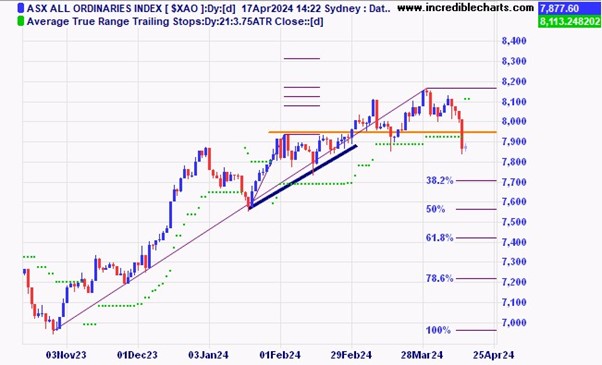

The local market had a shocker yesterday and overall is looking weaker after The All Ordinaries Index closed 1.8 per cent lower and below the recent support zone. How low will this correction take it?

The US based S@P 500 index is yet to breach the recent support zone. An 8.5 per cent fall from the top would put the index at the first Fibonacci retracement level.

Aristocrat Leisure has now fallen through a likely support area.

Iluka looks to be building some kind of a basing pattern.

Mader Group has made a series of lower highs. A break of the downtrend could see a move higher.

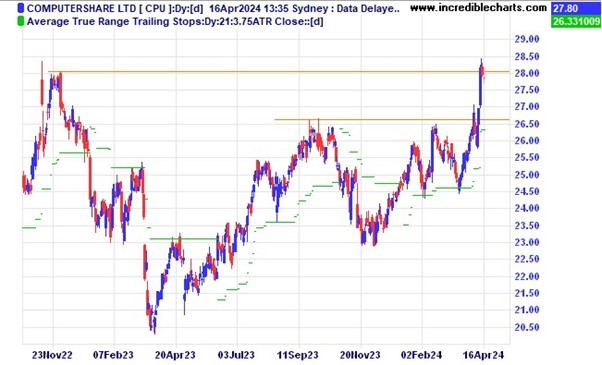

Computershare is one stock that benefits from higher interest rates. Can it overcome this resistance zone?

Evolution Mining has been struggling to move above the $4 level. When and if it does overcome the resistance zone we could see a decent rally. The shares are up over the mark today after their latest update.

Ioneer looks to be consolidating the recent move up.

Vulcan Energy is struggling to move above the resistance zone for now.

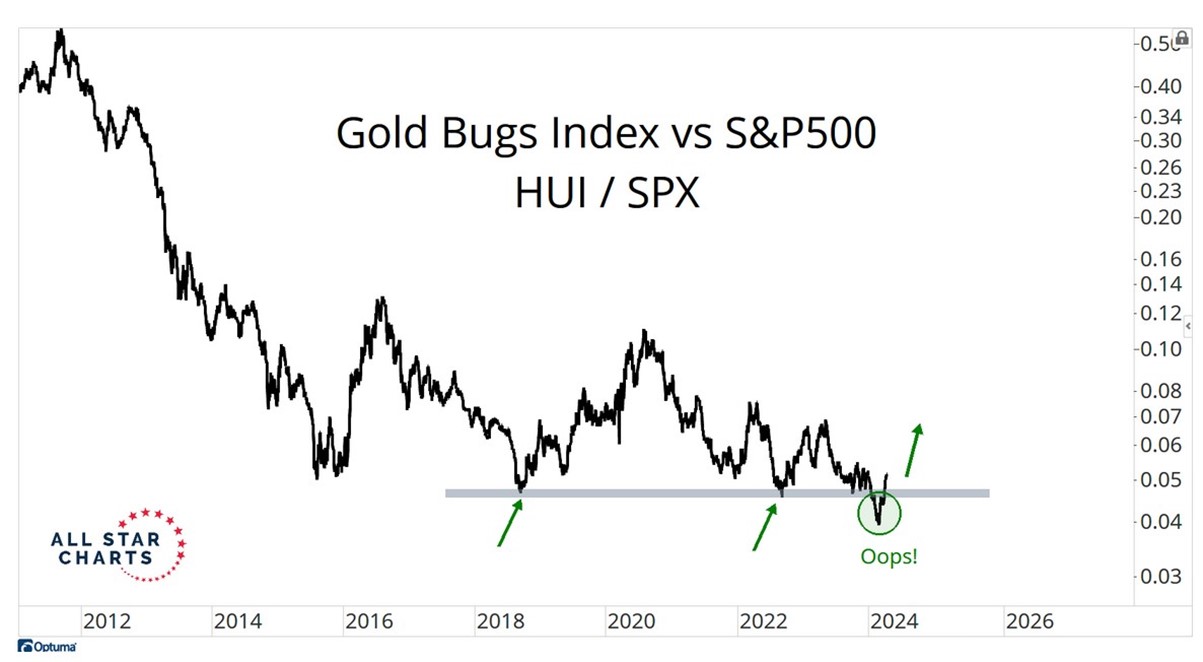

This chart shows the previous outperformance of most stocks versus gold mining stocks. Looks like that trend could be reversing.

