When things do not go in the right direction it is good to have a pre-determined exit point. With the S@P 500 trade things initially went as planned then some unexpectedly high employment numbers came out and the market turned south and we were stopped out. The market could provide another entry point and with the Federal Reserve chairman due to speak it could be a volatile time and for now we will stand aside.

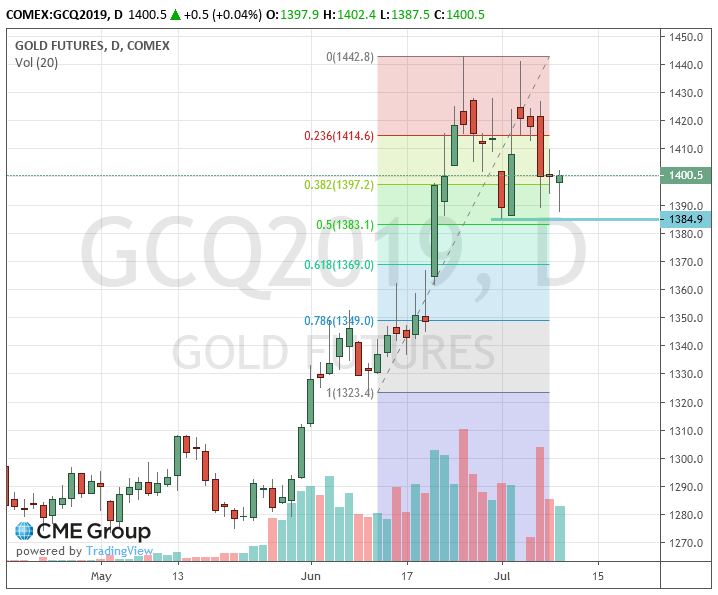

The gold market looks to be at an interesting juncture having retraced to the 50 per cent level of the last range up and could be seen as a way to play lower interest rates.

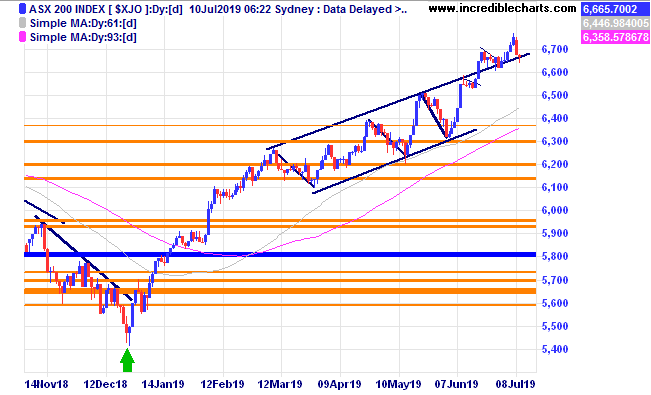

The local market has fallen from recent highs and is still close to the top line of the trend channel.

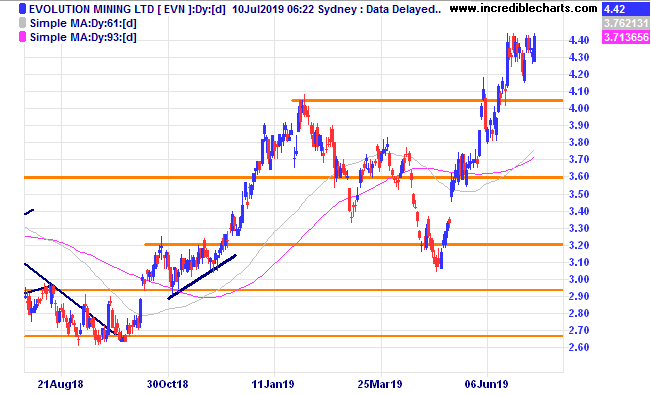

The price of Evolution has been in a sideways congestion for a while with quite a few gold stocks forming interesting patterns.

