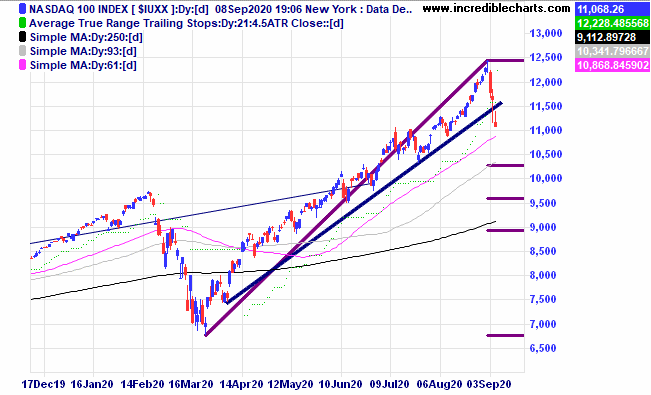

The Nasdaq Index in the US which has been leading world markets higher off the March low is looking stretched and closed lower again last night and has now moved below the uptrend line. Even a small 32 per cent retracement of the run up could see it move down towards the 10,200 level.

The following chart shows how fast this rally has been compared to previous recoveries after a bear market. Some might say a correction is overdue.

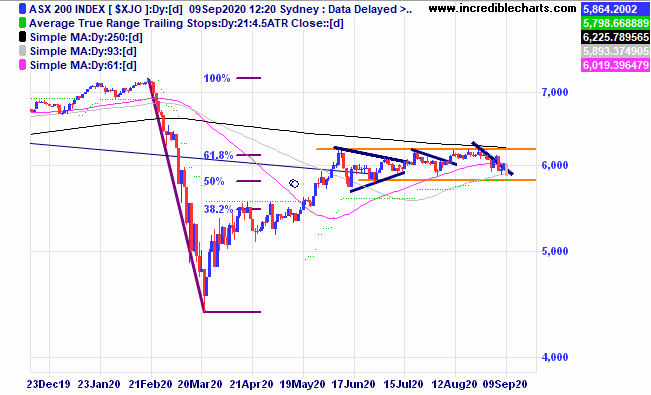

Despite the big drop in the index today the local market continues to trade within a sideways range. Can it rebound yet again or will the index finally fall through support? We bought back the small short position in the ASX 200 cfd’s as price bounced up from the lower support zone.

The strong Bear fund gives investors exposure to a down trending market without the volatility of cfd’s. We bought a big parcel late on Monday after price moved above the down trend line and formed a higher low. The ATR trailing stop is yet to trigger a reversal.

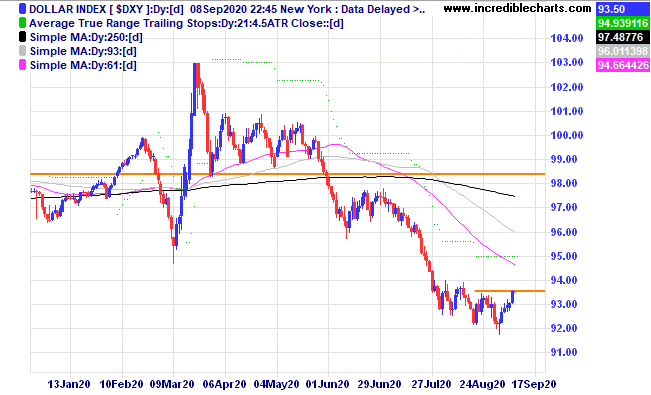

The US Dollar Index looks to be gaining strength and a break above resistance could put the Australian Dollar ETF under pressure.

A few shares were looking close to a buy before today’s decline including Credit Corp.

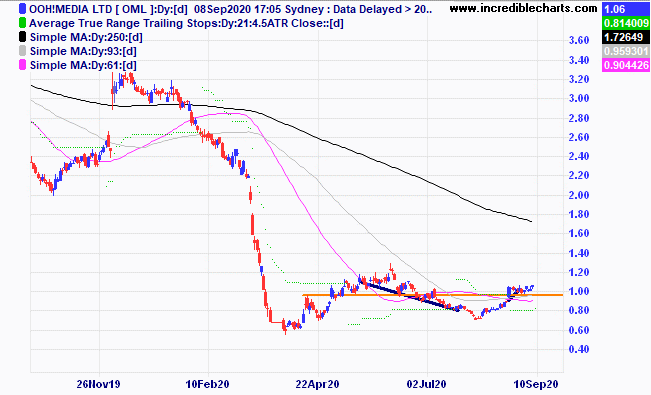

OOH Media again looks to be on the move higher.