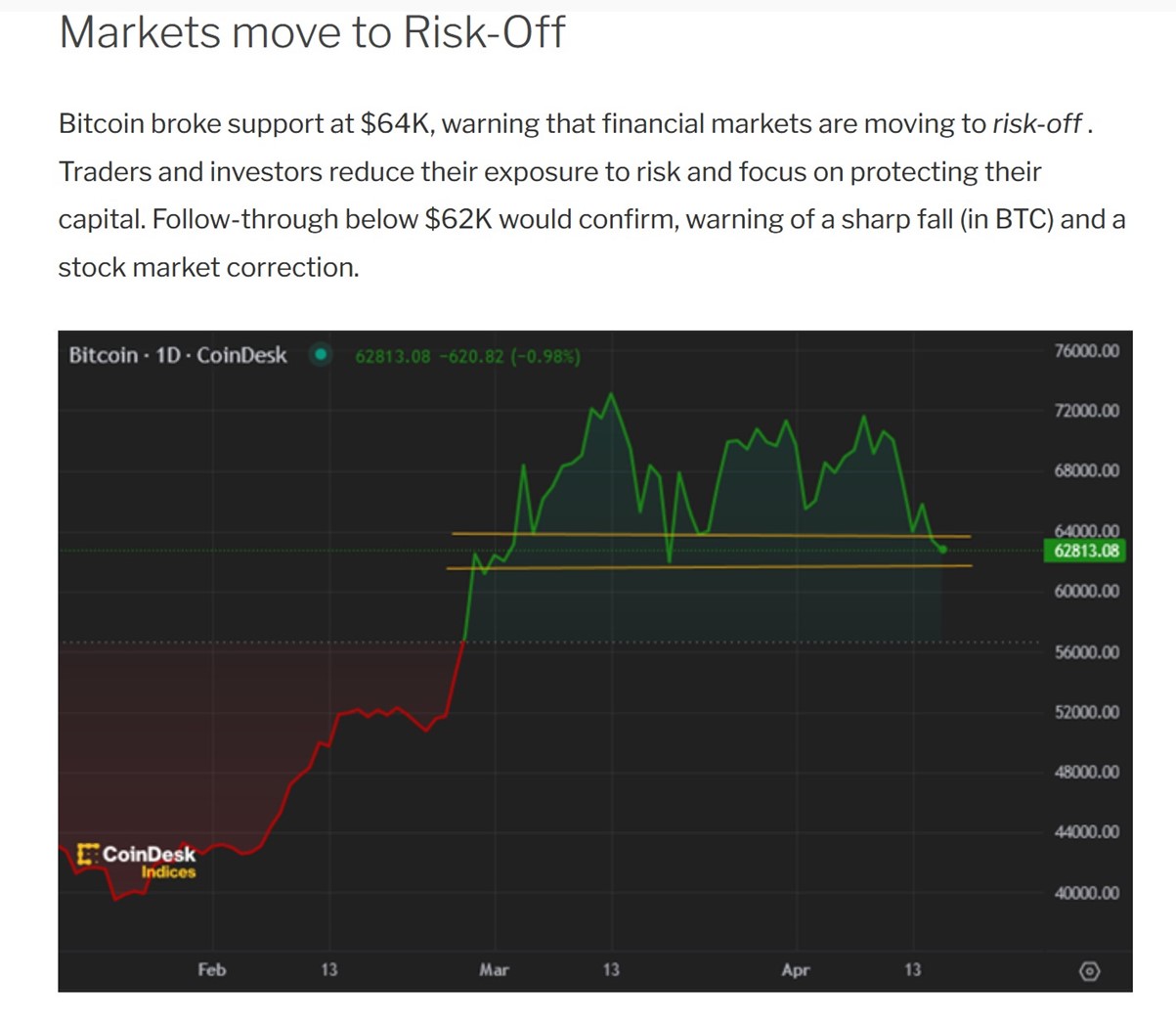

A recent view of the Bitcoin chart and some analyst commentary from Colin Twiggs.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here