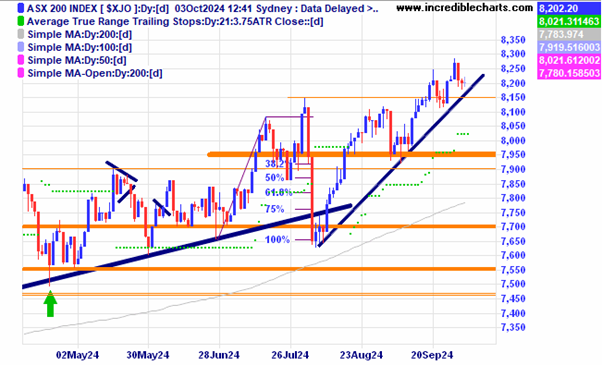

The local market is treading water the last two days after trading higher with the help of China’s stimulus package.

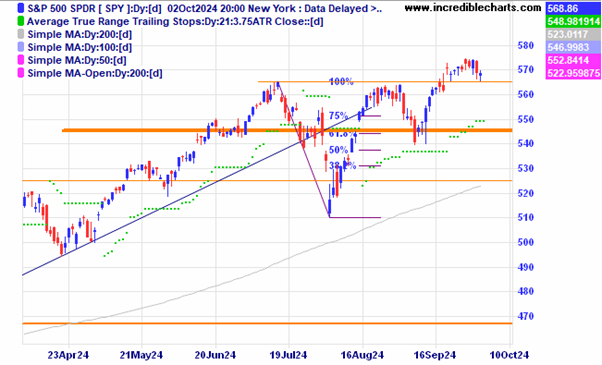

This ETF based on the S@P 500 index looks to be holding at a support and resistance zone for now.

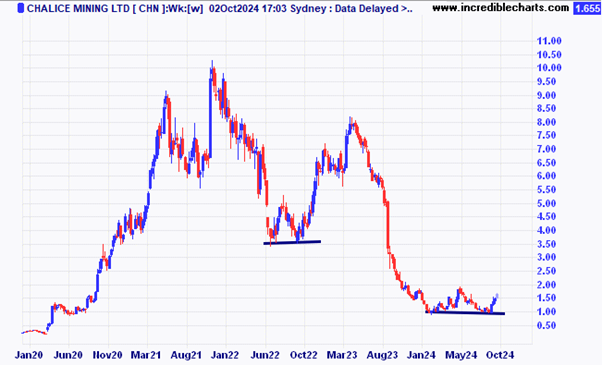

Chalice looks to be forming a bottoming pattern.

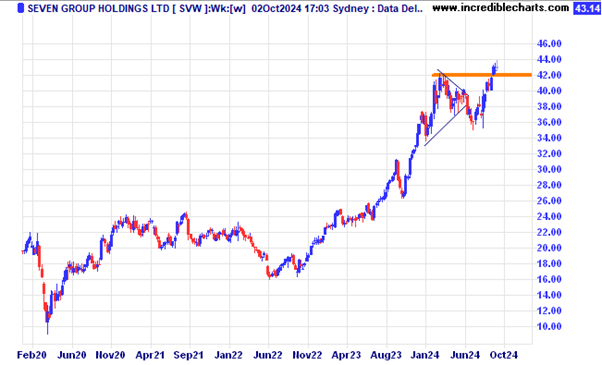

Seven Group is making fresh highs.

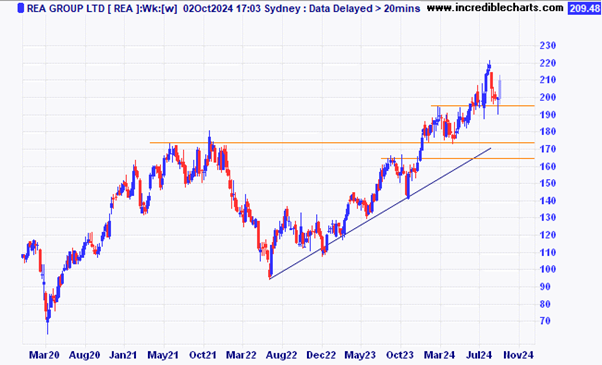

REA Group is up after news that their last bid for a UK company was knocked back.

