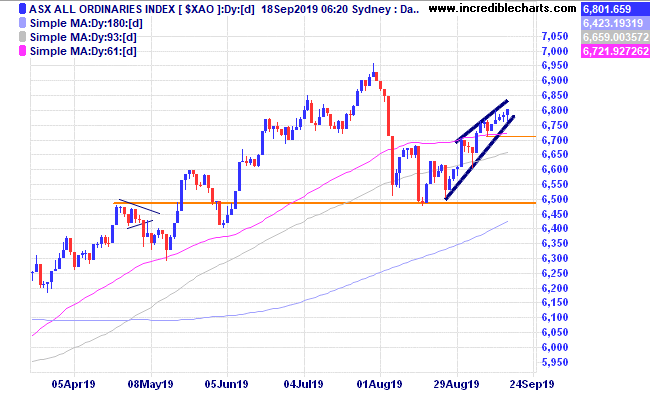

The local market has been inching slowly up after the swift decline in early August and then forming a small basing pattern. It looks like a rising wedge type pattern forming and prices could break either way.

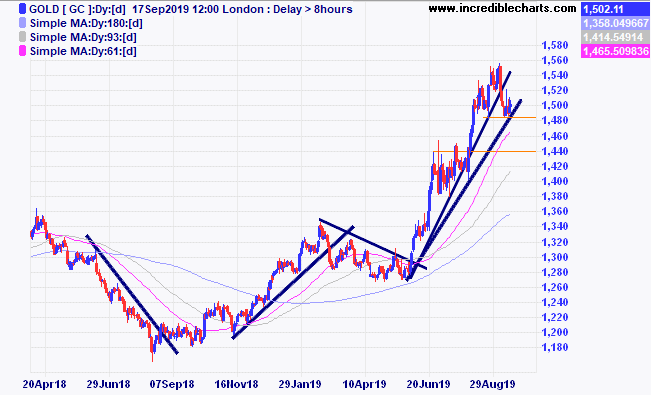

The price of oil and gold have retreated after the initial jump in prices. The gold price is currently holding support and could retrace further if broken as seen on the daily chart.

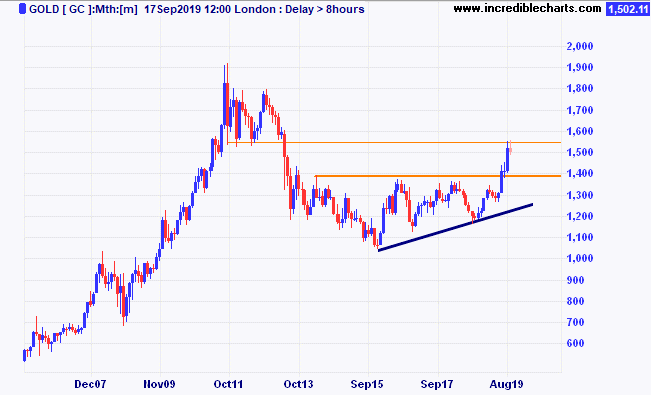

On a longer-term monthly chart the price just touched a possible resistance zone and a retracement to down near the breakout level could set this market up for further gains over the longer term.

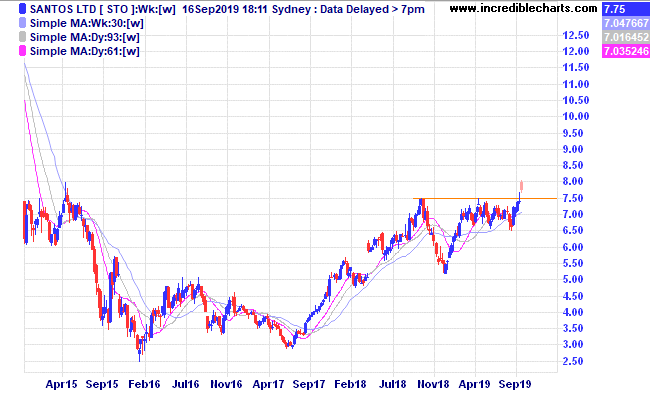

Santos moved up out of the recent sideways pattern and we bought a parcel for the educational portfolio. After long periods of consolidation prices can move quickly and you take your chances when opening any position. Traders like to keep risks small and it is by taking a lot of small risks and trades over time that you can make the markets work in your favour. No-one has a crystal ball and you never really know which way it will work out, some might say it is a lot of “educated guesses” which in essence it is even when you take positions in the direction of the prevailing trend.

