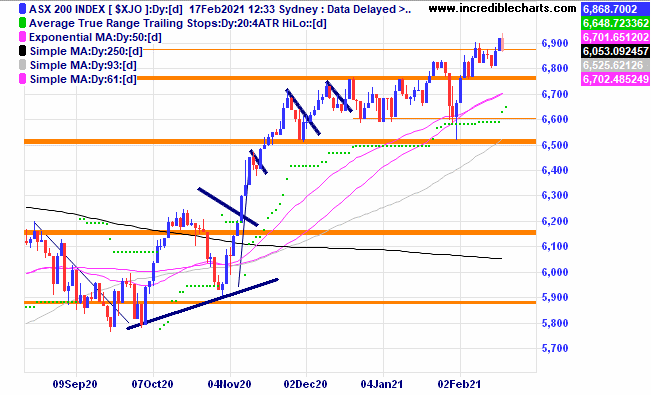

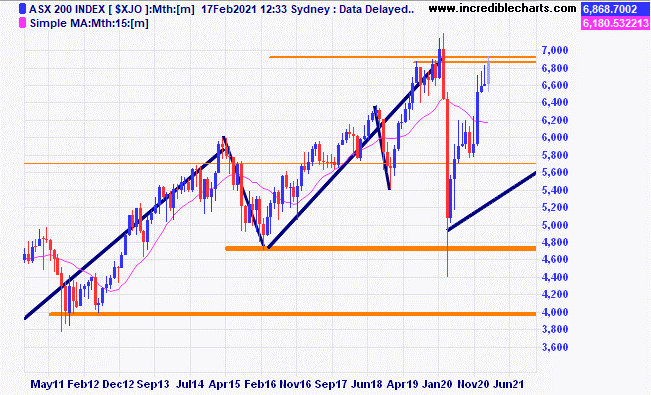

The local market has made a second higher low from the recent spike low. Today the market is taking a breather and a move below the recent swing low would be a negative sign.

On a monthly timeframe the local market has run into a resistance zone under the previous all-time high.

BHP recently posted great earnings numbers and talk of a new commodity supercycle might push the price a lot higher after making a higher swing low above the support zone.

We were stopped out of Resolute today.

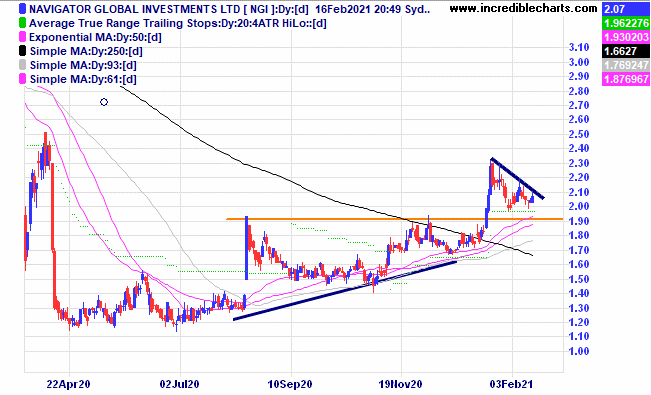

Navigator Global is yet to trigger and we bought some today in anticipation of a move higher.

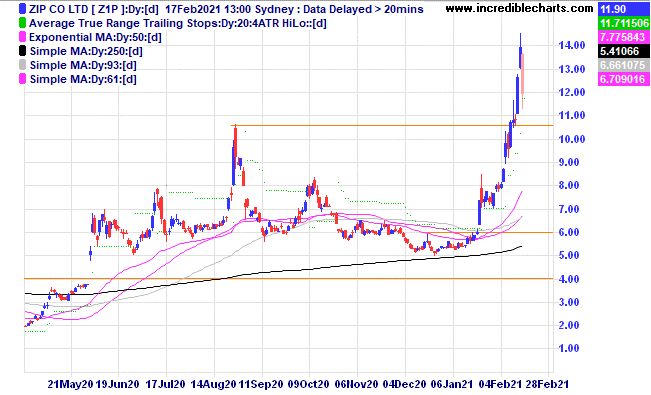

Z1P had a couple of big days up after making a new yearly high and today’s lower price could help form the next higher swing low and a possible trade entry point.

Rare Earths miner Lynas is in a strong trend.

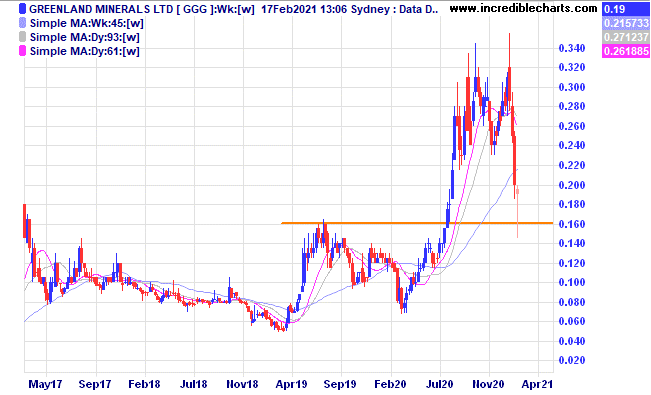

Greenland Minerals a possible rare earth miner in the making has bounced nicely from the support level.

