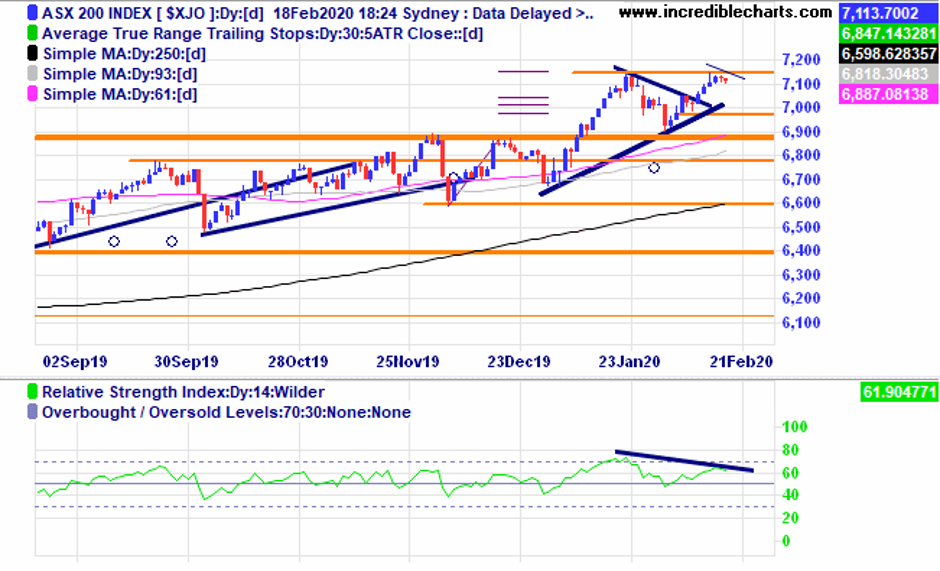

The local market remains close to recent highs and could potentially be forming a double top pattern. World share markets have managed to hold steady as the coronavirus drama in China continues to unfold and companies start to report the potential ramifications under the continuous disclosure regime. RSI divergence shows the possibility of a weakening market. The educational portfolio sold 8 ASX 200 cfd’s on Monday to hedge our positions. Further action on this front may well be needed. Time will tell.

Palladium has again hit new yearly highs and continues the strong run up.

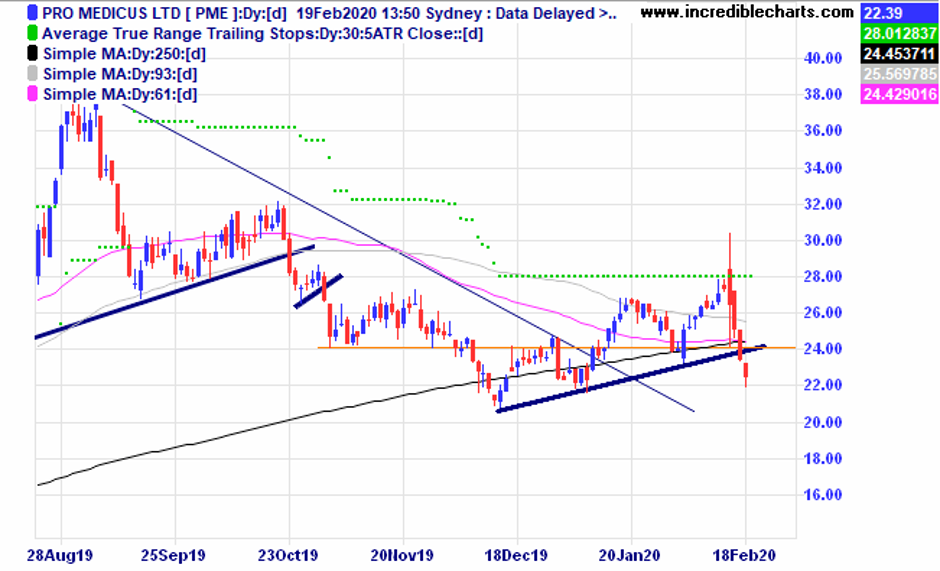

Our position in Pro Medicus started well and then had a volatile day when results were released. It then turned down below possible support levels and we were stopped out.