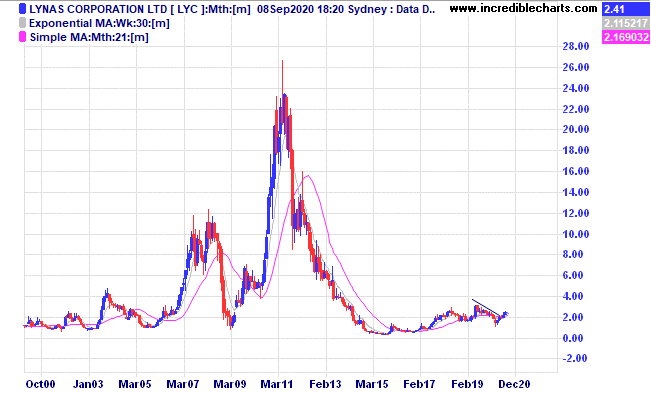

A monthly chart of Lynas Corporation shows the current rally could be just beginning.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $281.67 | $288.17 | +$65.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $58.28 | $59.45 | +$46.80 |

Bought Evolution

| Bought 400 at $3.98 | 24/3/2020 | $5.62 | $5.61 | -$4.00 |

Bought Silverlake

| Bought 1,500 at $1.41 | 24/3/2020 | $2.23 | $2.26 | +$45.00 |

Bought Nickel Mines

| Bought 6,000 at 52.5c | 29/4/2020 | 71 | 70 | -$60.00 |

Bought Aristocrat Leisure | Bought 100 at $26.80 | 19/5/2020 | $27.67 | $29.34 | +$167.00 |

Bought Stavely

| Bought 4,000 at 56c | 11/6/2020 | 53 | 52.5 | -$20.00 |

Bought Ardent Leisure | Bought 3,000 at 40c | 1/7/2020 | 42.5 | 44c | +$45.00 |

Bought Flight Centre

| Bought 150 at $11.50 | 1/7/2020 | $12.47 | $13.50 | +$154.50 |

Bought Galaxy

| Bought 2,500 at $1.16 | 5/8/2020 | $1.24 | $1.36 | +$300.00 |

Bought Integrated Research | Bought 700 at $4.40 | 5/8/2020 | $4.26 | Sold 3/9 at $4.10 | -$142.00 |

Bought NextDC

| Bought 250 at $11.97 | 5/8/2020 | $11.88 | Sold 2/9 at $11.20 | -$195.00 |

Bought Ardent Leisure | Bought 1,500 at 35c | 6/8/2020 | 42.5c | 44c | +$22.50 |

Bought Pro Medicus

| Bought 100 at $25.30 | 19/8/2020 | $26.25 | $25.90 | -$35.00 |

Bought Aust Dollar ETF AUDS | Bought 500 at $10.49 | 31/8/2020 | $10.64 | $10.24 | -$200.00 |

Bought Costa Group

| Bought 700 at $3.65 | 2/9/2020 | $3.65 | $3.55 | -$70.00 |

Sold 4 ASX 200 cfd’s

| Sold 4 at 6,050 | 2/9/2020 | 6,050 | 7/9 Bought 4 at 5,950 | +$370.00 |

Bought BBOZ Strong Bear ETF | Bought 500 at $8.40 | 7/9/2020 | $8.40 | $8.19 | -$105.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $70,534.65 |

|

|

| $70,534.65 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$384.80 |

|

|

| +$384.80 |

| Current total $70,919.45 |

|

|

| $70,919.45 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $39,567.70 |

|

|

| $39,567.70 |

Prices from Tuesday’s close or 6am for US | Cash available $31,351.75 |

|

|

| $31,351.75

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here