The local market has largely moved sideways since the US election and this monthly chart shows the ASX 200 index close to the trend channels upper trend line where prices have retreated from in the past.

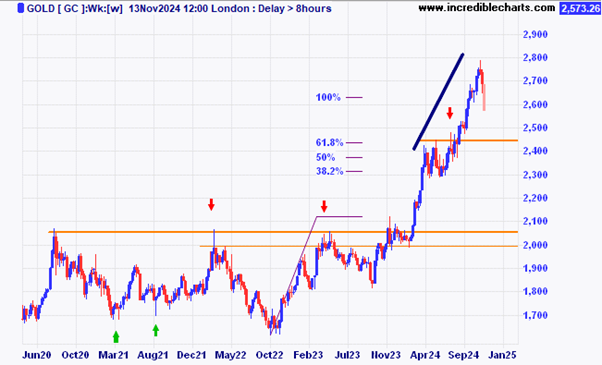

The price of gold has come down the last two weeks from the peak as a higher US dollar takes its toll on commodity prices.

The SPY ETF of the largest 500 US companies briefly hit the 600 level. Is now the time for a retracement?

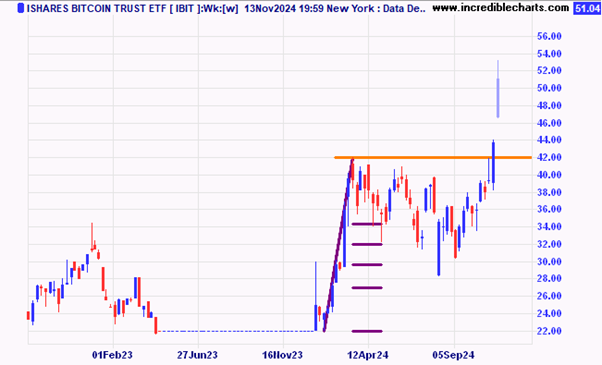

This ETF of IShares bitcoin trust shows the big jump in bitcoin the last two weeks.

Avita Medical just moved above a consolidation area.

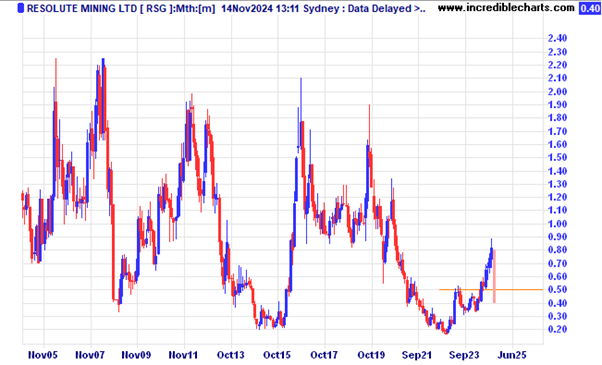

Resolute Mining was dumped after news some executives had been detained. Country risk at a dangerous level.

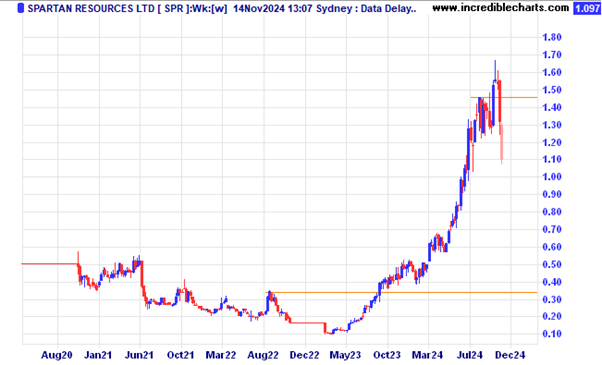

Spartan has come off the boil.

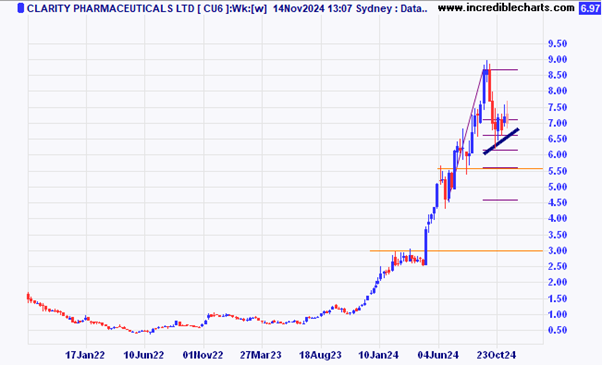

Clarity Pharmaceuticals could be forming a bearish type flag pattern.

