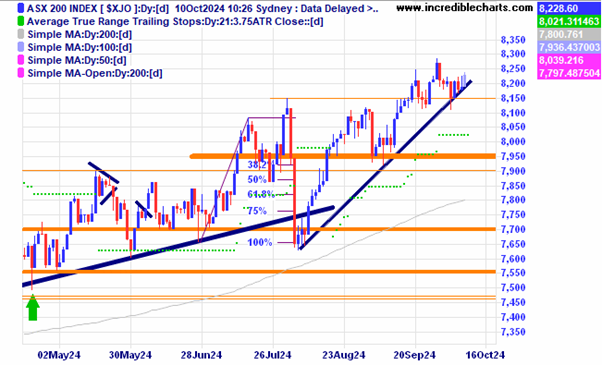

The local index has ticked up today and is not far away from fresh highs.

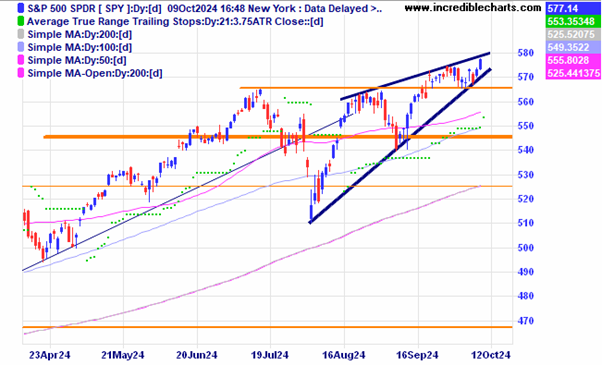

One analysts take on the SPY S@P 500 ETF is that the formation of this ascending wedge pattern could see some storms ahead if the pattern plays out, sometimes they do not go as expected.

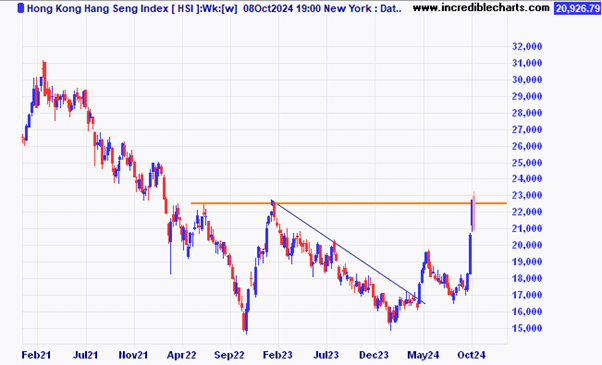

After the initial surge higher the Hong Kong index has run into a resistance zone at around the same time a second round of Chinese stimulus measures disappointed the markets.

Longer term Arcadium investors have seen shares soar over 90 per cent this week with Rio circling.

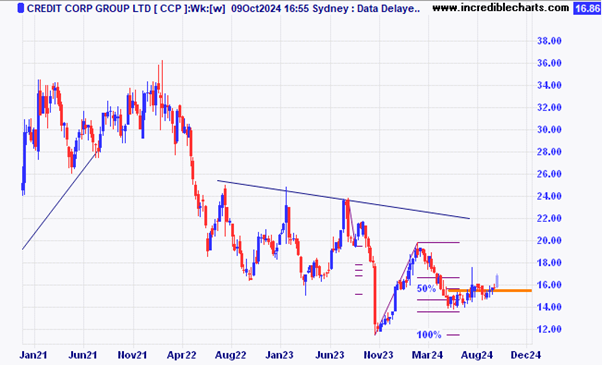

Credit Corp has moved higher.

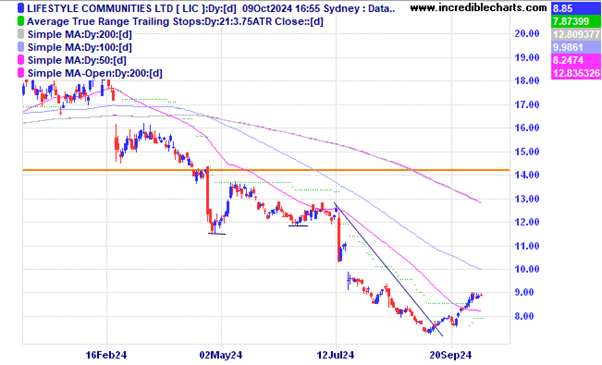

Lifestyle Communities is consolidating for now. A break higher could be interesting.

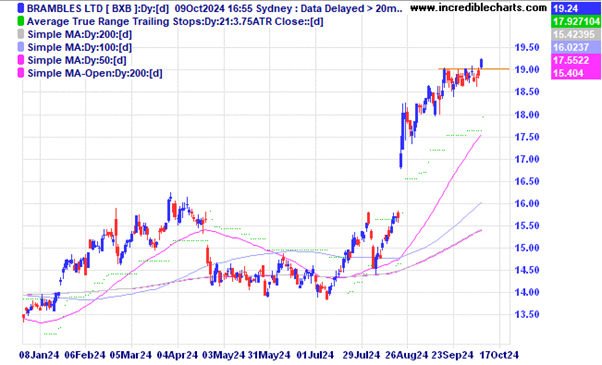

Brambles has nudged higher after some sideways consolidation.