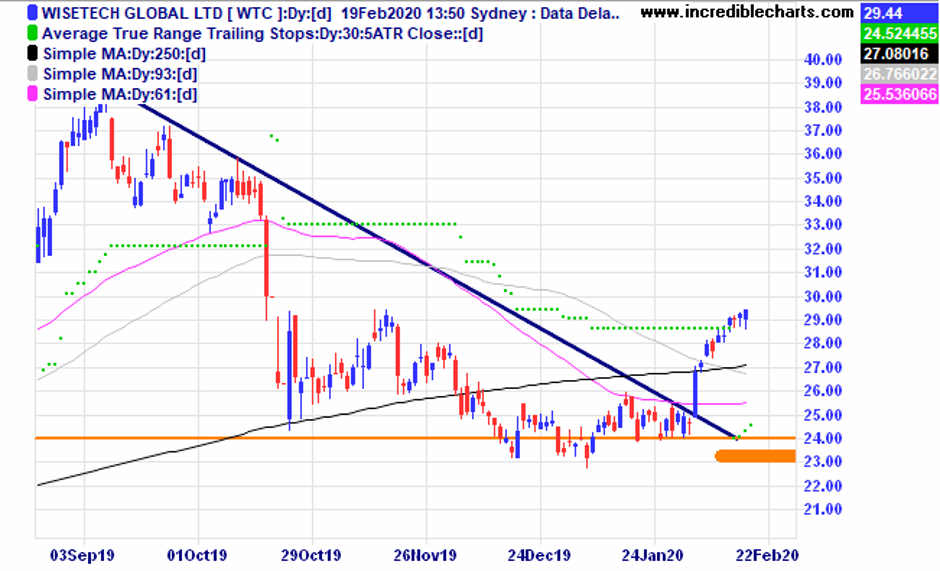

Wisetech Global is down 20 per cent at the latest quote to just over $23.00 after results came out today and we closed our position to be updated in the next table.

Newcrest Mining has not been performing well and briefly moved below our stop loss point. We sold our position today.

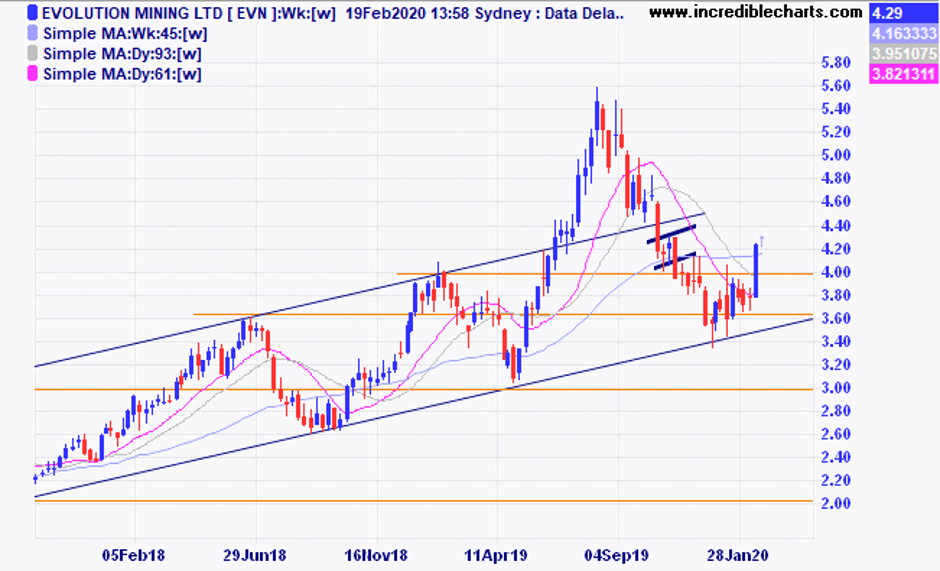

Other gold mining companies have been performing well including Evolution which has bounced nicely from the ongoing trend line and above a resistance zone. We bought a parcel today.

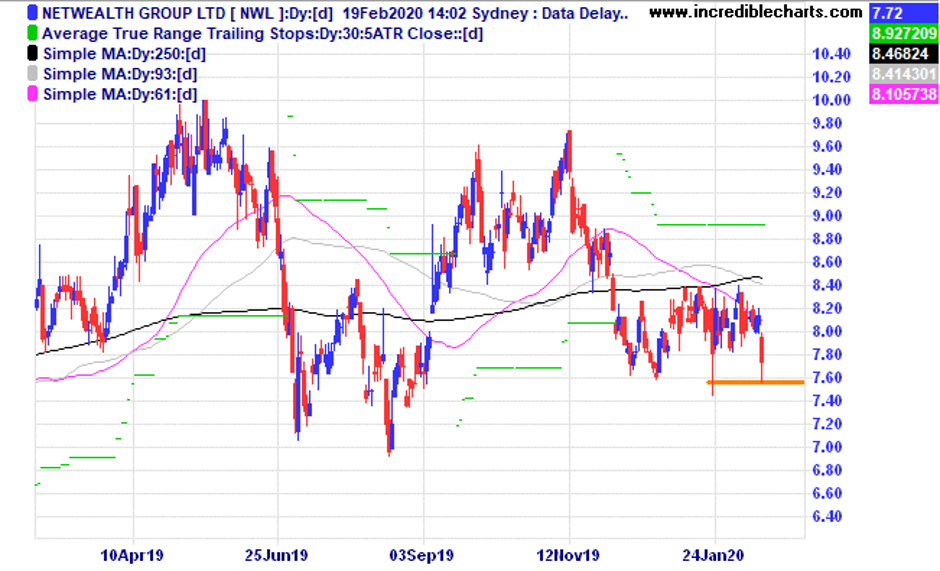

Netwealth is up around 10 per cent today.