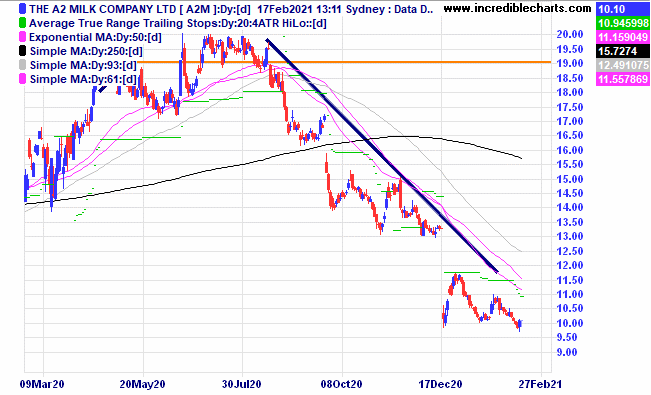

A2 Milk has made a slightly lower low and a possible triple bottom pattern.

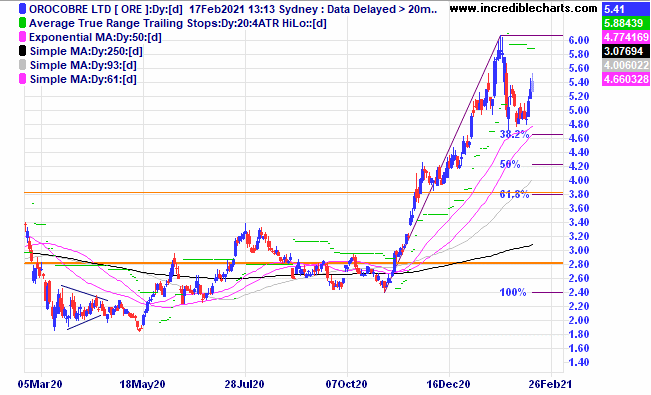

Lithium miner Orocobre has bounced from the 38 per cent retracement zone.

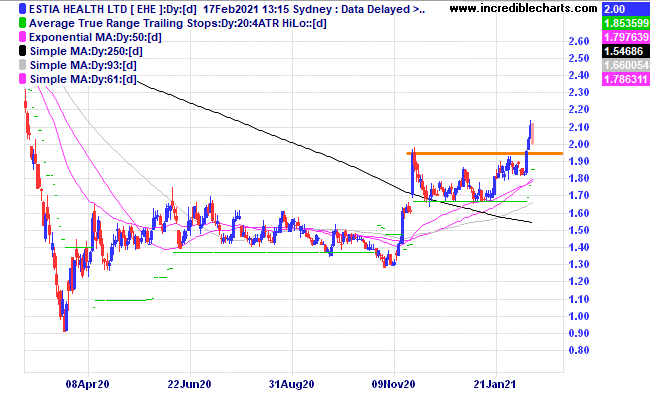

Estia Health punched through the resistance zone and could form a higher low which could present some interesting possibilities.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL c/fwd 29/12/2020 at $288.30 | Bought 10 at $183.00 3/12/2018 | 3/12/2018 | $273.57 | $288.84 | +$152.70 |

Bought Nickel Mines c/fwd 29/12/2020 at $1.14 | Bought 1,900 at 52.5c | 29/4/2020 | $1.20 | $1.30 | +$190.00

|

Bought NDQ ETF c/f $28.07 | Bought 100 at $26.50 | 1/10/2020 | $29.31 | $29.50 | +$19.00 |

Bought Resimac c/f $2.04 | Bought 1,500 at $1.45 | 2/10/2020 | $2.32 | $2.50 | +$270.00 |

Bought Webjet c/f $5.32 | Bought 600 at $3.90 | 4/11/2020 | $5.04 | $4.78 | -$156.00 |

Bought Hearts and Minds c/f $4.36 | Bought 600 at $4.50 | 11/11/2020 | $4.65 | $4.67 | +$12.00 |

Bought Perseus c/f $1.26 | Bought 2,200 at $1.20 | 2/12/2020 | $1.22 | $1.23 | +$22.00 |

Bought Resolute c/f 78.5c | Bought 2,000 at 79c | 2/12/2020 | 68.5 | 70.5c | +$40.00 |

Bought Baby Bunting c/f $4.85 | Bought 500 at $4.60 | 17/12/2020 | $5.71 | $5.82 | +$55.00 |

Bought AUDS ETF

| Bought 250 at $11.75 | 7/1/2021 | $11.45 | $11.68 | +$57.50 |

Bought Harvey Norman | Bought 500 at $5.10 | 13/1/2021 | $5.62 | $5.71 | +$45.00 |

Bought Platinum Asset Management | Bought 600 at $4.20 | 31/1/2021 | $4.29 | $4.39 | +$60.00 |

Bought Data#3

| Bought 500 at $5.75 | 10/2/2021 | $5.75 | $6.11 | +$180.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $51,516.70 |

|

|

| $51,516.70 |

| Gains/losses week +$947.20 |

|

|

| +$947.20 |

| Current total $52,463.90 |

|

|

| $52,463.90 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $34,185.90 |

|

|

| $34,185.90 |

Prices from Tuesday night or 6am for US positions. | Cash available $15,567.20 |

|

|

| $15,567.20

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here