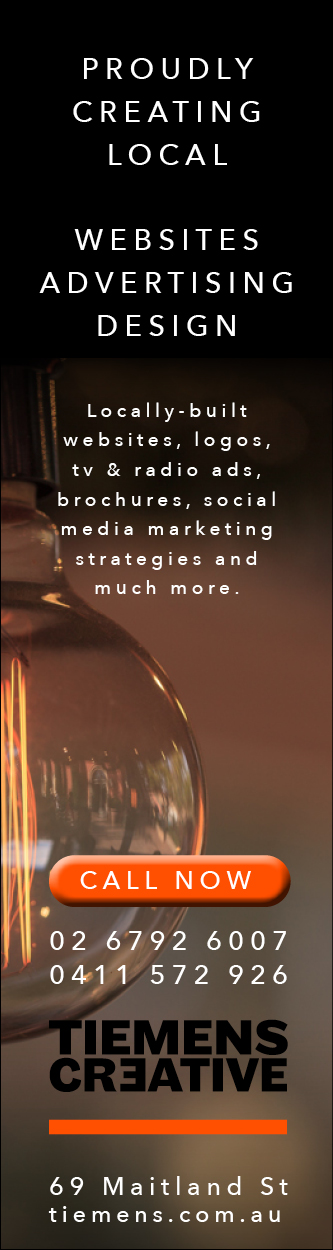

The local market is having another positive day after a week of red ink after breaking down out of a bearish flag pattern.

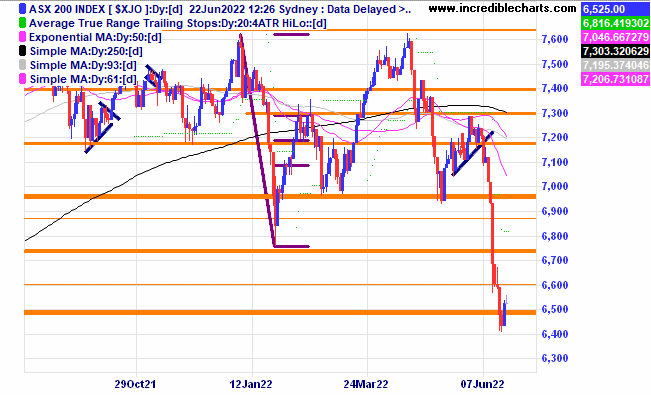

A weekly chart of the local market shows we are at some trend line support and a probable horizontal support zone. How long this current low holds is anyone’s guess. Some kind of rebound could be expected from here.

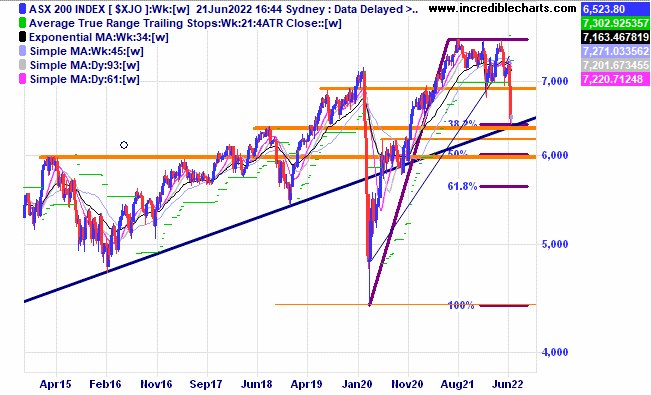

After reaching close to the 2018 highs Whitehaven Coal has made a lower high and dropped through one of our stops and we sold more than half our stake. We retain the rest for now keeping a close watch on prices. Perhaps some sideways consolidation before the next big move, time will tell.

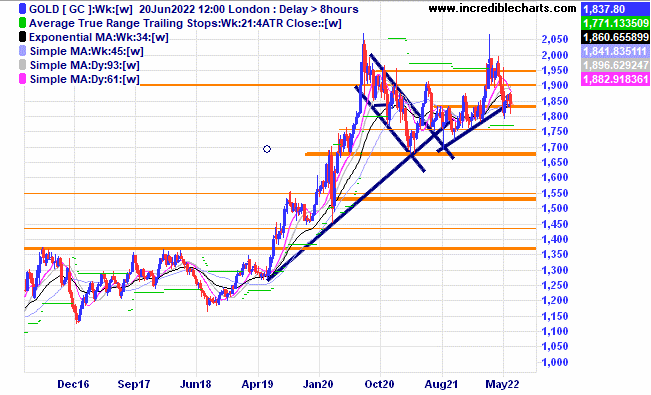

The price of gold is only just hanging on. Maybe higher inflation might put a spark into the price.

This graph shows that after an extreme low in sentiment there can be above average returns for the next year. That time to turn could be fast approaching.

A look at some significant declines from the 1970’s shows reactionary moves higher did not last long.

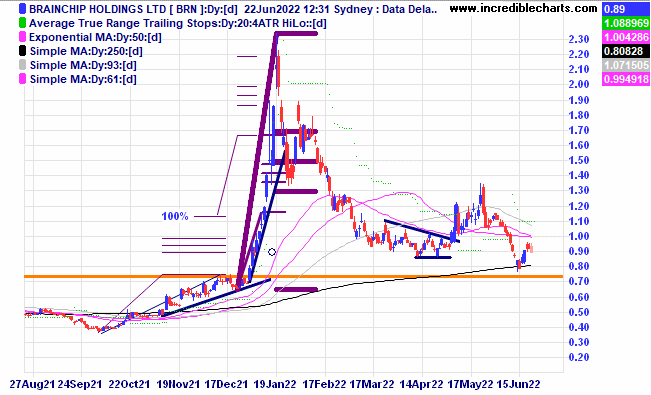

We bought back into Brainchip to speculate on a decent move after being included in an index update after price bounced off support.