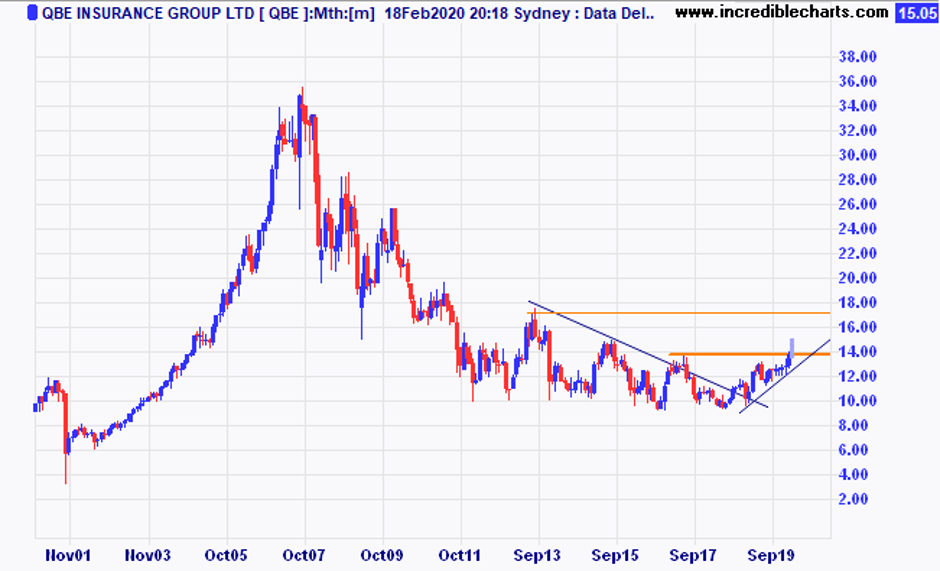

Insurer QBE has moved up out of congestion and we bought a parcel today.

IPH has made a fresh yearly high and we bought some today.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $325.73 | $331.17 | +$54.40 |

Bought Westgold c/fwd 3/1 at $2.33 | Bought 1,000 at $1.03 7/2/2019 | 7/2/2019 | $2.20 | $2.14 | -$60.00 |

Buy Wagners c/fwd $2.73 | Bought 1,000 at $1.75 on 16/10/2019 | 16/10/2019 | $1.90 | $1.85

| -$50.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $71.85 | $71.58 | -$10.80 |

Bought Newcrest Mining c/fwd 3/1 at $30.44 | Bought 100 at $30.20 31/12/2019 | 31/12/2019 | $29.80 | $27.39 | -$241.00 |

Bought Resolute Mining | Bought 2,000 at $1.25 | 8/1/2020 | $1.13 | $1.12 | -$20.00 |

Bought Appen

| Bought 100 at $25.00 | 16/1/2020 | $26.77 | $26.05 | -$72.00 |

Bought Capitol Health | Bought 8,000 at 25.5c | 5/2/2020 | 25.5 c | 28 | +$200.00 |

Bought EML Payments | Bought 500 at $5.40 | 5/2/2020 | $5.26 | $5.55 | +$145.00 |

Bought City Chic

| Bought 900 at $3.20 | 5/2/2020 | $3.10 | $3.10 | Steady |

Bought Pro Medicus

| Bought 100 at $25.60 | 5/2/2020 | $27.07 | Stopped 17/2 at $22.30 | -$517.00 |

Bought Polynovo

| Bought 700 at $2.90 | 5/2/2020 | $3.00 | $3.09 | +$63.00 |

Bought Wisetech

| Bought 100 at $28.30 | 12/2/2020 | $28.30 | $29.44 | +$114.00 |

Sold 8 ASX 200 cfd’s

| Sold 8 at 7,125 | 17/2/2020 | 7,125 | 7,113 | +$96.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $51,495.50 |

|

|

| $51,495.50 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$298.40 |

|

|

| -$298.40 |

| Current total $51,197.10 |

|

|

| $51,197.10 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $37,385.90 |

|

|

| $37,385.90 |

Prices from Tuesday’s close or 6am for US | Cash available $13,811.20 |

|

|

| $13,811.20

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise…

Cheers Charlie.

To order photos from this page click here