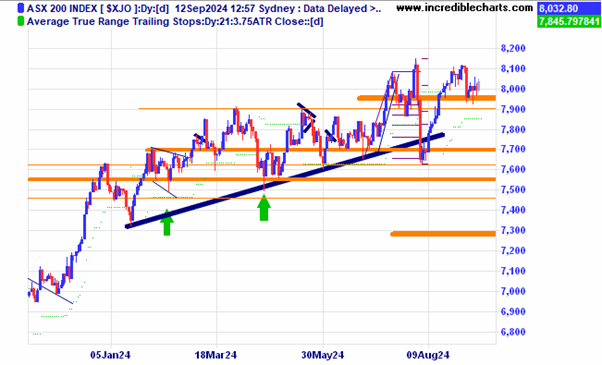

The local index is slowly moving towards the previous highs and could be forming a bearish flag type pattern, or not.

The Australian dollar looks to be consolidating at current levels with some stiff resistance at the 68 cent level.

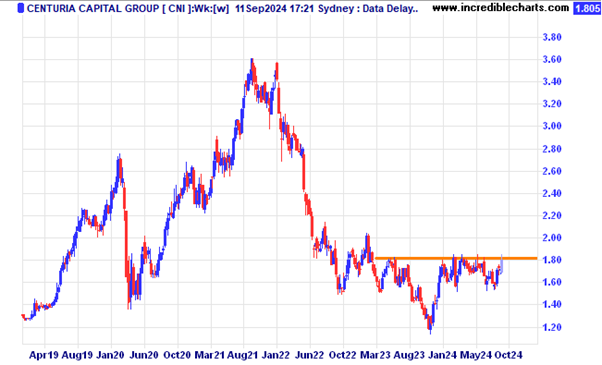

Centuria Capital is yet to move beyond the resistance zone.

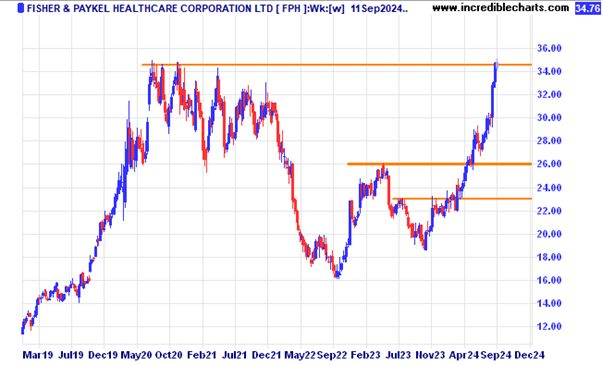

Fisher and Paykel has reached the level of previous highs where price has paused before.

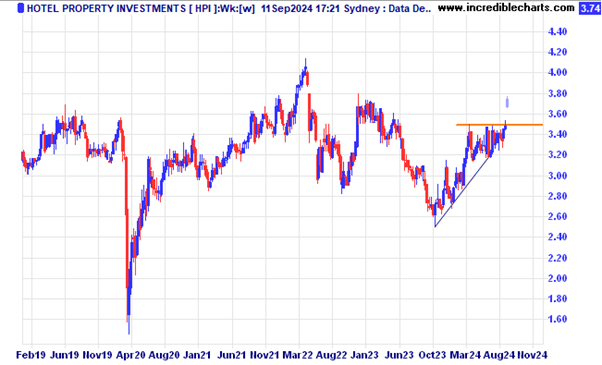

Hotel Property Investments jumped on news of a potential takeover.

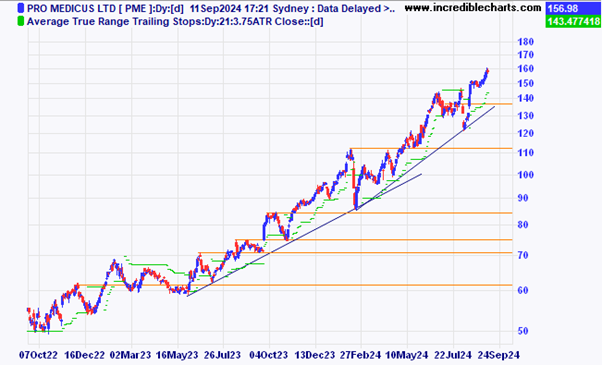

Pro Medicus has been rising steadily for some time.

