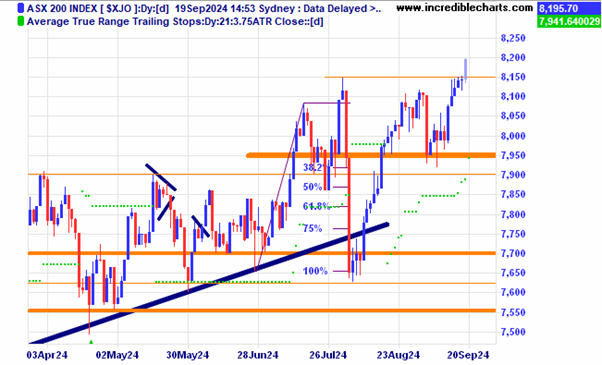

The local market has whipsawed a bit during the day and is up around half a percent and headed for a record high at the close today.

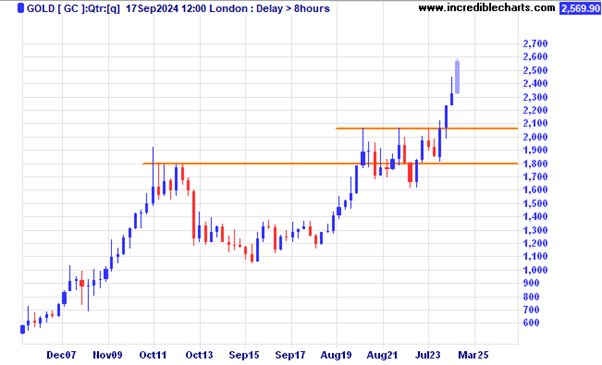

The price of gold on a quarterly chart.