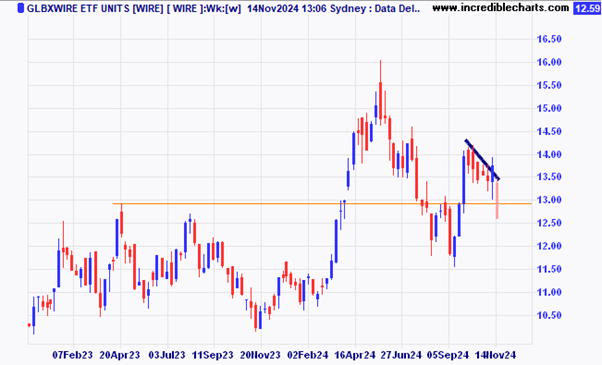

This copper ETF is down this week.

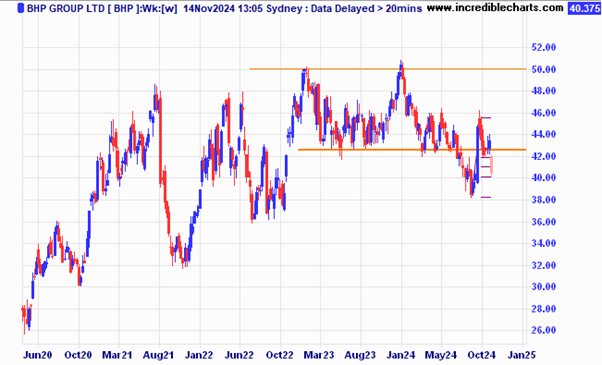

BHP is being hit by commodity price declines and worries of a possible US/China trade war.

