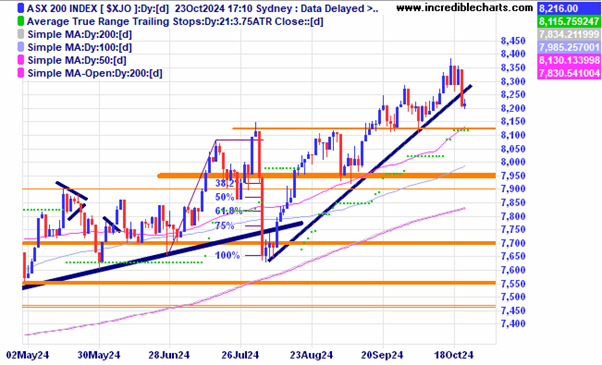

The local market has come off the highs and might settle at the closest support zone. Time will tell. The US indices mostly moved lower overnight and closed up slightly from the lows of the day.

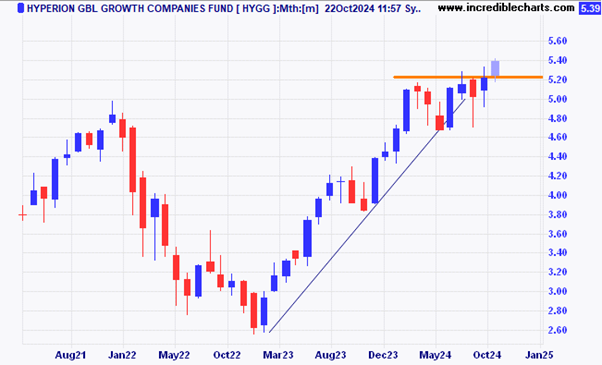

Hyperion Global Growth just made a fresh high after some consolidation.

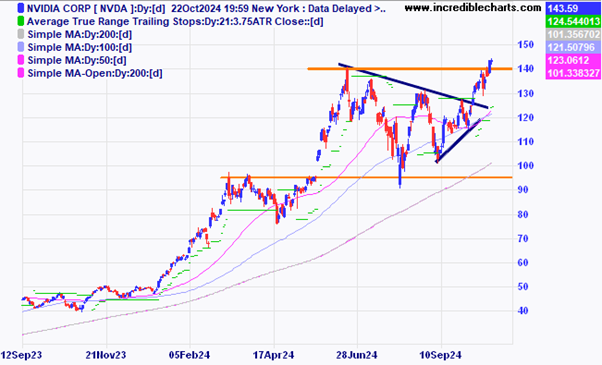

Interesting to see the much-hyped Nvidia nudge out a new high early in the week yet closed down overnight.

Opthea could be forming an ABC type pattern as it looks for a support zone for a possible bounce.

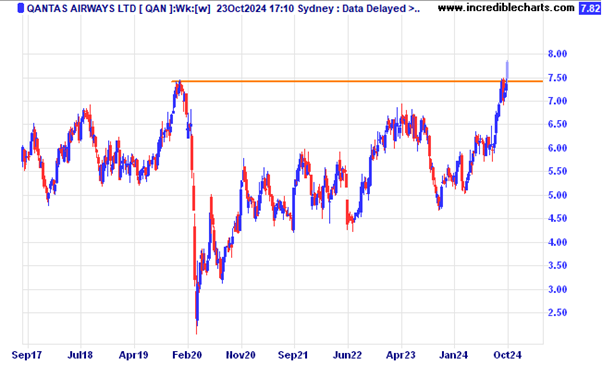

Qantas just hit a fresh high.

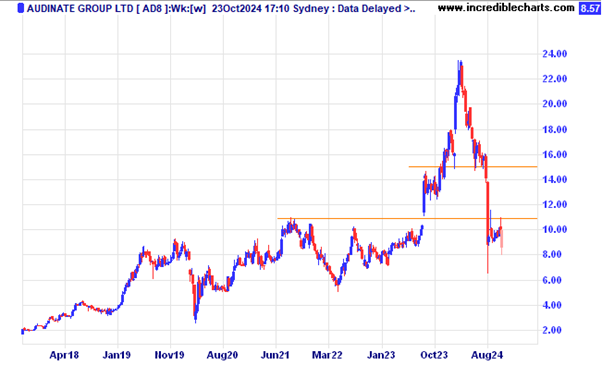

Audinate looks to be under pressure again after their latest update disappointed investors.

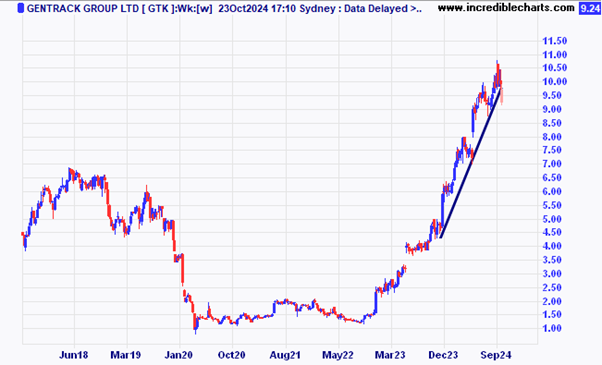

Gentrack’s steep rise looks to be taking a breather.