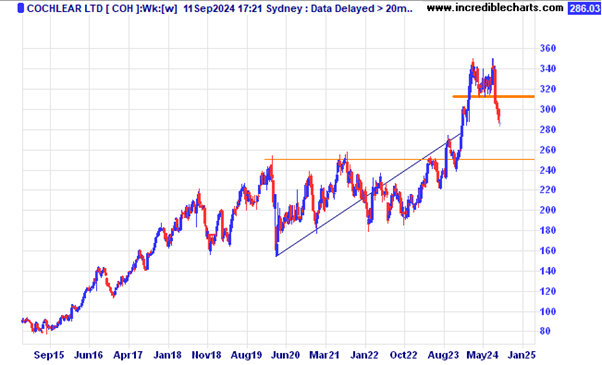

Cohlear has moved below a recent support level.

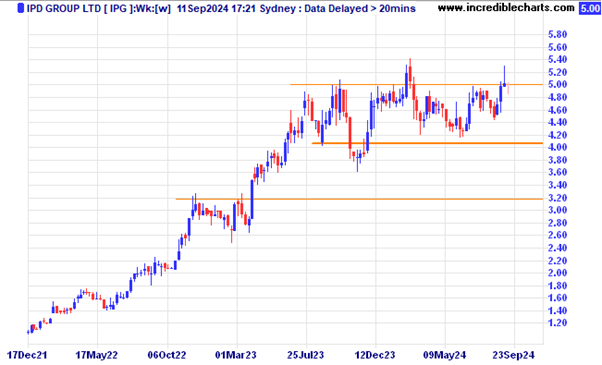

IPD Group has spiked again at these levels.

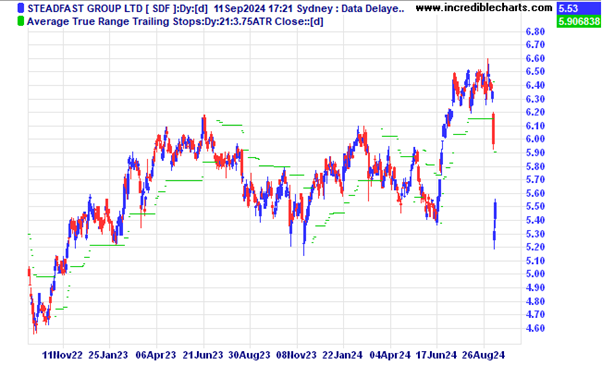

Steadfast Group has moved lower after a Four Corners story on Strata management misdeeds.

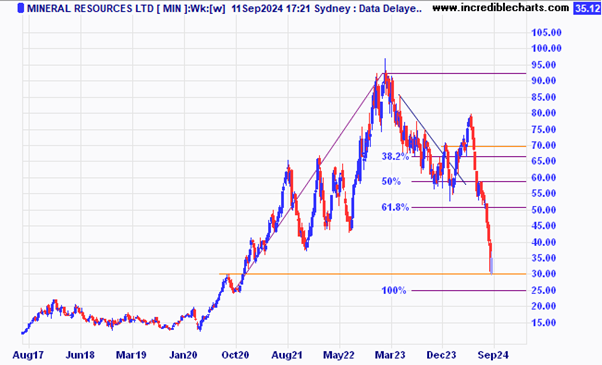

Mineral Resources has had a bounce after selling down ownership of a haulage road. A Chinese lithium company announced cutting production at low grade mines which boosted the lithium price and most listed lithium stocks including MIN.

RPM Global is one of a few companies being promoted in the latest ASX index rebalance. Full details on the ASX website.