Wagners could be building a basing pattern.

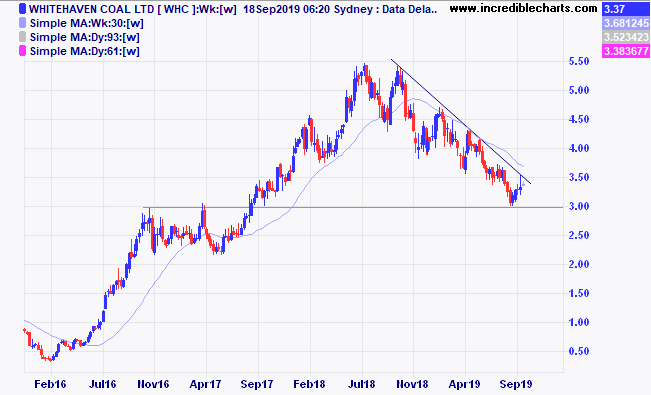

We bought a parcel of Whitehaven Coal in anticipation of a breakout above the trend line after price moved up from a possible support level.

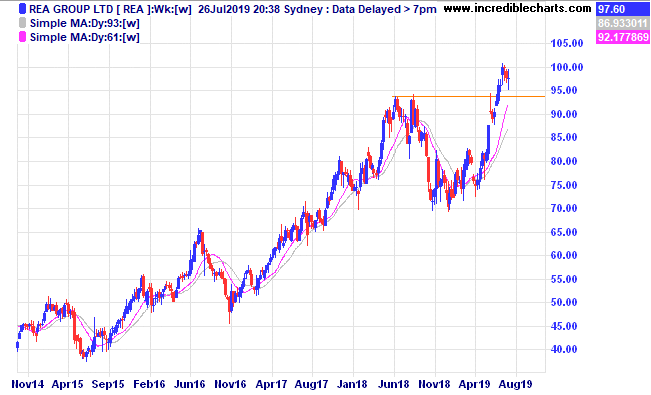

REA Group looks to be consolidating the recent break higher.

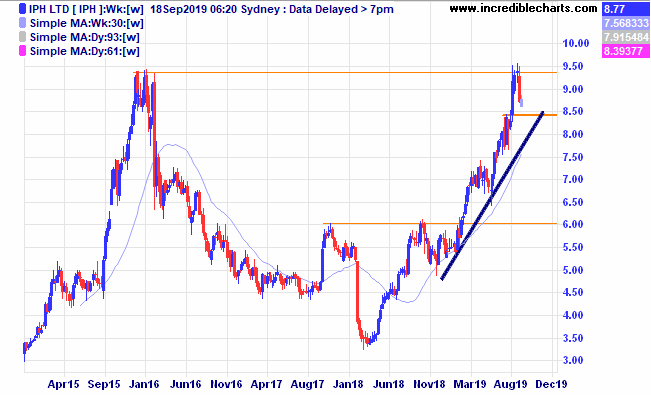

IPH has an interesting pattern on the weekly chart with prices moving down from all-time highs, traders will be keeping a watch on how far this will fall.

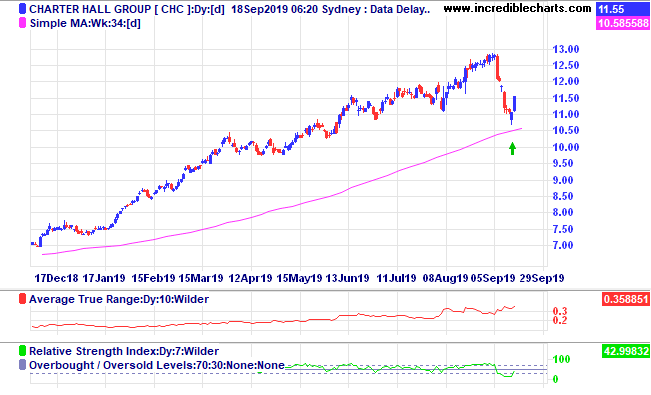

Charter Hall fell through two of our support levels and we were stopped out.