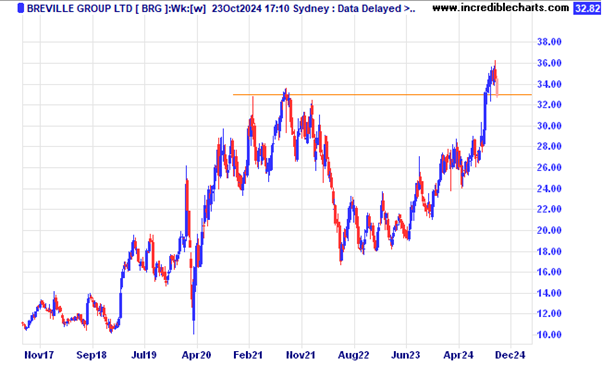

Breville is moving back towards the support/resistance zone.

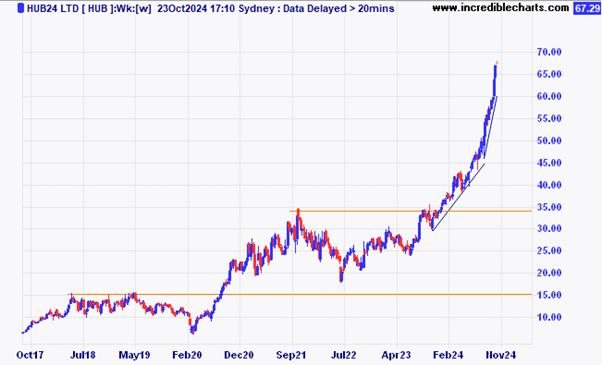

Wealth platform mob Hub24 has been going gangbusters this year. Parabolic moves don’t last forever.

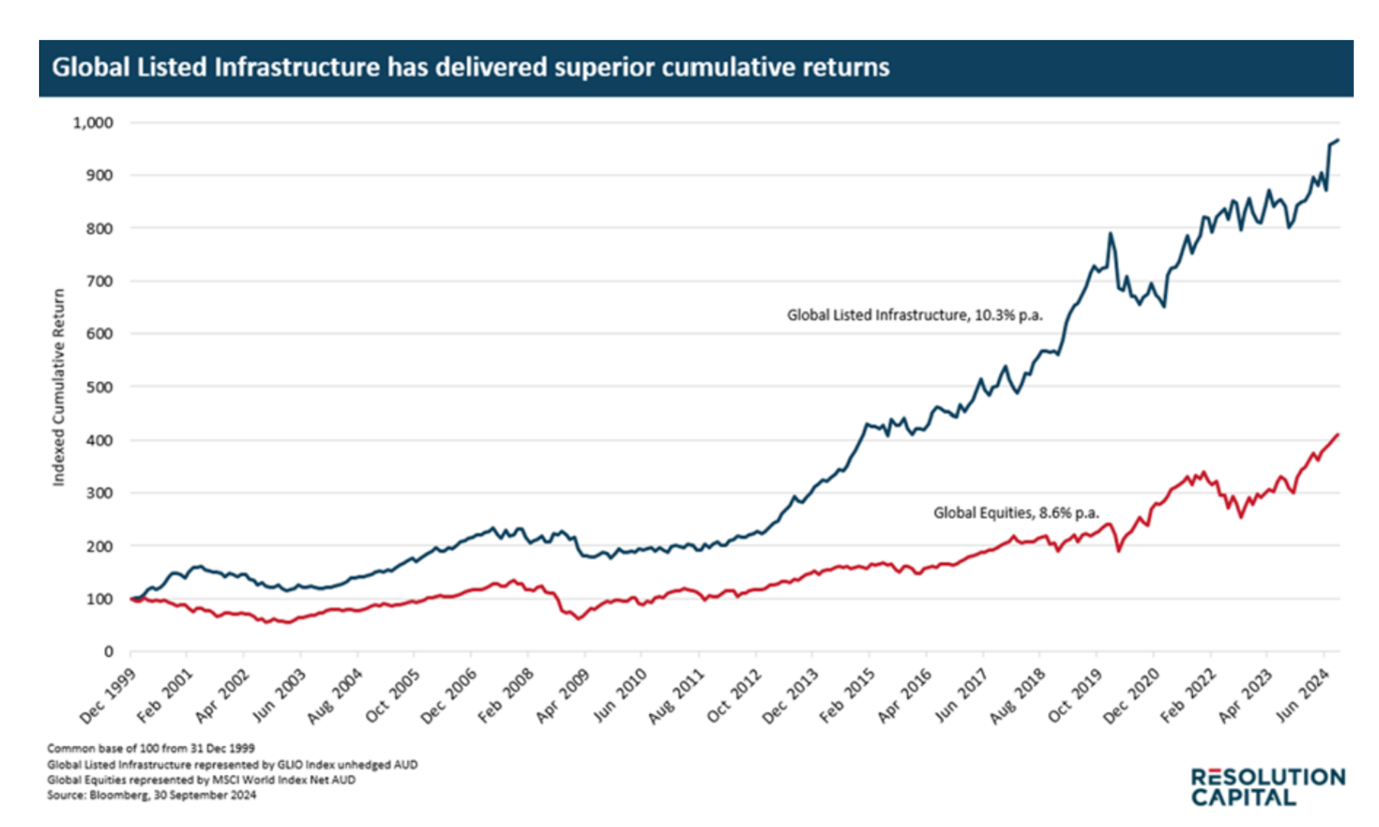

This chart shows global listed infrastructure has been outperforming global equities for the past 20 years.

An interesting look at rolling 10yr returns from the S@P 500. After a steep rise in returns comes a slowdown. The ebb and flow of markets. Goldman Sachs analyst David Kostin reckons the S@P 500 will grow at around 3 per cent the next decade. Time will tell.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here