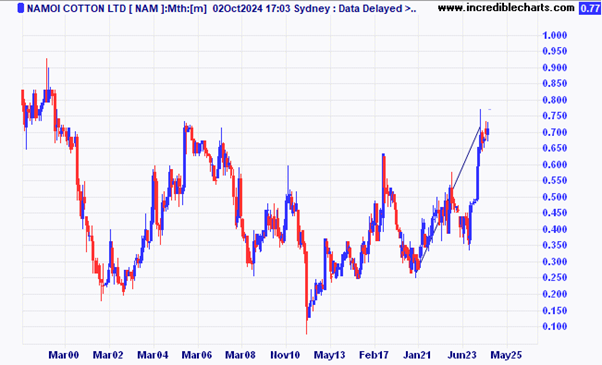

A look at the Namoi Cotton share price over the years.

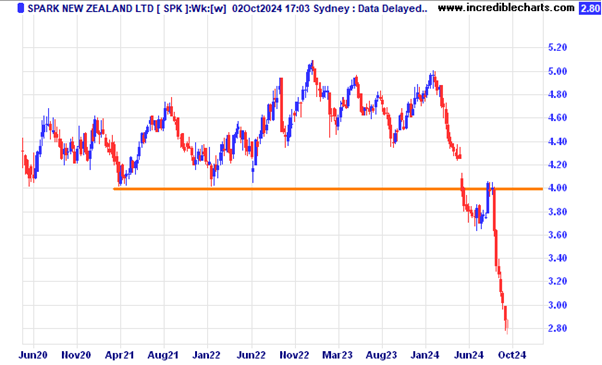

Spark New Zealand’s share price is a lot lower after moving down through the support zone.

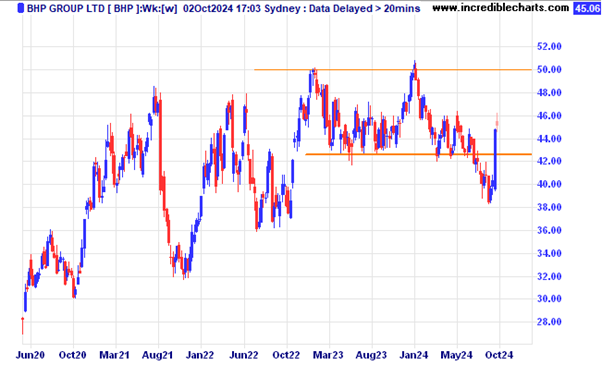

BHP Group is one of a lot of resource companies that rallied on the back of China’s recent stimulus package.

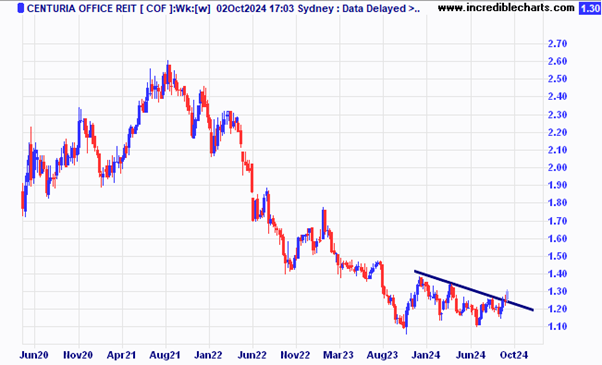

Centuria Office REIT has moved above the down trend line.