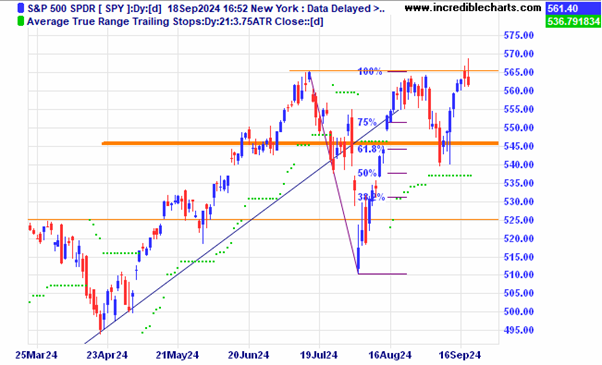

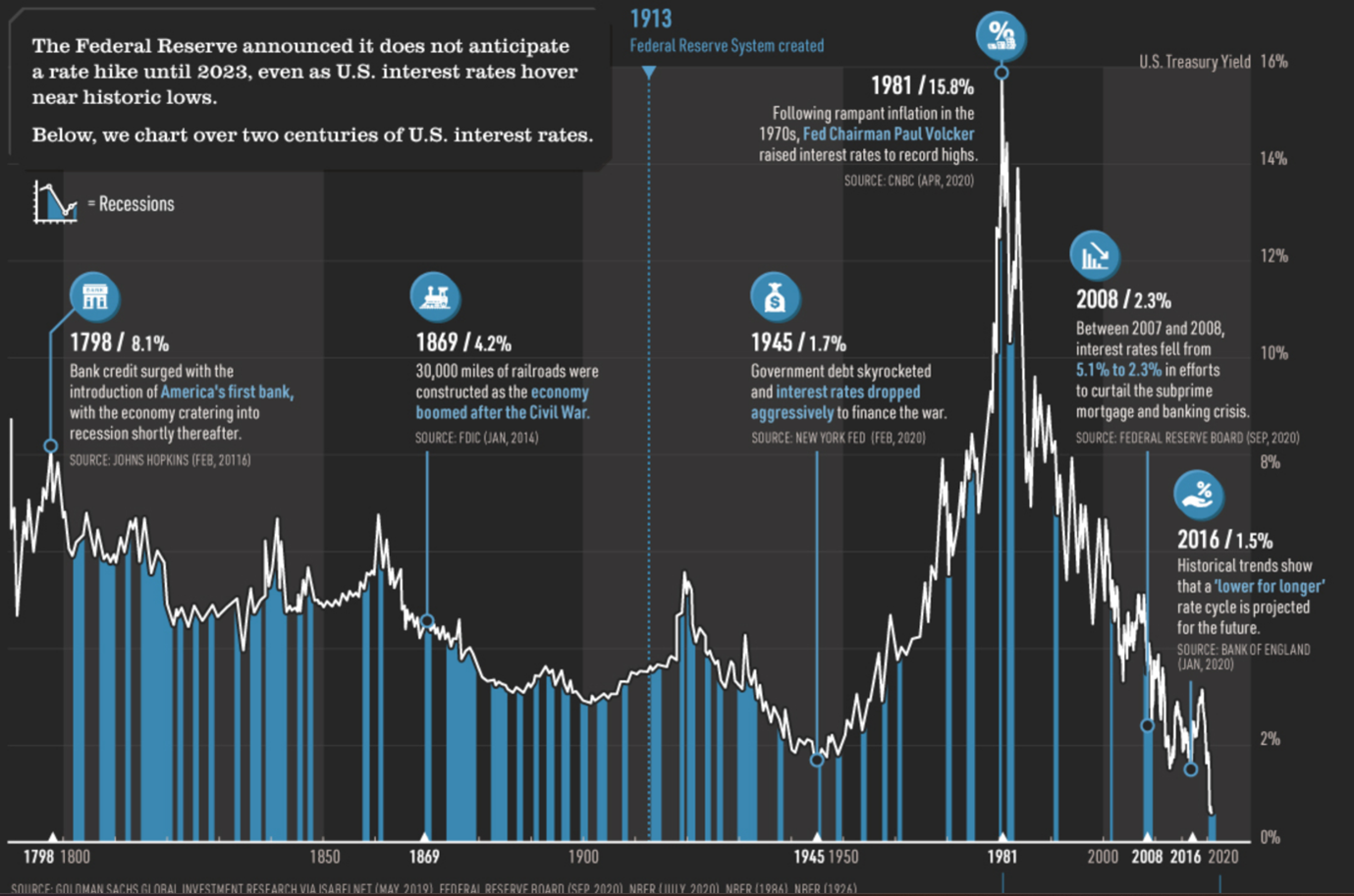

The US S@P 500 index briefly spiked higher after US interest rates were cut by half a percentage point. Friday’s end of quarter expiry of options could prove to be interesting. US Overnight futures are up.

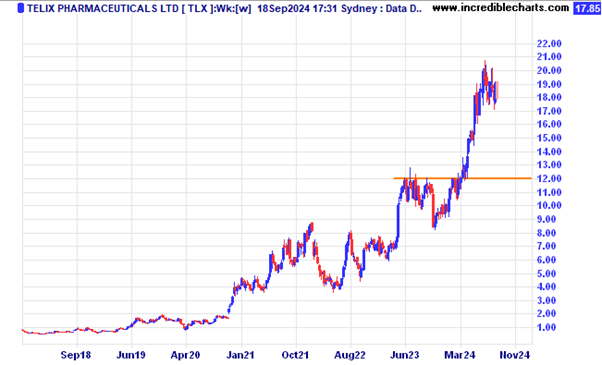

Telix looks to be consolidating at this level for now.

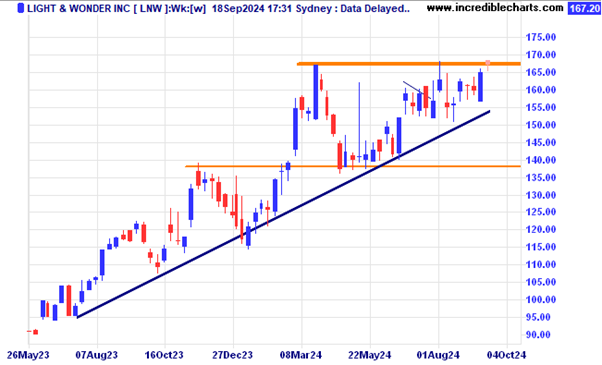

Light and Wonder looks to be posturing for a move higher.

This chart of Westpac shows just how strong this year is so far.

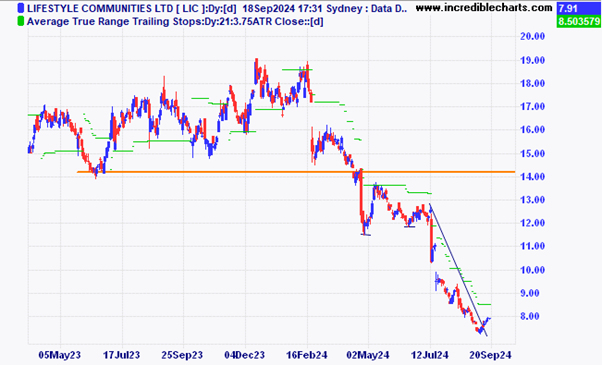

Lifestyle Communities looks to be making a bottoming type formation.