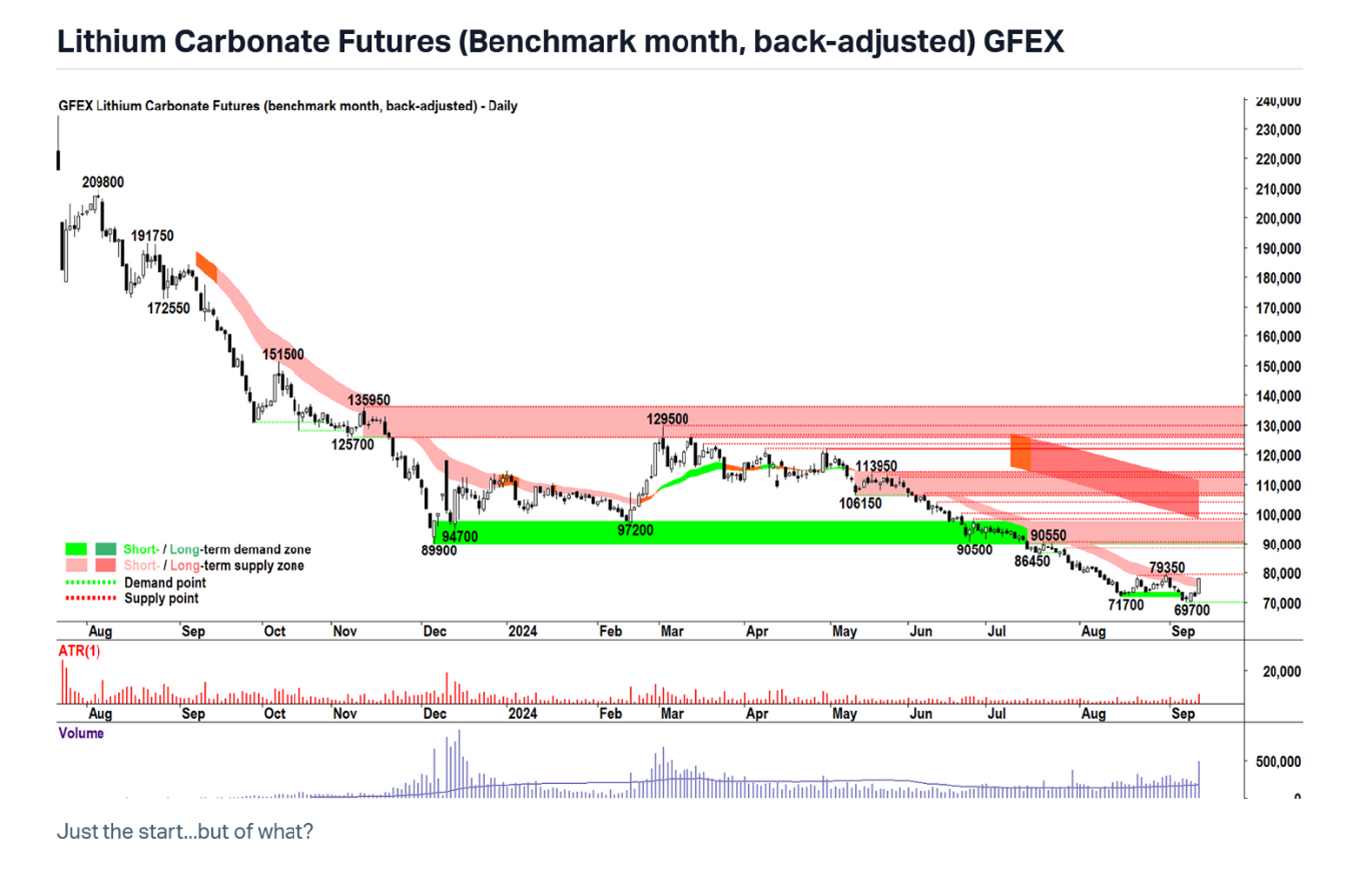

Vulcan Energy rose from a previous support zone on higher lithium prices.