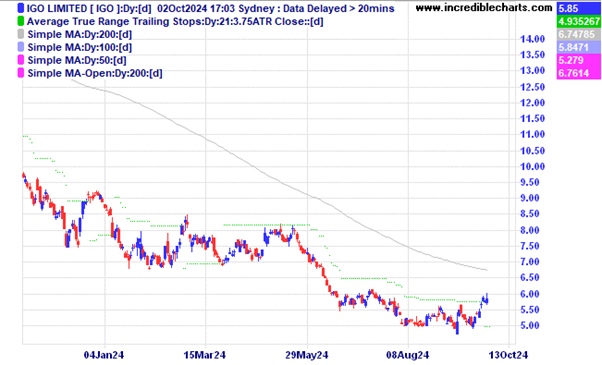

IGO looks to be forming a basing type of pattern.

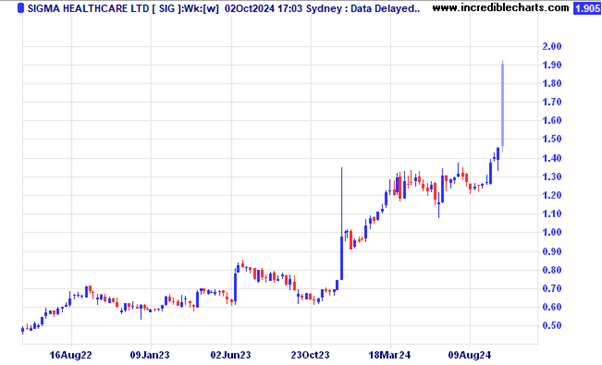

Sigma Healthcare moved higher after news the Chemist Warehouse deal became more likely.