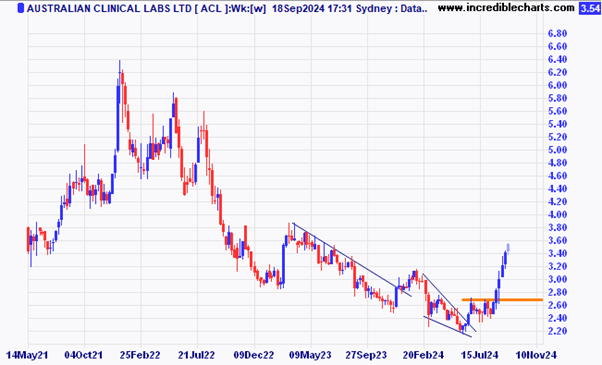

Australian Clinical Labs is rising after breaking through the resistance zone.

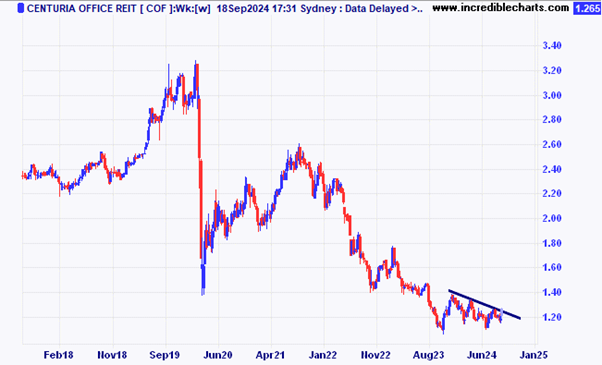

Centuria Office REIT is finding it difficult to break the down trend line for now.

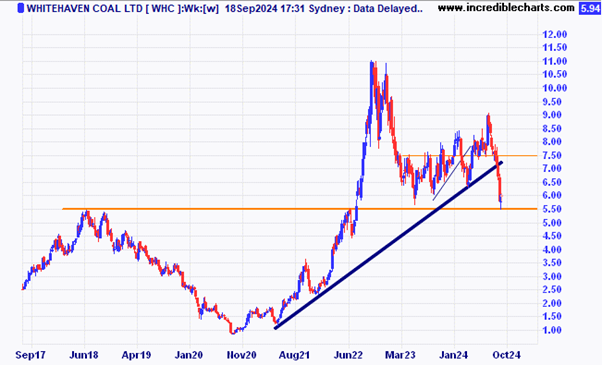

Whitehaven Coal made a little bounce at a possible support zone.

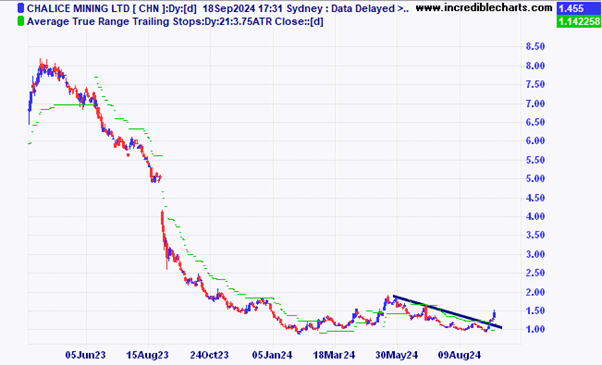

Chalice mining looks to be turning around.

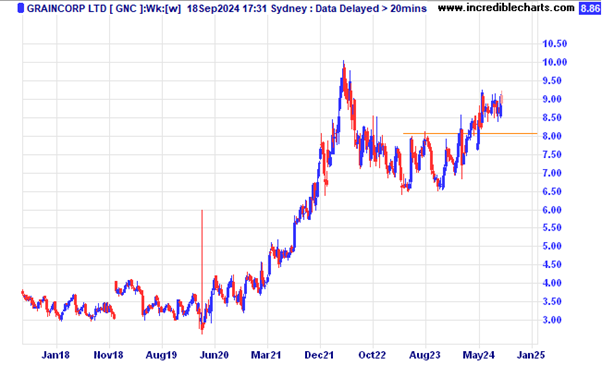

Graincorp is trading sideways and not too far off the highs.

One reason the All Ordinaries index has spent a lot of time in a mostly sideways move is the resources sector which makes up a big part of the overall market is in a downtrend and putting a dampener on a strongly rising market. This chart comes from Carl Capolingua at Market Index.

This chart from Carl at Market Index shows the real estate sector is rising. The prospect of lower rates is seen as a catalyst for higher prices.

A long-term chart of US interest rates.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here