The price of lithium rose after a Chinese company closed down some lower grade mining.

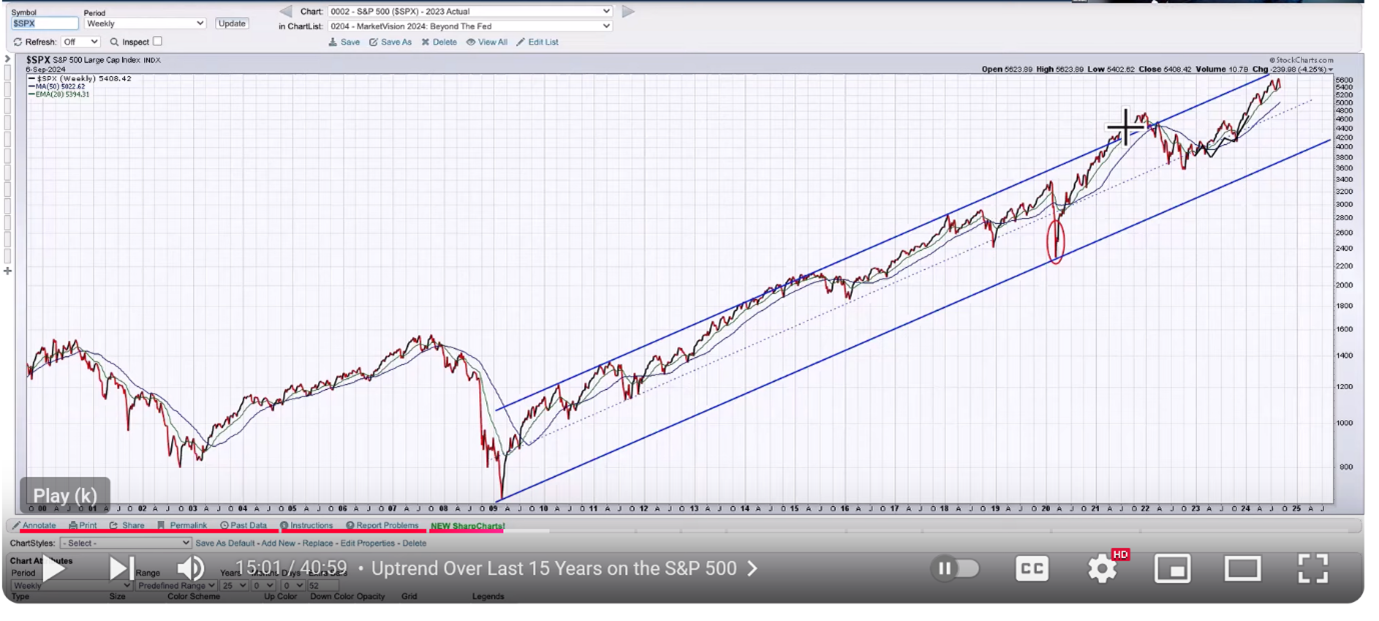

This graph shows that the US S@P 500 index could fall further before it hits the midline of the current up trending channel.