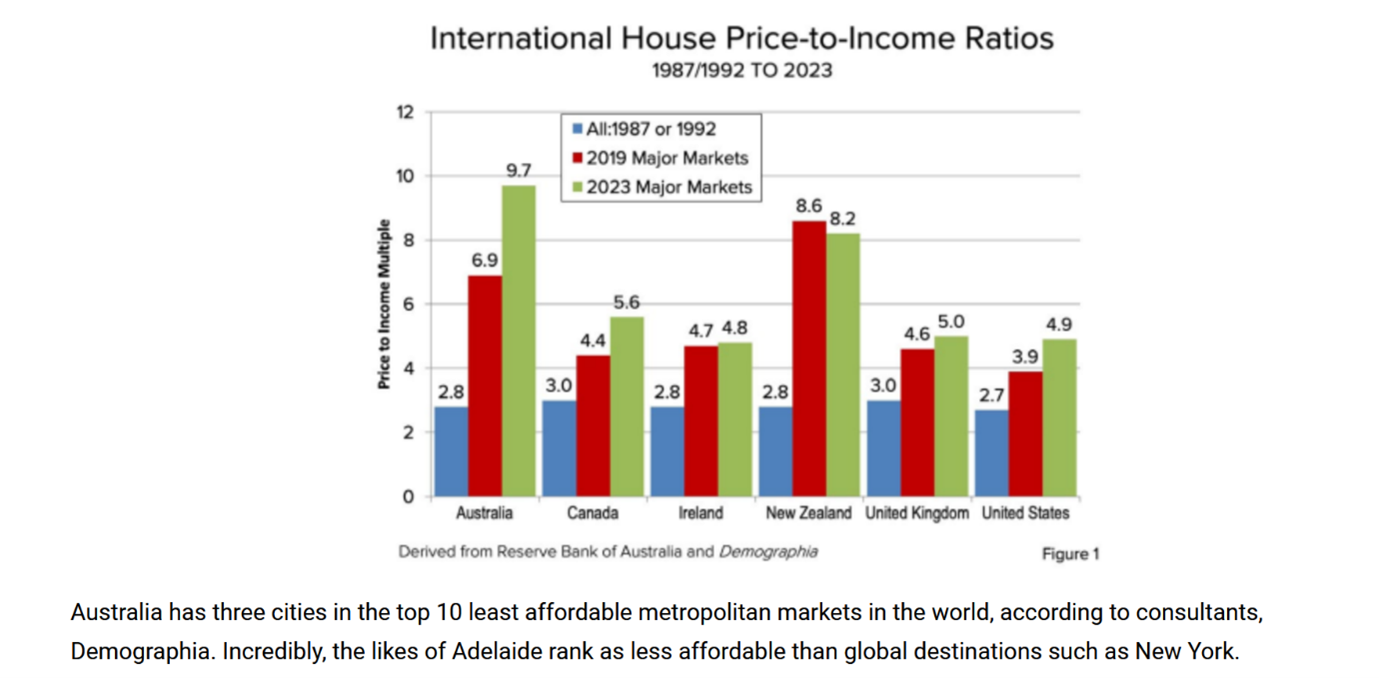

This chart shows a different look at Australia’s housing affordability compared to other countries. Australia’s residential real estate is valued at close to $11 trillion.

This interesting chart on the US dollar index comes from All Star Charts newsletter. Will it bounce, possibly due to a flight to safety as things heat up in the middle east or will it crumble?

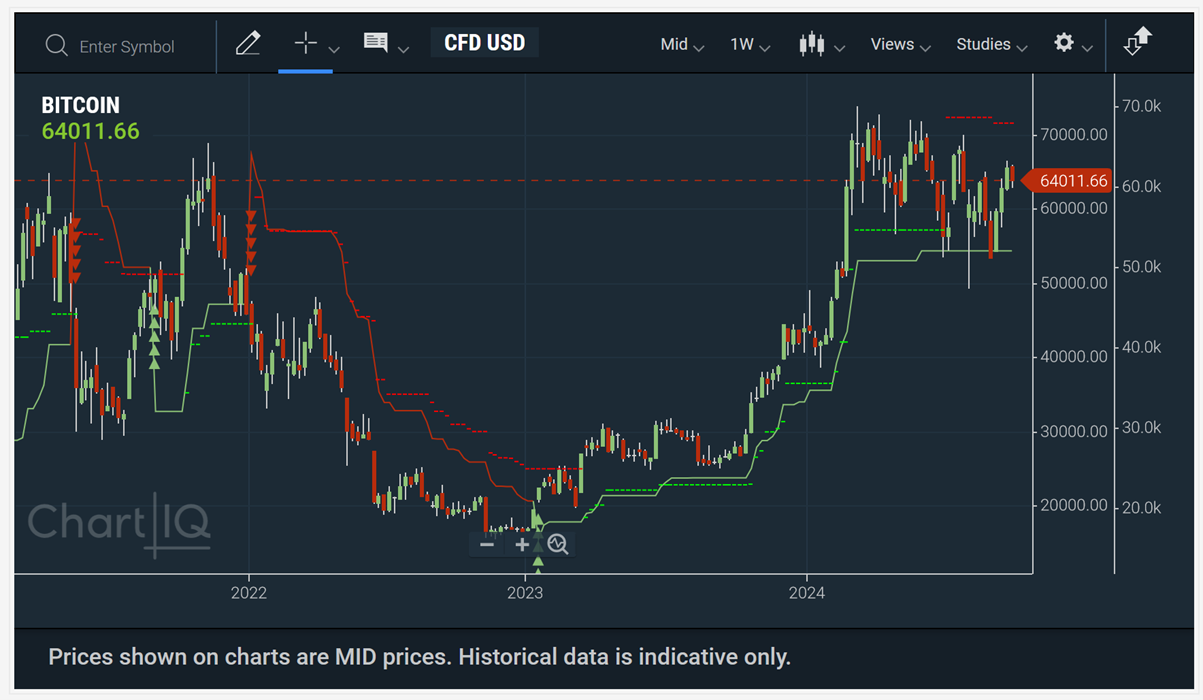

This weekly chart of Bitcoin shows the possible formation of a bullish cup and handle pattern.