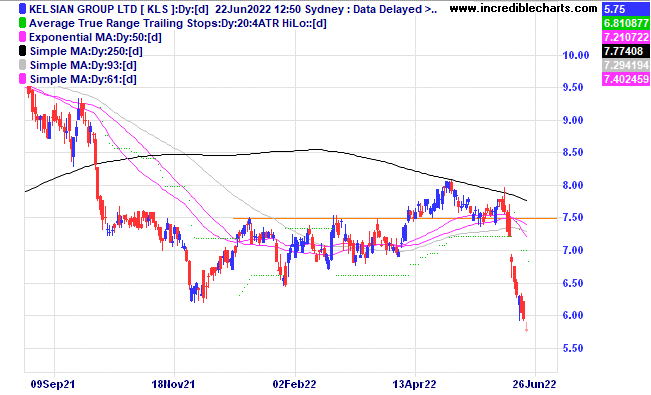

We were stopped out of Kelsian and Santos last week.

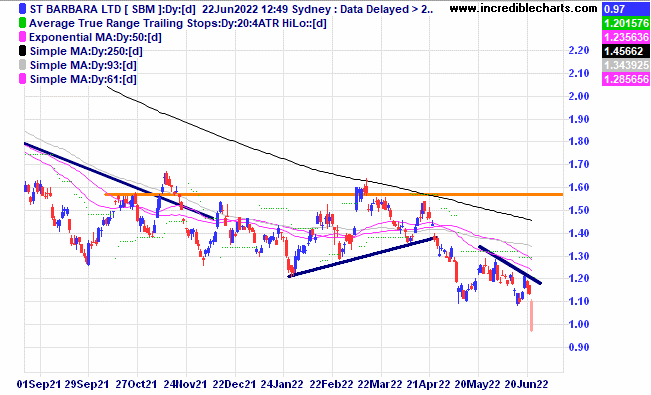

After enduring some price decline we were stopped out of St Barbara and Red5 today.

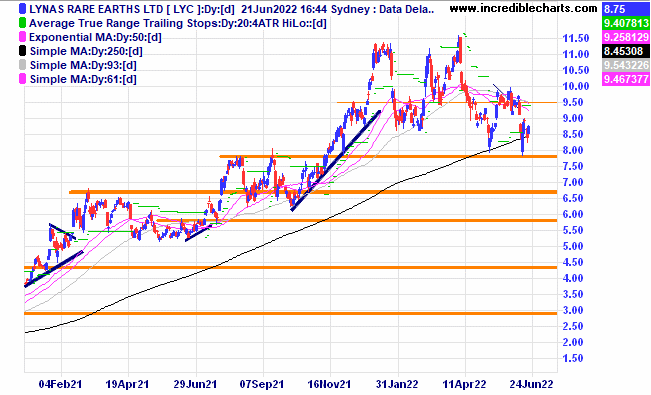

Lynas looks to be holding at support for now.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 700 at $2.70 | 23/12/2021 | $5.11 | Sold 400 at $4.80 300 left at $4.78 | -$154.00 -$99.00 |

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $23.51 | $23.92 | +$49.20 |

Bought Red5

| Bought 3,000 at 29.5c | 9/2/2022 | 33 | 32c | -$30.00 |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $262.00 | $260.00 | -$24.00 |

Bought St Barbara

| Bought 2,000 at $1.52 | 8/3/2022 | $1.13 | $1.13 | Steady |

Bought Judo

| Bought 1,000 at $1.70 | 20/4/2022 | $1.47 | Sold 15/6 $1.45 | -$50.00 |

Bought Stavely

| Bought 6000 at 40c | 27/4/2022 | 32 | Sold 15/6 at 29c | -$210.00 |

Bought Kelsian

| Bought 300 at $7.90 | 4/5/2022 | $6.78 | Sold 15/6 at $6.50 | -$114.00 |

Bought Lynas

| Bought 300 at $9.20 | 17/5/2022 | $8.52 | $8.75 | +$69.00 |

Buy BBOZ ETF

| Buy 500 at $4.10 | 7/6/2022 | $4.82 | $5.05 | +$115.00 |

Buy Santos

| Bought 300 at $8.70 | 8/6/2022 | $8.07 | Sold $7.80 | -$111.00 |

Bought BBUS ETF

| Bought 100 at $11.20 | 10/6/2022 | $12.70 | $13.23 | +$53.00 |

Bought Brainchip

| Bought 4,000 at 80c | 16/6/2022 | 80c | 92c | +$480.00 |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $57,218.68 |

| |

| $57,218.68 |

| Gains/losses week -$25.80 |

|

|

| -$25.80 |

| Current total $57,192.88 |

|

|

| $57,192.88 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $21,712.40 |

|

|

| $21,712.40 |

Prices from Tuesday night or 6am for US positions. | Cash available $36,190.50 |

|

|

| $36,190.50

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here