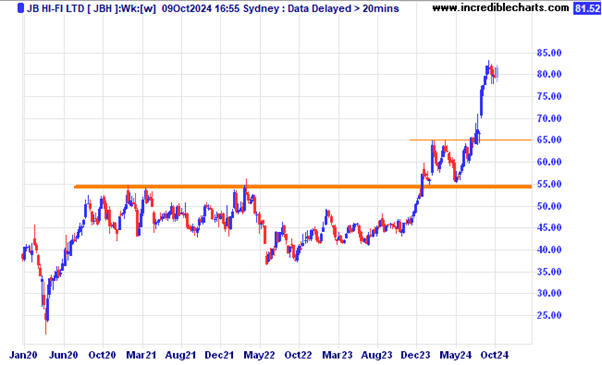

JB Hi-Fi is taking a breather after the run up.

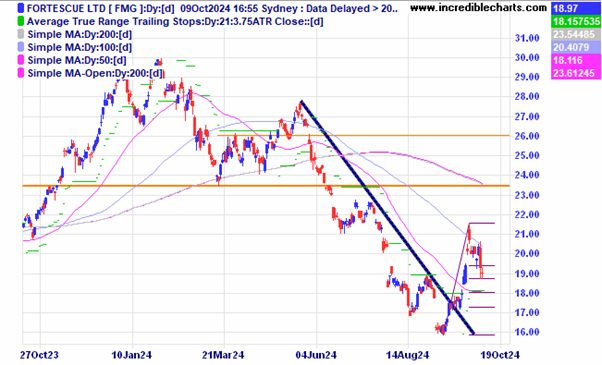

Fortescue is one of a number of resource stocks to fall after the initial move up on Chinese stimulus measures.

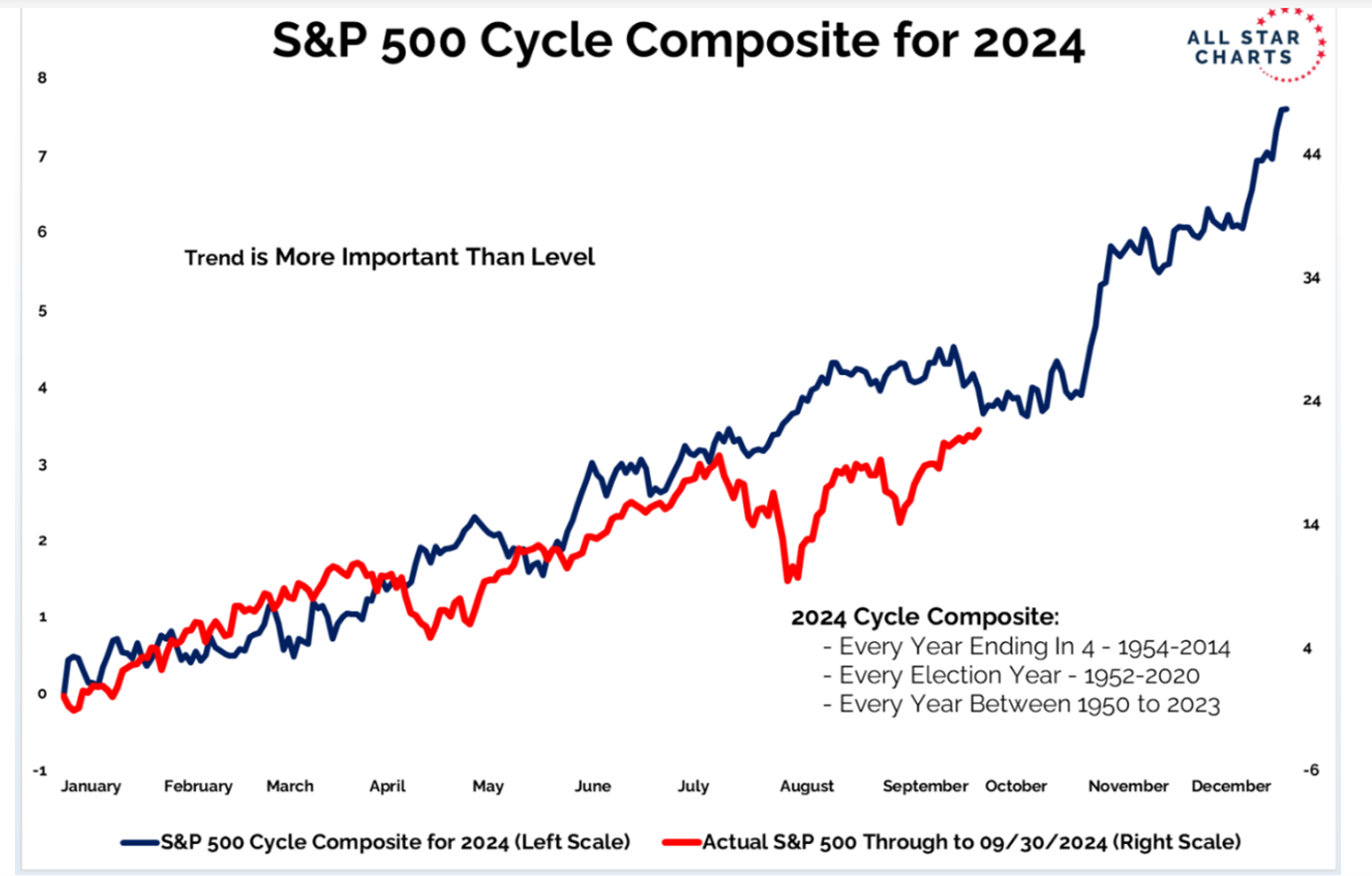

This a cyclical look at how 2024 is moving against a composite yearly cycle constructed at All Star Charts from a lot of previous yearly cycles.

A look at how some previous interest rate cutting cycles have played out for the US stock market. It must be noted that not all rate cutting cycles have seen the market move lower…the three most recent have, will that trend continue?

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here