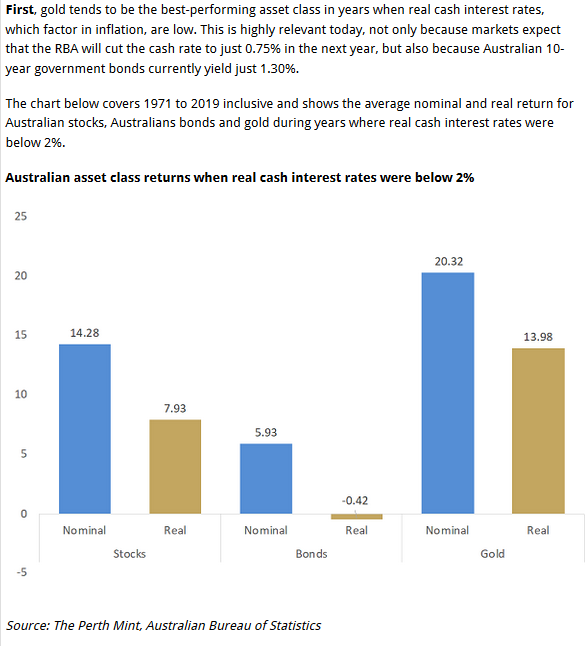

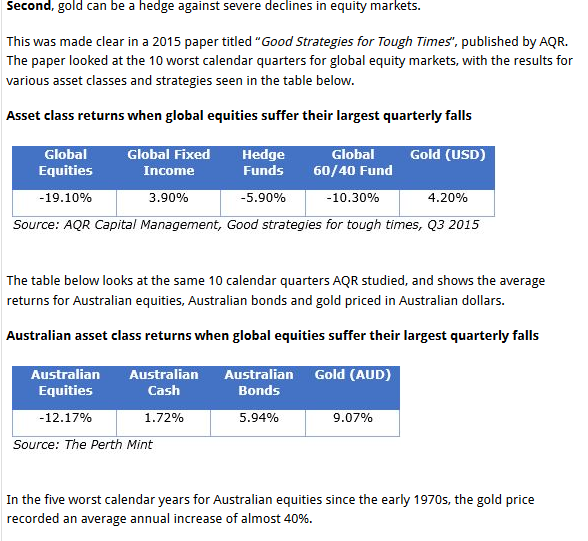

Shown below are some interesting statistics on how the price of gold moves when equites are under pressure and interest rates are relatively low. Correlation is not necessarily causation so traders need to be aware of the risks.

Gold can do well when equites markets are performing poorly.

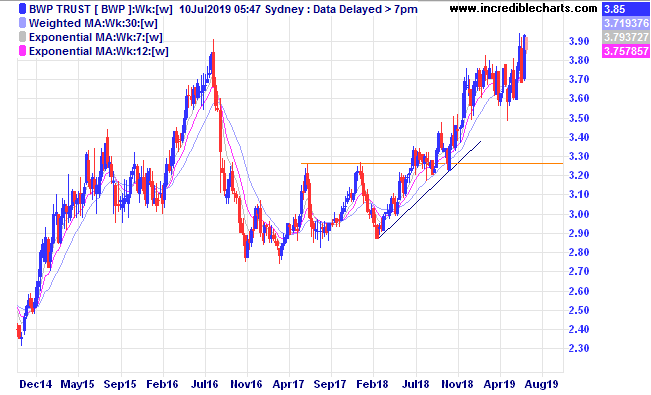

Can the chase for yield push property trusts like BWP higher?

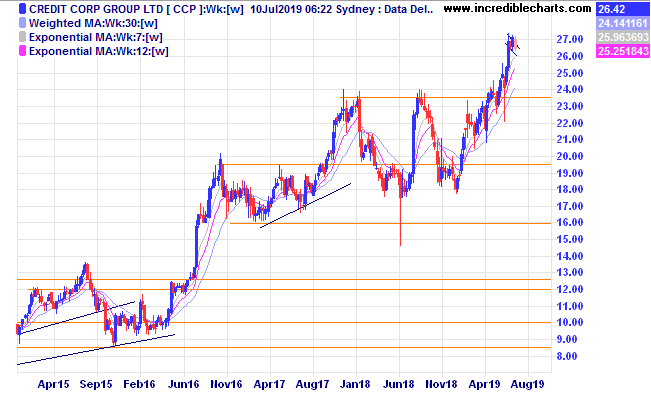

Credit Corp could be forming a bullish flag type pattern.