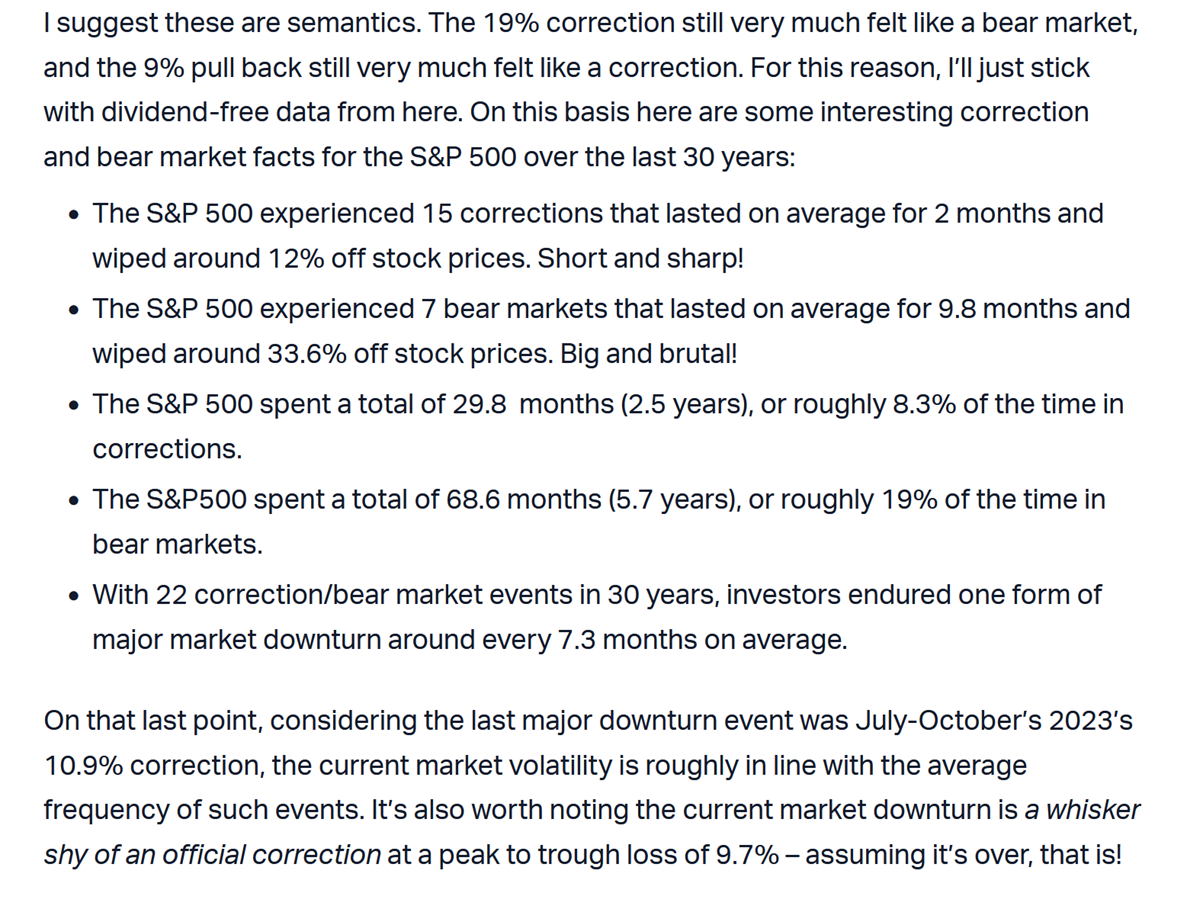

Here are some interesting statistics on bearish events of the US S@P 500 index over the past 30 years.

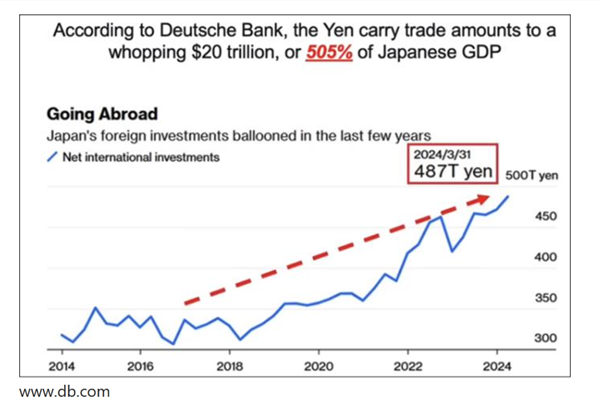

Another rate adjustment from the Japanese central bank could send the markets into more volatility with recent estimates the Japanese carry trade could be worth a whopping $US20 trillion in total. Their next interest rate meeting comes on September 19th one day after the US rates decision.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here