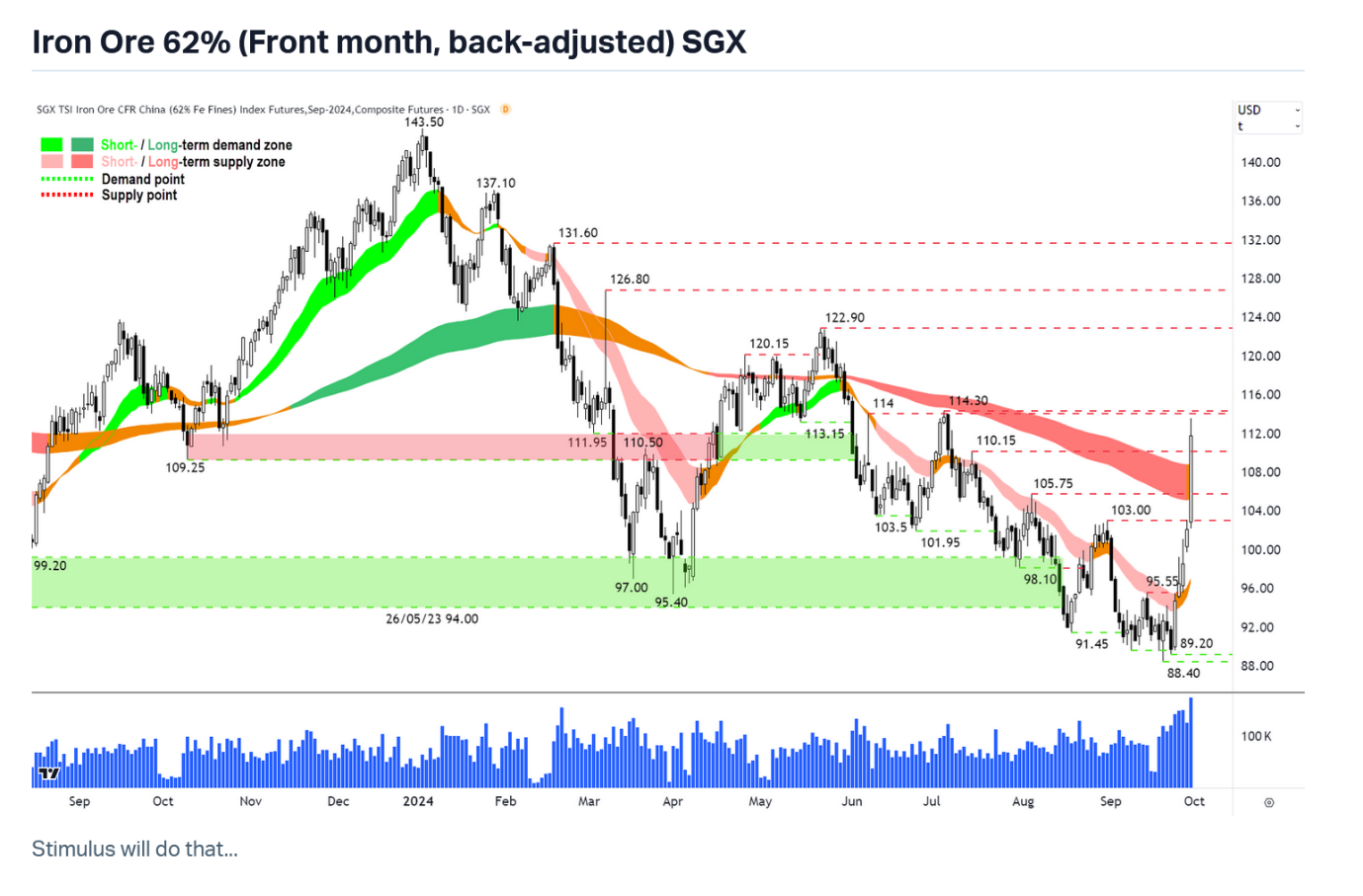

The iron ore futures price has shot up after China announced an economic stimulus package as this recent chart from Market Index shows.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here