Another way of looking at Charter Hall is that it has just bounced up from the longer-term moving average. It all depends on your time perspective as to what you do as a trader or investor.

Polynovo has had a stellar year and is up close to 50 per cent from when we exited our position. You don’t always get it exactly right though we still made a good profit on the stock.

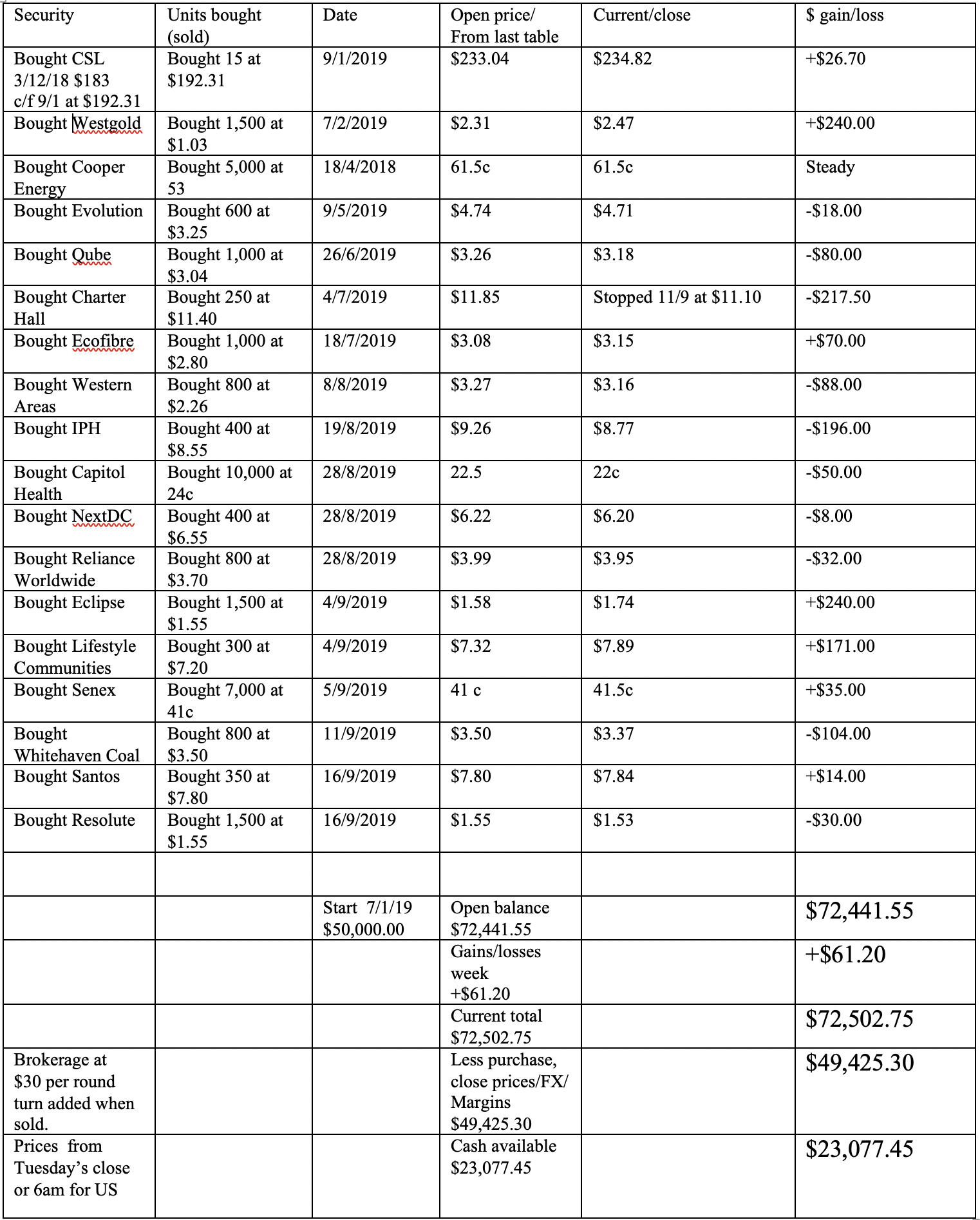

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise…Cheers Charlie.

To order photos from this page click here