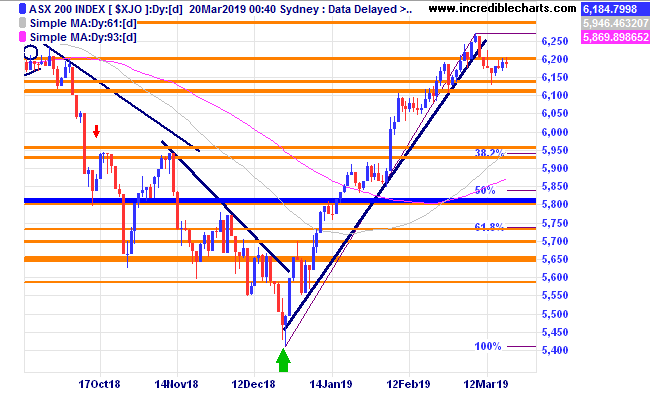

The local market has been drifting sideways for a few days trading in a 100 point range just above a previous support and resistance zone and below the strong uptrend line from the December lows as commentators ponder the next move.

The all-ordinaries accumulation index which keeps adding dividends along the way has recently reached a new

all-time high.

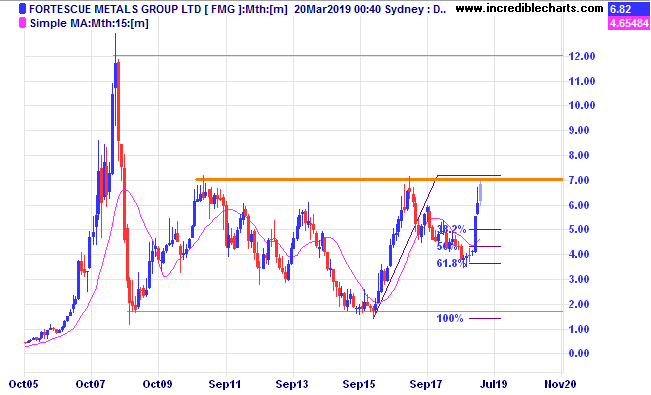

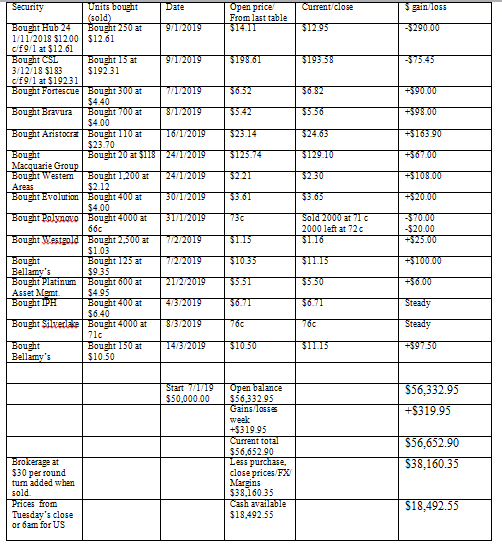

Fortescue Metals run could soon be over if price fails to breach previous high water marks around $7.

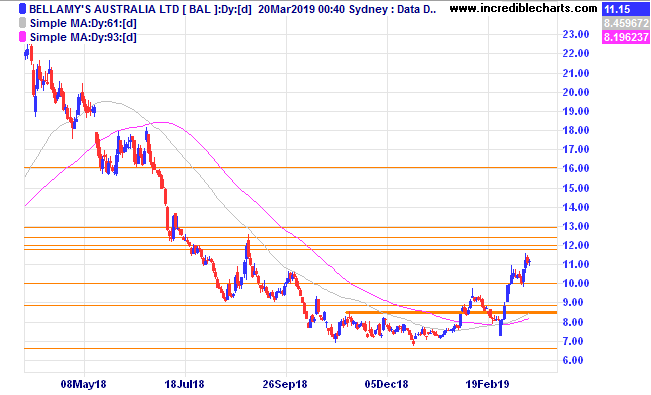

Bellamy’s has moved up quickly from the lows and we topped up our reduced holding with a tight stop in place as it approaches previous turning points.

We sold half the Polynovo stake when it fell below the most recent upwards trend line and will keep an eye on a possible re-entry point.