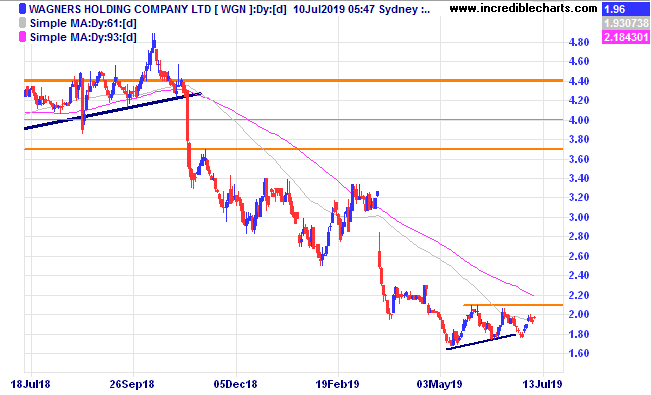

Wagners looks to be forming a possible basing pattern.

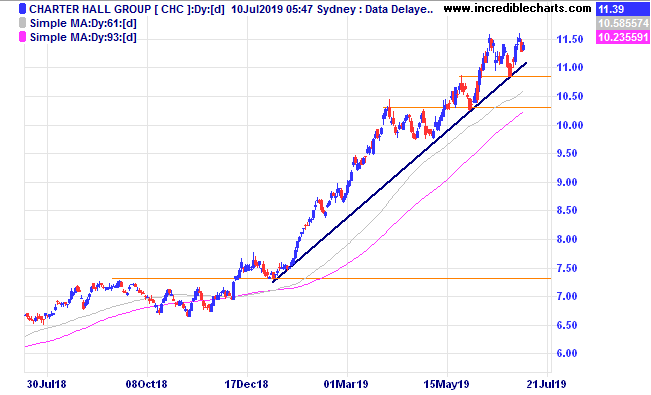

We bought a parcel of Charter Hall as it continues to bounce up from the trend line.

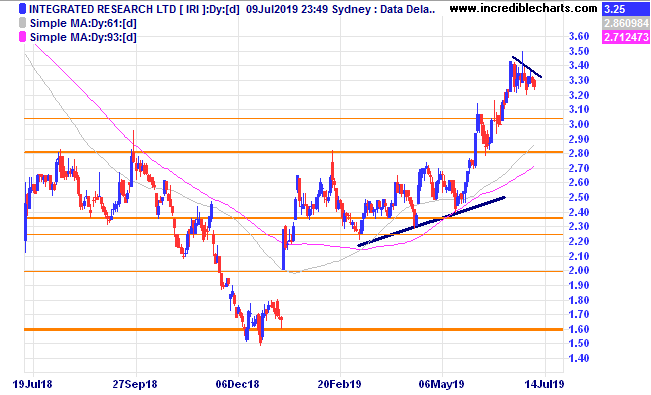

Integrated Research looks to be forming a possible continuation pattern.

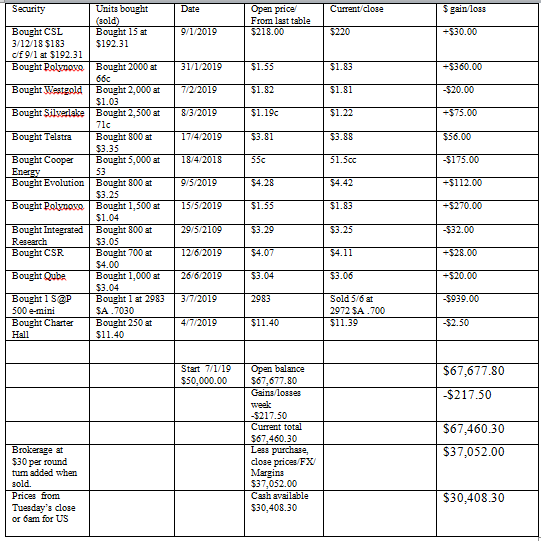

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here