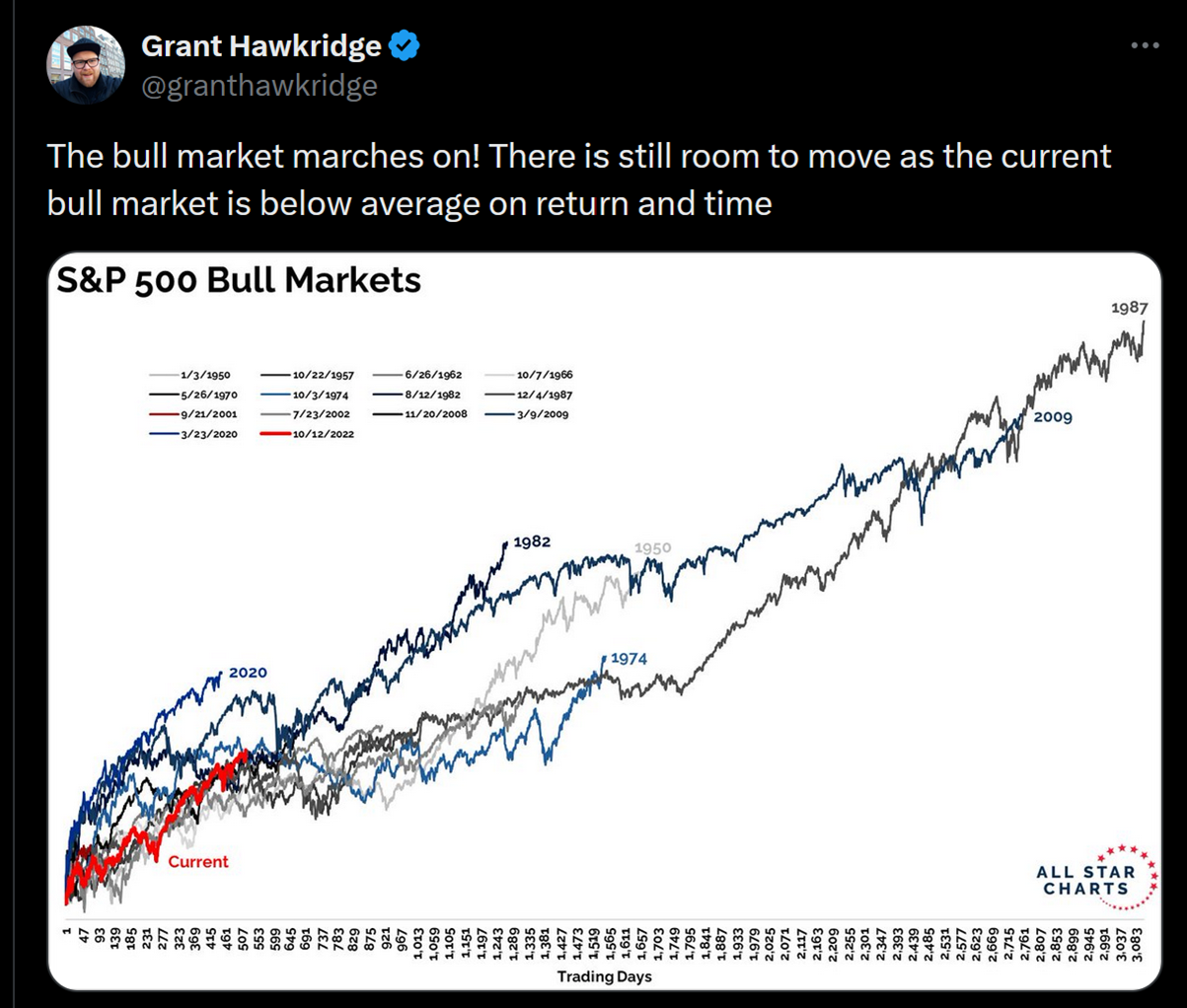

One look at this current bull market in US stocks compared to previous runs up.

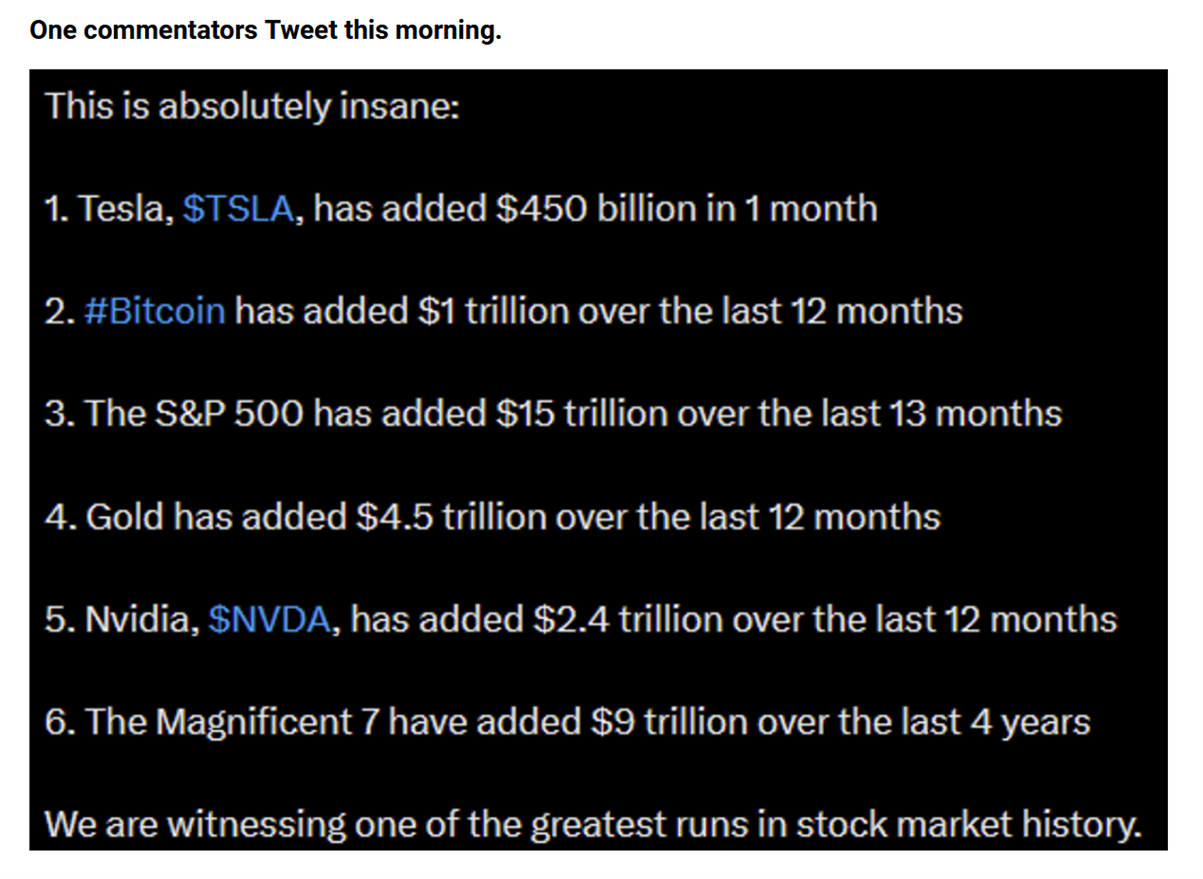

How some investments have gained over the past year or more.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here