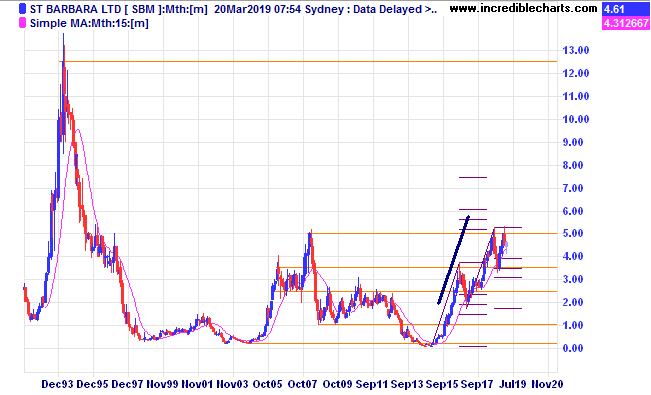

St Barbara gold is also having a tough time getting past old highs and if it should break through current resistance $12 would be an interesting target.

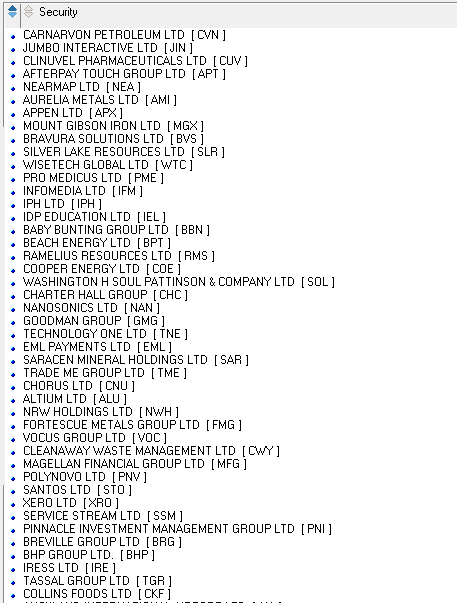

A list of the top gainers over the past 12 months from companies listed in the top 300 with gains of 237 per cent for Carnarvon down to 33 per cent for Collins Foods.

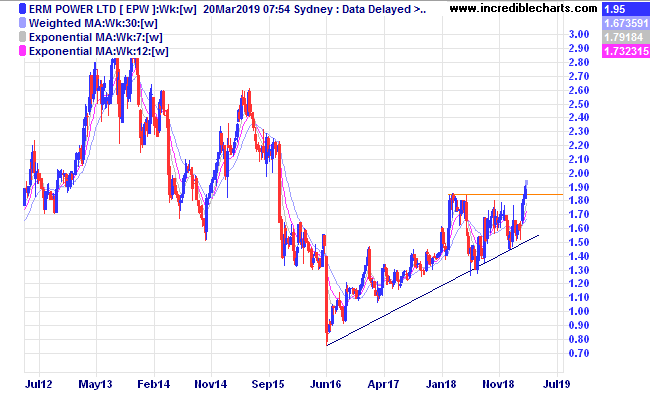

ERM Power shows an interesting break higher on the weekly chart.

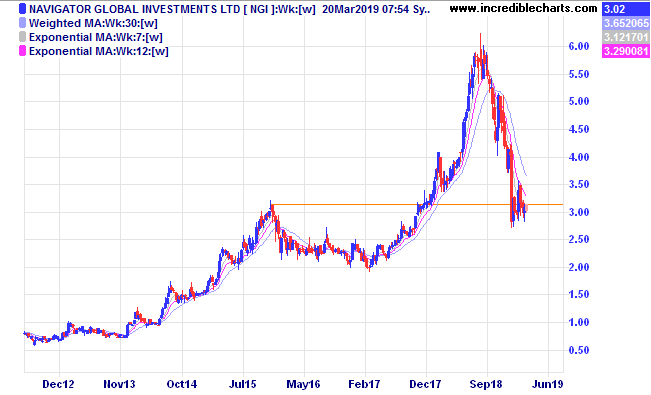

Navigator Global Investments looks to be consolidating at these levels.

US Ten Year interest rates have been moving down and have stalled at a previous inflection point.

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here