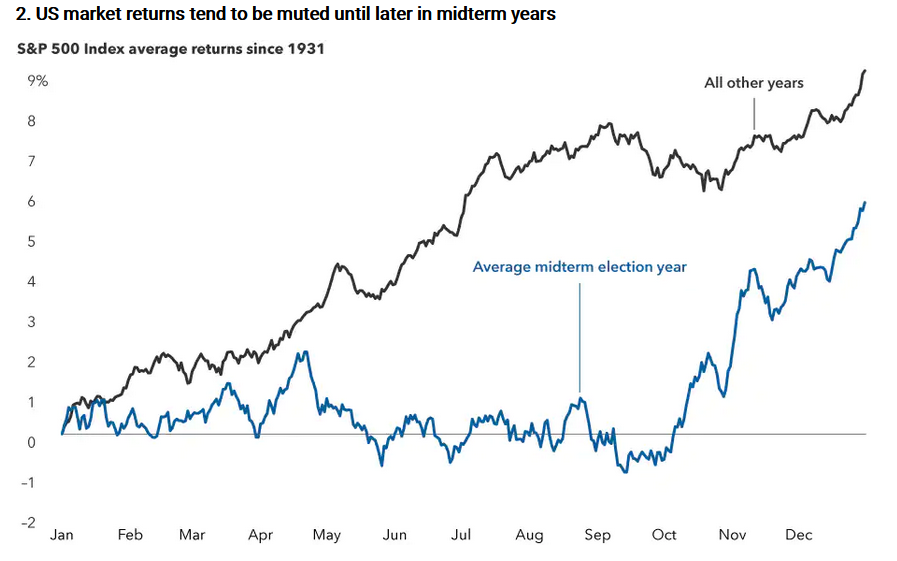

This graph shows that markets in the US usually do not turn up until after the mid-term elections. A decent rally could be coming in the last quarter. Time will tell and keeping some powder dry till then is the aim for now.

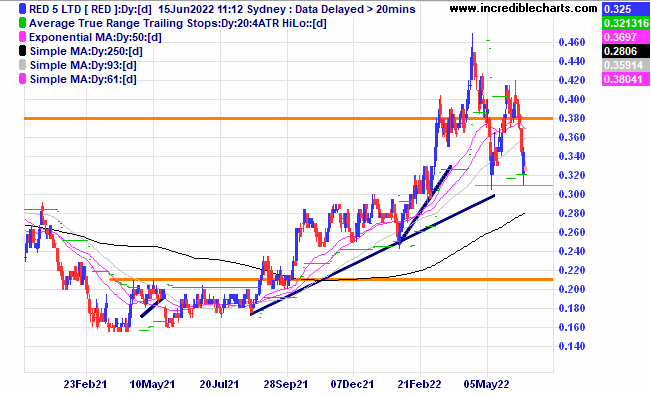

Red5 is one of a few stocks holding above recent lows and a possible support zone. Others include Santos, Computershare and Lynas all of which we continue to hold for now.

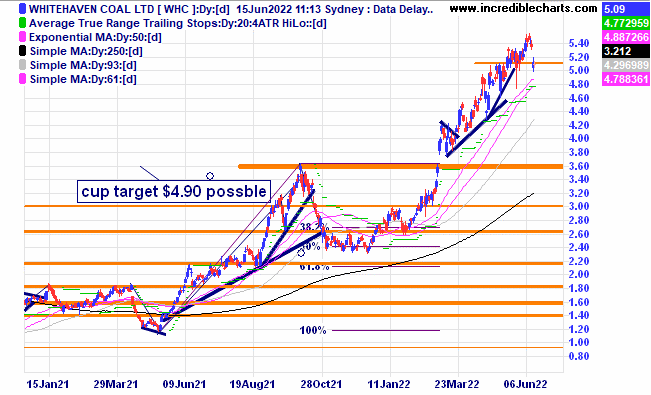

Whitehaven Coal is also holding up relatively well.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 700 at $2.70 | 23/12/2021 | $5.42 | $5.11 | -$217.00 |

Bought Brainchip Holdings | Bought 500 at 85c | 5/1/2022 | 99c | Sold at 90c | -$75.00

|

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $23.25 | $23.51 | +$31.20 |

Bought Red5

| Bought 3,000 at 29.5c | 9/2/2022 | 37 | 33c | -$150.00 |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $266.00 | $262.00 | -$48.00 |

Bought St Barbara

| Bought 2,000 at $1.52 | 8/3/2022 | $1.17 | $1.13 | -$80.00 |

Bought Judo

| Bought 1,000 at $1.70 | 20/4/2022 | $1.82 | $1.47 | -$350.00 |

Bought Flight Centre

| Bought 100 at $21.80 | 20/4/2022 | $20.50 | Sold $19.00 | -$180.00 |

Bought Stavely

| Bought 6000 at 40c | 27/4/2022 | 31.5c | 32 | +$30.00 |

Bought Kelsian

| Bought 300 at $7.90 | 4/5/2022 | $7.61 | $6.78 | -$249.00 |

Bought Brainchip

| Bought 1,000 at $1.00 | 5/5/2022 | 99c | Sold at 90c

| -$120.00 |

Bought Whitehaven

| Bought 400 at $5.10 | 17/5/2022 | $5.42 | Sold $5.11 | -$154.00 |

Bought Lynas

| Bought 300 at $9.20 | 17/5/2022 | $9.49 | $8.52 | -$291.00 |

Sold 5 ASX 200 cfd’s

| Sold 5 at 7,160 | 7/6/2022 | 7,100 | Buy 5 at 6,965

| +$645.00

|

Buy BBOZ ETF

| Buy 800 at $4.10 | 7/6/2022 | $4.22 | Sold 300 $4.96 500 left at $4.82 | +$192.00 +$300.00 |

Buy Santos

| Bought 300 at $8.70 | 8/6/2022 | $8.70 | $8.07 | -$189.00 |

Sold 5 ASX 200 cfd’s

| Sold 5 at 6,960 | 10/6/2022 | 6,960 | Buy 5 at 6,590 | +$1,820.00 |

Bought BBUS ETF

| Bought 200 at $11.20 | 10/6/2022 | $11.20 | Sold 100 at $12.90 100 left $12.70 | +$140.00 +$150.00 |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $57,218.68 |

| |

| $57,218.68 |

| Gains/losses week +$1,205.20 |

|

|

| +$1,205.20 |

| Current total $57,218.68 |

|

|

| $57,218.68 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $29,092.20 |

|

|

| $29,092.20 |

Prices from Tuesday night or 6am for US positions. | Cash available $32,450.50 |

|

|

| $32,450.50

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here